Regional gas markets are unpredictable and disrupted when Henry Hub prices are high, cold weather arrives, and demand exceeds supply – if January 2026 is a good example. Was this an early warning as to how basis markets could behave if supply can’t keep up with LNG and data-center demand? Should you hedge this risk?

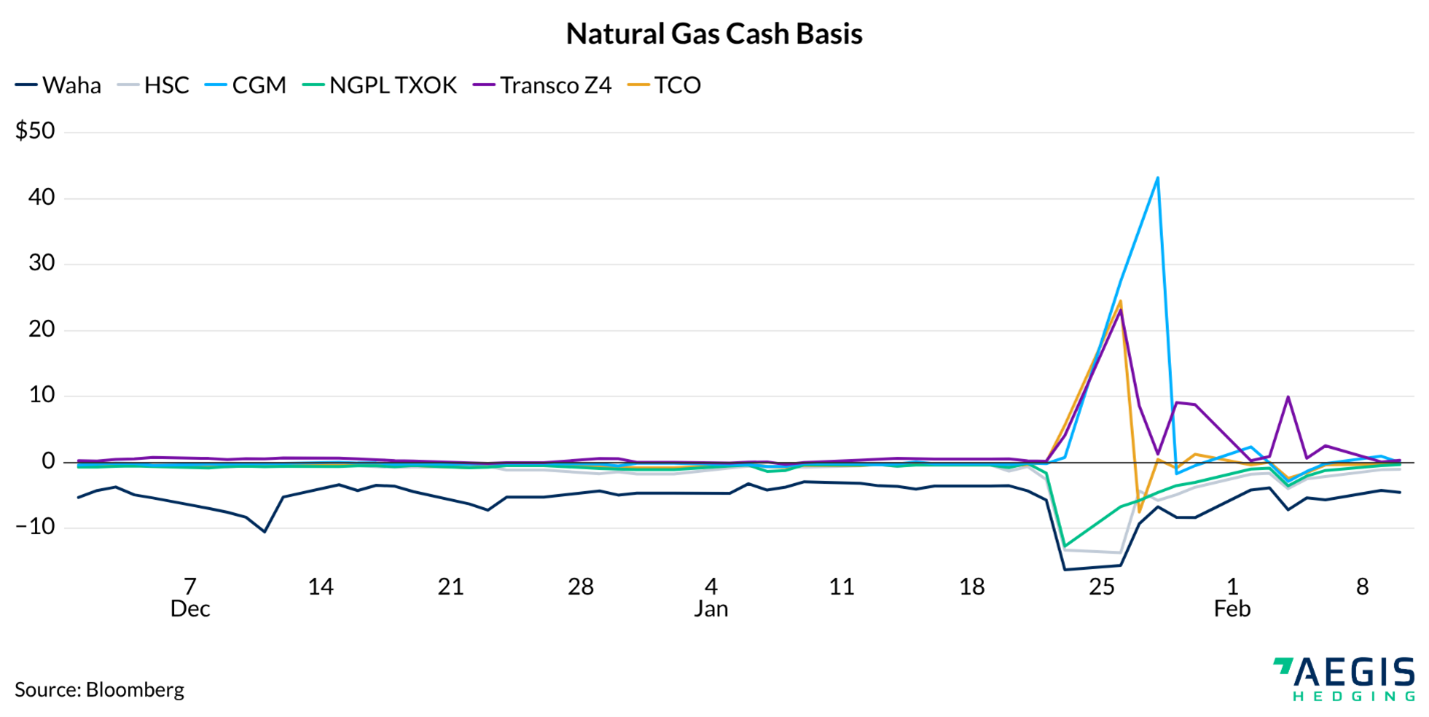

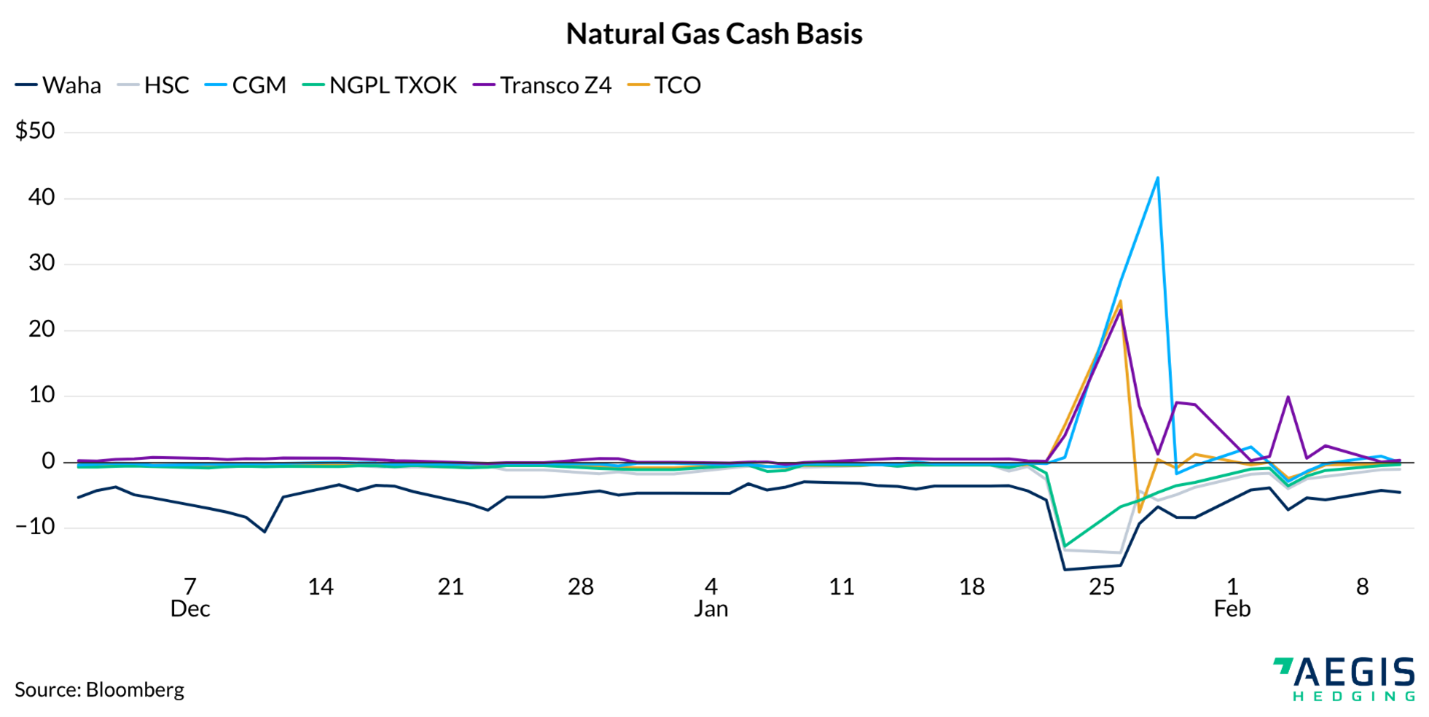

- The chart above shows daily cash basis, or the spread between Henry Hub and regional cash prices

- In reaction to winter storm Fern, natural gas demand and cash prices rose to seasonal highs, although some basis prices moved in the opposite direction than they did in 2022 under similar circumstances

- While fixed-price gas traded higher at the major hubs in the eastern US, not all prices were at a premium to Henry Hub

- Basis prices in the Haynesville/East Texas area heavily depended on location, with some moving up, and some, down

Houston Ship Channel – The Cause of Western Weakness?

Despite near-record power demand in Texas, and a sudden drop in gas supply due to freeze-offs, Houston Ship Channel (HSC) experienced a significant discount relative to Henry Hub, influencing upstream markets like Waha and NGPL TXOK.

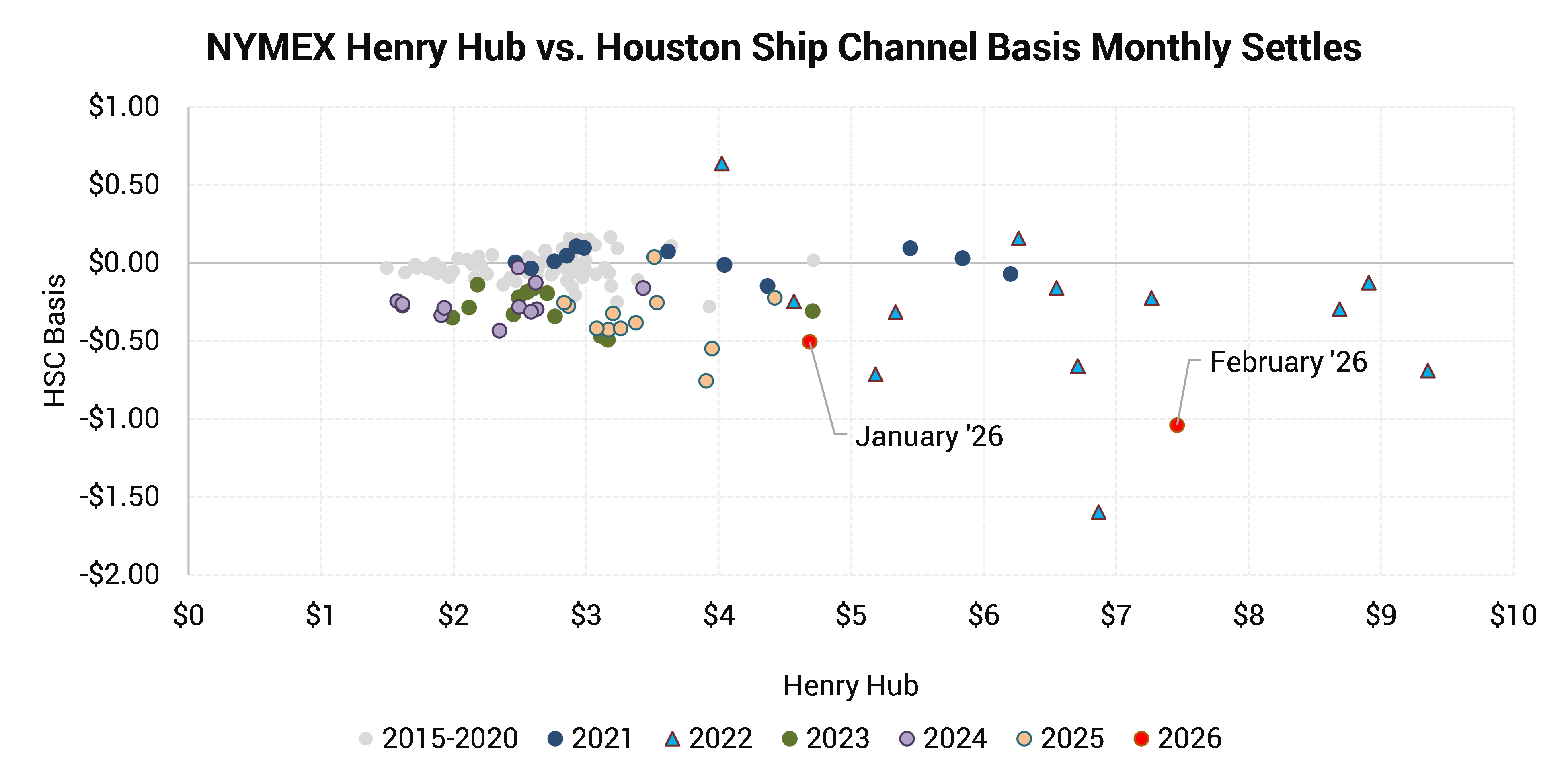

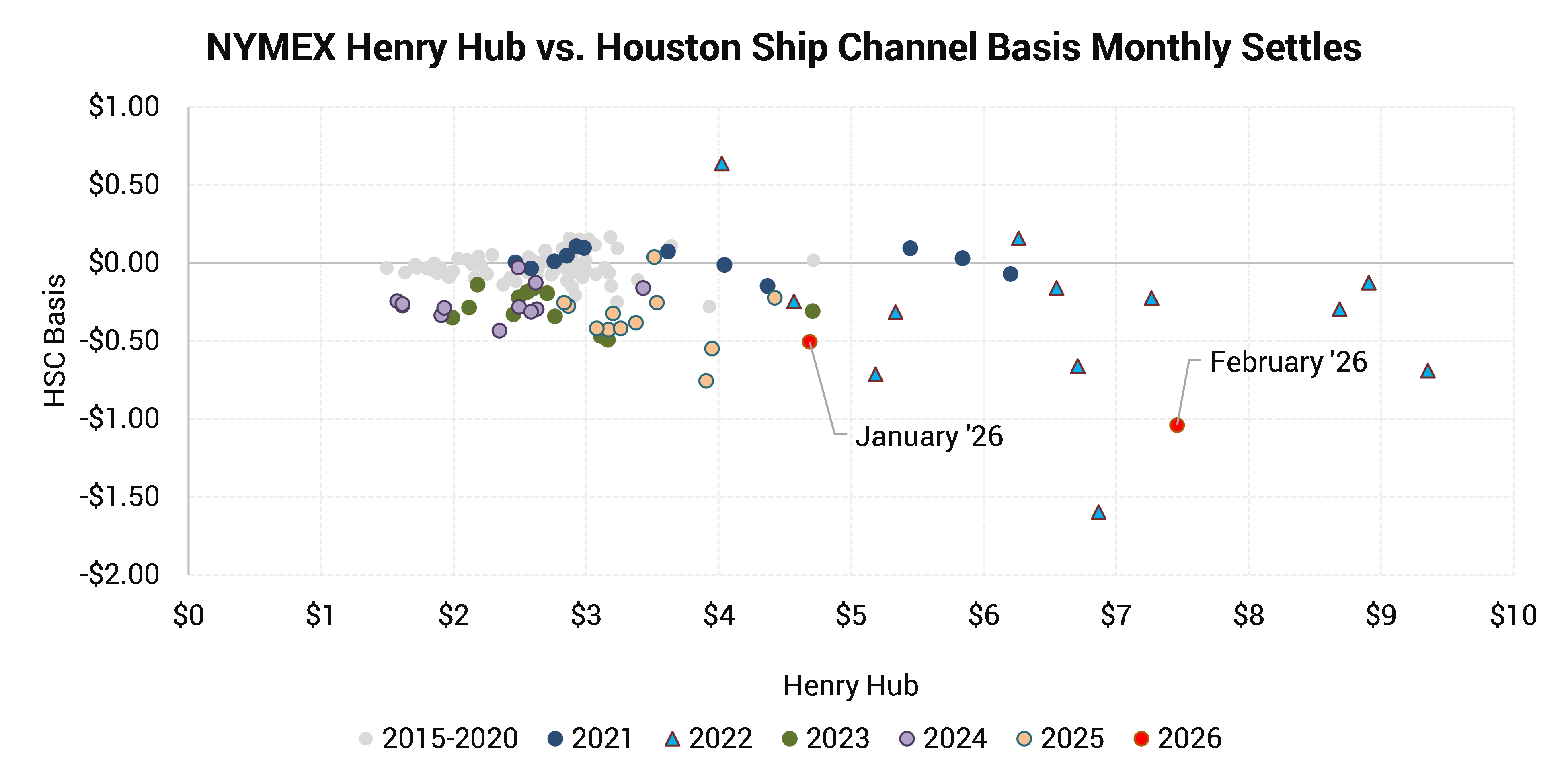

- The chart above shows Houston Ship Channel first-of-month basis settlements against NYMEX Henry Hub settlements

- Houston Ship Channel typically trades relatively close to Henry Hub, but during the high price regimes of 2022 and early 2026, HSC basis widened to more than -$1.00/MMBtu at times

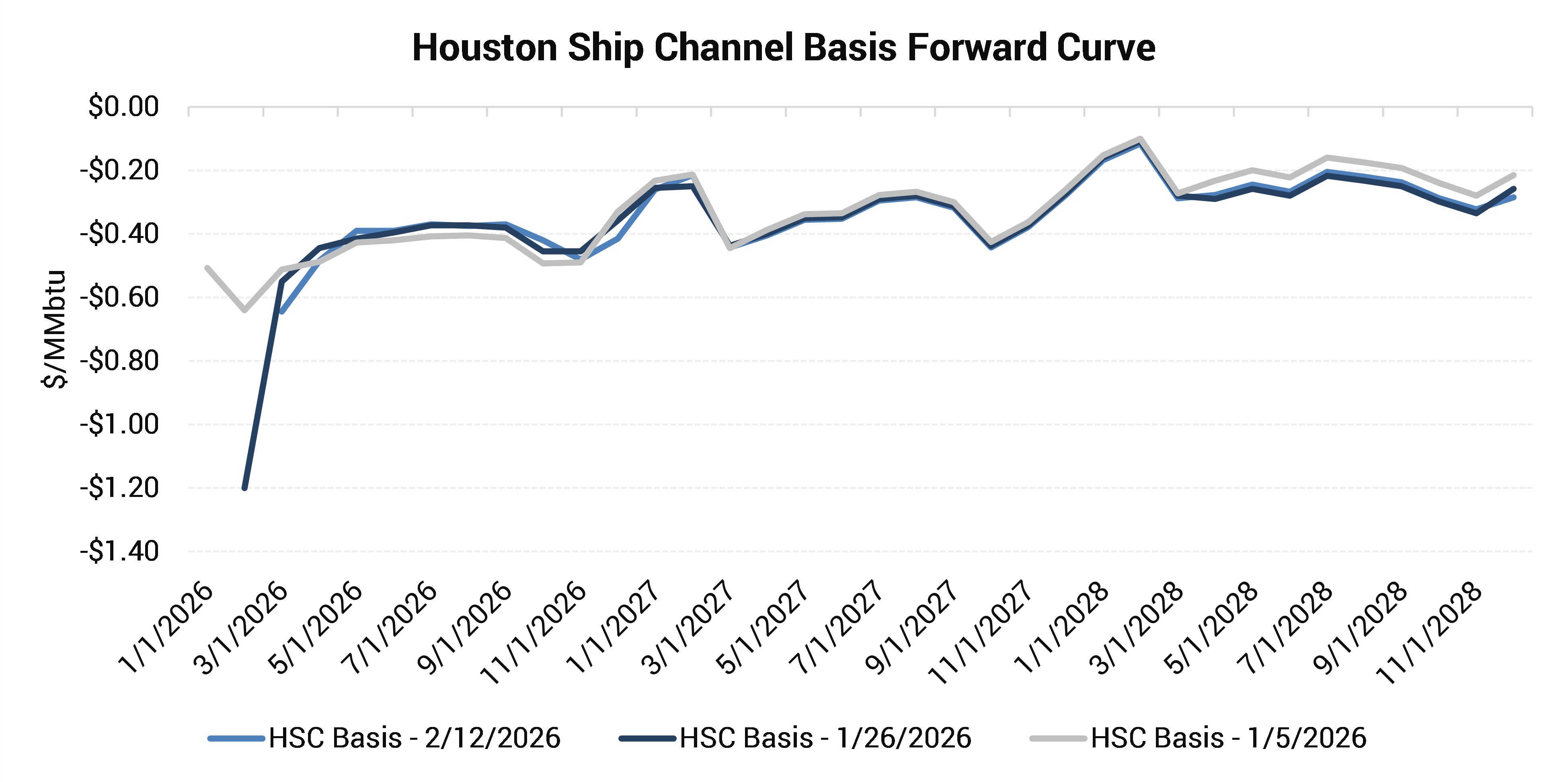

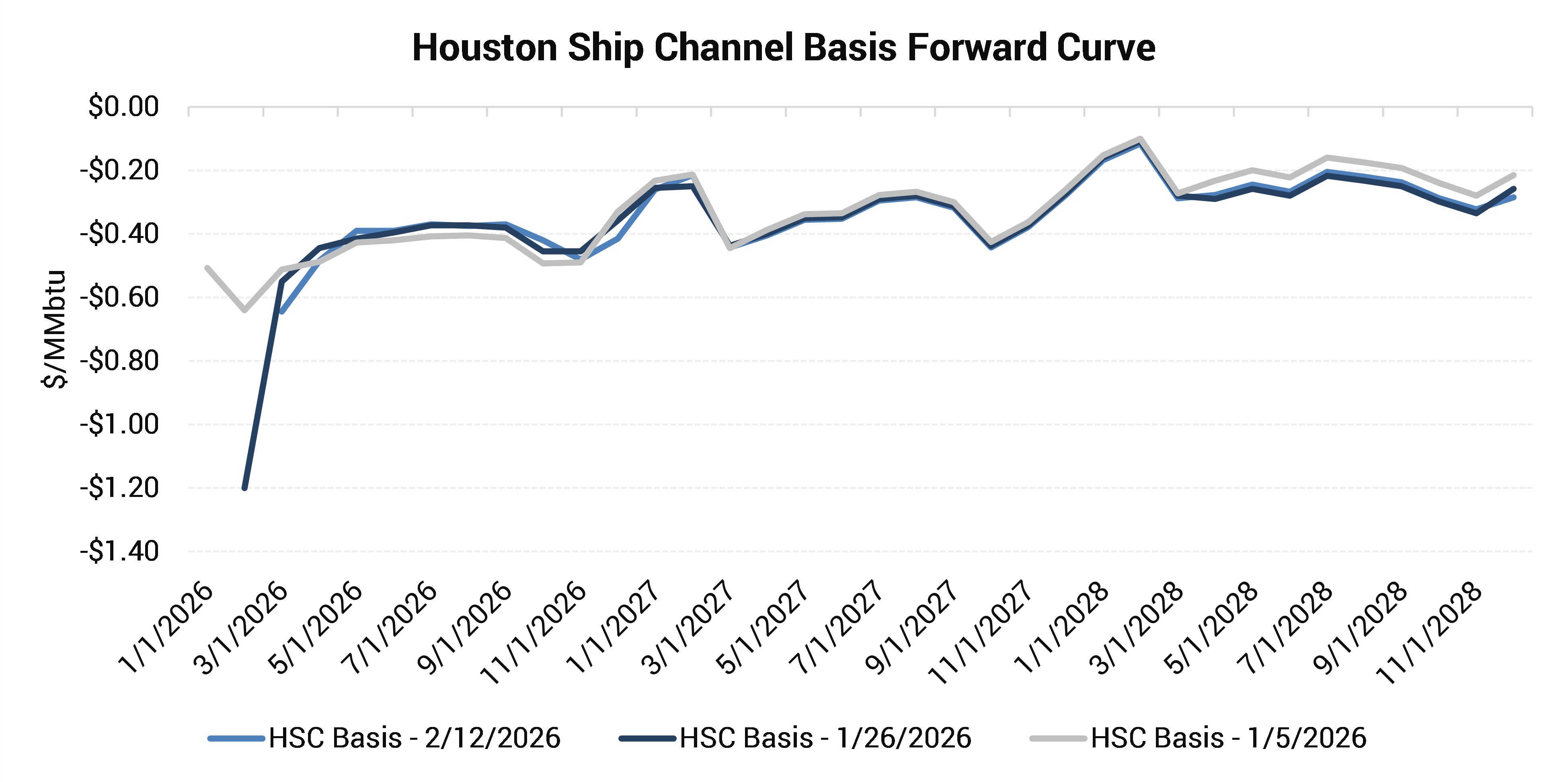

- The chart above shows a snapshot of the HSC basis forward curve on three dates this year: before winter storm Fern showed up in forecasts, during the event, and two weeks after

- On January 5, the HSC forward curve appeared relatively normal, but by January 26 the February contract had declined from -$0.64/MMBtu to -$1.20/MMBtu

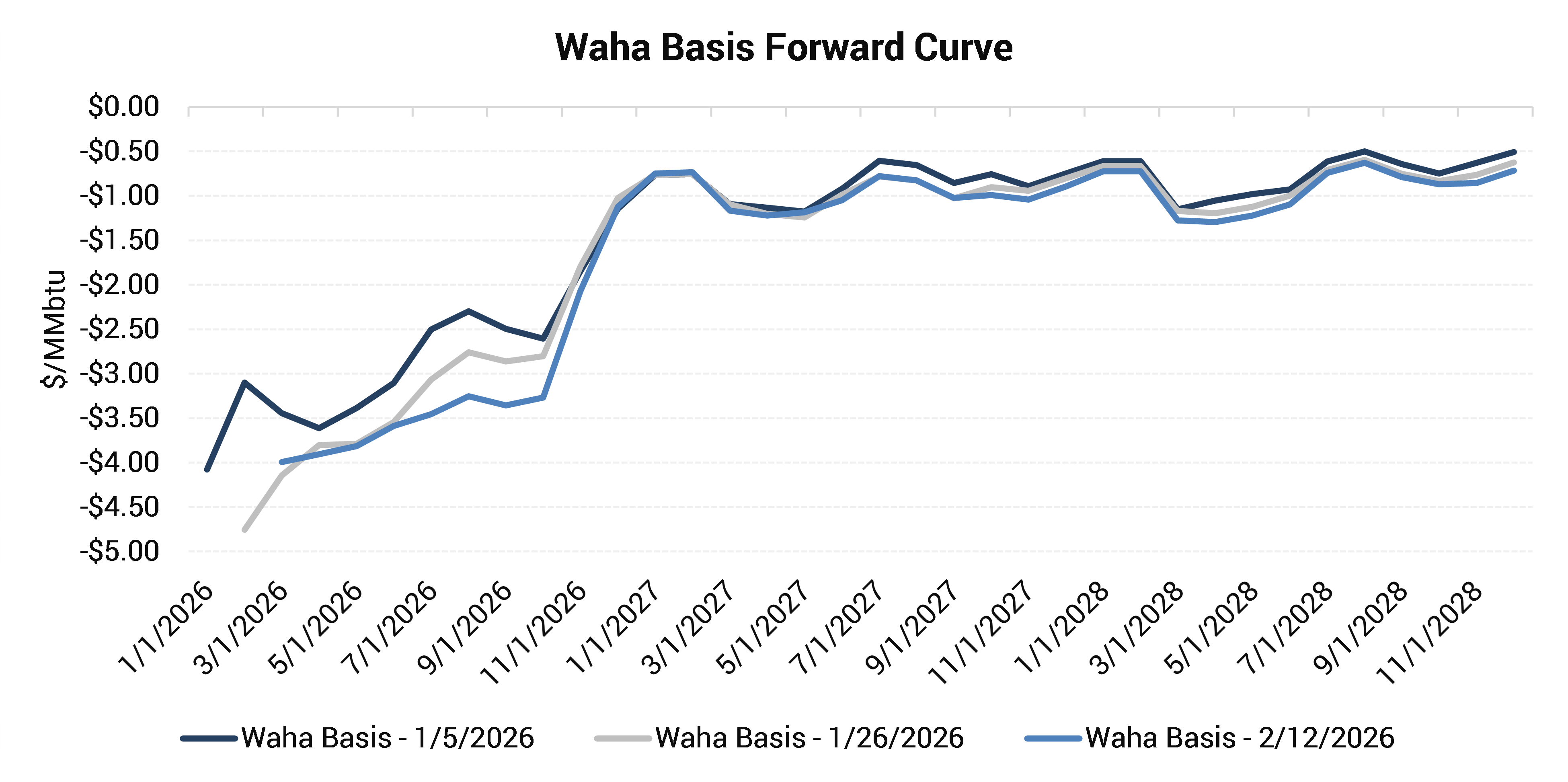

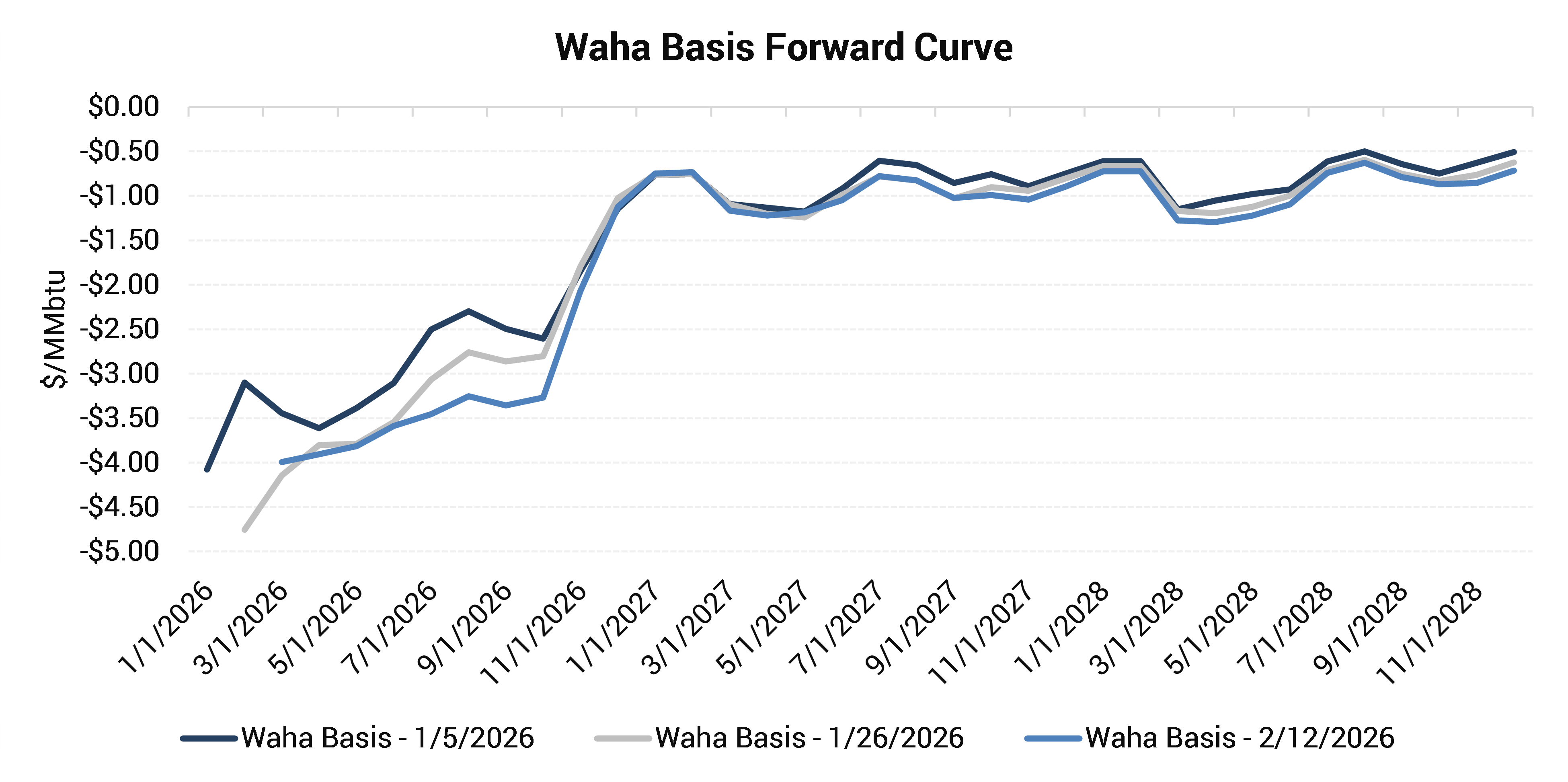

Waha – Can’t Catch a Break

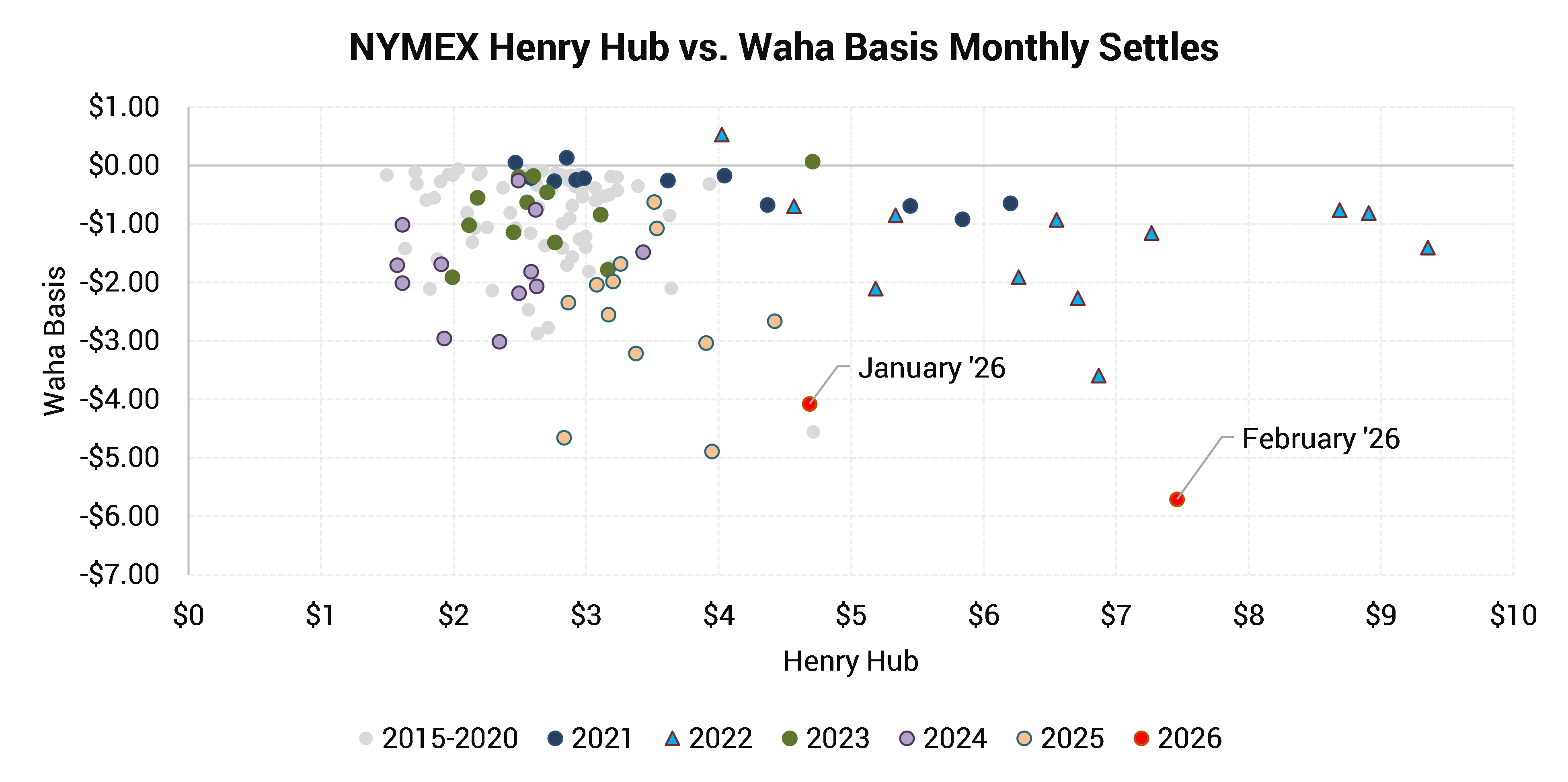

In the past, Waha did not have a strong inverse relationship with Henry Hub prices. But in January, even though demand in the western half of Texas was strong, and supply was diminished, Waha basis suffered larger discounts due to the weakening downstream market at HSC.

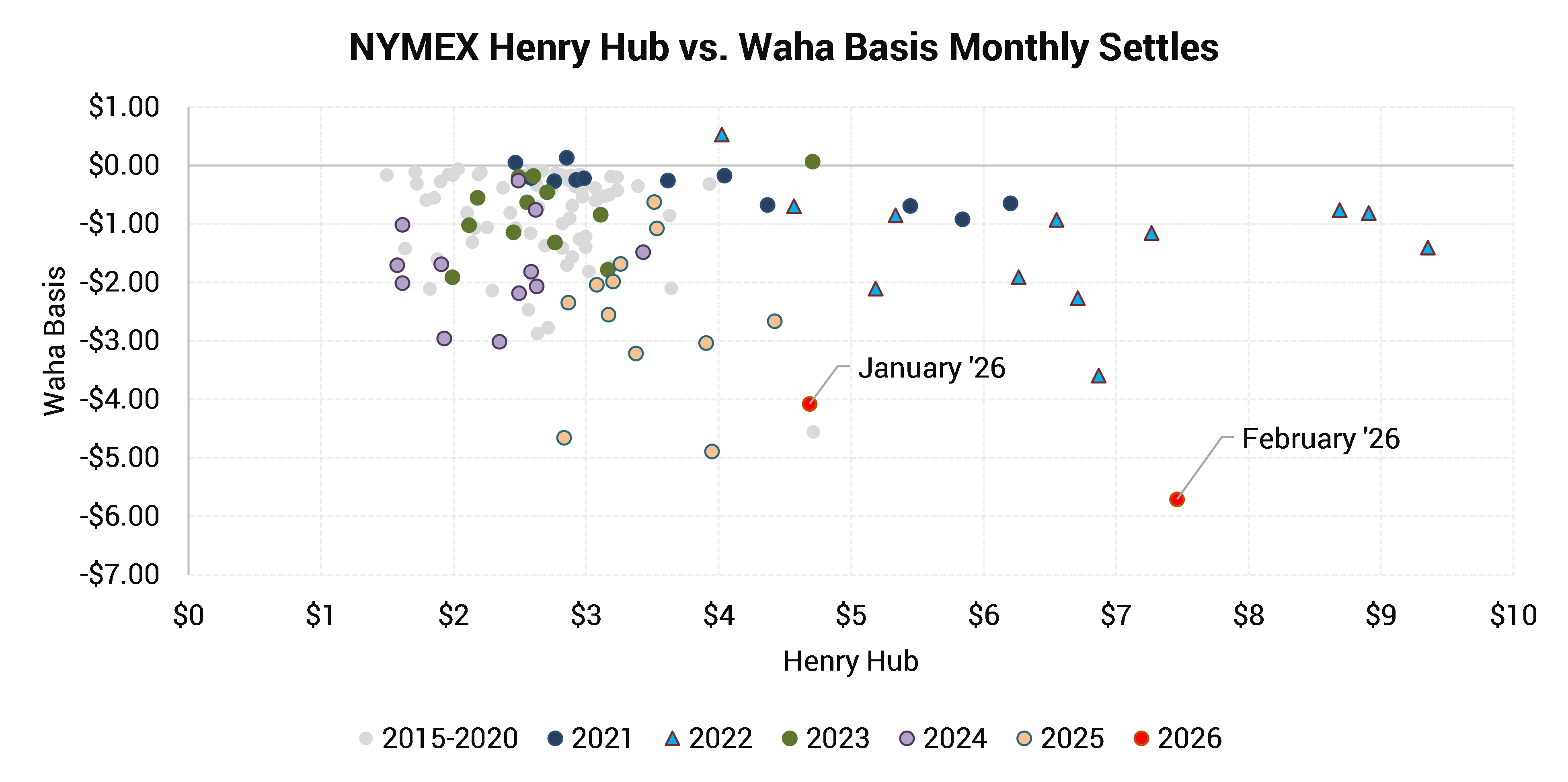

- The chart above shows monthly Inside FERC (a.k.a. First of Month) settlements for the months that were about to begin

- Amid winter storm Fern (during January 2026), the February 2026 Waha basis contract settled at a multi-year low of (negative) -$5.71/MMBtu

- Weakness in Waha basis is often more correlated to maintenance events or periods where pipeline egress capacity is limited, but this event appears to be related to price weakness in Houston

- Most of the price impact on Waha was limited to the prompt month and balance of 2026

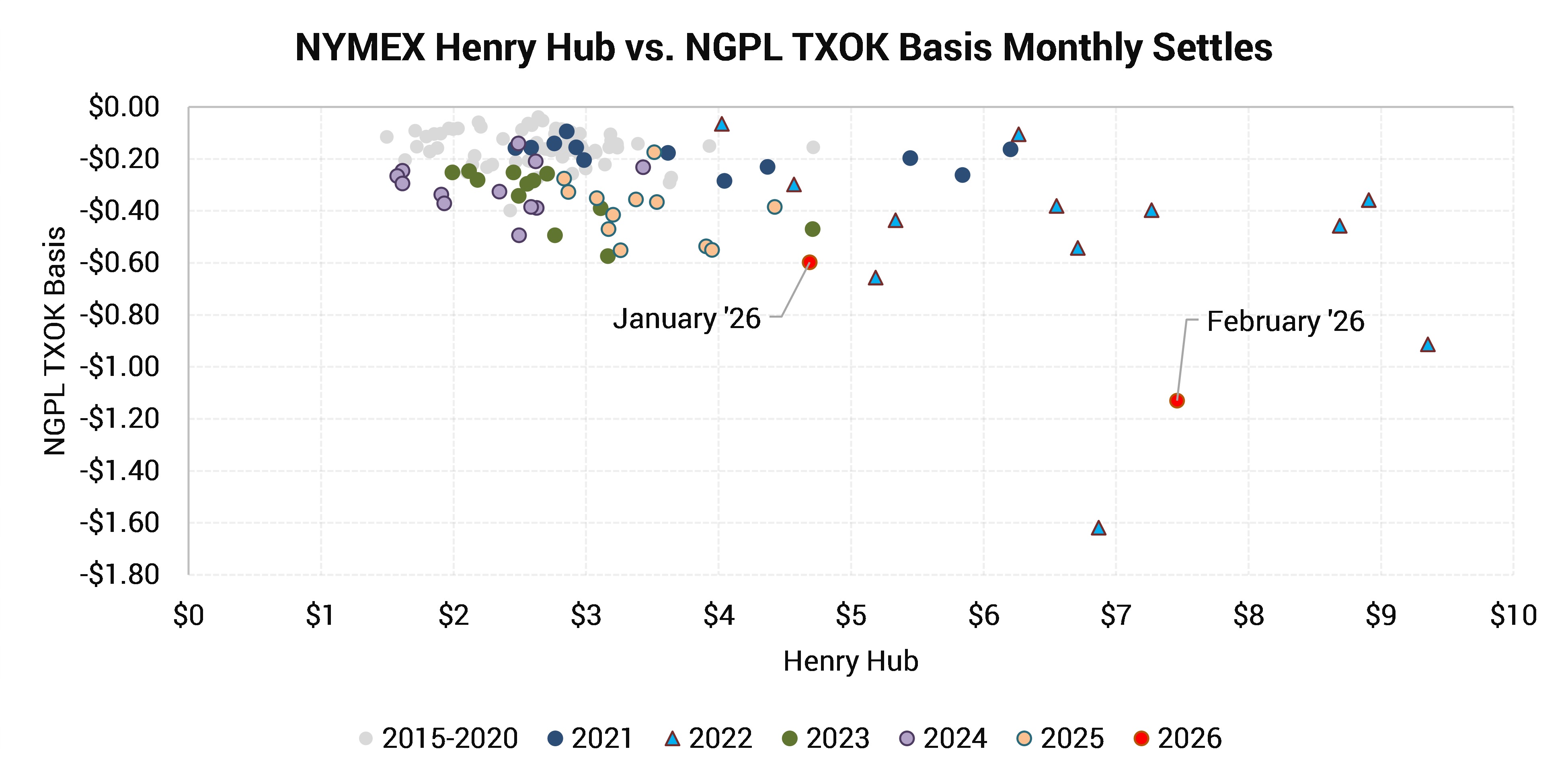

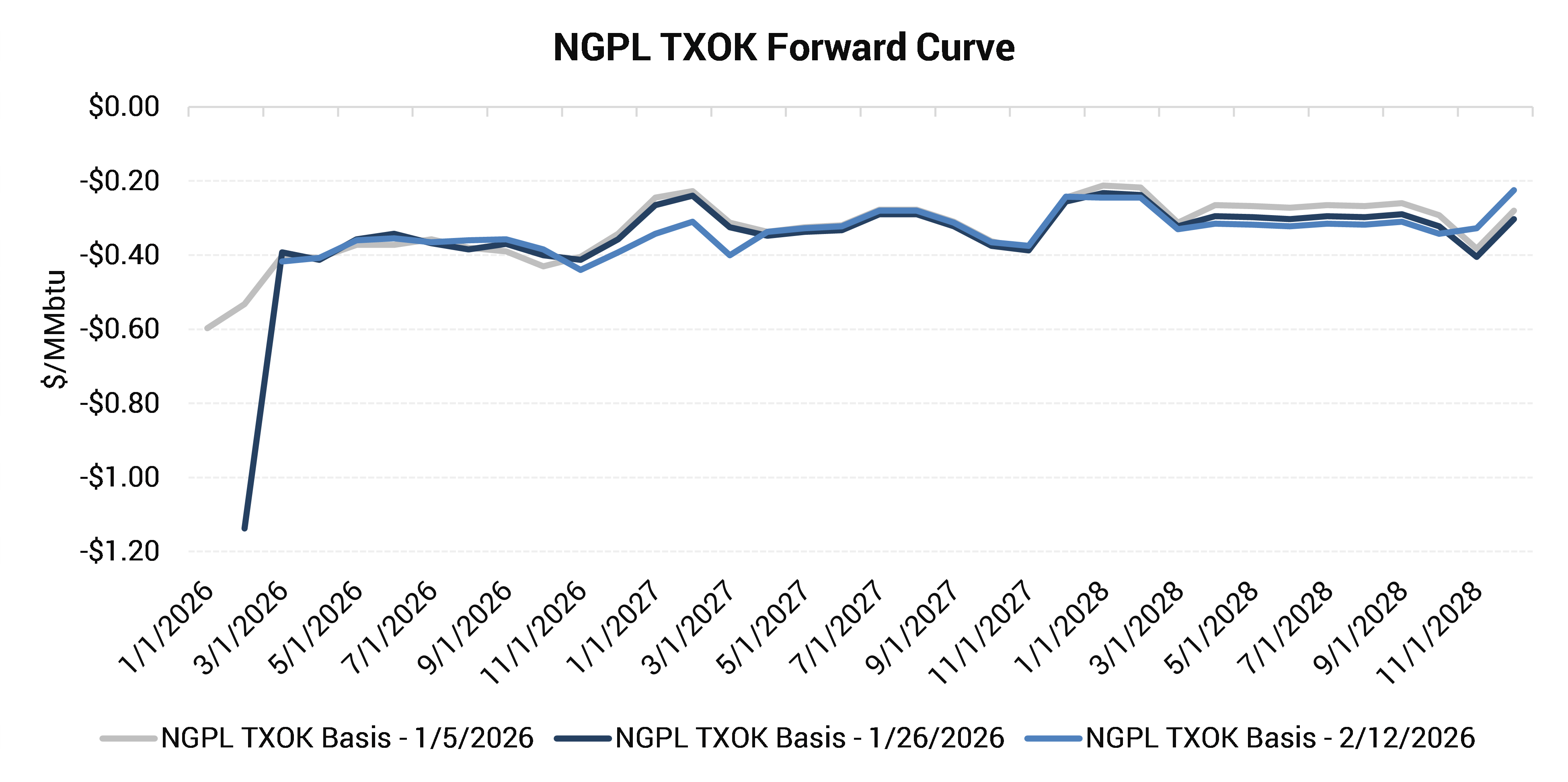

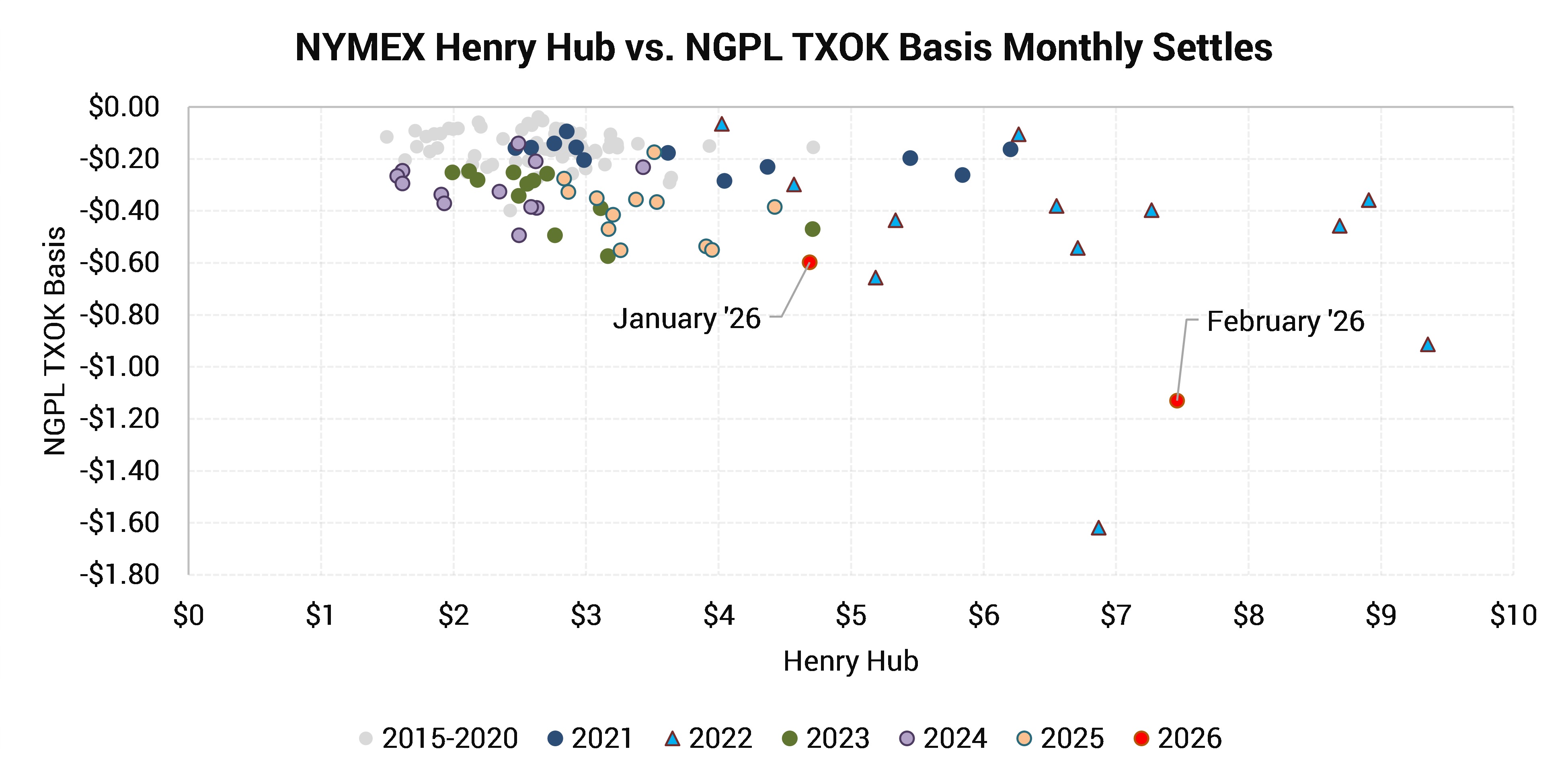

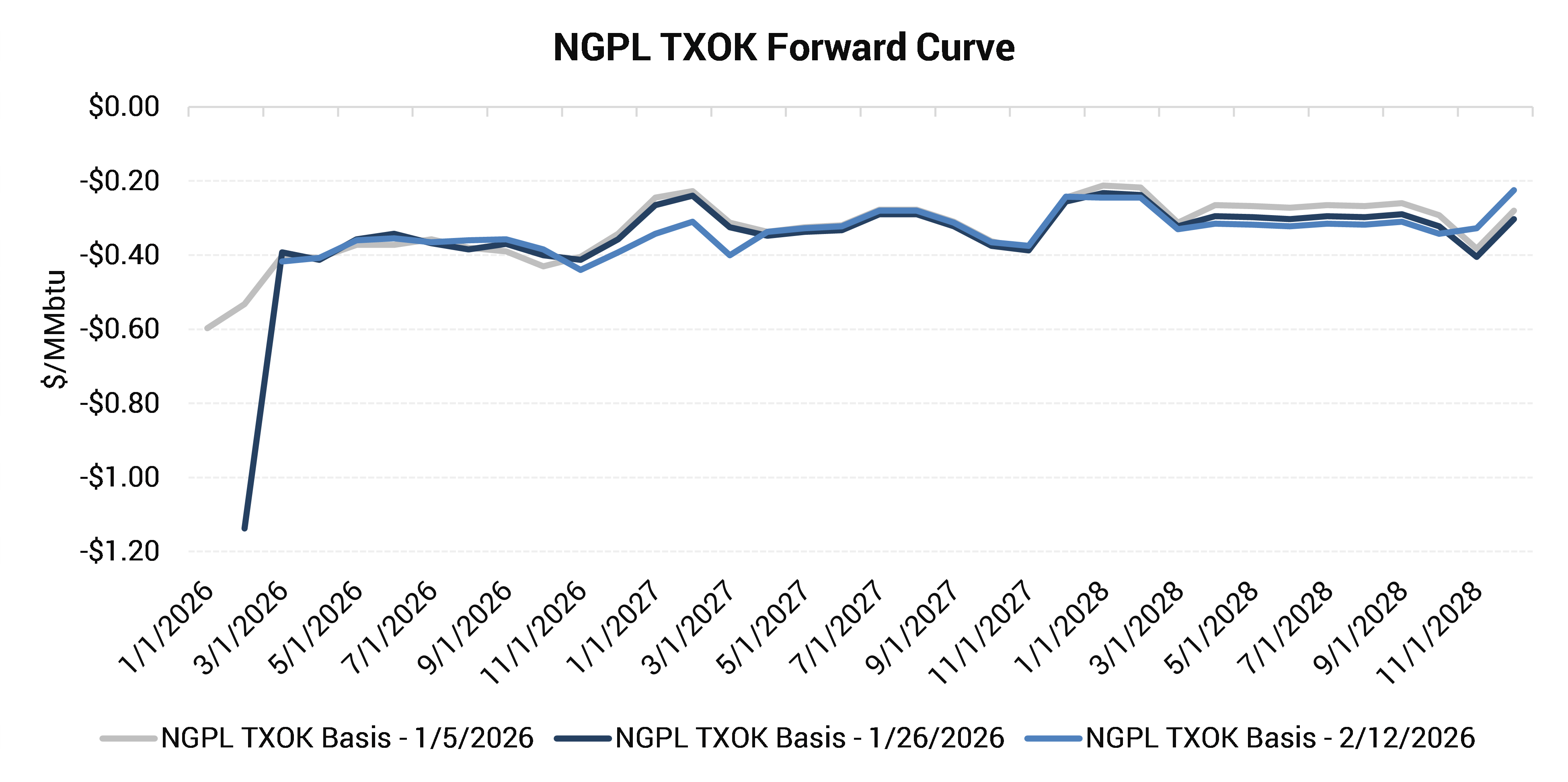

NGPL TXOK – Another HSC Victim

The western part of the Haynesville play is connected to pipelines more related to southeastern Texas than southern Louisiana. NGPL TXOK is a pipeline segment that delivers to some of the same locations as do those in the Houston Ship Channel footprint. The result? There was a large discrepancy between western Haynesville gas prices and eastern Haynesville gas prices.

- Despite both NGPL TXOK and Columbia Gulf Mainline (CGML; discussed later in this article) both being Haynesville linked hubs; their basis traded in opposite directions during the winter storm

- Demand to the north and east of the Haynesville region was much stronger than on the Texas side of the border, so while some eastern hubs settled at a premium (such as CGML), NGPL TXOK fell to a steep discount

- February NGPL TXOK basis fell from -$0.53/MMBtu on January 5 to -$1.14/MMBtu by January 26

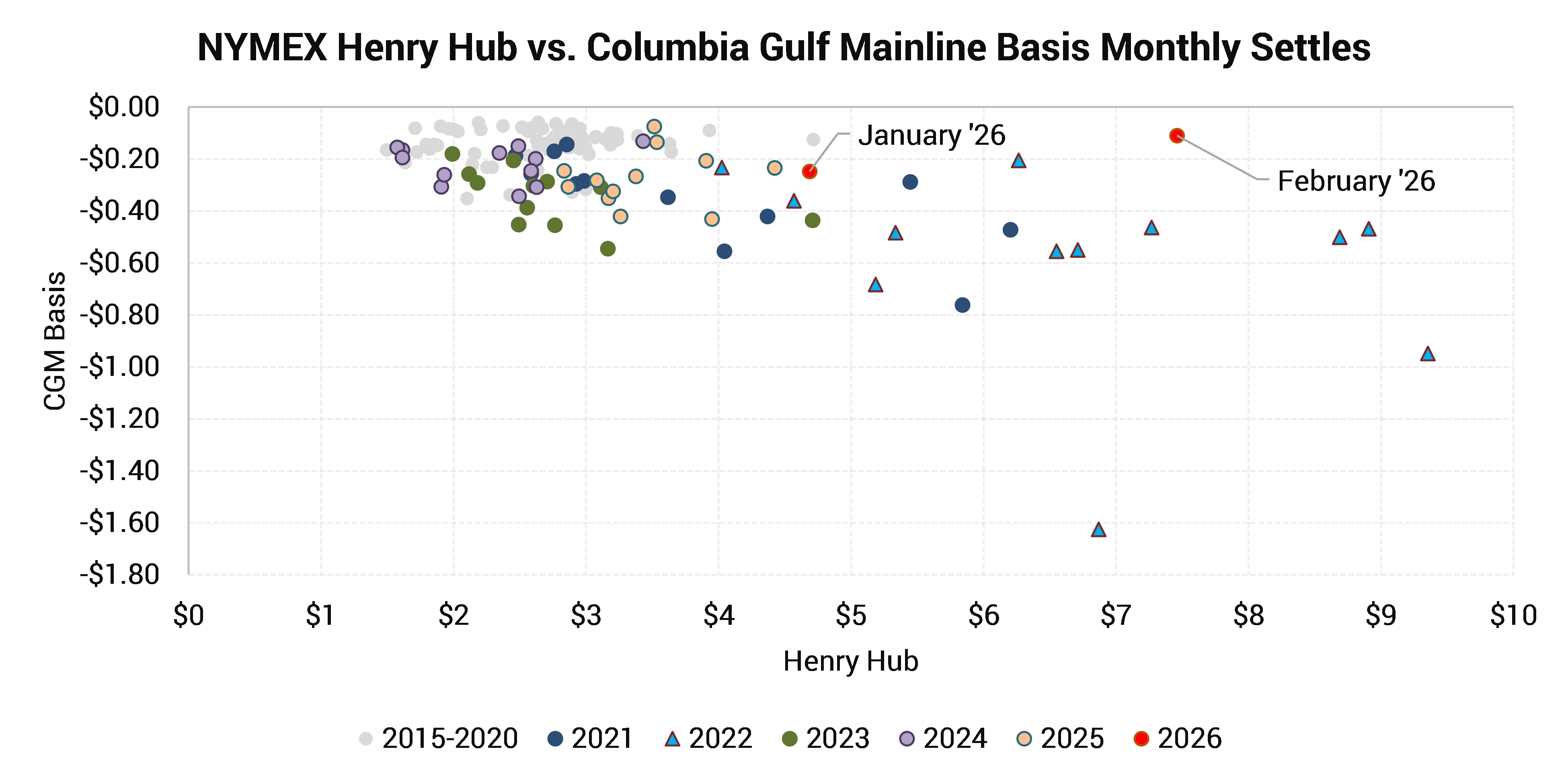

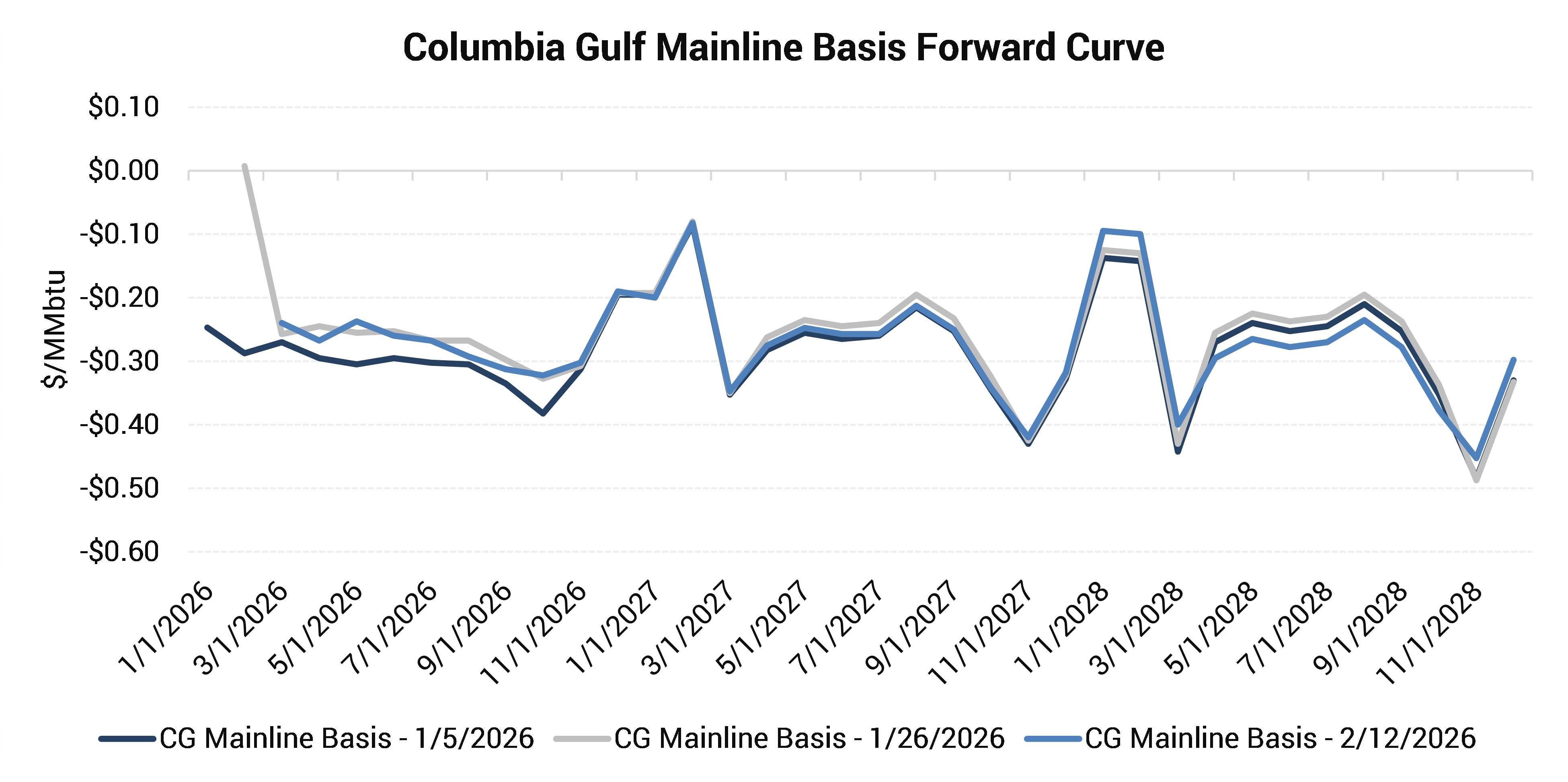

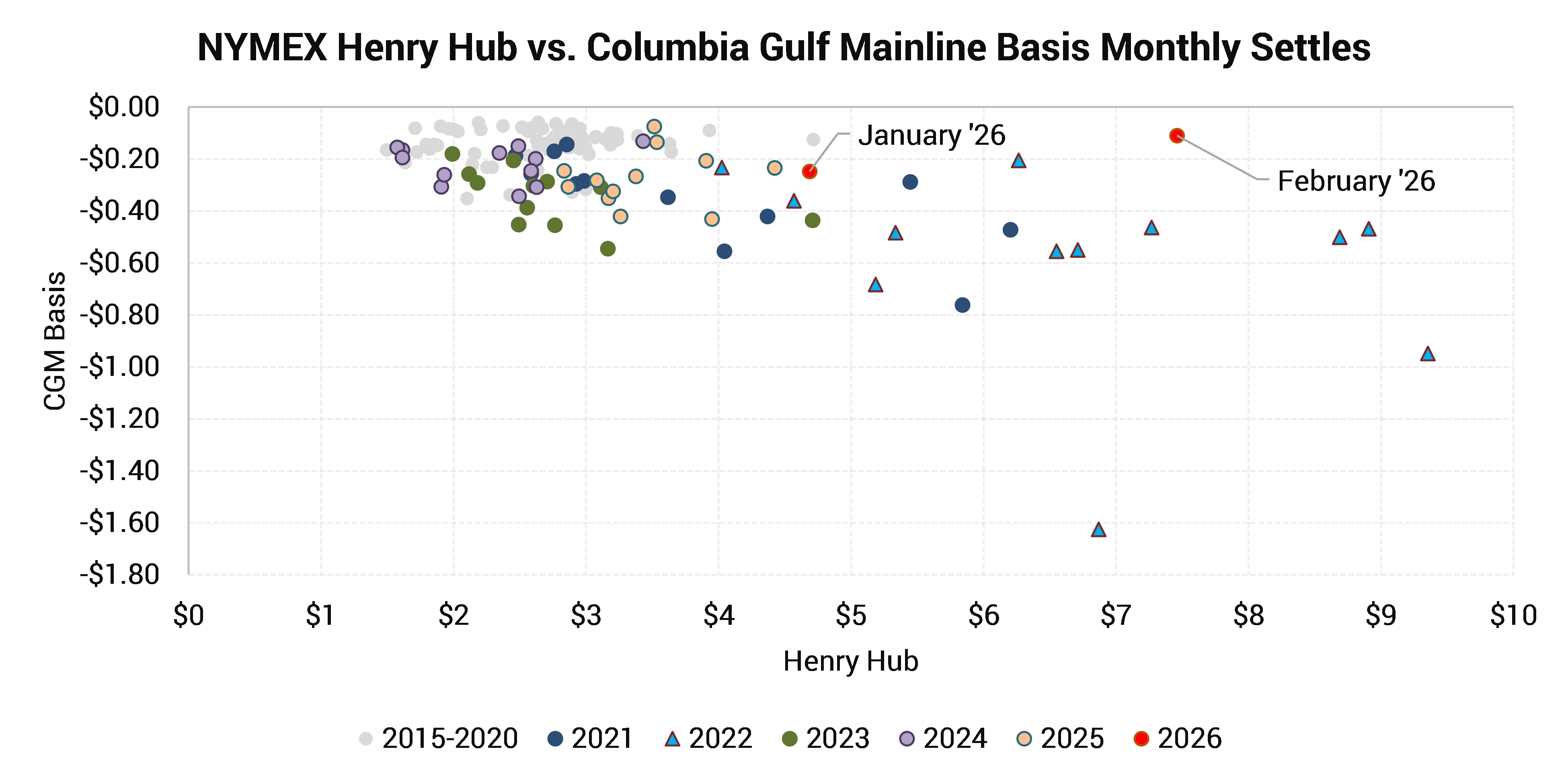

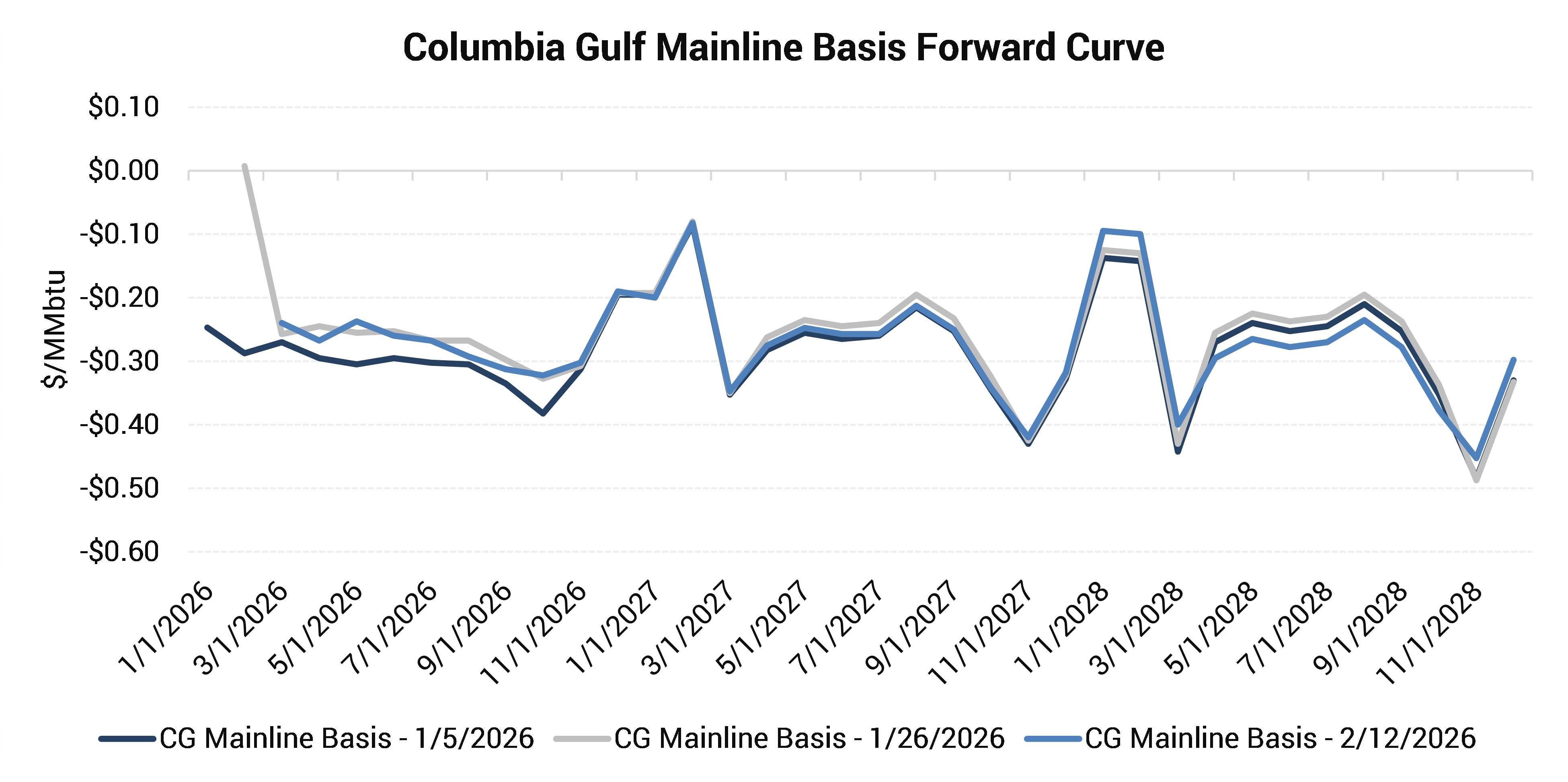

Columbia Gulf Mainline – Participated in Eastern Demand

The Columbia Gulf Mainline location represents gas traded in Mississippi and the northern two-thirds of Louisiana on the Columbia Gulf pipeline. Because of its nearness to pipelines that serve the US Southeast and Middle Atlantic, the CGML basis tightened to some of its highest (that is, least negative) values in 12 years.

- Columbia Gulf Mainline represents trades on the Columbia Gulf pipeline in the eastern part of the Haynesville, and connects to TCO (Columbia Gas system) in the eastern Midwest and Northeast

- February 2026 CGML basis settled only 11c below Henry Hub, while CGML cash prices traded at a significant premium, as the storm disrupted supply in northern Louisiana

- This was starkly different from what happened in 2022, when CGML basis widened amid consistently high Henry Hub prices

- By January 26, 2026, February CGML basis had climbed nearly 30c and was trading above Henry Hub (see gray line in the chart), before settling at an 11c discount

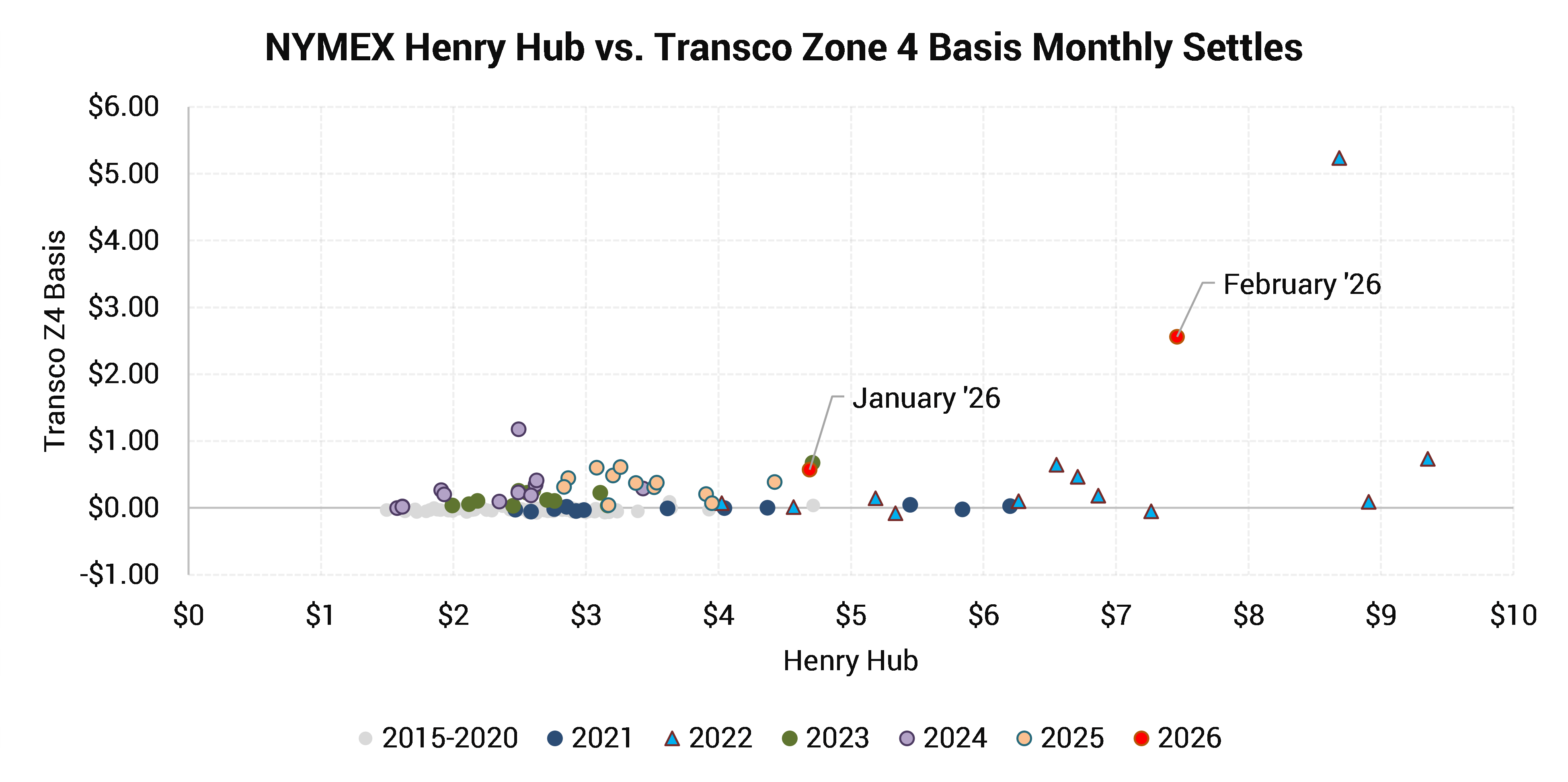

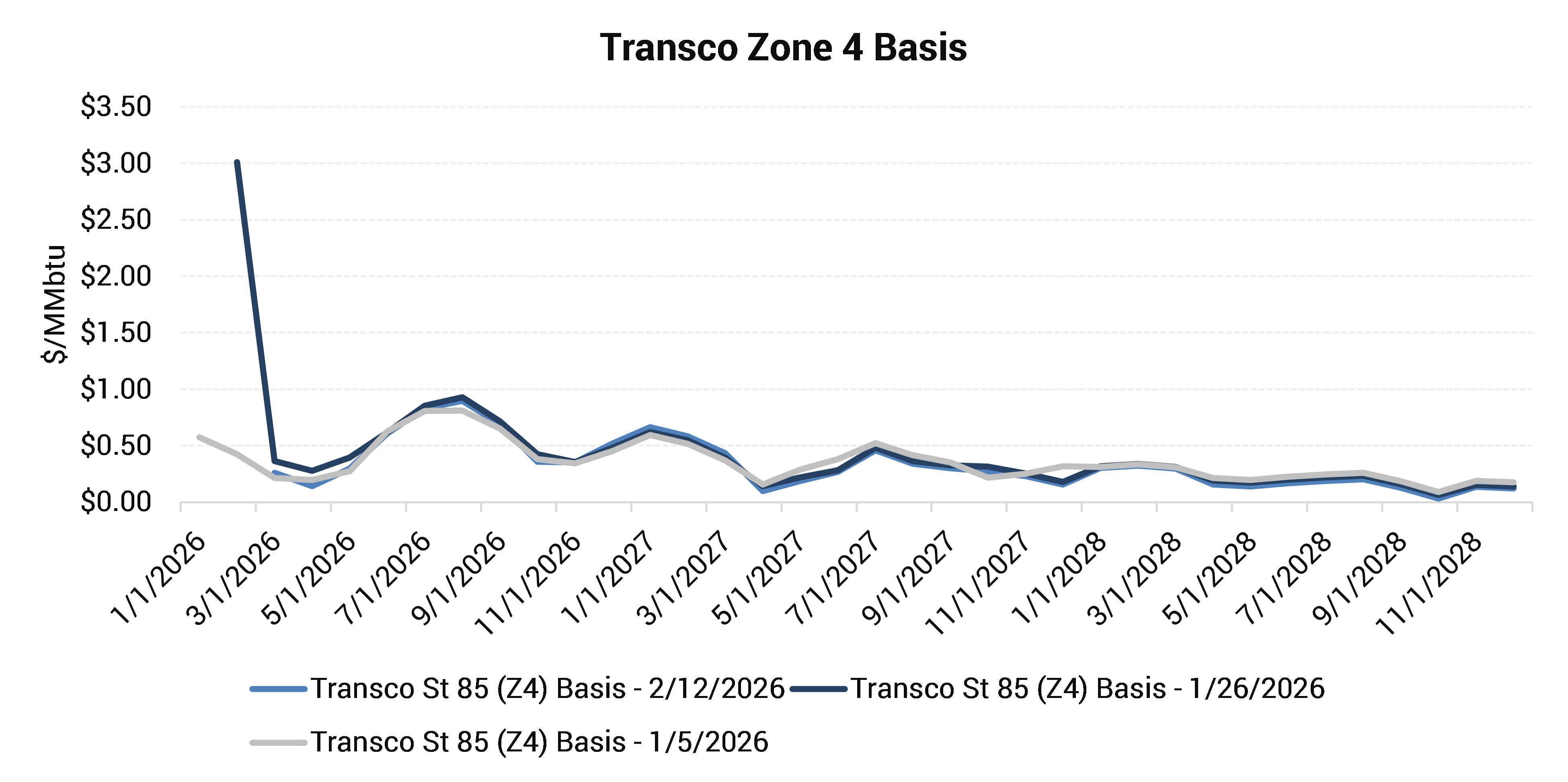

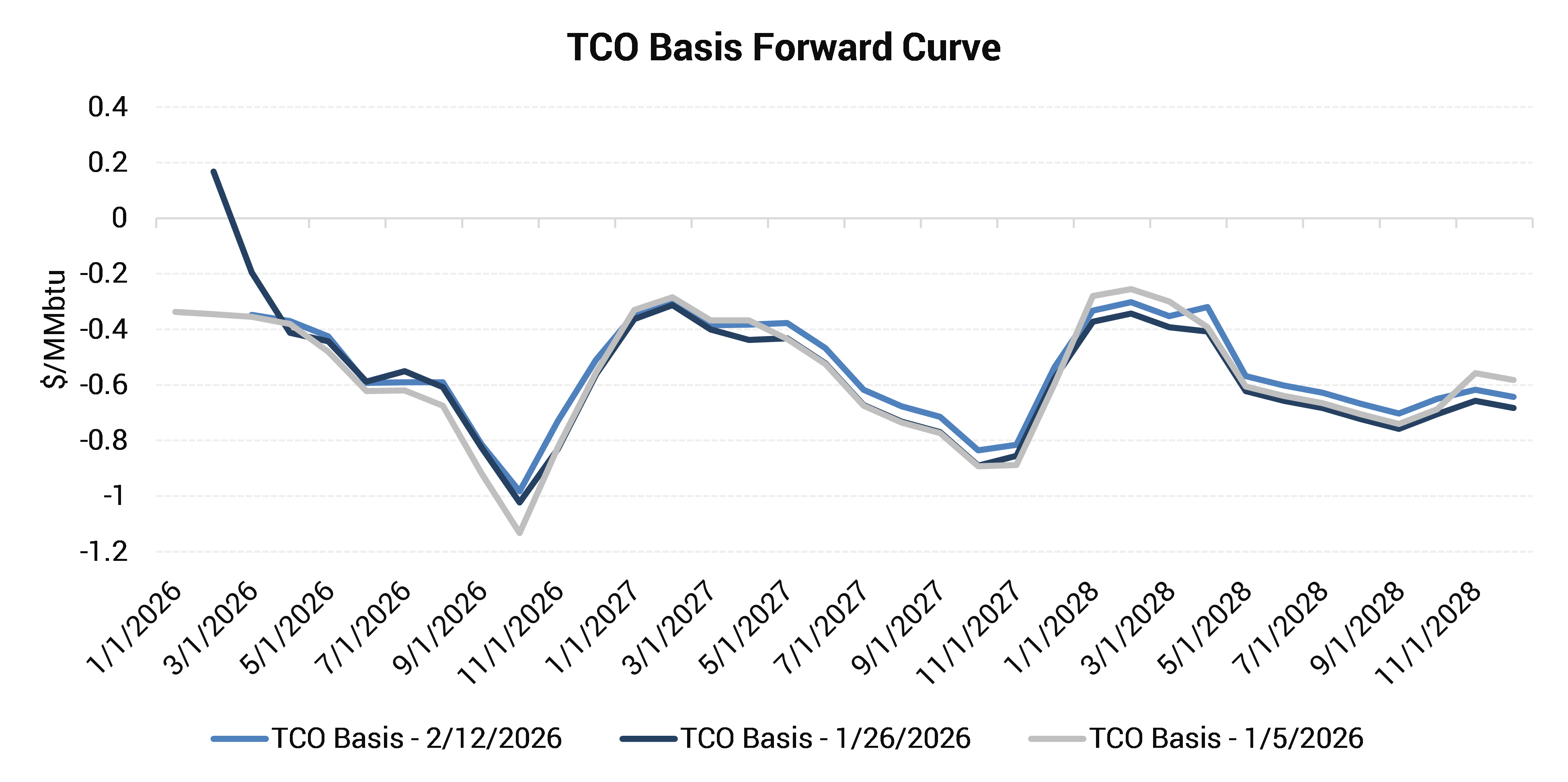

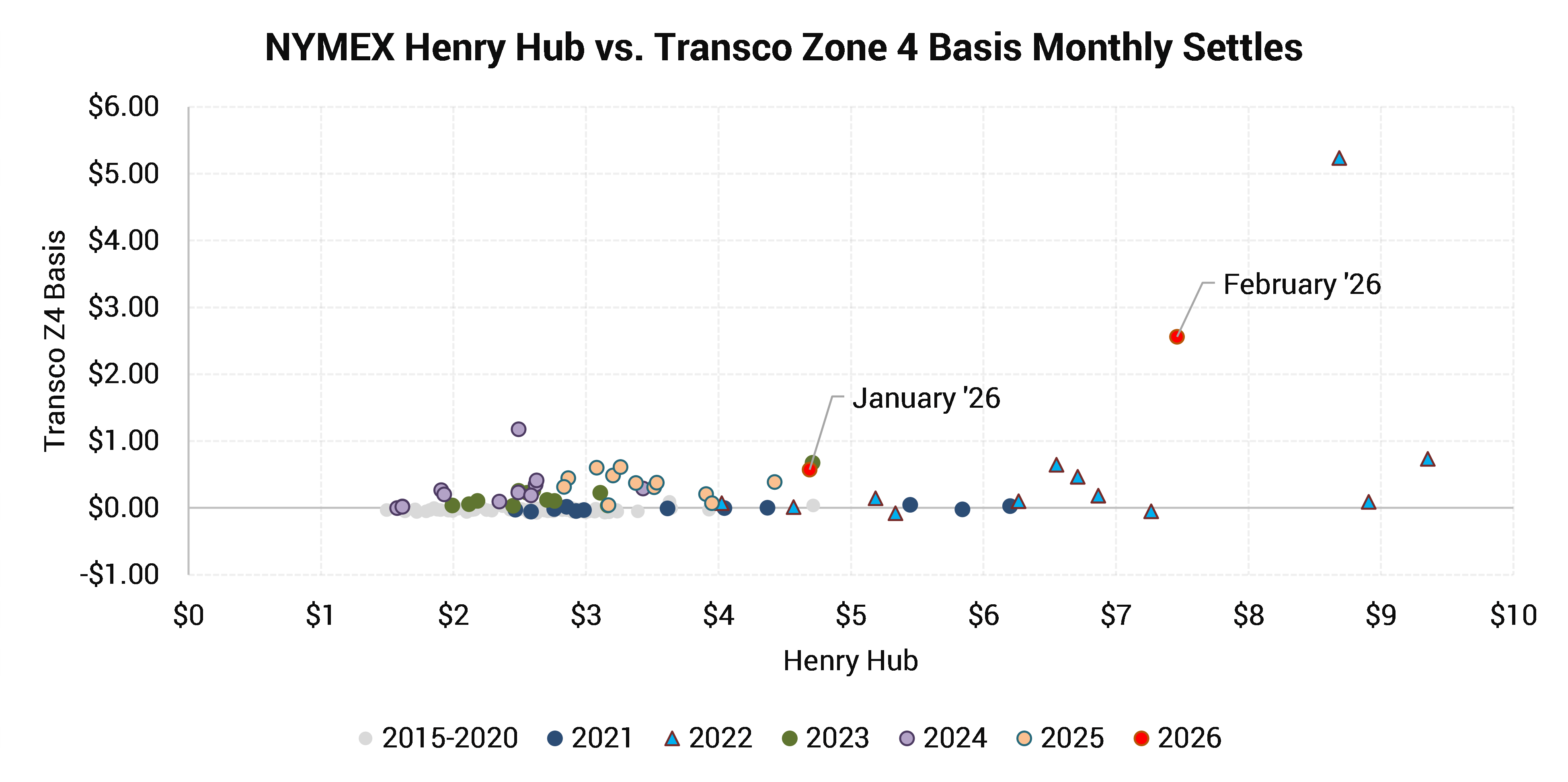

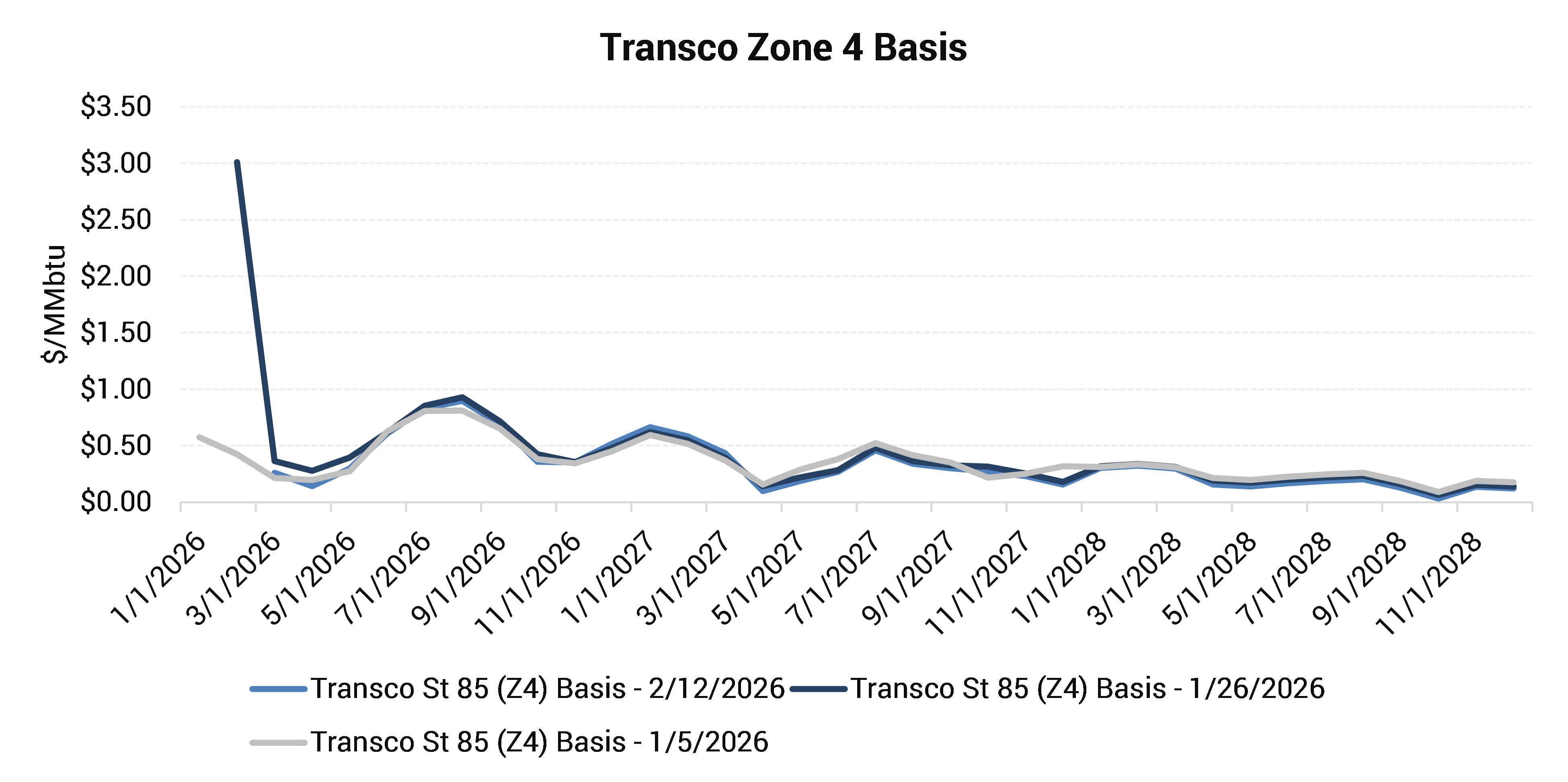

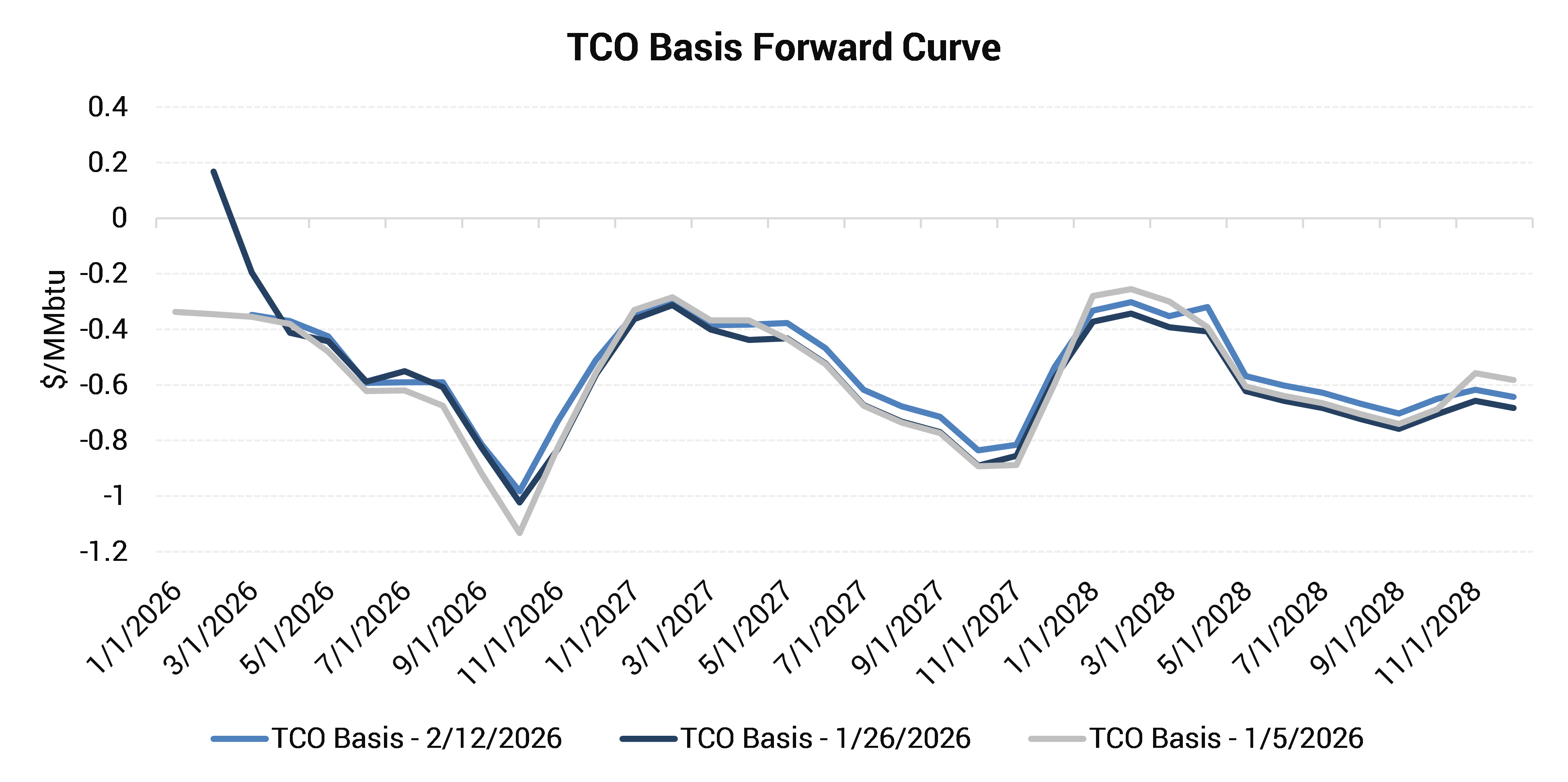

TCO and Transco Z4 – Northern Demand Markets Attracted Gas

Connected to Columbia Gulf (described above) is its sister system, Columbia Gas (a.k.a. TCO), a large and widespread delivery system for the eastern Midwest and Northeast. Basis there escalated during the cold. Meanwhile, the gigantic Transcontinental Pipeline, which runs from South Texas all the way to New Jersey/New York, was on the bid, trying to pull gas away from Louisiana pipes.

- Transco Zone 4 (Station 85), located somewhat in central Alabama, almost always trades and settles near or at a premium to Henry Hub, given it serves Southeast demand centers

- This premium can expand significantly during times of above-average demand

- Columbia Gas Transmission or TCO is a large pipe system in the Northeast, and a major source of gas supply, while also serving a large amount of Northeast demand

- Higher Henry Hub prices have often correlated with weaker Appalachian basis prices (i.e. Appalachia prices may have risen, but not as much as Henry Hub did)

- While TCO cash prices briefly traded more than $20/MMBtu higher than Henry Hub in January, the February contract settled at a discount of 15c

- Strong Northeast demand supported TCO basis prices this year, but 2022 saw much wider basis pricing

- As demand in the Southeast surged, Transco Z4 basis jumped to a $3/MMBtu premium

- The combination of strong downstream and in-basin demand lifted TCO prices to a premium of nearly 20c

Conclusion

If you haven’t heard, there is a new round of LNG exports coming to the US Gulf Coast. Power demand for natural gas is growing too, but only as fast as the power grids can manage it. Combined, we may be headed for a persistently undersupplied market, prone to more volatility at Henry Hub.

Gas basis may see some strange trading. As we showed above, when the complicated network of gas prices interacts with changing supply-demand dynamics, there can be unexpected changes in price relationships.

This basis risk is something to consider hedging if the risk is material to your revenue or fuel expense.