Looking for something specific? Jump to a section:

Commentary Outlook & Notes Market-Relevant Events Infrastructure Supply Chart Pack

Rockies basis pricing has continued to slide as robust production outpaces demand. Regional inventory levels for the week ending January 9, 2026 stand at 251 Bcf, a new five-year high for the same corresponding week. Production is also at a five-year seasonal high consistently maintaining above 8.2 Bcf/d. Demand has been seasonally low, with November 1, 2025-January 15, 2026 averaging 500 MMCf/d less than last year over the same period.

January 16: The selloff in the prompt month contract has continued as the Feb26 CIG basis price has fallen to -$0.950 from +$0.220 on October 31. There has been a bit more buying pressure in Summer26, helping keep price action slightly more stable. The Summer26 contract is down to only -$1.045 from -$0.8225 on October 31. It's a very similar story at NWP Rockies as the Feb26 contract price has fallen to -$0.935 from +$0.430 on October 31. Summer26 NWP Rockies basis is down to -$1.0125.

December 12: Rocky Mountain basis pricing has been under consistent selling pressure for the past month. Front month CIG basis (Jan26) has fallen from $0.385 as of the close on November 12 to -$0.320 intraday on Friday December 12. Similarly, Jan 26 NWP Rockies basis has sold off from $0.7775 as of the close on November 12 to -$0.185 intraday Friday December 12. Surprisingly, Summer 26 (Apr26-Oct26) hasnt been as negatively affected as the front month tenors or Winter 26/27 (Nov26-Mar27).

November 17: Prompt month pricing looks much stronger from the start of the month, but this is likely due to the contract rolling to Dec25 rather than a structural shift in underlying fundamentals. Since its first day trading as the prompt contract (November 3) the Dec25 CIG basis price has risen to $0.1145 intraday November 17 from $0.03. The contract hit as high as $0.255 on November 14 following six days of buying. Basis pricing at NWP Rockies has fallen since the start of the month with the Dec25 basis swap down to $0.380 intraday November 17 from $0.4795 at the open on November 3. The Summer26 contract for both CIG basis and NWP Rockies basis have come under selling pressure the past few trading days leading to price declines of roughly $0.03 each.

October 20: The November CIG basis price continues to see volatility as the contract trades back near its monthly low. There have been major swings in price over the past month as heavy selling pressure gave way to a string of strong buys. However, sellers have once again returned, pushing price back down to -$0.685 intraday on October 20. The trading pattern seen in the prompt month contract has also carried into 2026 as both the Winter 25/26 and Summer 26 strips have followed the same pattern. The Summer 26 strip is currently trading -$0.8495 intraday on October 20, down $0.11 from a month ago. NWP Rockies basis continues to hold a slight premium to CIG with the November contract trading down to -$0.430 and Summer 26 down to -$0.680.

October 2: Rockies basis pricing has come under heavy selling pressure the past seven trading days. The newly prompt November CIG contract is down 55%, falling from -$0.4175 at the open on September 24 to -$0.65 intraday October 2. Over the same period, NWP Rockies basis pricing for November is down from -$0.085 to -$0.4115. Falling basis pricing is not constrained just to the prompt month as Winter 25/26 and Summer 26 are down across both CIG and NWP Rockies.

September 12: Regional basis pricing has been stable for the past month as higher demand has matched increased supply. As a result, regional storage levels have only increased 4 Bcf since the first full week of August. The Oct25 CIG basis contract has risen $0.246 since August 1 to trade -$0.5835 intraday on September 12. Over the same period the Oct25 NWP Rockies basis contract is up $0.28 to trade -$0.41 intraday on September 12. Forward strips, Nov25-Mar26 (Winter) and Apr26-Oct26 (Summer), have been relatively stable following heavy selling on August 5 and 6. Basis pricing at CIG is currently trading -$0.055 for Winter 25/26 and -$0.75 for Summer26. NWP Rockies basis is trading $0.38 during Winter 25/26 and -$0.53 for Summer26.

Price action will continue to be heavily weather driven and influenced by adjacent regions as the Rockies looks to push gas out during the summer and meet regional demand during winter. No significant changes to pipeline egress capacity are expected over the next few years. However, there will be small increases in pipeline capacity from a few pipeline expansions throughout late 2025 and early 2026.

CIG Rockies & NWP Rockies Basis Outlook and Notes

|

Winter '25-'26

Cold winter weather across the West Coast and Rockies provide low probability but highly impactful upside potential

Williams' expects its 325 MMcf/d expansion of MountainWest Overthrust Pipeline to be online in 4Q25. The additional capacity will allow more eastern Rockies gas to flow to premium western markets

|

Summer '26

Shoulder seasons (spring/fall) look particularly susceptible to low prices as demand evaporates, and production expectations remain robust

De-risk on strength, particularly on early November 2025 or December 2025 cold spells which should help lift the forward curve

Additional supply coming from the Bakken into Cheyenne/CIG could pose additional pressure in 2026 as the Bakken Xpress project is scheduled to be completed in March 2026

|

Winter '26-'27

Basis pricing during Winter will remain susceptible to price appreciation should sustained cold materialize for the West Coast, Rockies, or Midwest regions although supply remains robust

Take advantage of basis prices that are a premium to Henry Hub to de-risk the portfolio

|

|

|

For more discussion on basis price moves and the current forward curves:

For more discussion and charts, jump to our outlook and chart pack. Remember, the local market is influenced by the broader gas market. Consult our Gas Macro Outlook for more.

|

Recent Market-Relevant Events

01.08.2026

Laramie County as approved the Crusoe AI datacenter in southeast Wyoming powered by Tallgrass

|

06.24.2025

Canadian exports to Rockies/PacNW hit low as LNG Canada ramps up

|

06.14.2025

Tallgrass secures anchor shippers for new Permian-to-REX pipeline

|

|

|

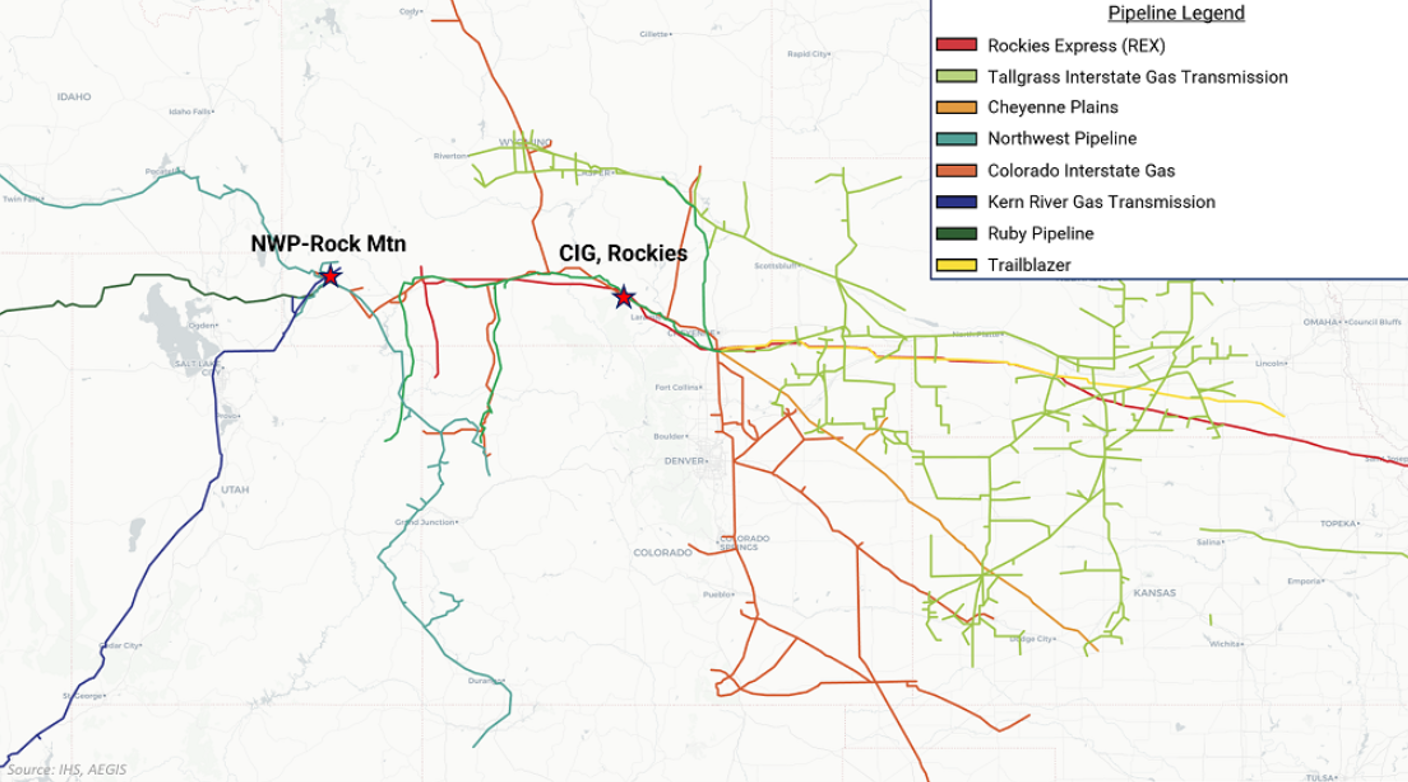

A lack of production growth since 2020 has meant pipeline egress capacity has not been challenged by production. However, there are limitations and constraints within the basin to move gas from east to west from CIG/Cheyenne to NWP Rockies/OPAL. Expectations are the basin will continue to have available egress out of each major corridor. A few in basin pipeline projects will also help move natural gas intrabasin.

|

For a discussion of production outlook:

Below are the most market-relevant infrastructure projects that appear to be funded and going forward. The projects that offer intra-region capacity (egress) are also shown in the chart above.

Note: Deeper discussion included below the map.

|

Major Pipeline Corridors Out of The Rockies

Gas Pipeline Flows

Gas Pipeline Projects

MountainWest Overthrust Westbound Expansion

In-service date: 4Q25

Capacity: 0.3 Bcf/d

|

Source: Williams

|

|

MountainWest Overthrust Expansion - Construction on Williams' MountainWest Overthrust expansion is ongoing. According to the companies latest maintenance schedule, commissioning should take place November 6-8.

|

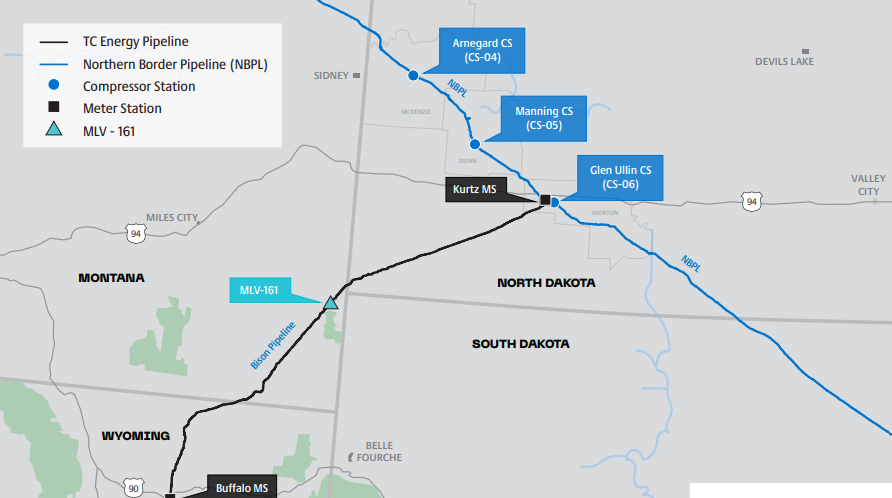

Bison Xpress

In-service date: March 2026

Capacity: 0.3 Bcf/d

|

Source: TC Energy

|

|

|

Bison Xpress - TC Energy is working to increase capacity on the Northern Border Pipeline (NBPL) system by replacing three existing compression stations. The increased capacity of 300 MMcf/d will be leased by Wyoming Interstate Company as part of its Bakken Xpress Project. In addition, the project would allow bidirectional natural gas flow on TC's Bison pipeline.

|

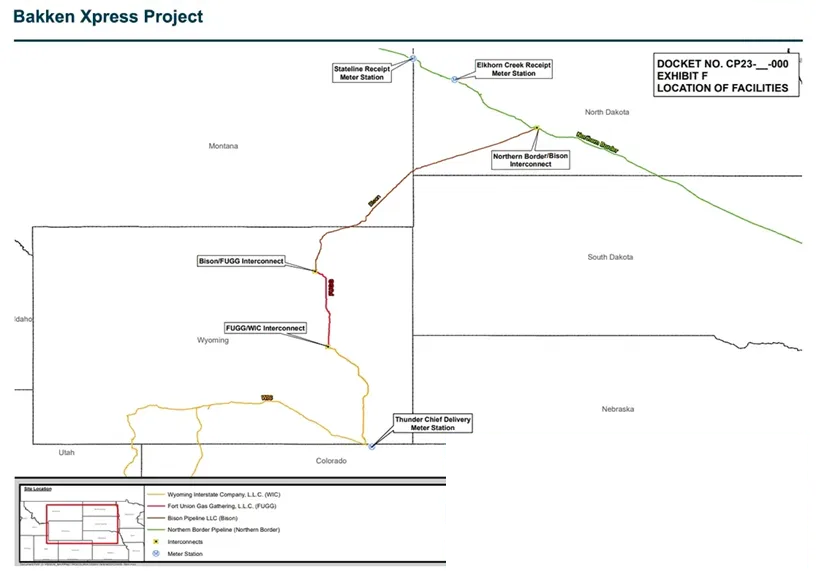

Bakken Xpress

In-service date: March 2026

Capacity: 0.3 Bcf/d

|

Source: NGI, Kinder Morgan

|

|

|

Bakken Xpress - Kinder Morgan's connection to the Bison Xpress project, which will provide egress south from Bison pipeline to Cheyenne via the Fort Union Gas Gathering system and Wyoming Interstate Pipeline.

|

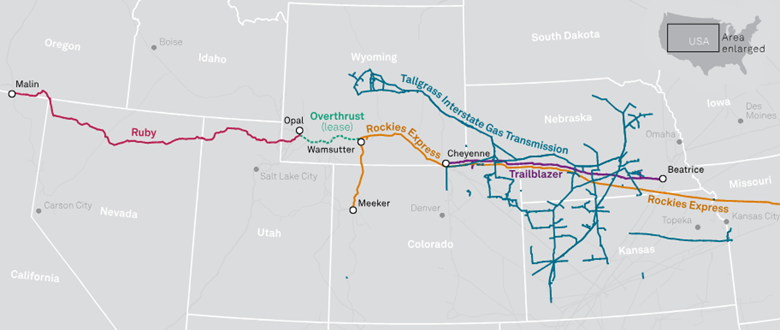

Tallgrass Permian-to-REX Pipeline

In-service date: late 2028

Capacity: 2.4 Bcf/d

|

Source: S&P, Tallgrass

|

|

|

Tallgrass Permian-to-REX Pipeline - Tallgrass Energy plans to build a 2.4 Bcf/d greenfield pipeline linking the Permian Basin to the Rockies Express Pipeline (REX), targeting a late 2028 in-service date. The project has secured anchor shipper agreements, enabling it to move forward pending regulatory and corporate approval. The pipeline will enhance access to Midwest and Plains markets via REX and Tallgrass Interstate Gas Transmission (TIGT), with optional flows westward through Ruby and Overthrust.

|

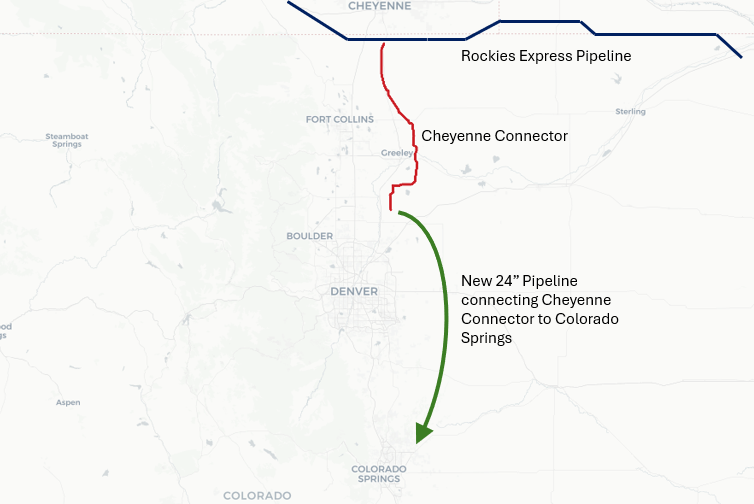

REX/Cheyenne Connector Enhancement

In-service date: 2Q28

Capacity: 0.25 Bcf/d

|

|

|

| REX/Cheyenne Connector Enhancement - Rockies Express, Cheyenne Connector and East Cheyenne Gas Storage jointly filed an application to FERC requesting authorization for Rex to lease 250,000 Dt/d capacity on Cheyenne Connector and build a new 153 mile 24" pipeline to Colorado Springs. The application submitted on August 15 is the latest in a series of announcements by Tallgrass to enhance its ability to meet local demand in the Rockies. |

Local Supply

|

Production made a noticeable jump at the end of 2025, averaging over 8.2 Bcf/d since November, 2025 and reaching over 8.4 Bcf/d on a few occasions according to S&P. Meanwhile, the rig count has also increased up to 46, the highest number since 2023.

|

|

Operator Guidance

Civitas Resources (Q3 2025 EC)

|

11/06/2025

|

|

2025 Guidance:

Announced merger with SM Energy while also selling two non core DJ Basin packages during the third quarter

Key Basin Activity:

DJ production increased six percent quarter over quarter to 155 MBoe/d (46% crude oil)

Activity in the basin included 31 wells drilled, 28 wells completed and 40 wells turned to sales

Due to pending merger with SM Energy, no new guidance was provided

|

|

Williams (Q3 2025 EC)

|

11/04/2025

|

|

2025 Guidance:

Adjusted EBITDA guidance reamains unchanged at $7.75 billion midpoint

Key Basin Activity:

Completed and placed into service Northwest pipeline Stanfield South expansion

New open season announced during 3Q25 for 64,000 Dth/d of additional capacity on MountainWest Overthurst pipeline from Opal Processing Plan and Pioneer Processing Plan to a future lateral and Green River West Tap

Continue to see strong demand growth in Rockies/Northwest due to industrial expansions, mining and power reliability concerns

|

|

EOG (Q3 2025 EC)

|

11/07/2025

|

|

2025 Guidance:

Full year 2025 free cashflow estimates raised to $4.5 billion, up $200 million from prior guidance

Key Basin Activity:

Powder River Basin (PRB) was cited as an "emerging" play, making "tremendous progress on improving well performance and lowering costs"

Not expecting to materially increase production in 2025

|

|

Occidental Petroleum (Q3 2025 EC)

|

11/11/2025

|

|

2025 Guidance:

Slightly increased production guidance to 1,440-1,480 MBoe/d

Key Basin Activity:

Rockies well performance increased 14 MBoe/d compared to midpoint of guidance

Continue to guide Rockies & Other production in the 271-277 MBoe/d

Activity remains two rigs and one frac crew

Don't expect to increase capital into Rockies but may shift allocation of resources between DJ and Powder River Basin

|

|

|

Local Demand

|

Demand in the Rockies varies wildly between Winter and Summer. This winter has been particularly poor with demand seasonally the lowest in three years. From November 1, 2025-January 15, 2026, demand has averaged 500 MMcf/d less than a year ago over the same time period. The basin will continue to rely on moving gas out of the region, supplying the West Coast, Midwest and Midcontinent.

|

|

Recent Market-Relevant events

|

Wyoming Approves Data Center Campus That Includes 2.7 GW of New Natural Gas Fired Generation

(January 8, 2025)

Market Impact: Additional regional demand should benefit regional basis pricing

-

Laramie County, Wyoming approved Project Jade, an AI data center campus by Crusoe, and the BFC Power and Cheyenne Power Hub

-

The datacenter complex will consist of a 1.8 gigawatt data center designed to scale up to 10 gigawatts as well as corresponding power generation capacity

-

Initial power needs will be supported by 2.7 gigawatt of natural gas fired generation or roughly 0.45 Bcf/d of natural gas

-

The project is anticipated to bring its first phase online in mid-2027

|

|

Canadian Gas Exports to Rockies/PacNW Hit 2025 Low as LNG Canada Starts Production

(June 24, 2025)

Market Impact: Lower natural gas imports from Canada should support western US basis pricing moving forward

-

Canadian natural gas exports to the Rockies/PacNW fell to 3.48 Bcf/d in June, the lowest monthly average of 2025 and 0.74 Bcf/d below January levels, amid soft Pacific Northwest demand and rising domestic competition

-

The start of production at LNG Canada Phase 1 (targeting ~2 Bcf/d) is emerging as a new structural factor reducing westbound export flows, as Canadian supply increasingly stays north to serve LNG demand

-

The declining exports, paired with LNG Canada's ramp-up, signal increased Canadian gas competition in western North American markets and point to higher price volatility ahead, especially into winter

|

Tallgrass Secures Anchor Shippers for New Permian-to-REX Pipeline Targeting Late 2028 Start

(June 14, 2025)

Market Impact: This should weigh on CIG pricing later in the decade as Permian gas further supplies the Rockies and adjacent demand markets

-

Tallgrass has signed anchor shipper precedent agreements to support the construction of a pipeline from the Permian Basin to the Rockies Express Pipeline (REX), unlocking up to 2.4 Bcf/d of new natural gas takeaway capacity

-

These commitments provide financial justification for project buildout, targeting in-service by late 2028, contingent on final regulatory and corporate approvals

-

The pipeline will provide access to REX's east-west backbone, linking Permian gas to Midwest, Rockies, and Northeast markets

-

The project could help alleviate future Permian gas bottlenecks, improve basis differentials, and support AI-driven power demand and reshoring -related industrial growth across multiple U.S. regions

|

Williams MountainWest Overthrust Expansion Underway, In-Service by 4Q 2025

(March 03, 2025)

Market impact: Price spreads between CIG and NWP Rockies should tighten as additional gas moves west across the basin

-

Williams began construction on its MountainWest Overthrust expansion in April 2025, with 4Q 2025 targeted for in-service, per maintenance schedule

-

The expansion will add 325 MMcf/d of new westbound capacity to the Opal hub (Wyoming), bolstering east to west natural gas flows in the Rockies

-

The construction schedule includes multiple compression upgrades and station outages spanning April to October, with some segments experiencing 100% nomination cuts during work windows

-

Once complete, the project should tighten regional price spreads and position Williams to capture stronger western flows amid Canadian competition and renewables intermittency

|

|

|

Don’t stop here.

See how other regions are performing right now:

|