After numerous delays over the past several years, the Golden Pass LNG export plant developed by ExxonMobil and Qatar Energy finally looks to be on track and nearing completion. The startup of this plant will add on to already impressive growth in LNG feedgas demand, which reached new records in 2025. While Golden Pass should be starting up in the first part of 2026, as developers have guided for some time now, the exact timing could have major implications for supply-demand balances this winter and heading into Summer 2026.

Once operational, Golden Pass will consist of three 790 MMcf/d liquefaction trains, which should enter service throughout 2026, equaling about 2.4 Bcf/d in total. It has been expected that Train 1 would enter service around Q1 2026 for some time now, and this continues to be the case. However, as this approaches, more information about the exact timing has surfaced.

A cargo of LNG is currently headed to Golden Pass from Qatar, to be used to cool down plant equipment ahead of Train 1’s startup. Typically, following the importation of a cargo, feedgas flows ramp up over the following months. With the cargo set to arrive in the first week of December, this would put feedgas flows ramping up in late December and January. In addition to this, an anonymous source with knowledge of the facility was cited as saying that Golden Pass plans to export the first cargo in February 2026, implying feedgas volumes should begin ramping up prior to that.

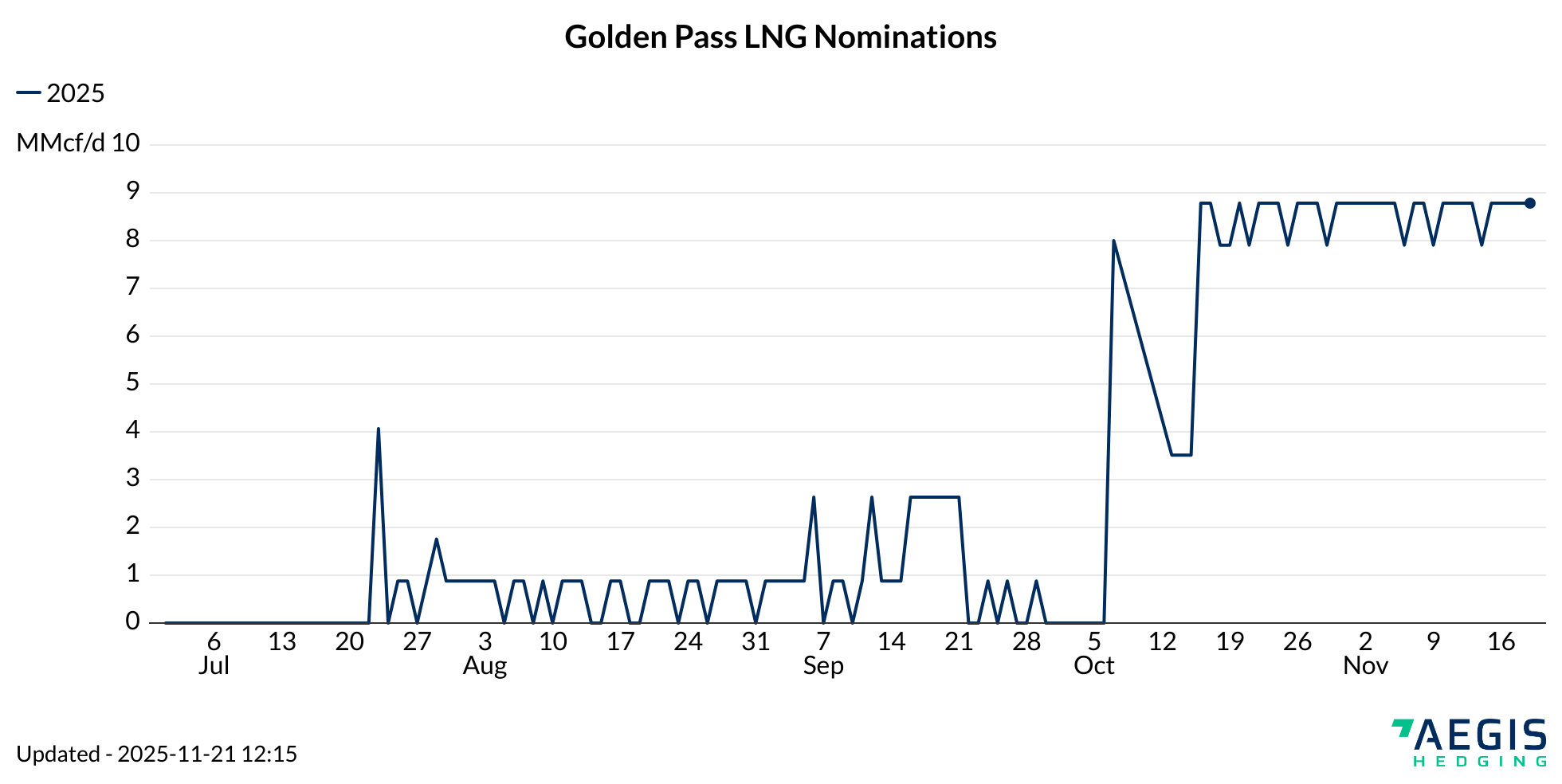

Currently Golden Pass is receiving about 8-9 MMcf/d, likely for the purpose of testing on-site equipment, but not liquefying gas yet. Based on the available information, it’s likely that nominations will begin to rise around the second half of December heading into 2026 and possibly nearing 700 MMcf/d around February. This would not materially change the supply-demand balance for most of Winter ‘25/’26 but could help tighten the market around the end of winter and heading into summer. The startup should have a bigger impact on the Summer 2026 supply-demand balance, especially as Train 2 is expected to start up in late summer. By this time next year, Golden Pass should be taking about 1.5 Bcf/d, and readying Train 3 for startup around the end of 2026.

If this timeline pans out and there are no unexpected delays it would push Lower-48 LNG feedgas demand close to 20 Bcf/d in March 2026, and more than 21 Bcf/d by year-end. This would represent a year-over-year increase of 2-4 Bcf/d, likely tightening the supply-demand balance unless gas production growth is significantly more robust than anticipated.