Looking for something specific? Jump to a section:

Commentary Outlook & Notes Market-Relevant Events Infrastructure Supply Chart Pack

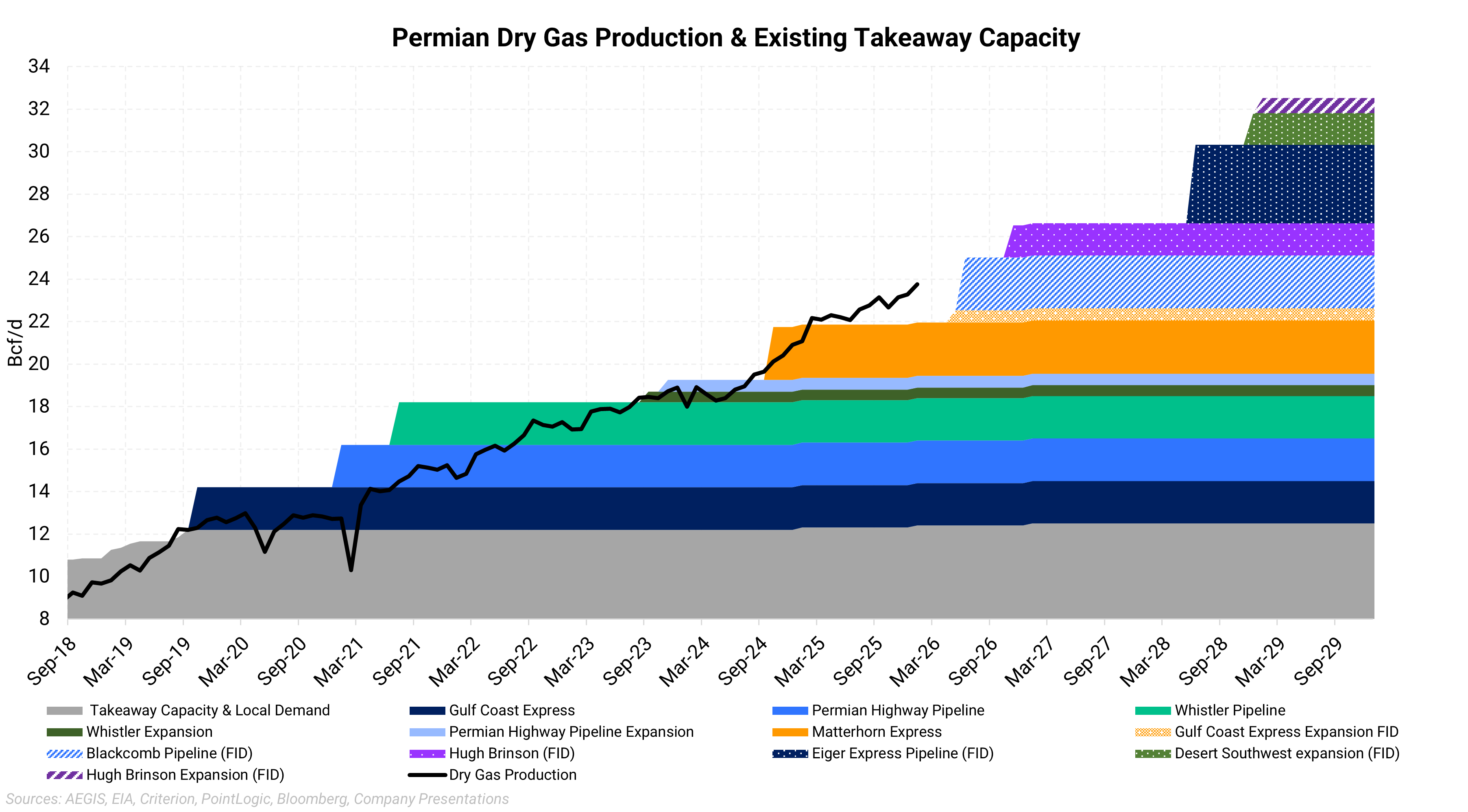

The Permian Basin has been operating near the limits of available gas egress capacity for several years, keeping the system structurally constrained. This is expected to change later in 2026, when roughly 4.5 Bcf/d of new outbound pipeline capacity is scheduled to enter service. Until that capacity comes online, Waha basis is likely to remain stressed. Producers have been aggressive in hedging Waha exposure for 2026 for some time, reflecting limited near-term relief. Further out, materially improved pricing in 2027 has attracted additional hedging interest, as the Waha forward curve converges toward Henry Hub through the remainder of the decade. The tightening of the Waha–Henry Hub spread reflects growing confidence that incremental pipeline additions will materially reduce the risk of prolonged system congestion.

Commentary

February 20: Waha cash prices have been negative 38 out of 51 days so far in 2026. The only reprieve came during Winter Storm Fern, when prices briefly spiked to nearly $15/MMBtu for several days. Looking beyond the daily prints, Waha futures have also moved lower. As of February 19, the Summer ’26 (April–October) Fixed Waha strip was trading at -$0.33/MMBtu — negative across the entire strip. Waha basis, or the discount to Henry Hub, averaged -$3.60/MMBtu over the same period. We have long cautioned about this stretch of the Waha curve, as the region faces an extended window without meaningful new pipeline egress capacity (approximately 4.5 Bcf/d) until the second half of 2026. The Permian natural gas pipeline system is undoubtedly under strain, and additional records could be set this year. With 38 negative cash days already recorded, 2026 is on pace to challenge prior records. Since 2021, the highest number of negative Waha cash price days occurred in 2024, at 158 days (43% of the year). The Permian Basin clearly needs that additional 4.5 Bcf/d of takeaway capacity bigly.

January 27: Winter Storm Fern sent Waha cash prices to their highest levels since 2021, with weekend spot gas ( Jan. 24-26) trading near $15/MMBtu. That’s a sharp reversal from January's pre-storm average, when Waha prices averaged below zero amid persistent takeaway constraints out of the Permian. While $15 gas is a welcome reprieve for Permian producers, it pales in comparison to Winter Storm Uri, when Waha cash prices spiked above $200/MMBtu. The difference reflects a Texas grid that is better winterized and more operationally prepared than it was in 2021. Permian dry gas production dropped to roughly 19 Bcf/d during the recent storm, down from pre-storm levels near 24 Bcf/d, according to S&P Global data. These freeze-offs reduced supply just as heating demand increased, creating the conditions for a sharp, but temporary, price spike. Interestingly, Waha basis for February weakened despite the rally in outright prices. Basis moved from around -$3.00 to -$4.76/MMBtu as Henry Hub February futures surged above $6.00/MMBtu. Waha fixed prices did rise directionally with Henry Hub — climbing to about $2.05/MMBtu from near zero — but the move lagged the benchmark. Because Waha did not increase one-for-one with Henry Hub, the basis widened (became more negative).

In short, Fern delivered a classic Permian weather-driven squeeze: localized supply losses plus strong regional demand lifted cash prices, but structural takeaway limits kept Waha from fully participating in the broader Henry Hub rally.

January 12: Waha basis prices have remained depressed to start January. The prompt, Feb26, contract has traded within a narrow band, -$2.94 on the high end and -$3.15 on the low end with most of the activity between -$3.00 and -$3.10. Production remains elevated, averaging 23.67 Bcf/d so far in 2026, helping to keep pressure on price ahead of the next set of pipeline additions which come online this summer. Daily pricing hasn't faired any better with negative pricing throughout January. Maintenance on El Paso earlier this month led to gas daily prices settling -$1.895 on January 6. Planned and unplanned pipeline maintenance will continue to be a negative factor for daily Waha prices as egress capacity remains scarce.

December 22: The Waha prompt month is now January and traded at $1.76/MMBtu for fixed price and -$2.67 for Waha basis as of December 1. In the past month, two significant developments in the Permian are worth noting. First, WhiteWater, along with its partners, announced an expansion of the Eiger Express Pipeline from 2.5 to 3.7 Bcf/d. WhiteWater said it secured additional firm transport agreements since announcing the project in August 2025. The mainline will be upsized from a 42" to a 48" diameter pipeline, along with incremental compression. The in-service date for Eiger remains mid-2028. Secondly, the last piece of capacity for another WhiteWater pipeline, Matterhorn, appears to be online. The final 500 MMcf/d of the 2.5 Bcf/d Matterhorn pipeline is likely in service, as measured flows from the interstate connections to the intrastate system have reached new highs. This should provide much-needed new egress for Permian operators; however, there is likely production ready to fill this added capacity quickly.

Waha Basis Outlook and Notes

|

Summer '26

The Permian’s next major takeaway project doesn’t come online until 3Q of ’26. Waha cash prices started 2026 negative most days and we expect that to continue.

Possible overbuild in outbound capacity as Blackcomb, GCX expansion, and Hugh Brinson come into service. The Waha forward curve is the weakest for this time period as the basin likely operates near the limit of egress. Expect bearish pricing in both cash and possiblt the prompt-month if and when pipe maintenance reduces capacity.

|

Winter '26-'27 & Summer '27

Blackcomb and a GCX expansion will add 3.1 Bcf/d of new eastbound capacity from the Permian. How quickly these pipelines fill will depend on how much uncommitted gas producers have ready to bring online. It is more realistic that some open capacity will remain after these expansions. The overbuild dynamic extends into 2027 as Hugh Brinson enters service. The Waha forward curve reflects this outlook, pricing at a narrower discount to Henry Hub during this period due to the expectation of excess takeaway capacity from the Permian.

|

Winter '27-'28 to 2030

Current oil prices have reduced forecasts for crude production growth in the Permian. However, rising GORs support expectations for continued strong gas production growth. Roughly 12 Bcf/d of new pipeline capacity is under development to help move gas out of the basin. It is possible the Permian may enter an overbuild phase through the remainder of the decade, easing system constraints and reducing the likelihood of the severely depressed prices observed in 2024 and 2025. One caveat: Producers in the region with whom we speak generally believe operators will ultimately fill all of this new pipeline capacity.

|

|

|

For more discussion on basis price moves and the current forward curves:

For more discussion and charts, jump to our outlook and chart pack. Remember, the local market is influenced by the broader gas market. Consult our Gas Macro Outlook for more.

|

Historical Pricing Regimes

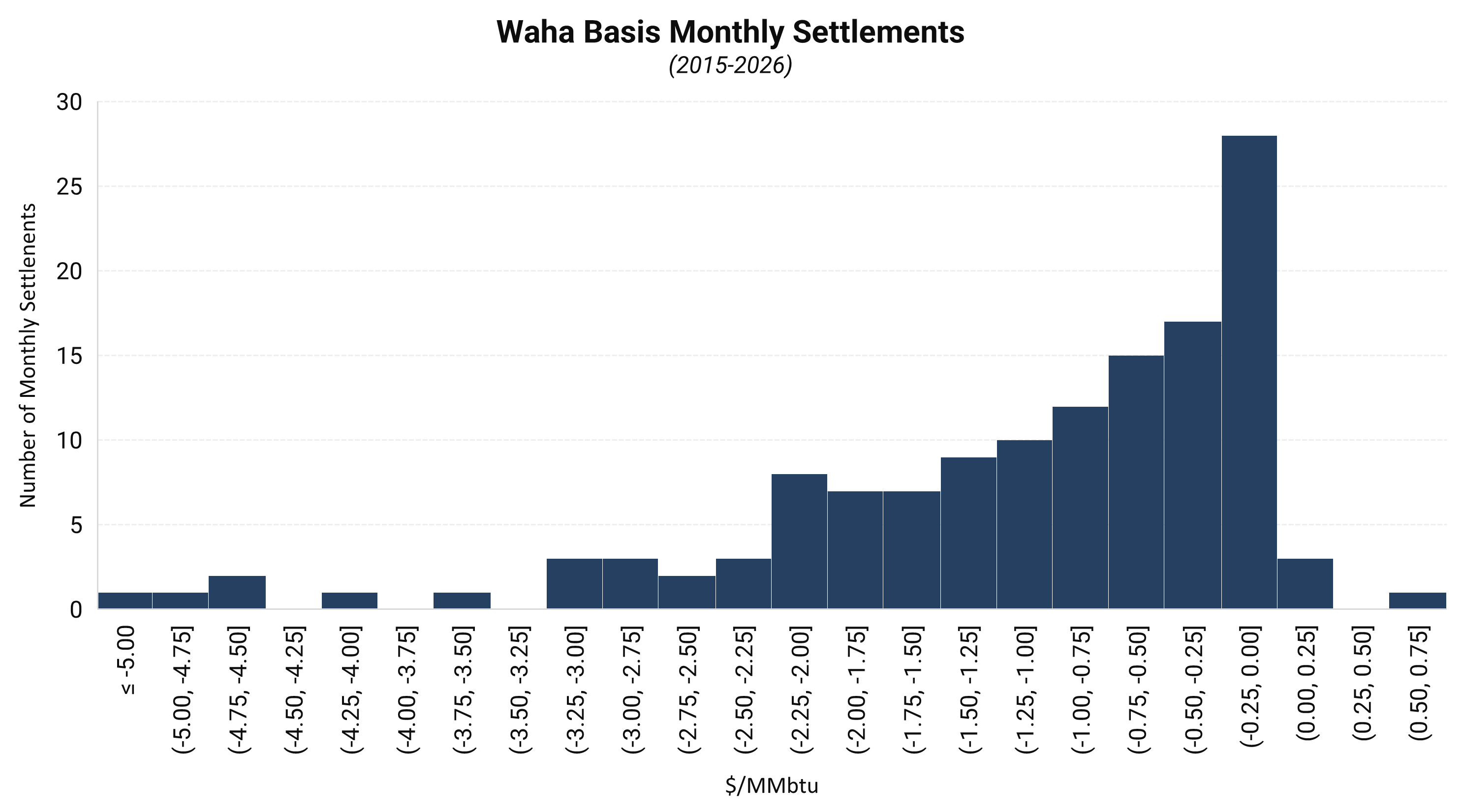

Waha gas has gone through multiple pricing regimes over the past 10 years. Below are a few charts showing these different regimes.

|

| |

|

|

|

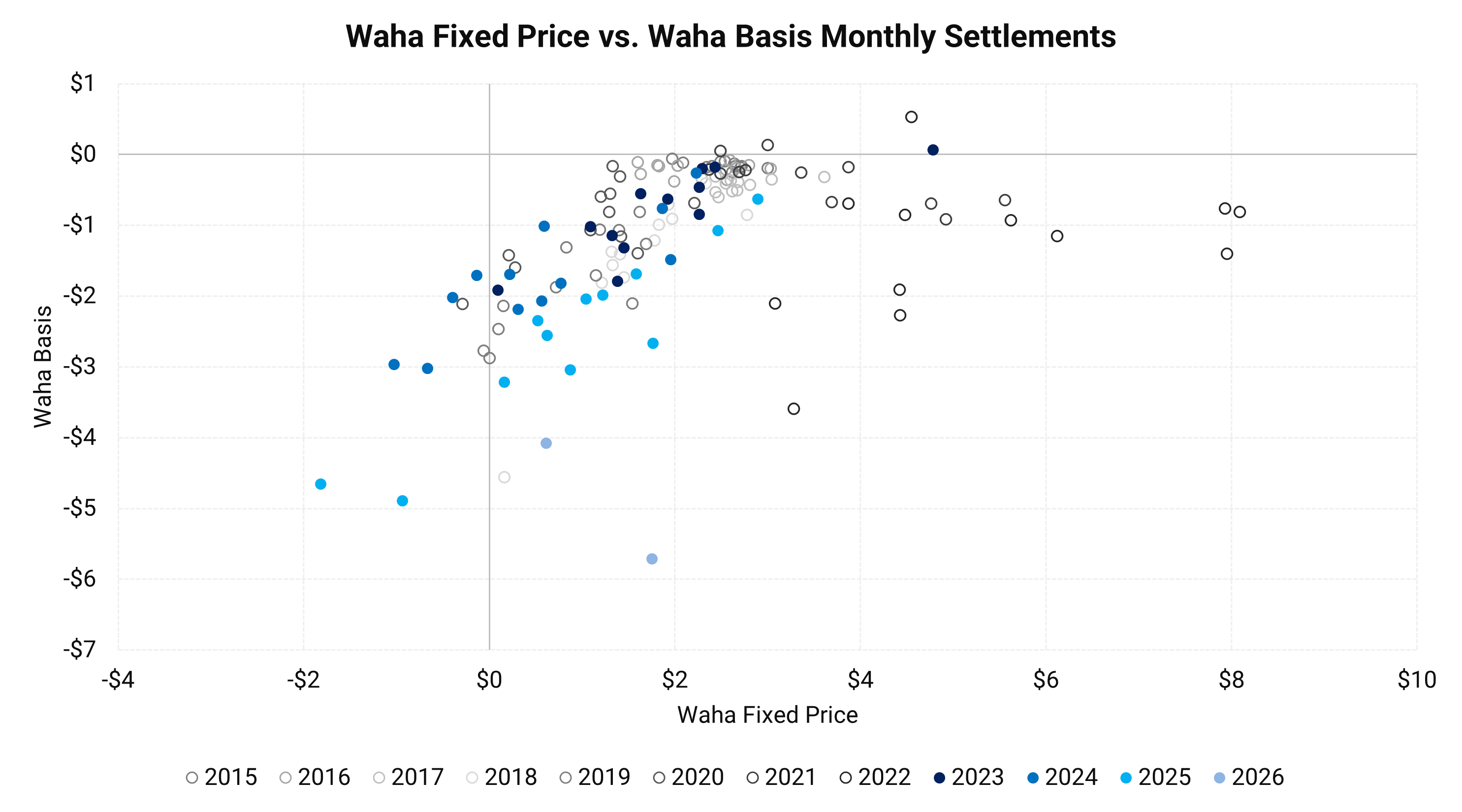

The histogram above shows how Waha basis settled monthly from 2015 through February 2026. The distribution exhibits a pronounced negative skew, with a long left tail reflecting episodic periods of severe constraint in the Permian.

Notably, the modal outcomes cluster between -$0.25/MMBtu and flat to Henry Hub. In other words, most months historically settled at only a modest discount to Henry Hub despite the extreme downside events that dominate the narrative.

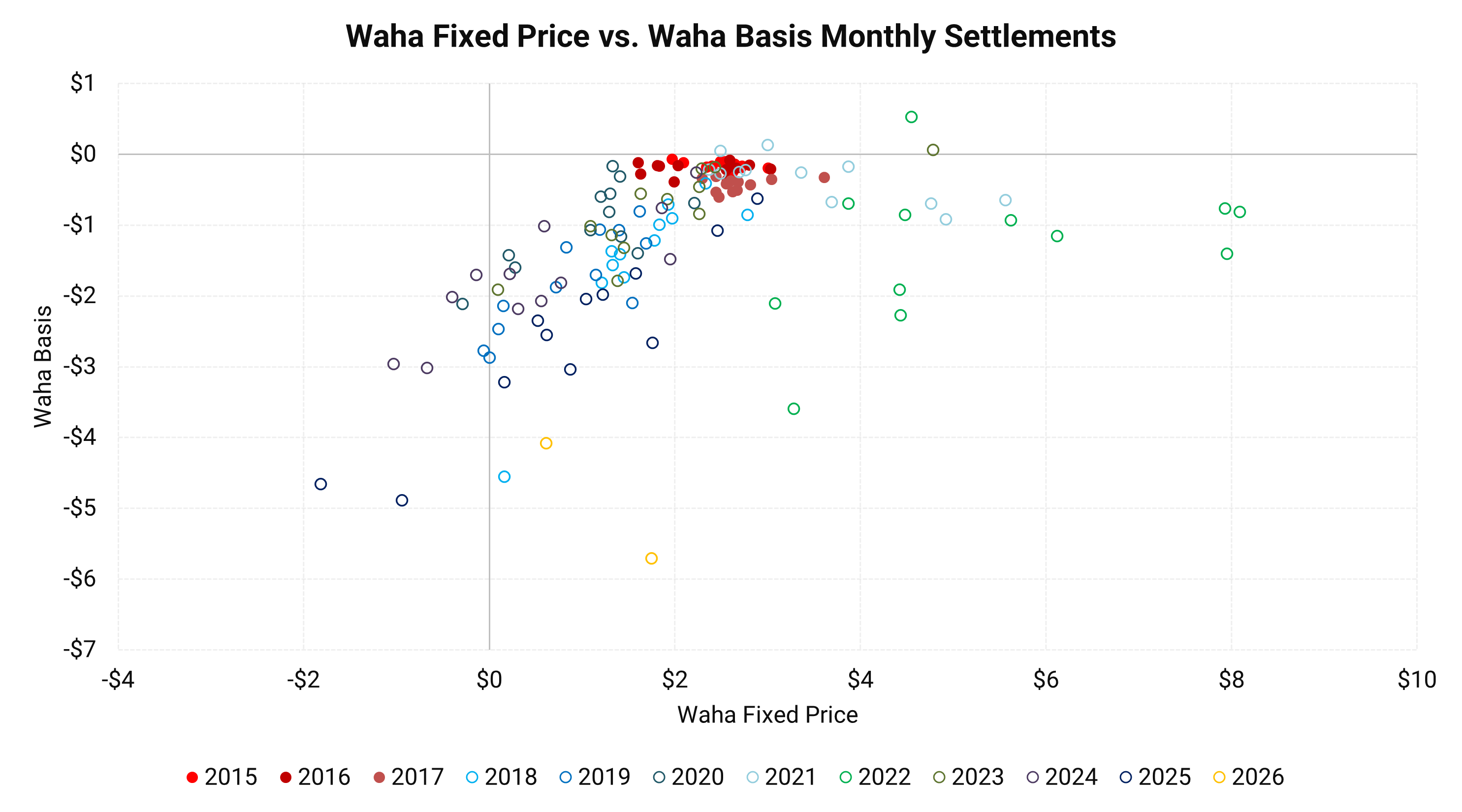

To look a bit deeper in the settlements we can break them down by year on the chart on the right.

|

Here we compare Waha fixed price versus Waha basis, showing monthly settlements back to 2015. The years 2015–2017 are highlighted in red to illustrate where most of those -$0.25 to $0.00 basis outcomes occurred.

This period coincided with the collapse in oil prices following the 2014 downturn. West Texas Intermediate plummeted in mid-2014 to below $40/bbl in 2015. The capital pullback was severe. Permian Basin rig counts declined from roughly 566 rigs in late 2014 to just 137 by 2Q 2016.

That contraction in drilling activity materially slowed associated gas growth. With production flattening — and in some areas declining — the natural gas pipeline system in the Permian avoided structural stress. As a result, Waha basis largely hovered near flat to Henry Hub during this stretch.

|

|

|

|

|

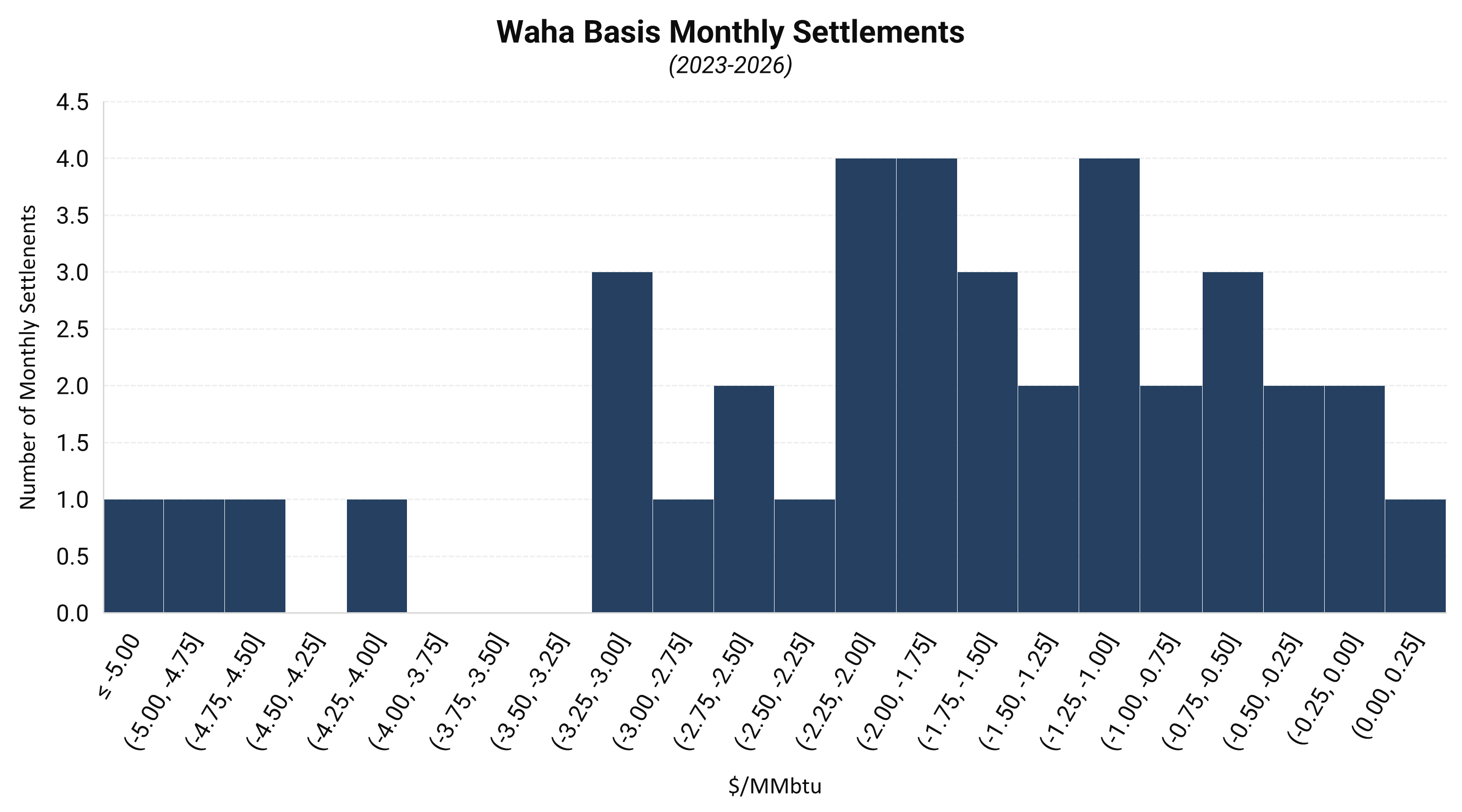

The chart above isolates Waha basis monthly settlements since 2023, and the contrast versus the prior decade is stark.

Where 2015–2017 saw clustering around -$0.25 to flat, the post-2023 regime has shifted materially lower. The average discount to Henry Hub is significantly wider, with many monthly settlements centered near -$2.00/MMBtu.

This represents a structural change in the distribution. The 2023–2026 window reflects sustained production growth running ahead of available takeaway capacity.

|

Above is the same historical Waha basis chart, but with the period from 2023 through early 2026 highlighted in blue.

The highlighted months visually compress toward the lower end of the distribution, underscoring just how different this regime has been relative to the prior decade. Instead of clustering near flat to -$0.25, settlements repeatedly anchor closer to -$2.00 — with multiple extreme downside events extending well beyond that level.

These blue datapoints reflect a structurally stressed natural gas system in the Permian. Associated gas growth has remained resilient, while incremental pipeline egress has lagged at times. The result has been persistent basis pressure, frequent volatility, and a distribution that is no longer merely negatively skewed — but fundamentally shifted lower.

|

|

| |

Recent Market-Relevant Events

12.22.2025

Energy Transfer to upsize Transwestern pipeline's Desert Southwest expansion project

|

8.25.2025

WhiteWater and Partners to announce new 2.5 Bcf/d Permian-to-Katy natural gas pipeline

|

8.6.2025

Energy Transfer to Build $5.3 Billion Texas-to-Arizona Gas Pipeline

|

|

|

The basin suffers from persistent oversupply compared to the amount of egress pipeline capacity. This affects the gas market more than it does crude oil, mostly because of aggressive additions in oil takeaway due to oil’s larger revenue share for almost all operators in the area.

|

|

As of 12/02/2025

|

For a discussion of production outlook:

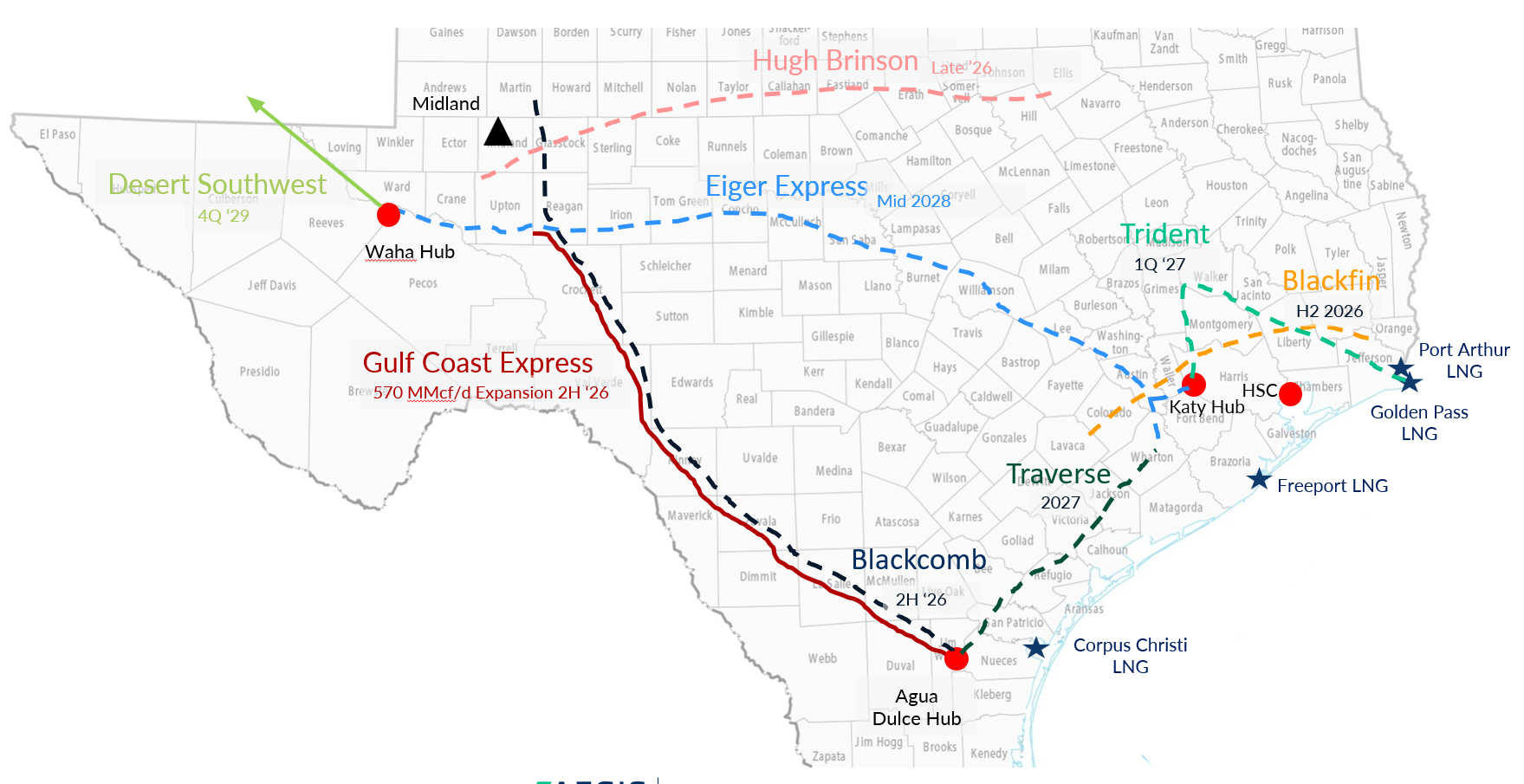

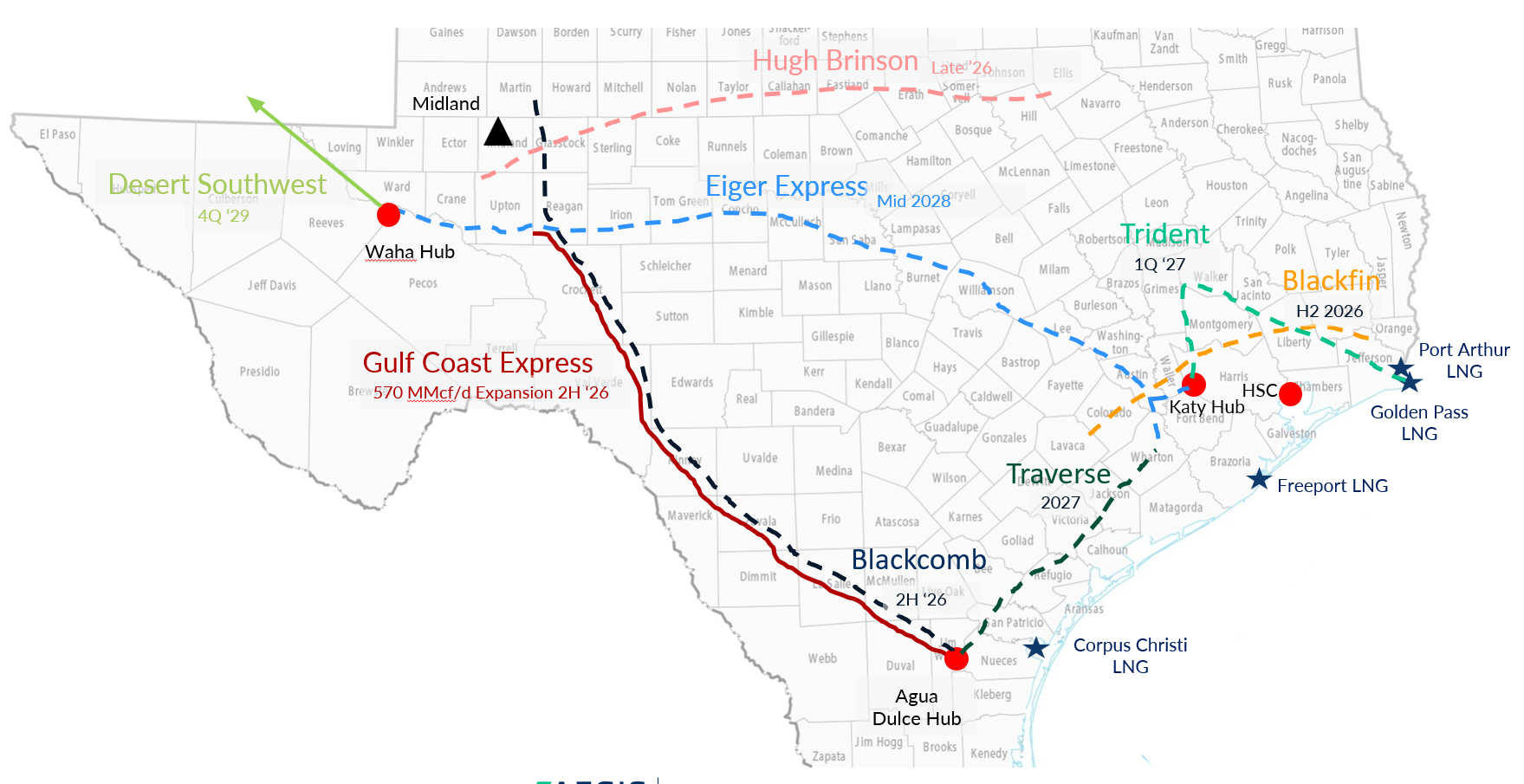

Below are the most market-relevant infrastructure projects that appear to be funded and going forward. The projects that offer intra-region capacity (egress) are also shown in the chart above.

Note: Deeper discussion included below the map.

|

Gas Pipeline Projects

Matterhorn Pipeline

In-service date: 3Q 2024

Capacity: 2.5 Bcf/d

|

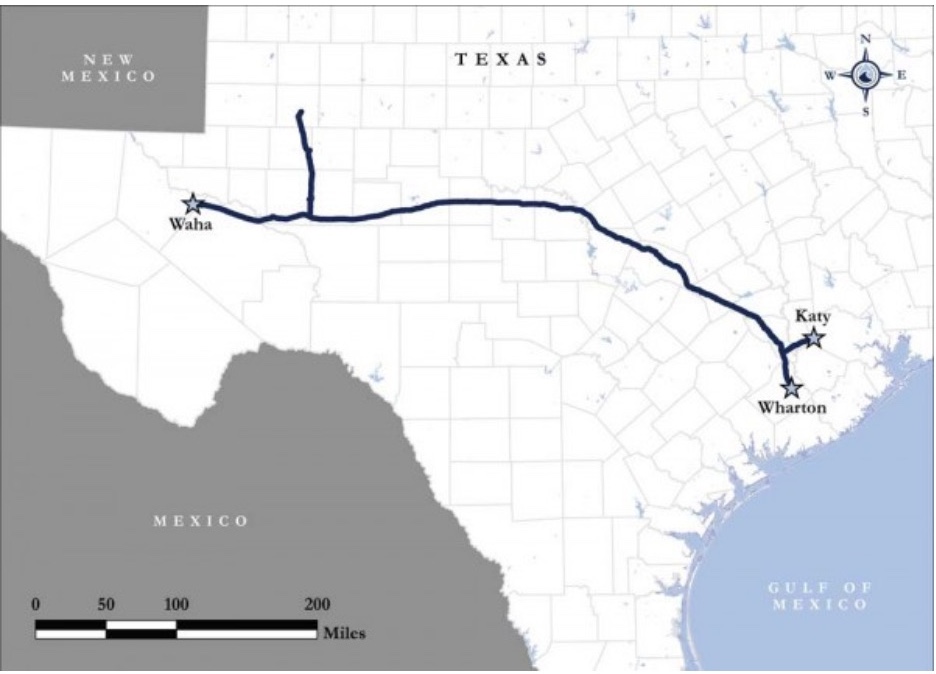

Source: WhiteWater

|

|

|

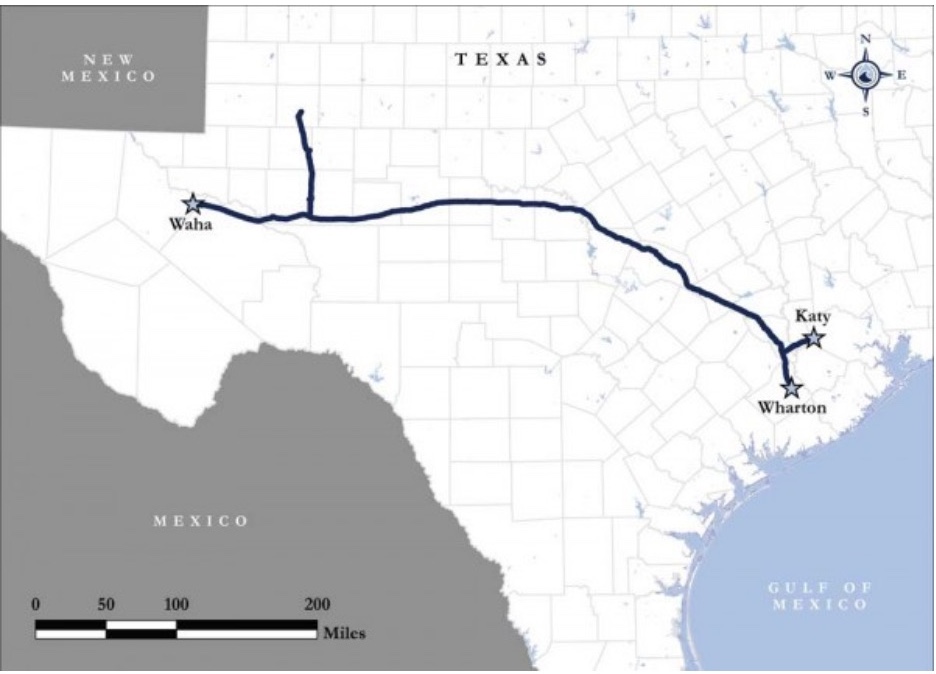

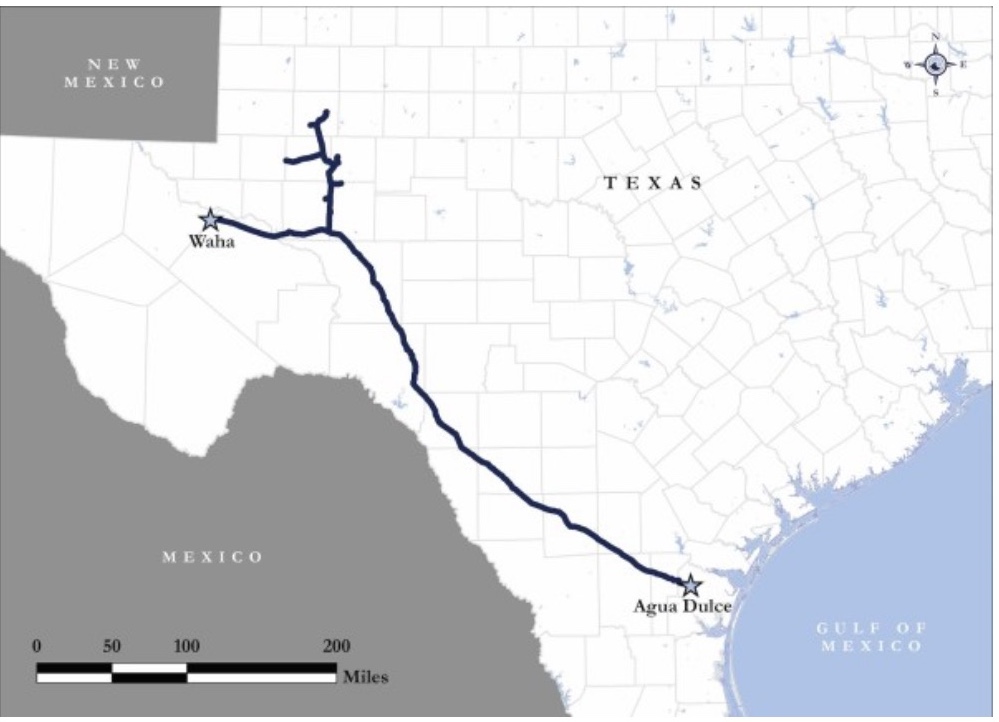

Matterhorn Pipeline - Whitewater Midstream's 2.5 Bcf/d pipeline entered service in the fall of 2024. The pipe originates in Waha and moves gas toward Katy, Texas.

|

Blackcomb

In-service date: 2H 2026

Capacity: 2.5 Bcf/d

|

Source: WhiteWater

|

|

|

Blackcomb - WhiteWater Midstream and Targa are moving ahead with building a new 42-inch, 365-mile natural gas pipeline from the Permian Basin in West Texas to the Agua Dulce hub in South Texas. The startup timeline is 2H 2026 and will transport up to 2.5 Bcf/d.Shippers include Devon, Diamondback Energy, Marathon Petroleum, and Targa. Will source in the Midland Basin and the 3 Bcf/d Agua Blanca pipeline system in the Delaware Basin owned by WhiteWater and MPLX.

|

Gulf Coast Express (Expansion)

In-service date: 2Q 2026

Capacity: 0.60 Bcf/d

|

Source: Kinder Morgan

|

|

|

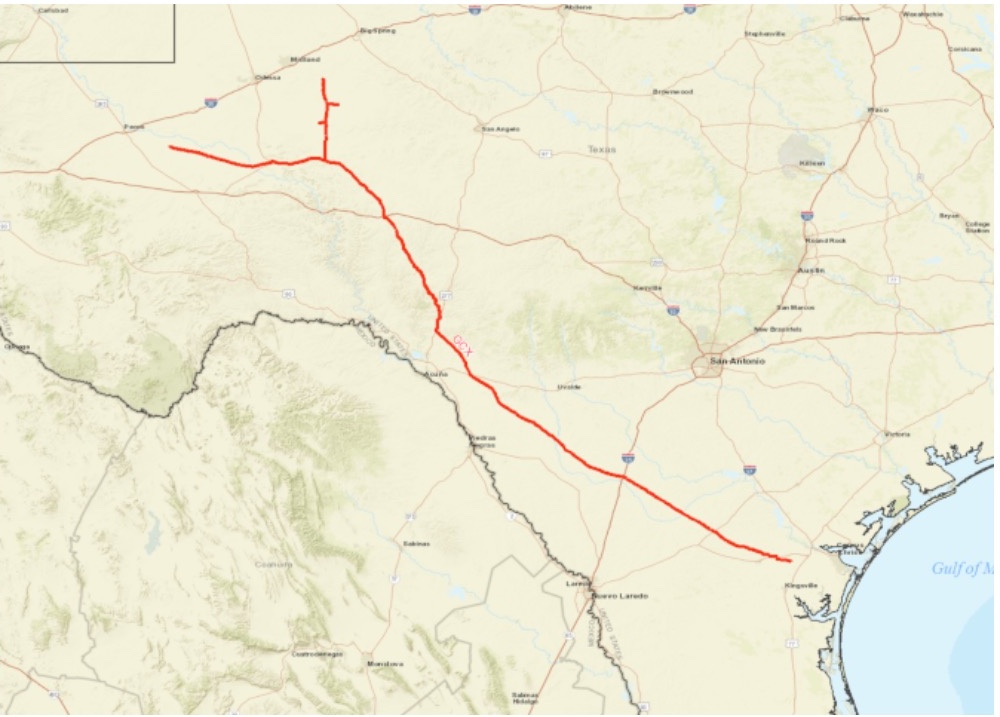

Gulf Coast Express Expansion - Kinder Morgan announced the start of an open season for the Gulf Coast Express expansion on May 16, 2022. The project entails adding compressors to the GCX pipeline to enhance its capacity from the Permian Basin to South Texas markets by 570 MMcf/d. The project is expected to be operational mid-2026, subject to additional customer agreements. Kinder's 3Q 2025 earnings call deck showed a 2Q26 in-service date.

|

Hugh Brinson

In-service date: Q4 2026

Capacity: 1.5 Bcf/d

|

Source: Energy Transfer

|

|

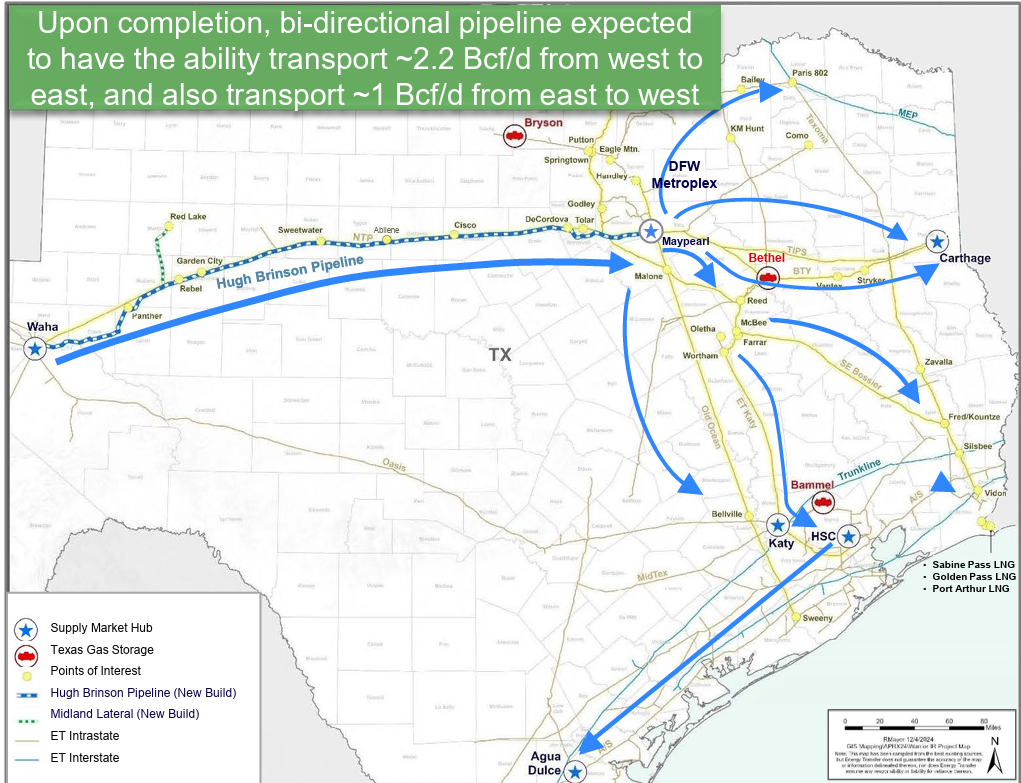

| Hugh Brinson - The Hugh Brinson Pipeline Project, formally know as Warrior, will be built in two phases. Phase I consists of roughly 400 miles of 42-inch pipeline running from Waha and the Midland Basin to Maypearl, Texas. The majority of the pipe steel has been secured and is being manufactured in U.S. mills. Phase I is designed for about 1.5 Bcf/d, is fully sold out under long-term, fee-based commitments with investment-grade counterparties, and will use Energy Transfer’s network south of the DFW metroplex to reach major trading hubs and markets. In-service is targeted for Q4 2026. Phase I also includes the Midland Lateral—a 42-mile, 36-inch line that will connect Energy Transfer processing plants in Martin and Midland counties to the mainline. Phase II adds compression, creating a bi-directional system able to move roughly 2.2 Bcf/d from west to east and about 1 Bcf/d from east to west. At start-up, more than 2.2 Bcf/d is expected to be under contract. Total capital for Phases 1 and 2 is estimated at approximately $2.7 billion. Source: ET |

|

|

Energy Transfer Transwestern Desert Southwest Pipeline Expansion Project

In-service date: Q4 2029

Capacity: 2.3 Bcf/d

|

Source: Energy Transfer

|

|

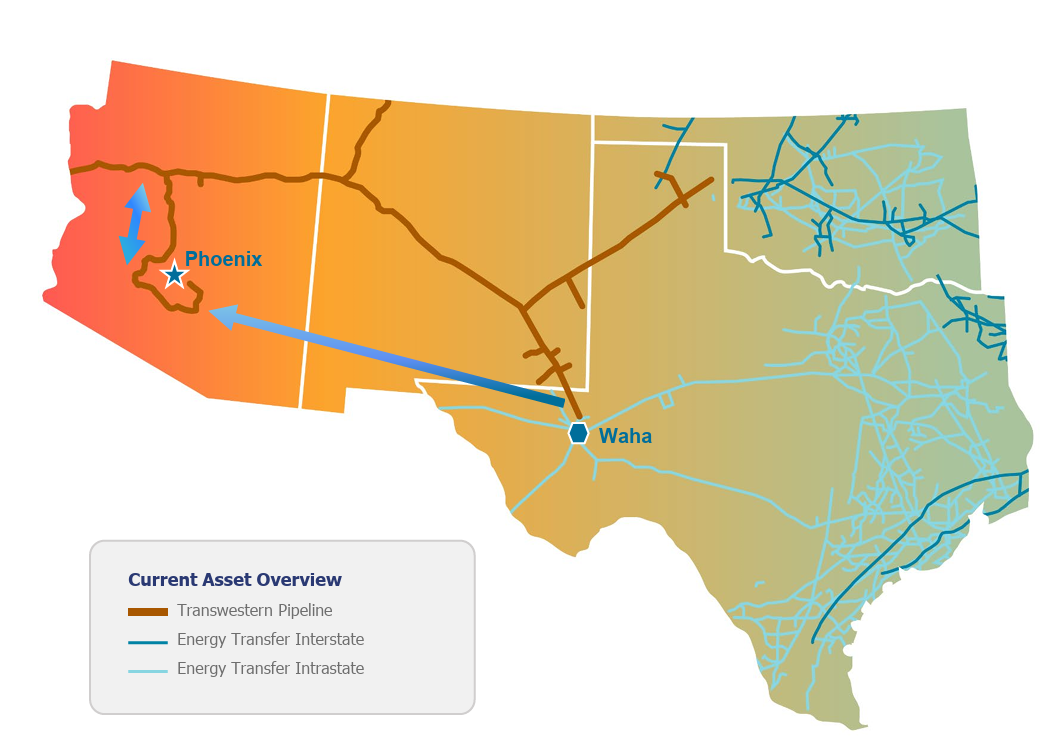

| Desert Southwest Pipeline Project - The Desert Southwest Pipeline Project is a 516-mile, newly upsized 48-inch diameter natural gas pipeline that will increase system capacity to up to 2.3 Bcf/d, depending on the final compression configuration. The project is designed to serve strong and growing natural gas demand across the Desert Southwest region. Following the upsizing, total project costs are now estimated at up to approximately $5.6 billion, excluding Allowance for Funds Used During Construction (AFUDC). Energy Transfer continues to target an in-service date in the fourth quarter of 2029. Source: Energy Transfer |

| |

Eiger Express Pipeline

In-service date: Mid 2028

Capacity: 3.7 Bcf/d

|

Source: WhiteWater

Note: Pipe footprint is the same as Matterhorn.

|

|

| Eiger Express Pipeline - The Eiger Express Pipeline is designed to transport up to 3.7 billion cubic feet per day (Bcf/d) of natural gas through approximately 450 miles of 48-inch pipeline from the Permian Basin in West Texas to the Katy area. Supply for the Eiger Express pipeline will be sourced from multiple connections in the Permian Basin, including gas processing facilities in the Midland Basin, and from the Delaware Basin via the Agua Blanca Pipeline, a joint venture between WhiteWater, Enbridge and MPLX. Source: WhiteWater |

|

|

Other Projects

|

|

Kinder Morgan's Copper State Connector (no FID) - The proposed project is a 630-mile, 42-inch greenfield pipeline capable of transporting 2.1 billion cubic feet per day (Bcf/d) from Waha to Arizona. During Kinder Morgan’s Q2 2025 earnings call, company representatives appeared to downplay the initiative when questioned by analysts, citing a competitive environment and uncertainty regarding tariff costs. Click here for the link to Kinder's comments in Docket G-00000A-25-0029 filed in February 2025 with the Arizona Corporation Commission.

Saguaro Pipeline (2028 no FID) - The pipeline is proposed to run from the Waha Gas Hub in the Permian Basin in West Texas, U.S. to the Mexican border in Hudspeth County, Texas. The pipe would be 2.8 Bcf/d at 48" diameter, owned by ONEOK. This pipe's future depends on whether Mexico's Pacific LNG reaches FID (expected 2025). If this is built, the Permian has more of a chance to be overbuilt with takeaway pipe through 2030.

Northbound Pipeline Expansions

Natural Gas Pipeline of America (NGPL) - Added compression to increase northbound capacity by 50 MMcf/d. Planned in-service of October 2025.

Northern Natural Gas - Expansion of 87 MMcf/d. In-service by November 2025.

Transwestern - Expansion of 80 MMcf/d. In-service by November 2026.

|

Local Supply

|

Based on public operator guidance, midstream company outlooks, pricing trends, and recent drilling activity, we anticipate continued growth in both oil and gas production in the Permian Basin, albeit at a slower pace than in the past two years. Historically, Permian gas supply has closely followed available pipeline takeaway capacity, meaning gas is always waiting when infrastructure allows. However, the trajectory of future oil supply growth may be more measured, as operators exhibit greater capital discipline. This moderation in oil production could result in a flatter gas supply growth profile, even with rising gas-to-oil ratios (GOR) and increased drilling in lower-liquids areas.

|

|

Operator Guidance

Diamondback Energy (Q4 2025 EC)

|

02/24/2026

|

|

2026 Guidance:

FY 2026 Production:

Total: 926-962 Mboe/d

Q1 2026 Production:

Total: 930-966 Mboe/d

2026 CapEx:

$3.6-$3.9B total CapEx

Strategic & Infrastructure Highlights

Gas Takeaway Expansion:

Current:

350 MMcf/d long-haul commitments

~70% of gas volumes exposed to WAHA pricing

By Q4 2026:

Commitments increase to ~800 MMcf/d

Diversification across multiple newbuild pipelines

Speficic Pipeline Commitments:

Hugh Brinson: 200 MMcf/d (HSC pricing)

Blackcomb: 250 MMcf/d (Agua Dulce: HH/HSC-linked)

Whistler: 275 MMcf/d

Matterhorn: 75 MMcf/d

Drilling & Basin Activity:

Midland Basin:

2026 well costs trending lower YoY

2026 activity supports steady production rather than aggressive DUC build

Management indictaed:

No meaningful DUC build expected in 2026

Activity aligned with capital discipline

Analyst Q&A Takeaways:

Waha Exposure Strategy:

Current: ~70% exposed

2026: materially reduced via pipeline contracts

Management possibly positioning ahead of expected 2026-2027 Permian takeaway growth

|

|

Devon Energy (Q4 2025 EC)

|

02/18/2026

|

|

2026 Guidance:

Q1 2026 Production:

Gas: 1,350-1,400 MMcf/d

Total: 823-843 Mboe/d

FY 2026 Production:

Gas: 1,360-1,400 MMcf/d

Total: 835-855 Mboe/d

2026 CapEx:

Q1 Total: $870-$930MM (Upstream $850-$900MM)

FY Total: $3.5-$3.7B (Upstream $3.425-$3.575B)

Strategic & Infrastructure Highlights:

Coterra Merger:

1.6 MMboe/d expected production

Acquisitions & Partnerships:

Matterhorn equity divestiture (~$409MM; capacity retained)

LNG export deal: 50 MMcf/d (10 years, starts 2028)

In-basin power deal: 65 MMcf/d (7 years, starts 2028)

Drilling & Basin Activity

Delaware Basin:

~90% of 2026 activity weighed to New Mexico

Base & Decline: Delaware base deline: mid-30% range

Downtime reduced from ~7% historically to <5%

Analysts Q&A Takeaways:

Delaware Repeatability:

Q4 benefited from some well timing

Wells outperformed internal expectations

Focus on flattening base declines and reducing downtime rather than pure growth

|

|

|

Coterra Energy (Q3 2025 EC)

|

11/04/2025

|

|

2026 Guidance:

FY25 Permian Oil Production: ~72% liquids mix of 367 MBOE/d in Q3

FY25 Permian D&C CapEx: $1.56B (in line with February guidance)

FY25 Net Wells Online: ~165 (upper end of guidance range)

Avg. Lateral Length: ~10,200 ft

Avg. Well Cost: $950/ft (↓10% YoY)

Primary Targets: Upper & Lower Wolfcamp, Bone Spring

Drilling & Basin Activity:

Franklin Mountain & Avant Acquisitions:

10% increase in inventory footage via trades, leasing, and delineation

10% reduction in well costs via optimized casing design and stimulation

5% LOE reduction to date; targeting 15% run-rate savings

Microgrid Development:

3 new microgrids in planning; potential to cut power costs by 50%

$25–50M in annual savings expected as power demand grows

Major Projects:

Barbell Row (Phase 1) and Bowler Row performing well; contributing to Q3 oil beat

Operational Efficiency:

Drilling times reduced from 15 to 13 days for 2-mile laterals

Scale and pad design driving down D&C and midstream costs

Strategic & Infrastructure Highlights:

CPV Power Deal: 50 MMcf/d gas supply to Basin Ranch Power Plant (Permian)

Gas Marketing:

Evaluating new long-haul pipeline access to reduce Waha basis exposure

Actively pursuing flow assurance and NYMEX-linked pricing

Analysts Q&A Takeaways:

Permian well productivity tracking at or above expectations

2026 CapEx expected to be modestly down; Permian activity to remain steady

Continued cost compression expected in Northern Delaware via pad scale and trades

Lightweight proppant trials underway in Delaware; results pending

|

|

|

Energy Transfer (Q4 2025 EC)

|

02/17/2026

|

|

2026 Guidance:

2026 Growth Capital:

$5.0-$5.5B, majority allocated to natural gas & NGL projects

~26% intrastate gas

~16% interstate gas

Strategic & Infrastructure Highlights

Hugh Brinson Pipeline:

~1.5 Bcf/d capacity Phase I (Q4 2026)

Expands to ~2.2 Bcf/d Phase II (Q1 2027)

Management indicated potential early volumes before official in-service

Desert Southwest Expansion:

Capacity upsized to ~2.3 Bcf/d

In-service target: Q4 2029

Management framed this as potentially one of their highest-return projects historically

FGT Expansions:

Phase IX: up to 550 MMcf/d capacity expansion (Q4 2028)

South Florida lateral: new 37-mile pipeline (Q1 2030)

Data Center & Power Demand Growth

~900 MMcf/d contracted with Oracle (multi-site)

~250 MMcf/d 20-year deal with Entergy LA

~190 MMcf/d new Oklahoma power connections (Q2 2026)

6+ Bcf/d total contracted pipeline capacity (last year)

Drilling & Basin Activity:

Current Permian processing capacity: ~5.4 Bcf/d

Additions:

Mustang Draw I: 275 MMcf/d (Q2 2026)

Mustang Draw II: 275 MMcf/d (Q4 2026)

Management noted ET still has ~160 MMcf/d of open capacity benefiting from Waha spreads

Analysts Q&A Takeaways:

Hugh Brinson Early Flow:

Potential early volumes before Q4 2026 official start

Waha & Spread Exposure:

~160 MMcf/d still exposed to basin spreads

Management excited about Hugh Brinson opening the basin structurally

|

|

Occidental Petroleum (Q4 2025 EC)

|

02/19/2026

|

|

2026 Guidance:

Total Production:

~1.45 MMBoe/d (+1% YoY)

2025 production was 1.434 MMBoe/d (record year)

Capital Program (2026):

$5.5-$5.9B (Down $550MM YoY ex-OxyChem)

~70% allocated to U.S. onshore

Strategic & Infrastructure Highlights

Permian Gas Optimization:

Midstream outperformed due to gas marketing optimization in the Permian

Q4 midstream earnings exceeded guidance by $172MM (transport optimization)

Gas Takeaway & Basis Implications:

2026 midstream earnings expected slightly lower as Permian gas takeaway capacity increases

Drilling & Basin Activity:

Permian:

US conventional capital down $400MM YoY

Achieved:

7% lower well costs

5% lower facilities costs

2.5 fewer rigs, 2 fewer frac crews

Permian production: +4% YoY

Analysts Q&A Takeaways:

Structural Cost Improvements Are Durable:

Savings are operational, not deferals

50% more wells drilled per rig since 2023

Simul-frac expanded to ~40% of US position

Permian Gas Transportation Margins Likely to Normalize:

2026 midstream earnings expected slightly lower as takeaway expands

Macro View (Supply TIghtness 2027+)

Global reserve replacement ratio <25%

Supply-demand balance expected to tighten by 2027

While oil-focused, tightening supply would indirectly support associated gas economics

|

|

|

| |

Local Demand

|

The Permian Basin is a supply zone with limited local demand relative to other areas in the US. Local gas demand can range from 400 MMcf/d and 700 MMcf/d depending on the season.

|

|

|

Wind and Solar Projects: The Permian Basin's sunny climate and high wind speeds make it an attractive location for renewable energy development. This increases competition in the power market and influences grid dynamics.

Infrastructure Limitations: Limited transmission capacity can bottleneck power flows from generation sites (e.g., gas plants or renewables) to demand centers.

Congestion Pricing: Transmission constraints often lead to price volatility and localized pricing spikes.

|

Market Design: The Permian Basin straddles the boundaries of the Electric Reliability Council of Texas (ERCOT) and the Southwest Power Pool (SPP), each with different market designs and rules that influence pricing and operations.

Environmental Regulations: Policies targeting emissions and flaring can shift market dynamics by incentivizing renewable energy or penalizing gas flaring.

Data Centers and Electrification: The rise of data centers and electrification of oilfield operations (e.g., electric drilling rigs) also adds to power demand.

|

|

|

Recent Market-Relevant events

|

Energy Transfer to Upsize Desert Southwest Expansion Project

-

Market Impact: The addtional capacity on ET's expansion will create additonal egress out of the Permian basin at the end of the decade. The expansion adds to a growing list of pipeline projects aimed at increasing natural gas takeaway capacity out of West Texas and southeastern New Mexico.

-

Energy Transfer upsized the pipeline in late 2025 to 2.3 Bcf/d from 1.5 Bcf/d due to customer interest.

- The pipeline will now be a 48" pipe versus the smaller 42" that was orginally planned.

-

"The Transwestern Desert Southwest Pipeline expansion will help enable us to meet the region's growing power needs and strengthen Arizona's energy infrastructure" - ET

-

The company still expects a Q4 2029 in-service date.

|

WhiteWater announces new Permian-to-Katy Natural Gas Pipeline

-

Market Impact: The pipeline is likley to follow Matterhorn's easement as the pipeline will be operated by WhiteWater and flows to Katy, Texas. Gas reaching the Katy area will soon have the capability to connect to both Blackfin and Trident that will take gas around Houston toward growing LNG demand.

-

The Eiger Express Pipeline is designed to transport up to 2.5 billion cubic feet per day (Bcf/d) of natural gas through approximately 450 miles of 42-inch pipeline from the Permian Basin in West Texas to the Katy area.

- Design capacity of the pipeline is 2.5 Bcf/d and estimated in service date by 1H 2028.

-

The Eiger Express Pipeline is a joint venture owned 70% by the Matterhorn JV, 15% by ONEOK, and 15% by MPLX. ONEOK's and MPLX's direct ownership interests in the Eiger Express Pipeline joint venture are incremental to their ownership through the Matterhorn JV, resulting in 25.5% and 22% ownership in the pipeline, respectively.

-

The Eiger Express Pipeline will be constructed and operated by WhiteWater and is expected to be in service in mid-2028, pending the receipt of customary regulatory and other approvals.

|

Energy Transfer to Build $5.3 Billion Texas-to-Arizona Gas Pipeline

-

Market Impact: Would provide more natural gas takeway capacity for the Permian basin. It would also better supply the desert southwest and possibly help feed the Mexican Costa Azul LNG facility.

-

The pipeline expansion of Transwestern would consist of 516 miles of 42-inch pipeline and nine compressor stations in Arizona, New Mexico, and Texas.

- Design capacity of the pipeline is 1.5 Bcf/d and estimated in service date by 4Q 2029.

- The project is supported by long-term agreements from invenstment-grade customers and the compay plans to launch an open season later this quarter.

|

Tallgrass Proposes new Permian to Rockies Express Pipeline

-

Market Impact: The new proposed pipeline could serve a varity of demand centers depending on where it would connect with Rockies Express (REX). Rockies gas production has been on the decline and is expected to continue into the future. Tallgrass has an extensive pipeline system in the Rockies that can reach the West Coast and demand centers in the Midwest.

-

Tallgrass anounced anchor shipper precedent agreementsfor a new pipeline that will move gas from the Permian Basin to the Rockies Express Pipeline and other points of delivery.

-

The company said there are sufficient agreements to financially justify construction of the project with an in-service date in late 2028.

|

WhiteWater Announces FID on Traverse Pipeline

-

Market Impact: This pipe is important for moving gas toward the Houston and eventually, toward LNG in Louisiana. However, it does not add extra egress for those exposed to Waha gas prices.

-

WhiteWater, MPLX LP, and Enbridge Inc., have partnered with an affiliate of Targa to move forward with the construction of the Traverse Pipeline.

-

The Traverse Pipline will be a bi-directional, 160 mile, 36-inch pipeline along the Gulf Coast between Agua Dulce in South Texas and the Katy area.

-

The pipeline will transport up to 1.75 Bcf/d and will be sourced from multiple locations such as Whistler, Blackcomb, and Matterhorn Express Pipeline.

|

Expansion of NGL and Natural Gas Takeaway From MPLX with Gulf Coast Projects

-

Market Impact: Added gas processing and pipeline expansions in the Permian will mean more gas reaching the Gulf to feed LNG growth through the end of the decade.

-

MPLX reported a significant uptick in its natural gas and NGL services in late 2024

-

New infrastructure includes the Gulf Coast fractionation complex, which will feature two 150 MBbl/d facilities, anticipated to come online by 2028 and 2029

-

The company is also working with ONEOK to build a 400 MBbl/d LPG export terminal and pipeline that is expected to come online in 2028

-

MPLX also mentioned that the Blackcomb and Rio Bravo Pipelines will enhance natural gas transport from the Permian to the Gulf Coast. The company is also boosting natural gas processing facilities, including the Secretariat processing plant in the Permian. The new facilities are expected to add 1.4 Bcf/d of processing capacity by late 2025.

|

Blackfin Pipeline gets approval to build lateral connection to LNG

-

Market Impact: A connection between Blackfin and CP Express means Permian gas could flow down Matterhorn—another WhiteWater pipeline—to Blackfin, then to CP Express and CP2 LNG. This, along with Kinder Morgan’s FID-approved Trident Pipeline, would help debottleneck the Katy and Houston area and route gas around Houston to the Beaumont/Port Arthur area.

-

The Blackfin Pipeline, owned by WhiteWater Midstream, was approved by the RRC on Jan. 28 for the addition of two laterals, including a 0.55-mile, 48-inch CP Express Delivery Lateral.

-

The CP Express Pipeline will deliver gas from far southeast Texas to Venture Global's proposed CP2 LNG project in Cameron Parish, Louisiana.

-

The other approved lateral, called the Matterfin Lateral, is 0.2 miles long and would likely link to the Matterhorn Express Pipeline, allowing West Texas gas to connect more easily to Louisiana LNG.

-

Blackfin started construction on the mainline in October 2024, according to RRC data.

|

Energy Transfer reaches FID on 2.2 Bcf/d Permian pipeline

-

Market impact: The addition of the Hugh Brinson pipeline in the winter of '26/'27 will likely add to the region's pipeline takeaway capacity overbuild. The Waha forward curve in 2027 reflects this reality.

-

Previously known as the Warrior Pipeline. The pipe has been renamed to Hugh Brinson.

-

The project is a 400 miles of 42" pipeline with an initial capacity of 1.5 Bcf/d.

-

Phase II will boost pipeline capacity to 2.2 Bcf/d, depending on demand.

|

|

|

Don’t stop here.

See how other regions are performing right now:

|