Price Pressure for Oil Looking One Sided

AEGIS is officially shifting its crude oil view to bearish versus the forward curve. At this stage, we find it difficult to make a rational case for prices to materially move higher and see greater probabilities that spot WTI prices settle below the curve.

The shift in our view shouldn’t come as a surprise for those who have heard our rhetoric recently. In our recent webcast, we hammered on the growing forecasted supply glut expected in the global oil market. This commentary carried plenty of bearish undertones despite officially sticking with a neutral view on the curve. That has changed as a rapid rise in global oil inventories may be just around the corner.

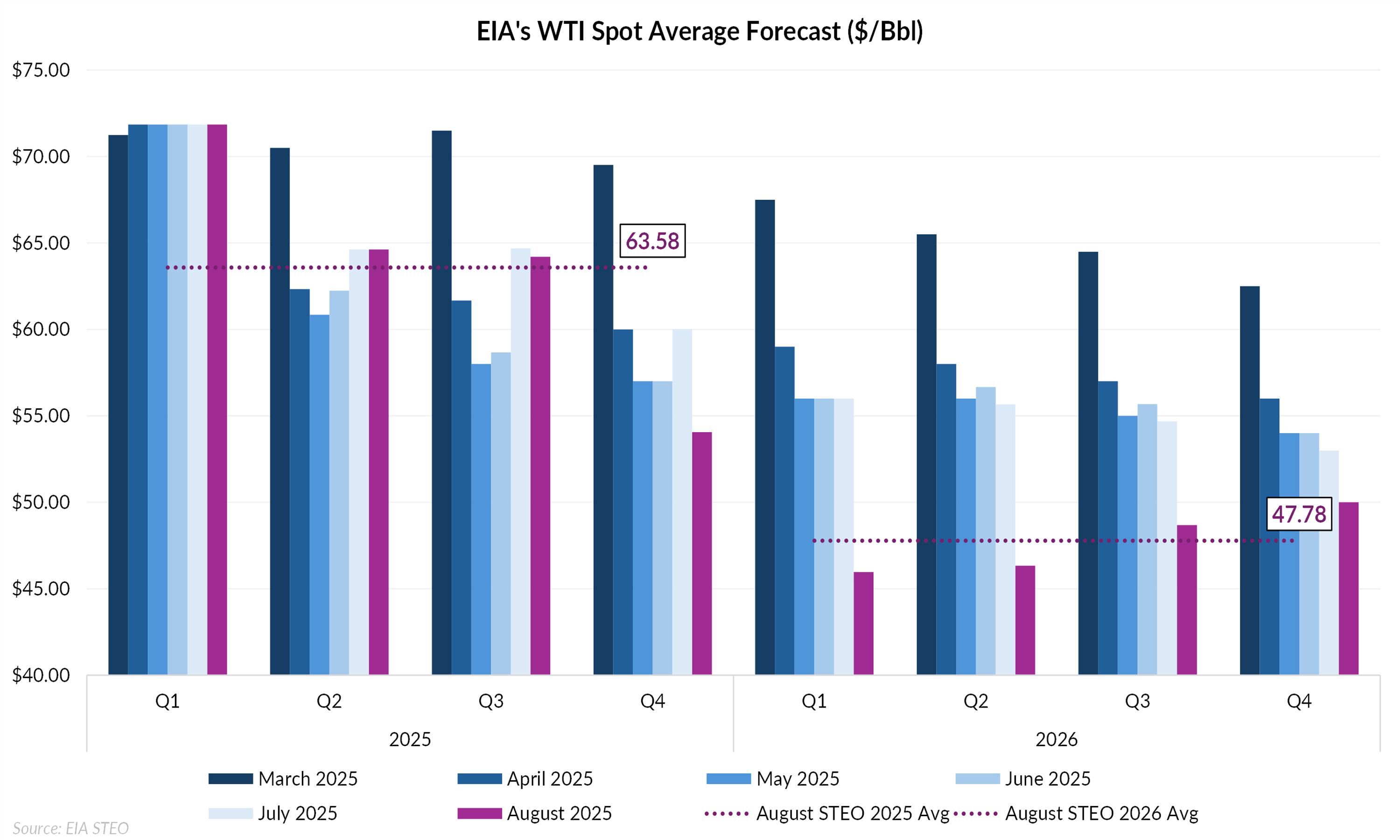

Unlike some other agencies and analysts, we are relatively late in formally adopting a bearish narrative. As of today, we join the broader consensus expecting weaker prices over the next 18 months. Read here for how not bullish speculators are on WTI crude. The most recent EIA price forecast, shown below, reinforces this view.

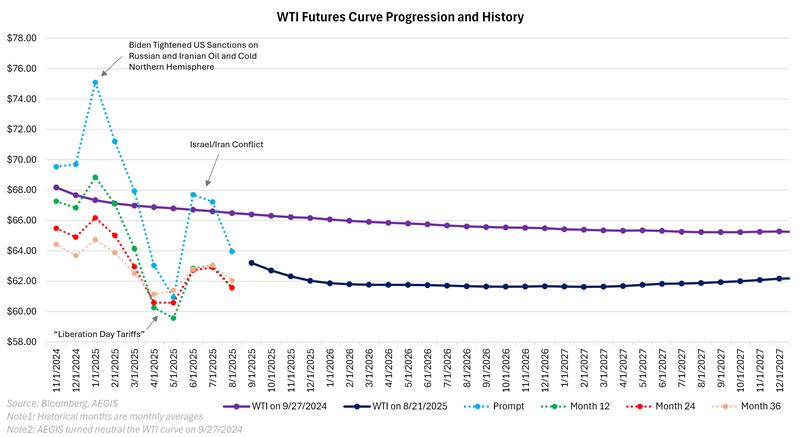

We shifted our view from bullish to neutral vs the curve on September 27, 2024, via our Market Summary that goes out to clients every Friday. Below is a graphic of the day we went neutral up until today August 21. Typically, looking back at how your price calls faired is quite humbling as many events happen outside what you are able to forecast, even if you have the perfect mousetrap. Yet, we didn’t fair too bad this time as WTI was mostly range bound over the past year while providing producers with some opportunities to catch price spikes.

The chart compares the WTI forward curve from our September 27, 2024 outlook (purple) with the curve as of August 21, 2025 (dark blue), the date we shifted to a bearish view. Between these two points, the chart also tracks how various maturities on the curve traded over time. For instance, the red line represents the monthly average price of the 24th month on the WTI curve. Highlighting multiple points along the curve provides a clearer picture of what producer hedgers monitor, rather than relying solely on the more volatile prompt-month contract.

In conclusion, we held on to neutrality for as long as possible—we dislike sitting in the middle, as it often feels like a copout. But with the projected degree of oversupply, we expect the WTI forward curve to give up its backwardation and transition into a modest contango if forecasts prove accurate.

Crude Oil Factors

Geopolitical Risk Premium. (Bullish, Mostly Priced In) President Trump is pushing for a summit between Vladimir Putin and Volodymyr Zelensky following a series of high-level talks. Vandana Hari of Vanda Insights said crude “may be in for a holding pattern,” noting that while the path to a resolution has opened, it could take time. A peace deal could eventually ease restrictions on Russian crude exports, though Moscow has largely maintained flows throughout the conflict.

Speculator Positioning (Bearish, Priced In) The latest CFTC data show that as of August 12, money managers reduced their net long in CME’s flagship NYMEX WTI contract to just 48,865 contracts, the smallest bullish position since April 2009. Meanwhile, trades of WTI done on the ICE exchange show money managers holding a net short of about 53,000 contracts. When the two venues are combined, overall positioning in WTI has slipped into net short territory for the first time on record.

OPEC Market Share War. (Bearish, Surprise) OPEC raised crude production by 360,000 bpd in June, its largest increase in four months, as Saudi Arabia led a push to reclaim market share despite weakening demand and rising global supplies. The Saudis, along with the UAE and Kuwait, ramped up both production and exports, signaling a strategic shift away from price defense and toward volume gains.

Oil/Product Inventories. (Bullish, Priced In) Crude inventories in the US remain low, although stocks have risen this year in-line with seasonal trends. Crude data is usually on a several-month lag. According to the July IEA report, OECD inventories have started to move higher. Global inventories are expected to increase throughout the year. Diesel inventories rose, but they’re still at the lowest seasonal level since 1996. According to Goldman Sachs, diesel-refining margins are likely to stay above long-run averages.

OPEC+ Quotas. (Bullish, Priced In) On June 2, OPEC+ announced its extension of 3.66 MMBbl/d cuts through December 2025. Additionally, the 2.2 MMBbl/d voluntary cuts from eight member countries will continue into Q3 2024 but will start to be reversed in October at a rate of 0.18 MMBbl/d per month. OPEC+ members agreed on September 5 to delay a planned gradual 2.2 MMBbl/d supply hike by two months, shifting the start to December. The group will add 0.19 MMBbl/d in December and 0.21 MMBbl/d from January onwards, with an option to adjust or pause these hikes depending on market conditions. The cartel also reaffirmed its compensation cuts of 0.2 MMBbl/d per month through November 2025, as members such as Iraq, Russia, and Kazakhstan have struggled to meet their original production quotas.

AEGIS notes that the global crude market would quickly build inventories without OPEC's support in reducing supply.

OPEC Unwind. (Bearish, Mostly Priced in) OPEC+ announced a 547 MBbl/d production quota increase for the month of September, completing the reversal of the group’s November 2023 supply cuts a full year ahead of schedule. The move brings the total unwind to approximately 2.5 MMBbl/d, including the 300 MBbl/d hike allocated to the UAE.

China Demand. (Bearish, Priced In) China's oil demand has been severely affected by a combination of economic weakness and electrification trends within the country. Continued weakness in China's real estate sector has led to slower economic growth. The Chinese government has responded with interest rate cuts and multiple stimulus packages. Electrification trends have also dampened oil demand growth, with the buildout of high-speed rail and LNG-powered trucks and busses impacting diesel demand. China is one of the most prolific adopters of electric vehicles, impacting gasoline demand. Some estimates show demand for transportation fuels in China peaking, but oil demand from China's petrochemical sector should continue for the next few decades.

USD (Bullish, Priced In) The US dollar index surged to multi-year highs toward the end of 2024. The dollar has since erased all post-election gains despite tariff fears being realized. Typically, a stronger dollar will have a negative impact on crude prices, while a weakening dollar will support prices.

Ukraine-Russia Resolution. (Bearish, Surprise) President Trump is pushing for a summit between Vladimir Putin and Volodymyr Zelensky following a series of high-level talks. Vandana Hari of Vanda Insights said crude “may be in for a holding pattern,” noting that while the path to a resolution has opened, it could take time. A peace deal could eventually ease restrictions on Russian crude exports, though Moscow has largely maintained flows throughout the conflict.

Trade War. (Bearish, Mostly Priced In) The EU and South Korea are both set to pay a 15% levy on imported good to the US, a similar deal to Japan. Brazil has been granted a seven day extension after the President said the major trading partner would pay a substantial 50% tariff rate. Trump said it would be difficult to reach a deal after Prime Minister Mark Carney anonunced that Canada would recognize the Palestinian state.

Projected Oversupply. (Bearish, Mostly Surprise) According to the EIA, global liquid fuels production will rise by 2.0 million b/d in 2H25 compared with 1H25, with OPEC+ and non-OPEC producers each accounting for about half of the increase. Gains from the United States, Brazil, Norway, Canada, and Guyana will match those from the producer group. Global demand is expected to climb by 1.6 million b/d over the same period, resulting in inventory builds accelerating by nearly 0.5 million b/d.

Trump/Iran/Venezuela. (Bullish, Surprise) The US government has let Chevron resume oil operations in Venezuela. Before losing their license to operate, the supermajor was producing 240 MBbl/d in Venezuela with most of the production going to refineries in the Gulf Coast.

Russian Supply. (Bullish, Surprise) Trump hes threatened secondary sanctions on any countries purchasing barrels from Russia if they do not reach a ceasefire deal with Ukraine in the coming days. He also expressed disapproval of India's large Russian crude purchases, stating that the country could face an unknown penalty for its actions.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as “edge,” “advantage,” ‘opportunity,” “believe,” or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.