| Commodity / Renewable Identificatin Numbers Exploring the RINs MarketA closer look into RIN generation, lifecycle, the impact on advancing net-zero carbon initiatives and potential hedging capabilities.What are RINs Market Dynamics Future Trends | |

RINs are unique codes used to track biofuels as they move through the fuel supply chain. Created under the Energy Policy Act of 2005 and expanded by the Energy Independence and Security Act (EISA) of 2007, the RFS program mandates the increased use of renewable fuels to reduce greenhouse gas (GHG) emissions. RINs serve as the currency of compliance under the Environmental Protection Agency’s Renewable Fuel Standard (RFS) Program.

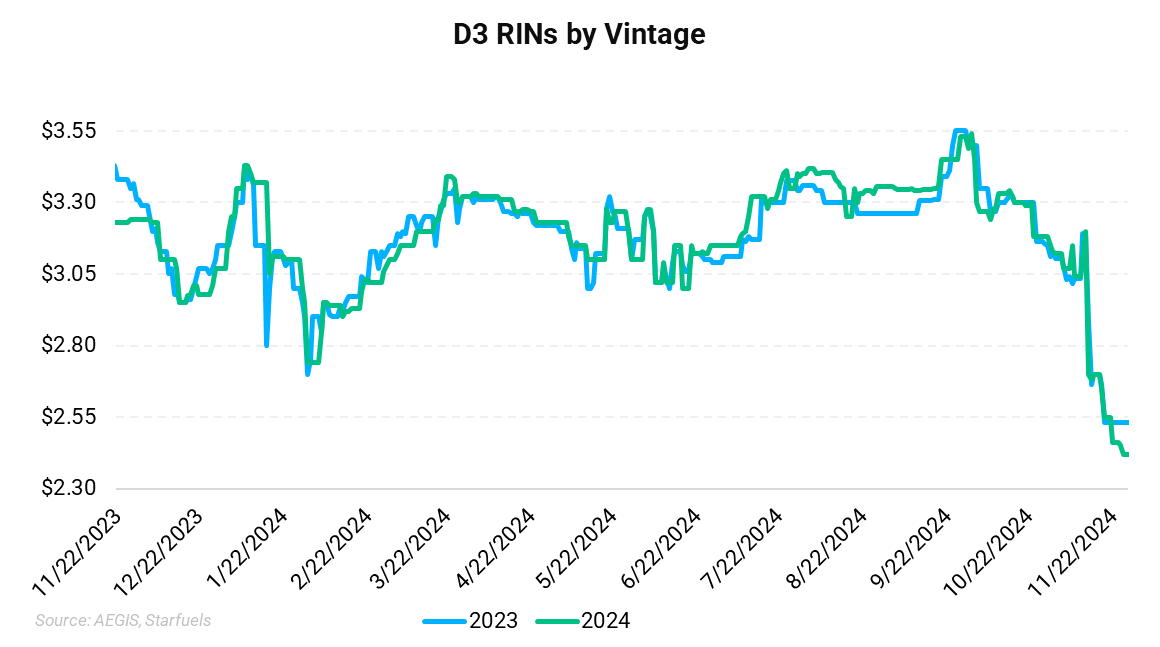

| Each type of RIN is associated with a specific type of biofuel and its equivalence value, which determines how many RINs are generated per gallon of biofuel. RINs are categorized by D-code, indicating the type of renewable fuel and its GHG reduction. | Types of RINsD6 RINs (Can be hedged): Generated from corn-based ethanol, the most common type D4 RINs (Can be hedged): From biomass-based diesel, including biodiesel and renewable diesel D5 RINs: From advanced biofuels like sugarcane ethanol D3 RINs: From cellulosic biofuels, often generated from biogas D7 RINs: From cellulosic diesel |

Historical PerspectiveInitial Implementation The Renewable Fuel Standard (RFS) program was created under the Energy Policy Act of 2005. The initial goal was to reduce greenhouse gas (GHG) emissions, enhance energy security by decreasing reliance on imported oil, and promote the use of renewable fuels. The program mandated the blending of renewable fuels into the US transportation fuel supply. Amendments and Updates In 2007, the Energy Independence and Security Act (EISA) significantly expanded the RFS program, introducing RFS2. This update established four categories of renewable fuels, each with specific GHG reduction thresholds: cellulosic biofuel, biomass-based diesel, advanced biofuel, and total renewable fuel. The RFS2 also increased the volume of renewable fuels required to be blended into the fuel supply. |

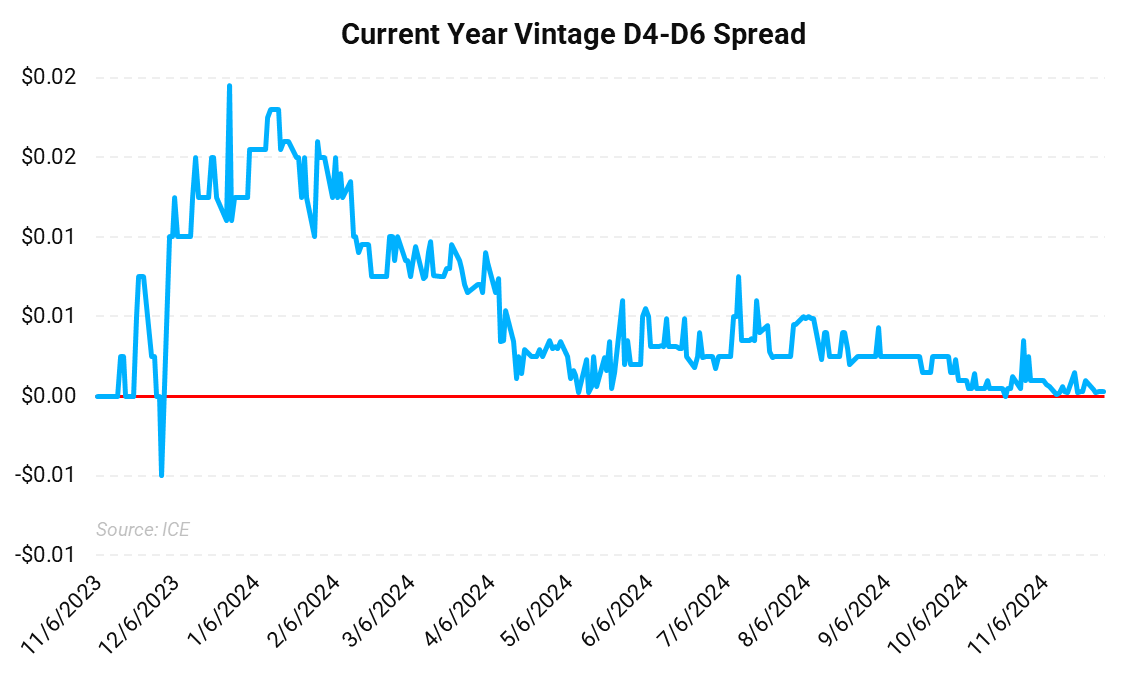

RINs are generated at the point of biofuel production or import. A RIN is a 38-digit code that tracks the biofuel through the supply chain. Once blended with petroleum-based fuel, RINs can be separated and traded. Obligated parties (OPs), including refiners and importers, must retire RINs to demonstrate compliance with the RFS. RINs have a lifespan of two years, and up to 20% of an obligation can be met with prior-year RINs.

What Does a RIN Look Like?

|

Market DynamicsWhen renewable fuel is blended with petroleum-based fuel, the RIN can be separated from the physical gallon of biofuel. Once separated, RINs can be traded independently in the market, allowing obligated parties to buy or sell RINs to meet their RFS obligations.

|

| Market Participants RIN Generators: U.S. and foreign biofuels producers generate RINs. Blenders: Separate RINs at the point of blending with gasoline or diesel. Obligated Parties: Refiners and importers required to meet RFS mandates. Must acquire and retire RINs to comply with the RFS. |  |

Factors Influencing PricesFeedstock Availability: Changes in the availability of feedstocks like corn, soybean oil, and used cooking oil can impact RIN prices. Regulatory Changes: Updates to RFS mandates, EPA rulings, and policy shifts can cause price volatility. Market Demand: The demand for RINs is driven by the blending obligations of refiners and importers. Speculative Activity: Speculative trading can contribute to RIN price volatility. Traders may buy and sell RINs to profit from price fluctuations, impacting overall market stability. |  |

The EPA's 'Set Rule' for 2023-2025 established lower-than-expected volumes for advanced biofuels, impacting RIN prices and related markets.

The Inflation Reduction Act (IRA) introduces new credits like the Clean Fuels Production Credit (CFPC) and increased subsidies for sustainable aviation fuel (SAF), and carbon capture and storage (CCS), further influencing the renewable fuels market.

RIN categories are nested, allowing certain credits to count towards multiple obligations. For instance, D4, D5, and D7 RINs can satisfy the advanced biofuel requirement, while D6 RINs are used for the total renewable fuel requirement. The structure ensures flexibility in meeting different mandates.

Future Outlook & TrendsThe future of crude oil is shaped by technological advancements, regulatory changes, and shifts in the global energy mix. Innovations in extraction and production, coupled with a growing focus on sustainability, are influencing the market outlook.

|