CME MWP reacts little.In 2023, the US imported 294,000 mt of aluminum products from Mexico, making them the third largest supplier to the US market, according to government data. However, Mexican volumes only represented about 5.3% of US imports last year. In recent years, Mexico has struggled to track how much aluminum it imports and from what origin. Therefore, it is essentially impossible to know how much “foreign” metal passed through Mexico and was sold into the US as a way to circumvent the US’s Section 232 tariffs. This is likely why the Midwest Premium market had little to no reaction to this news (as seen below). |

|

|

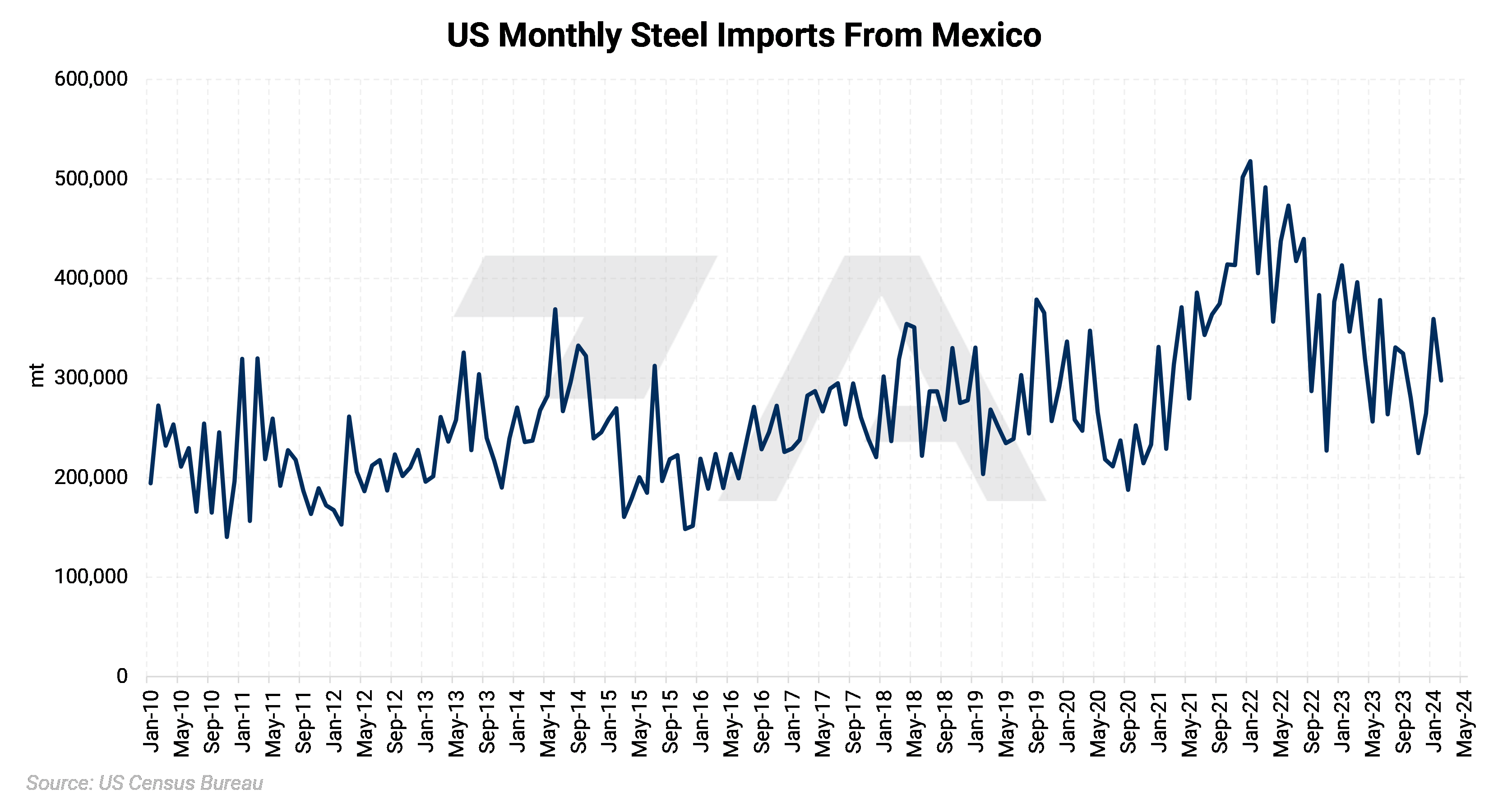

What about the HRC market?Unlike aluminum, the US does import significant quantities of steel from Mexico. Last year, the US imported nearly 3.8 million mt of steel from Mexico, making them the second largest supplier to the US market, according to government data. This means that, on average, the US imported more Mexican steel per month in 2023 than Mexican aluminum for the entire year. However, the origin issues for steel imports into Mexico are essentially the same as those regarding aluminum. It is essentially impossible to know how much “foreign” steel passed through Mexico and was sold into the US as a way to circumvent the US’s Section 232 tariffs. This is likely why the CME HRC market had little to no reaction to this news (as seen in the second chart below). |

|

|

|

This price risk can be hedged!As suggested from the outset, it is unknown if these new tariffs will materially impact the aluminum or steel markets in the US. Still, AEGIS encourages consumers of either metal to continue their hedging programs and review any exposures to price fluctuations. Below, we highlight hedging strategies for both metals. If you do not have a hedging program, please get in touch with AEGIS on how to develop one. |

|

|

|

|

AEGIS can build your hedging program.AEGIS can help aluminum and steel buyers develop specific strategies that fit their operations. We are also happy to introduce new clients to more counterparties, therefore ensuring that you are receiving the best possible price. Please contact us for details. |

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.