Looking for something specific? Jump to a section:

Commentary Outlook & Notes Market-Relevant Events Infrastructure Supply Chart Pack

Like much of the rest of the country, the lower Midcontinent (Midcon) has experienced a mild winter. This has had a dramatic negative effect on regional basis pricing over the past two months. NGPL Midcon Basis is used as a regional benchmark for Lower Midcon gas prices, with the basis spread being the discount or premium to Henry Hub. Forward prices for NGPL Midcon remain at a discount to Hub throughout the next two years, as Lower Midcon prices in general trade at discounts to downstream demand locations in the Midwest or Gulf Coast. The reason for this is that the Midcon is situated in between sources of supply and demand, while also having a substantial amount of production. At times of strong weather-driven demand during peak winter, prices may rise above Henry Hub, encouraging more gas to remain in the region.

Commentary

January 16: Price action across the lower Midcon and adjacent basins has consistently been sold off since the start of December. The prompt month Feb26 NGPL Midcon contract has fallen to -$0.700 intraday January 16, down from -$0.0725 on December 1. Interestingly, Summer 26 Midcon basis prices have rallied since the start of the year with NGPL Midcon basis up to -$0.545 from -$0.608 on December 31.

December 12:Most of the regional price points have been sold off since the beginning of the month. Many peaked on or around December 3 before succumbing to selling pressure. The prompt month Jan26 NGPL Midcon contract ended the month of November settling at $0.010. Multiple days of heavy selling pressure in the first week of December has dropped the contract to -$0.5725 as of the close on December 11. While the selling has affected the front end of the basis curve lower, the Summer 26 (Apr26-Oct26) and Winter 26/27 (Nov26-Mar27) strips have traded sideways.

November 21: NGPL Midcon basis pricing as been relatively stable the past month with the current prompt Dec25 contract seeing volatility the past week. Since the beginning of the month Dec25 basis pricing has fallen from -$0.215 on November 3 to -$0.220 intraday on November 21. However, we saw prices rise as high as -$0.0525 on November 14. We'd expect pricing at the front of the basis curve to remain volatile, reflecting changes inshort term weather forecasts and trade flow. Summer 26 and beyond have been steadily increasing the past couple of months.

October 20: The November NGPL Midcon basis contract has traded sideways since the start of October. From the beginning of the month the contract fell $0.015 from -$0.420 on October 1 to -$0.435 intraday on October 20. Over the same period, the Summer 26 strip increased in value $0.03 to -$0.539. Other Midcon regional basis hubs have followed a similar trend, with Panhandle and ONEOK showing comparable patterns for November and the Summer 26 strip.

September 15: Prompt month NGPL Midcon basis is at the highest level since late winter, while forward prices through the next few seasons have also moved higher. The Winter '25/'26 and '26/'27 seasonal strips are both near multi-month highs. Price action in nearby basis locations, such as Oneok Oklahoma Basis and Panhandle TX-OK Basis has been more muted, as prompt prices have risen but forward prices have remained relatively stable.

NGPL Midcon Basis Outlook and Notes

|

Winter '25-'26

Despite settling near parity to Henry Hub for the past five winters (Nov–Mar), NGPL Midcon forward pricing reflects a –$0.15MMBtu discount to Henry for the balance of Winter ’25–’26 (as of 11/21/25). This is not the case for ANR Oklahoma and Panhandle TX-OK forward pricing as both of these points trade over parity to Henry Hub.

|

Summer '26

There are fewer differences between major Midcontinent pricing hubs in the Summer ’26 strip (Apr–Oct). Nearly all points (NGPL Midcon, ANR Oklahoma, ONEOK Oklahoma, Panhandle TX-OK) are priced at about a –$0.60/MMBtu discount to Henry Hub as of November 21. The Summer ’26 discount to hub is consistent with levels observed over the past few years. Flows to Midwest demand centers are typically lowest in the summer months when Chicago area demand is much weaker than in winter.

|

Winter '26-'27+

Prices at Lower Midcontinent locations in Winter ’26/’27 are similar to those in the Winter ’25/’26 strip. Flow dynamics are also expected to be comparable between the two winters. The Permian Basin will gain new pipeline egress to the Gulf Coast in the second half of 2026, shifting some gas away from the Midcontinent. The impact is likely more concentrated in Summer ’27. The Waha curve shows significant improvement in 2027, and Lower Midcontinent pricing hubs also display modest gains in the forward curve for Summer ’27 compared with Summer ’26.

|

|

|

For more discussion on basis price moves and the current forward curves:

For more discussion and charts, jump to our outlook and chart pack. Remember, the local market is influenced by the broader gas market. Consult our Gas Macro Outlook for more.

|

Recent Market-Relevant Events

8.5.2025

Pipeline maintenance supporting midwest gas prices

|

7.14.2025

Midcon producers see $3.79 gas needed for substantial growth

|

5.2.2025

TC Energy approves ANR pipeline expansion

|

|

|

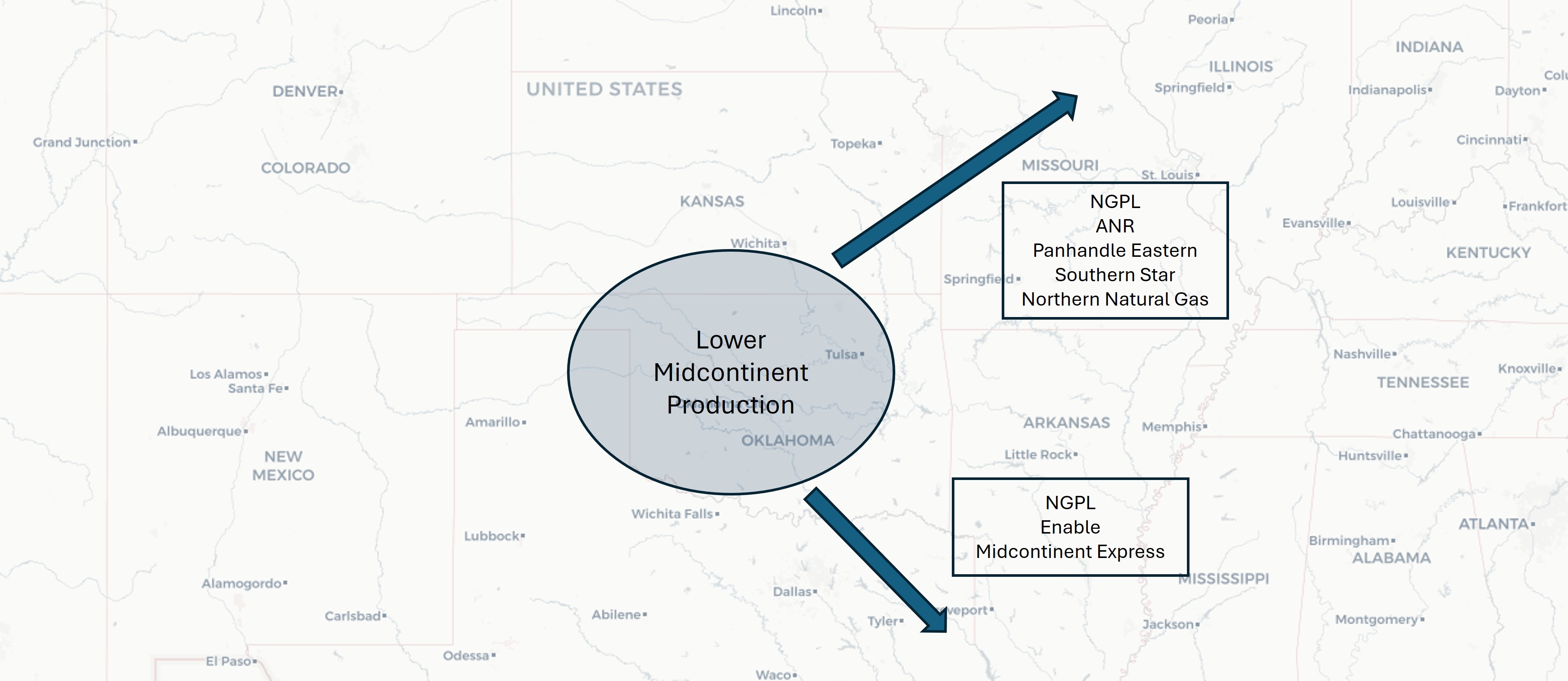

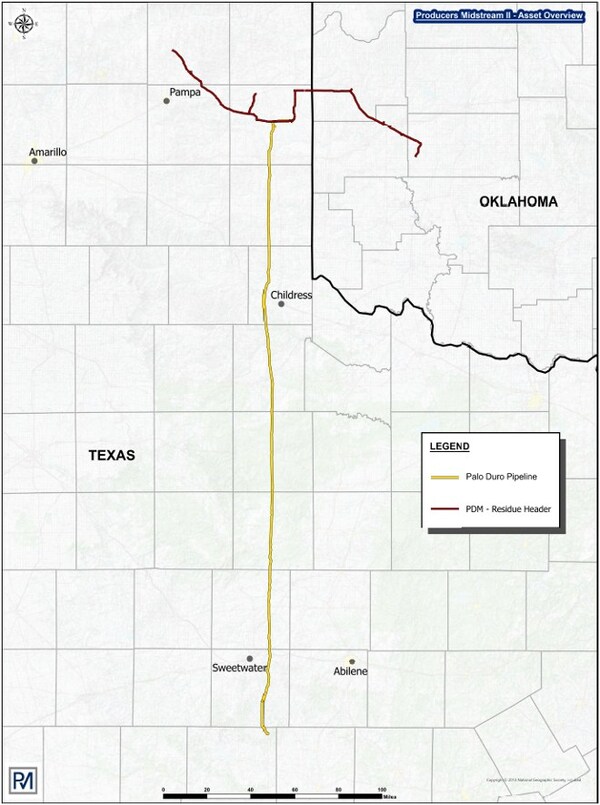

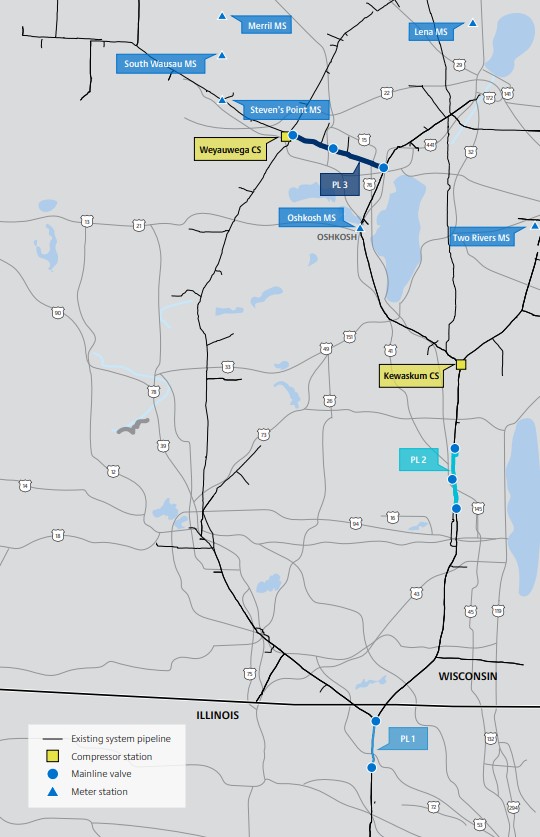

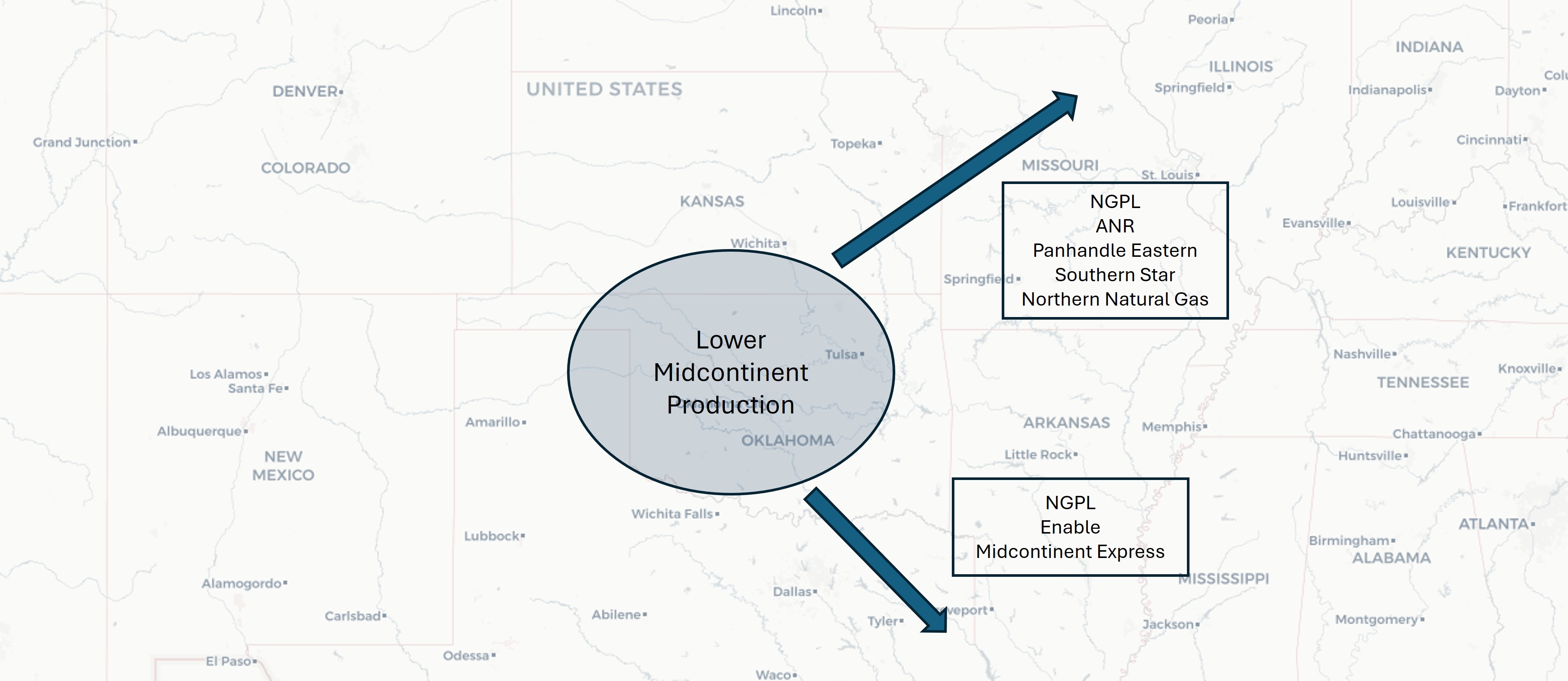

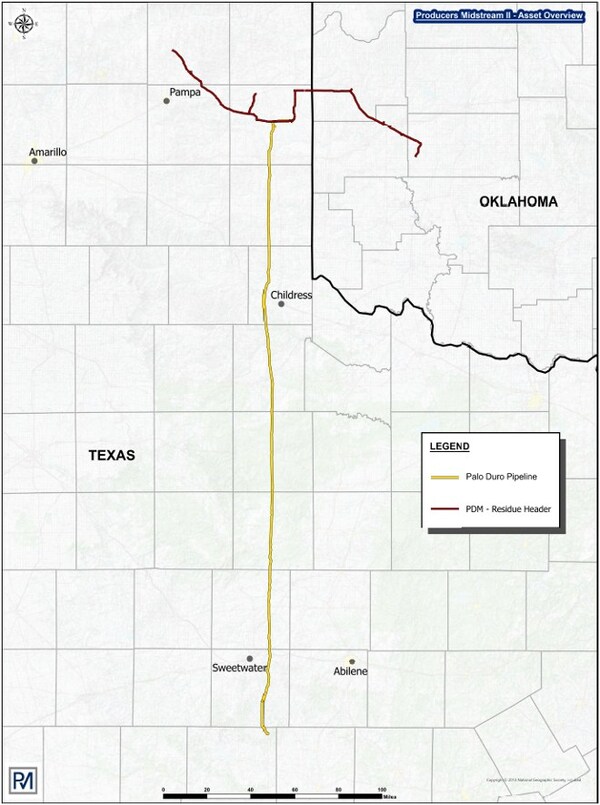

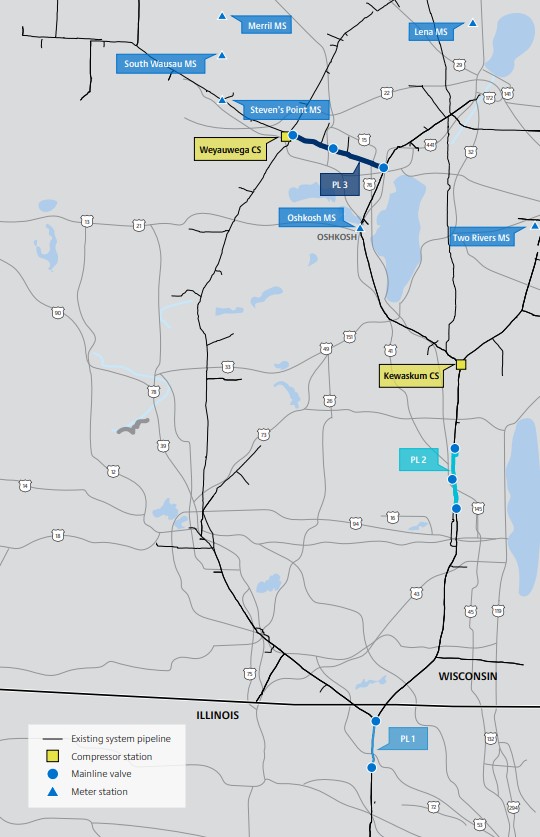

Several pipelines pass through the Midcontinent, bringing supply from west Texas and the Rockies into the Midwest. Meanwhile, gas also flows south through the region toward the Gulf Coast. During winter when the Midwest and Northeast consume the most gas, flows typically head north towards the large demand centers. There are only a few planned infrastructure expansions on the horizon, such as the small Palo Duro pipeline connecting Permian production to a system in southwest Oklahoma, and an expansion of the ANR pipeline in the Midwest.

|

For a discussion of production outlook:

Below are the most market-relevant infrastructure projects that appear to be funded and going forward. The projects that offer intra-region capacity (egress) are also shown in the chart above.

Note: Deeper discussion included below the map.

|

Major Pipeline Exits From the Lower Midcontinent

Gas Pipeline Flows

Gas Pipeline Projects

Palo Duro Pipeline

In-service date: 1Q 2026

Capacity: 80 MMcf/d

|

|

ANR Northwoods Expansion

In-service date: 2029

Capacity: 400 MMcf/d

|

|

Local Supply

|

Gas production in the lower midcon area has been relatively stable over the past few years, in a range between 7.5 and 8.5 Bcf/d. Output dropped to a multi-year low in 2024 amid price-driven curtailments in producing regions across the country. Since then, production has normalized, and moved back toward the top end of the range. Rig activity in Oklahoma climbed in early 2025 as prices jumped, but has since stabilized in the low 40s.

|

|

Operator Guidance

Devon (Q3 2025 EC)

|

11/06/2025

|

|

2026 Guidance:

Expecting CapEx in 2026 to decrease by $100 million from 2025 levels to $3.5 billion - $3.7 billion

Total production in 2026 expected to remain near current elvels at 835 Mboe/d to 855 Mboe/d

Crude oil is expected to make up roughly 388 Mboe/d of total production

Key Basin Activity:

Anadarko remains a steady contributor but not a grwoth engine like the Delaware Basin

Anadarko will continue to receive maintenance capital but not likely to see any growth capital

|

|

Gulfport (Q3 2025 EC)

|

11/05/2025

|

|

2026 Guidance:

Increased total production in 3Q25 to 1,119.7 MMcfe/d, up 11% from 2Q25

Full year 2025 total daily production expected to be 1.04 Bcfe/d

Key Basin Activity:

Anadarko (Scoop) 3Q25 net production was 203 MMcfe/d

No reported drilling or completion activity in the Scoop during third quarter

Continue to report expectations of 2 gross wells drilled, completed and turned to sales in Scoop during 2025

Scoop continues to receive base capital but no indication of growth capital being allocated there

|

|

Ovintiv (Q3 2025 EC)

|

11/05/2025

|

|

2025 Guidance:

Third quarter production was higher than guidance range across the board

Raised full year 2025 production guidance to a range of 610 MBoe/d - 620MBoe/d

Oil expected to be 208MBbl/d - 210MBbl/d for 2025 whiel gas will contribute 1,850MMcf/d - 1,870MMcf/d in 2025

Full year capital guidance maintained at $2.125 billion to $2.175 billion

Key Basin Activity:

Anadarko full year capital investment of $290 million - $310 million to bring on 37 net wells

Noted plans to market and sell Anadarko assets in 2026 in order to reduce debt

|

|

|

| |

Local Demand

|

Gas consumption in the Lower Midcontinent usually peaks around 7-8 Bcf/d during the coldest periods of winter, but averages closer to 4 Bcf/d year-round. Demand from the power sector results in higher summertime consumption. While the Lower Midcontinent is not a particularly large source of demand, the region relies on the Midwest and Gulf Coast as major sources of demand.

|

|

Renewables: The Southwest Power Pool or SPP, which includes most of the Midcontinent, is one of the largest regions for wind generation.

|

Data Centers and Electrification: The rise of data centers and electrification of oilfield operations (e.g., electric drilling rigs) also adds to power demand. As with many parts of the US with access to reliable gas and power supply, developers have started to build data centers in Oklahoma. Google operates one data center east of Tulsa, while a new 500-acre facility linked to Meta is also planned for the city.

|

|

|

Recent Market-Relevant events

|

Pipeline maintenance supporting midwest gas prices

(August 5, 2025)

Work on the Viking Gas Transmission system reduced flows heading into the midwest

-

A series of hydrotests reduced downstream flows from Minnesota into the midwest

-

Midwest spot gas prices strengthened amid the supply reduction, while prices near the Canadian border weakened

-

Gas inventories in the region had already been trailing other parts of the country, with lower supply exacerbating this

|

Midcon producers see $3.79 gas needed for growth

(July 14, 2025)

A survey by the Kansas City Federal Reserve found producers in the area think gas prices need to average $3.79/MMbtu for drilling to be profitable.

-

Executives noted that for drilling in the region to be profitable, natural gas prices will need to average $3.79/MMbtu, while a substantial increase in production may require an average of $5.01/MMbtu

-

One respondent stated that gas prices have been stronger this year, encouraging more activity in the mid-term, but this could weaken prices on a longer time frame

|

TC Energy approves ANR pipeline expansion

(May 30, 2025)

TC Energy approved a $900 million expansion of its ANR pipeline system through the Northwoods project, aiming to meet increasing natural gas demand in the U.S. Midwest with completion expected by late 2029.

-

The Northwoods project will expand ANR pipeline capacity by 0.4 Bcf/d with new infrastructure

-

Northwoods aims to serve Midwest electricity demand, including data centers and economic growth

|

|

|

Don’t stop here.

See how other regions are performing right now:

|