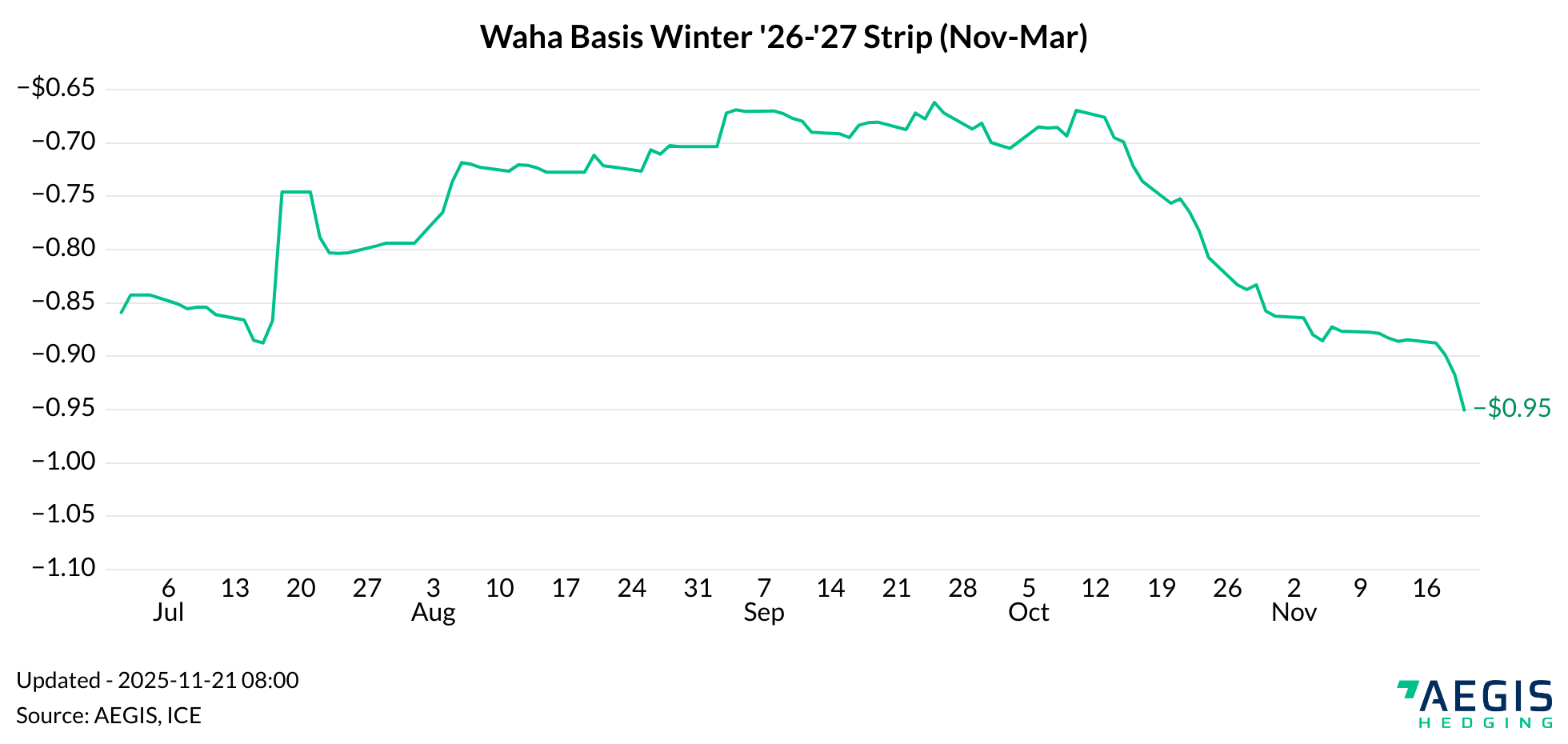

The “bullish” part of the Waha basis curve has been getting weaker. The Winter ’26-’27 strip has come off its near year-to-date high of -$0.66/MMbtu for Waha basis. Why has it been losing strength?

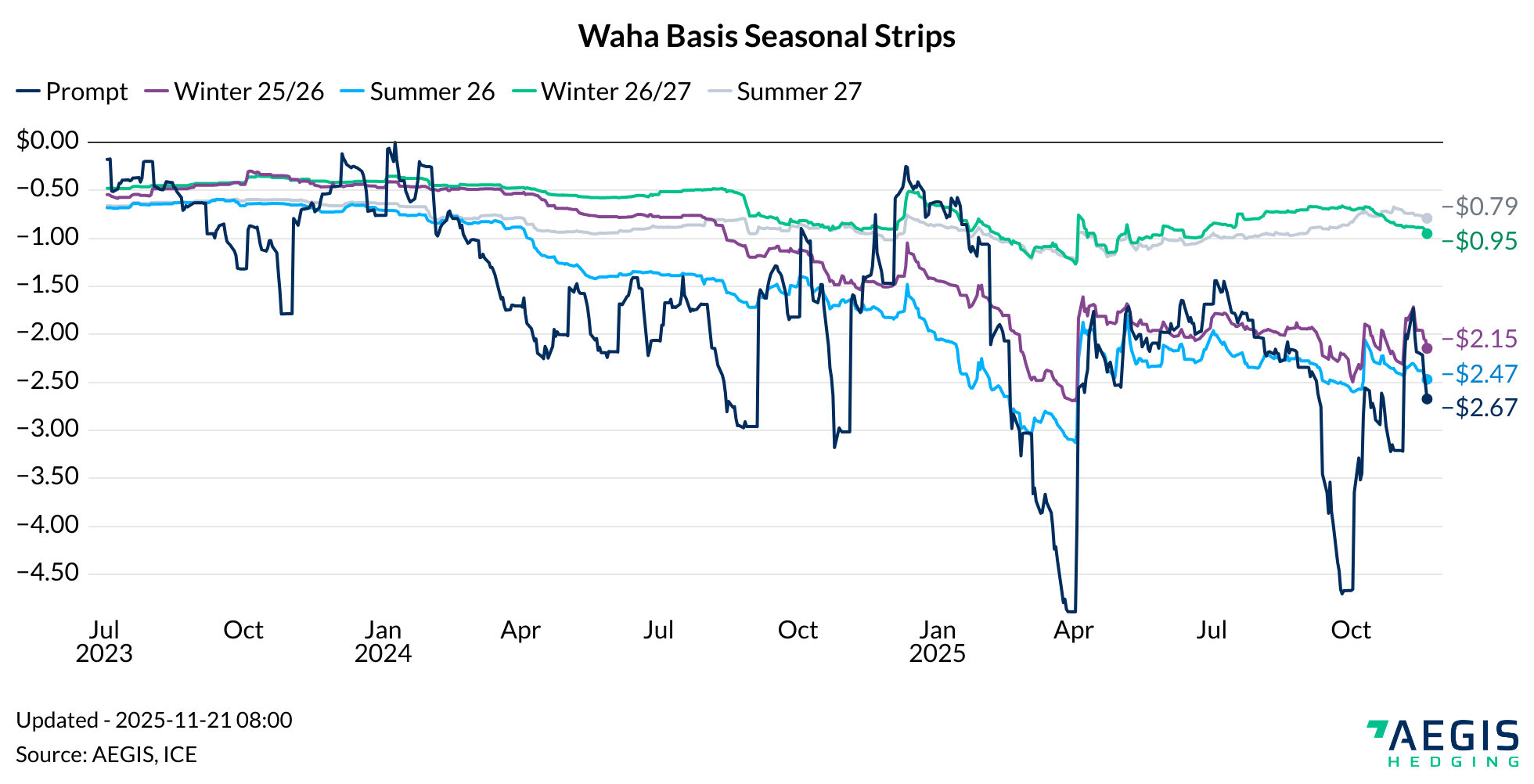

There is about 4.5 Bcf/d of greenfield and brownfield pipeline expansions expected to come into service between 3Q ‘26 and 1Q ‘27. This is why the Waha forward curve shows material improvement starting in late 2026. The chart below shows both Winter ’26-’27 and the Summer ’27 strip materially higher (less of a discount to Henry Hub) than more nearby tenors as Permian dry gas egress is tight.

There are a few likely contributors to weakening price in the Winter ’26-’27 strip. As the largest hedge advisor to US oil and gas producers, we can say that there has been an uptick in hedge volume for this part of the curve. Producers are only 12 months away from the first settlement on the Winter 26’-’27 strip and prices are much more attractive for producers than what has been available in the past two years. In other words, we have seen more selling pressure.

In addition to possible selling pressure, its possible sentiment is shifting toward gas supply growth being sufficient to meet the new pipeline capacity. This seems like a tall order, but when we talk to producers, they are generally very bullish about how fast gas supply can grow in the Permian. There has been article after article written about rising GORs (gas-to-oil ratio) in the Permian. There are forecasts for material step-ups in GORs over the next few years. On top of rising GORs, we hear that there is a good amount of gas “just waiting” to reach market that is hard to quantify. From our understanding, this would be wells that are “choked back” due to the lack of gas pipeline availability.

The analogy one could use would be how fast Matterhorn filled up when it came online late last year. From our observations, Matterhorn filled about a quarter earlier than many analysts were predicting. This could have been due to gas being suppressed in the wellhead (choked back) and opening the tap once egress becomes available.

In summary, we could see additional pressure on the Waha basis curve as the months move forward. The increase in selling that we see and public opinion on how efficient Permian operators are at producing natural gas may skew the “bullish” part of the Waha curve lower. All this despite crude oil prices are currently in the high $50’s.