Geopolitical risk premium dominates crude as US-Iran tensions escalate…again

The week’s crude rally was driven by geopolitical risk tied to rising US-Iran tensions. While diplomatic language early in the week suggested a possible framework for continued talks, subsequent reporting of expanded US military deployments, shortened negotiation timelines, and the potential for limited strikes quickly reintroduced a risk premium.

That premium is visible beyond flat price. Call skew has firmed materially, with upside protection trading at a premiums to downside hedges. Large blocks of call options changed hands mid-week, and second-month volatility has risen to levels not seen since last year’s conflict between Israel and Iran. In freight markets, VLCC tanker rates have also begun to respond to heightened uncertainty, reflecting risk pricing tied to potential transit disruptions in the Middle East.

The structural sensitivity lies in the Strait of Hormuz, through which roughly one-fifth of global petroleum liquids transit. In the event of a full-scale military strike on Iran, crude would likely rally, even absent confirmed disruption to physical flows. However, a formal closure or sustained disruption of the waterway would represent something different. A meaningful interruption to seaborne exports from the Persian Gulf would materially alter global supply-demand balances, tighten prompt availability, and force a structural repricing of crude markets.

Conversely, if tensions cool, whether through renewed negotiations, a reduced military posture, or a limited engagement, the embedded geopolitical premium would likely fade. In that scenario, market focus would shift back toward fundamentals, which continue to point to an increasingly loose medium-term balance.

Both the IEA and the EIA project substantial global inventory builds through 2026 as supply growth outpaces demand. The IEA expects a surplus exceeding 3.7 MMBbl/d next year, while the EIA’s latest Short-Term Energy Outlook similarly anticipates persistent stock builds into 2027. Absent a sustained geopolitical disruption that materially removes supply from the market, these projections argue for a structurally oversupplied backdrop.

AEGIS maintains a long-term bearish view grounded in this forward balance. However, the current Middle East situation introduces a high degree of short-term uncertainty that complicates positioning. Until clarity emerges on whether tensions escalate into a broader conflict or retreat toward negotiation, the market will remain dominated by geopolitical risk rather than underlying fundamentals.

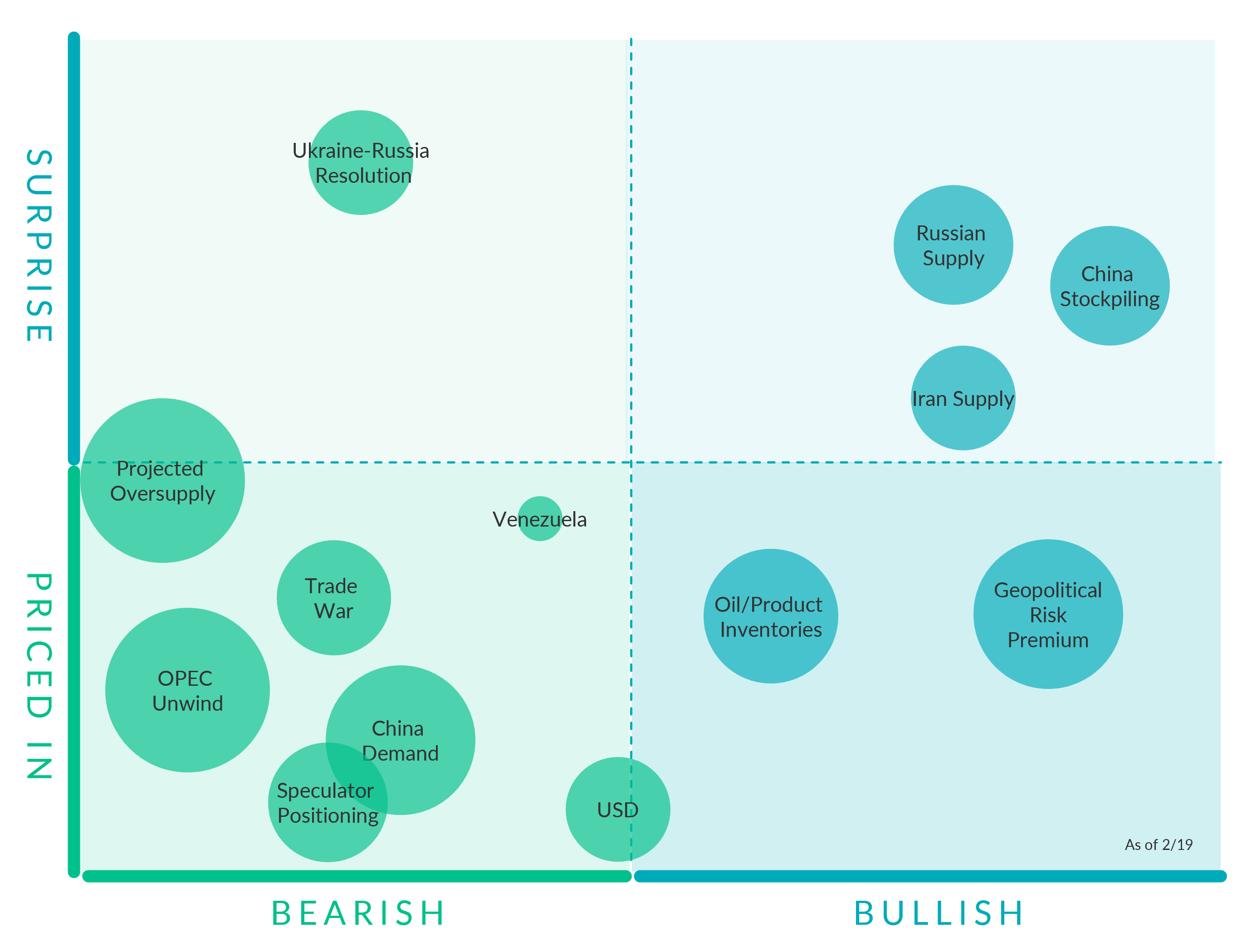

Crude Oil Factors

Geopolitical Risk Premium. (Bullish, Slightly Priced In) Prices remain elevated after President Trump indicated Iran has no more than 15 days to reach an agreement on its nuclear program, also noting that he is weighing the possibility of a limited military strike. In the past few week, the US has been ammassing its largest military deployment to the Middle East since 2003, heightening market concerns over potential supply disruptions.

Speculator Positioning (Bearish, Priced In) Elevated geopolitical risk is increasingly reflected in oil market positioning. According to Bloomberg, upside-focused options have traded at sustained premiums to downside protection for much of the year, and roughly 10 MMBbl of Brent June $100 calls reportedly changed hands midweek.

Oil/Product Inventories. (Bullish, Priced In) The latest Oil Market Report from the IEA indicates global inventories are expanding at the fastest pace since the pandemic, with stockpiles rising sharply and OECD inventories returning above historical norms. Demand growth expectations have been revised lower and the agency now anticipates a surplus exceeding 3.7 MMBbl/d in 2026, underscoring the scale of the emerging imbalance.

OPEC+ Quotas. (Bullish, Priced In) OPEC+ has paused planned oil production increases through Q1 2026, keeping output targets unchanged for January–March after raising quotas by about 2.9 m b/d through late 2025. Eight key producers, including Saudi Arabia and Russia, reaffirmed the freeze at their early January meeting, emphasizing market stability amid a looming surplus and seasonal demand patterns.

OPEC Unwind. (Bearish, Mostly Priced in) Several OPEC+ members are signaling room to restart supply increases as early as April, arguing fears of a broad global glut may be overstated. The alliance’s final production decision may ultimately hinge on the trajectory of US policy toward Iran and whether geopolitical tensions escalate or continue to ease.

China Stockpiling. (Bullish, Surprise)A significant portion of recent global stock builds has been absorbed into Chinese strategic reserves, effectively converting what would otherwise appear as excess supply into incremental demand. The EIA expects this pattern to persist through 2026, with China continuing to add crude to storage at a pace near 1 MMBbl/d before moderating in 2027. This behavior helps cushion near-term price declines by tightening observable market balances, even as underlying global supply growth continues to exceed consumption. Once strategic stockpiling slows, however, the buffering effect diminishes, leaving prices more directly exposed to the broader surplus implied by rising non-OPEC production and moderating demand growth.

USD (Bearish, Priced In) The recent U.S. Supreme Court decision overturning former President Trump’s broad tariff authority led to a modest dip in the U.S. dollar as investor uncertainty eased and Treasury yields rose, reflecting a short-term softening in safe-haven demand. In oil markets, a weaker dollar can be slightly supportive for crude prices by making oil cheaper in foreign currency terms, but the ongoing geopolitical risk premium from Middle East tensions continues to be the dominant driver of crude strength at the moment.

Ukraine-Russia Resolution. (Bearish, Surprise) Talks between Russia and the Ukraine are ongoing and being mediated by the US, but no tangible results are yet to arise that would bring an end to the war in Ukraine. A peace deal, if followed by the elimination of sanctions on Russian oil over its invasion of Ukraine, could unleash supply from the world's third largest producer.

Trade War. (Bearish, Mostly Priced In) The U.S. Supreme Court ruled 6-3 that former President Trump’s broad global tariffs imposed under an emergency powers law were unconstitutional. The decision represents a major legal setback for Trump’s trade agenda and the broader “trade war” strategy, potentially easing U.S. trade tensions with partners.

Projected Oversupply. (Bearish, Mostly Surprise) The latest EIA STEO reinforces that these geopolitical episodes are occurring against a backdrop of persistent oversupply. The STEO forecasts global oil inventories will continue to build through 2026, with implied stock builds averaging roughly 2.8 MMBbl/d, as global production growth outpaces demand.

Iran Supply. (Bullish, Slight Surprise) Iran continues to supply roughly 3.2–3.3 mb/d, with exports near multi-year highs around 1.7–2.0 mb/d. With flows still intact, Iran’s impact on crude has been more about potential disruption than realized supply losses.

Russian Supply. (Bullish, Slight Surprise) Russian exports also faced growing logistical friction as US sanctions pushed more barrels into shadow-fleet channels. Strikes on refineries and export facilities have slowed transit and increased reliance on intermediaries, lifting Russian oil-on-water above 180 MMBbl.

Venezuela. (Bearish, Slight Priced In) Venezuela remains a constrained but potentially growing source of supply, producing roughly ~0.8–1.1 mb/d in recent months, far below historical capacity and less than 1% of global output.

Recent policy shifts and easing restrictions could allow incremental increases, with analysts suggesting output could rise by roughly 30% from current levels in the short to medium term, though structural limitations and infrastructure decay cap near-term upside.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as “edge,” “advantage,” ‘opportunity,” “believe,” or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.