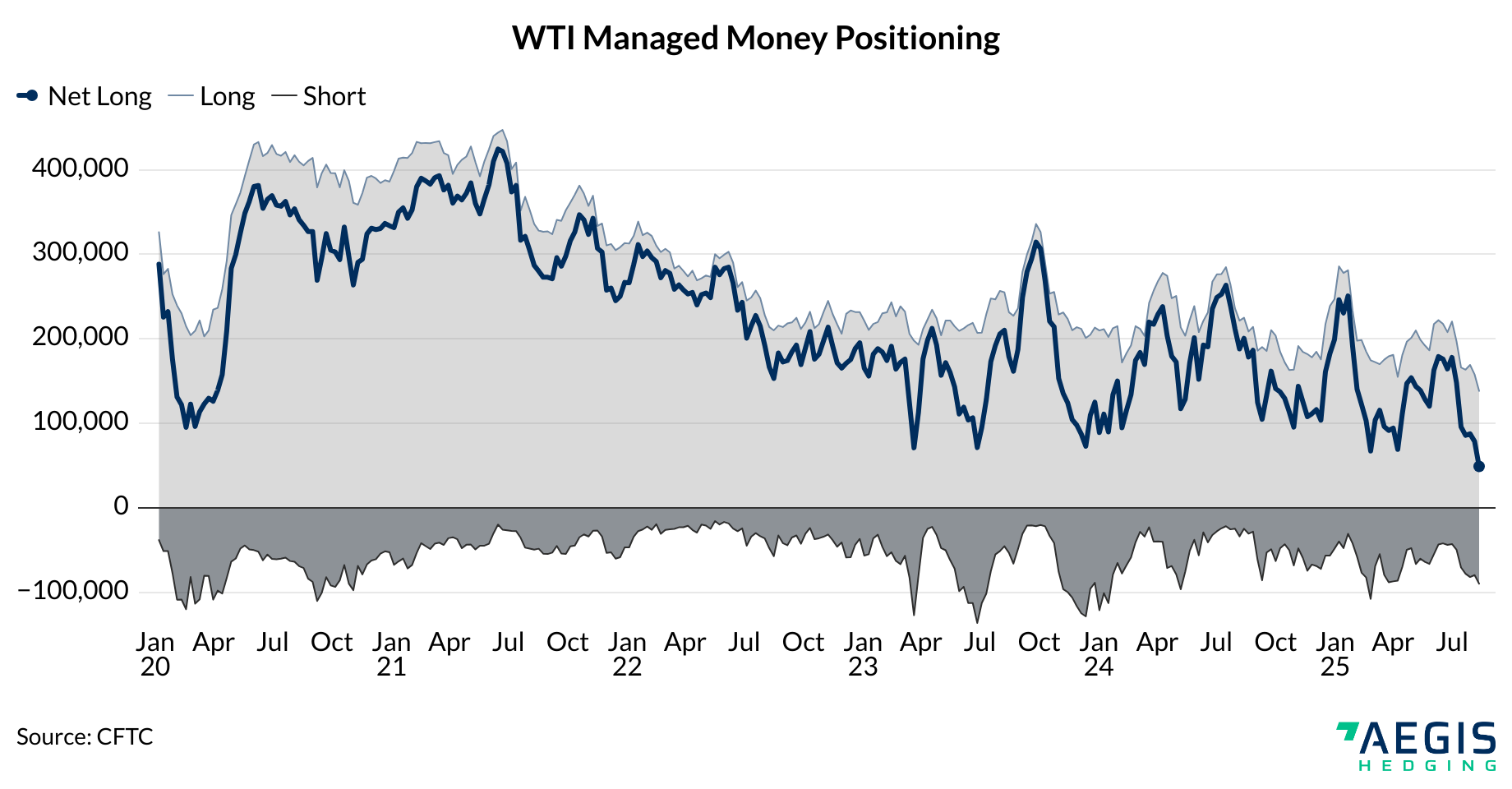

Money managers have cut their crude oil exposure to the lowest levels in more than 15 years, pushing WTI futures into unprecedented territory. The latest CFTC data show that as of August 12, money managers reduced their net long in CME’s flagship NYMEX WTI contract to just 48,865 contracts, the smallest bullish position since April 2009.

Meanwhile, trades of WTI done on the ICE exchange show money managers holding a net short of about 53,000 contracts. When the two venues are combined, overall positioning in WTI has slipped into net short territory for the first time on record.

Positioning Breakdown

The reduction on CME was driven primarily by long liquidation (–20,190 contracts), alongside a smaller increase in new shorts (+12,282). Total open interest stands near 2.01 million contracts.

This chart reflects CME’s NYMEX WTI positioning only, which remains net long at 48,865 contracts. It does not include ICE WTI, where funds are net short.

Why It Matters

Historical Context

The last time net length in CME WTI was this low, crude prices had collapsed during the global financial crisis. While today’s fundamentals are different, the signal from positioning is similar: money managers show little appetite to hold bullish exposure, reflecting a highly skeptical view of oil’s trajectory.

Conclusion

CFTC data confirm that Managed Money has retreated sharply from crude, leaving WTI futures at their most bearish positioning since 2009. With CME longs pared back to crisis-era lows and ICE showing outright net shorts, the combined picture is one of unprecedented caution in oil markets.