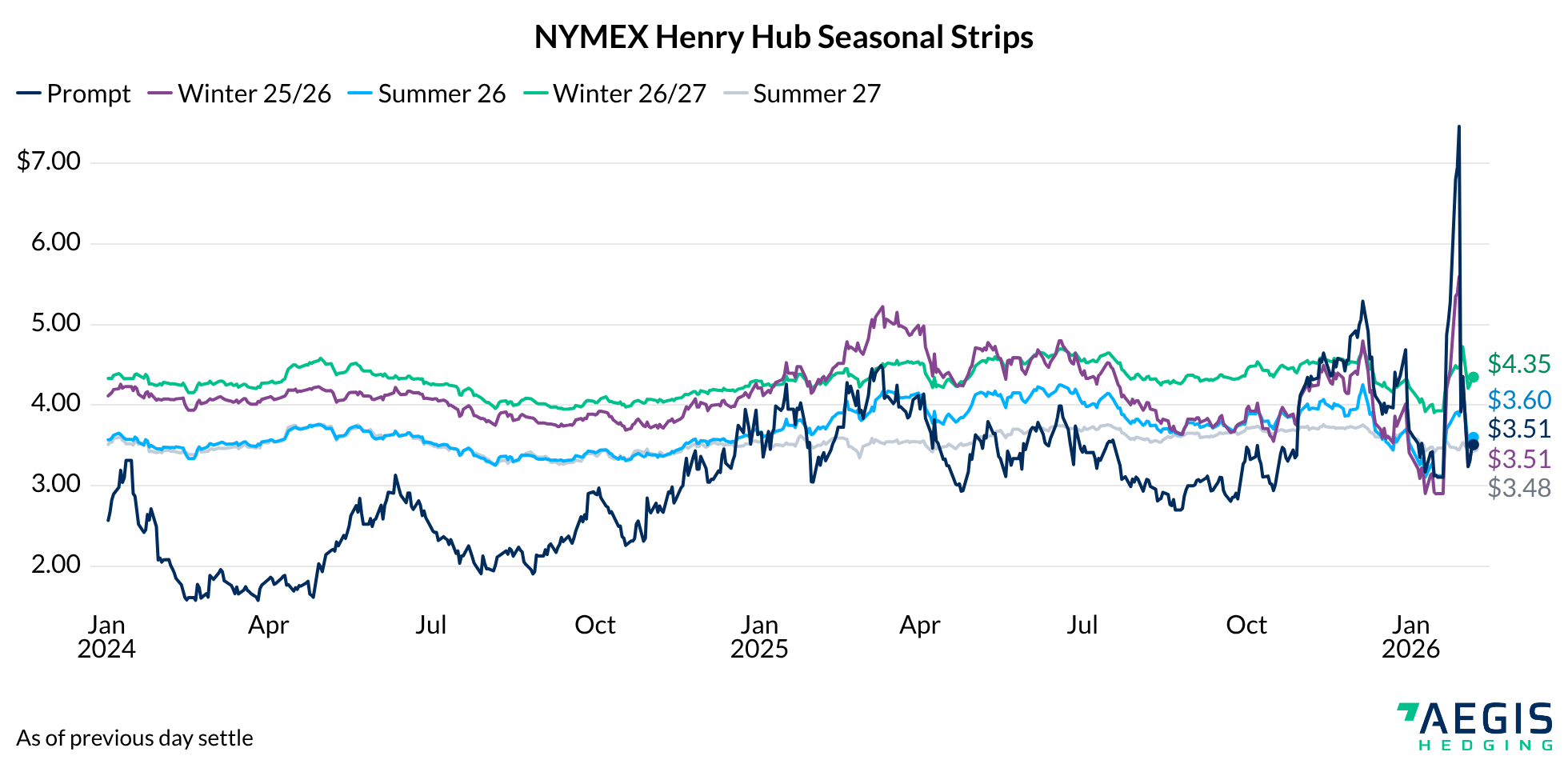

Last week’s winter storm Fern sent natural gas demand higher, supply lower, and resulted in the highest monthly Henry Hub contract settlement since 2022. Most direct impacts from the storm are now behind us, but it has shifted the outlook for gas going forward this year. The storage withdrawal from last week set a new record and has pushed Lower-48 inventories back into a deficit, making it more difficult to build storage this summer in advance of Winter ‘26/’27. This dynamic has led to stronger prices for next summer and winter, although an untimely shift in weather forecasts this week has erased some of those gains.

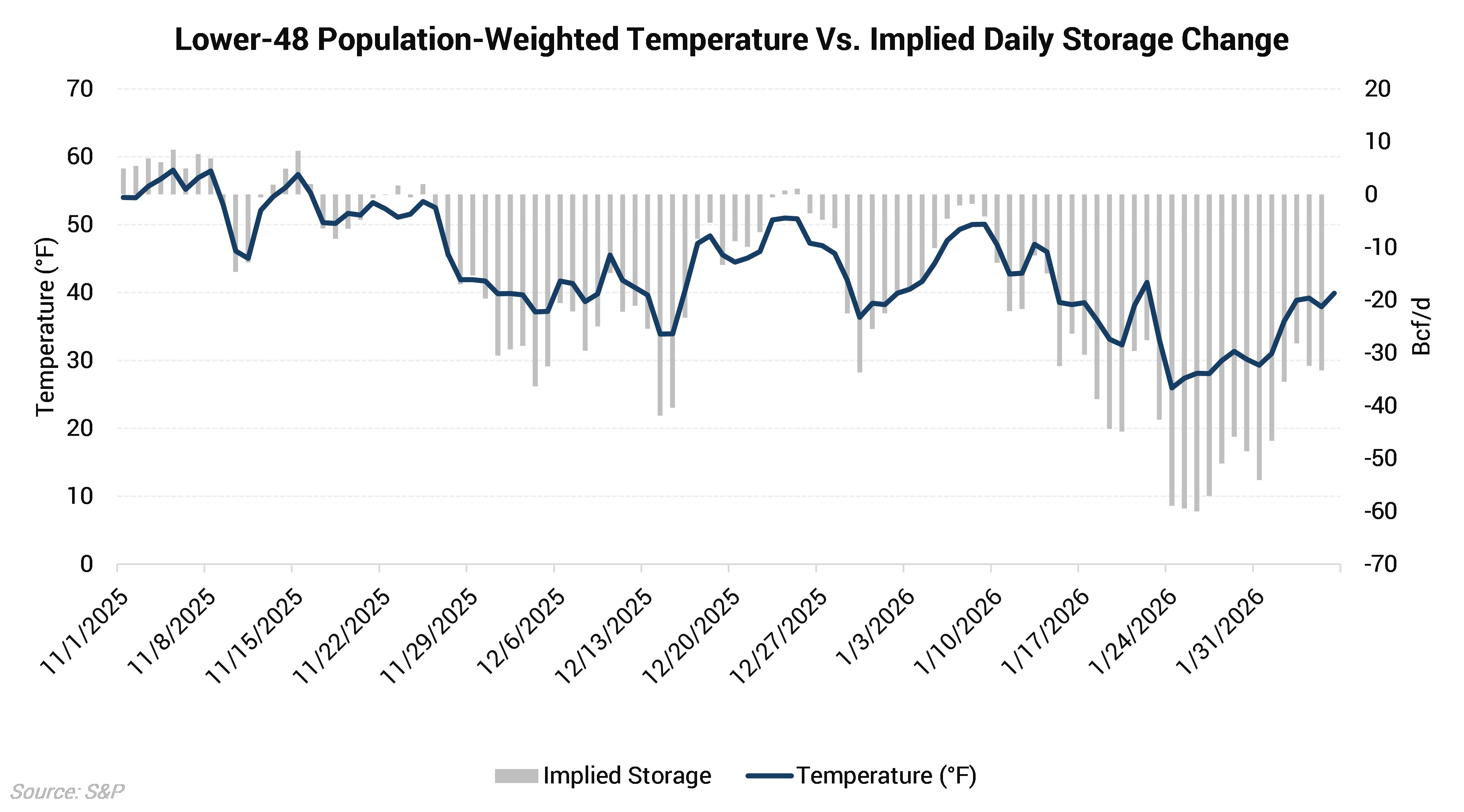

Lower-48 population-weighted temperatures plunged to the lowest level seen so far this winter, more than 10 ºF below the ten-year average. This sent weather-driven gas demand to the highest level seen so far this winter, with res/com demand reaching 72.8 Bcf/d, and gas power demand jumping to 44.9 Bcf/d. In addition to surging demand, with temperatures below freezing, several producing regions suffered from freeze-offs. Total Lower-48 dry gas production fell to 94.9 Bcf/d, according to data from S&P. Several regions such as the Permian Basin, Haynesville, Midcont, and Northeast saw supply drop. Canadian imports jumped to nearly 11 Bcf/d, offsetting some of the production losses, but large withdrawals from storage were required to balance supply and demand.

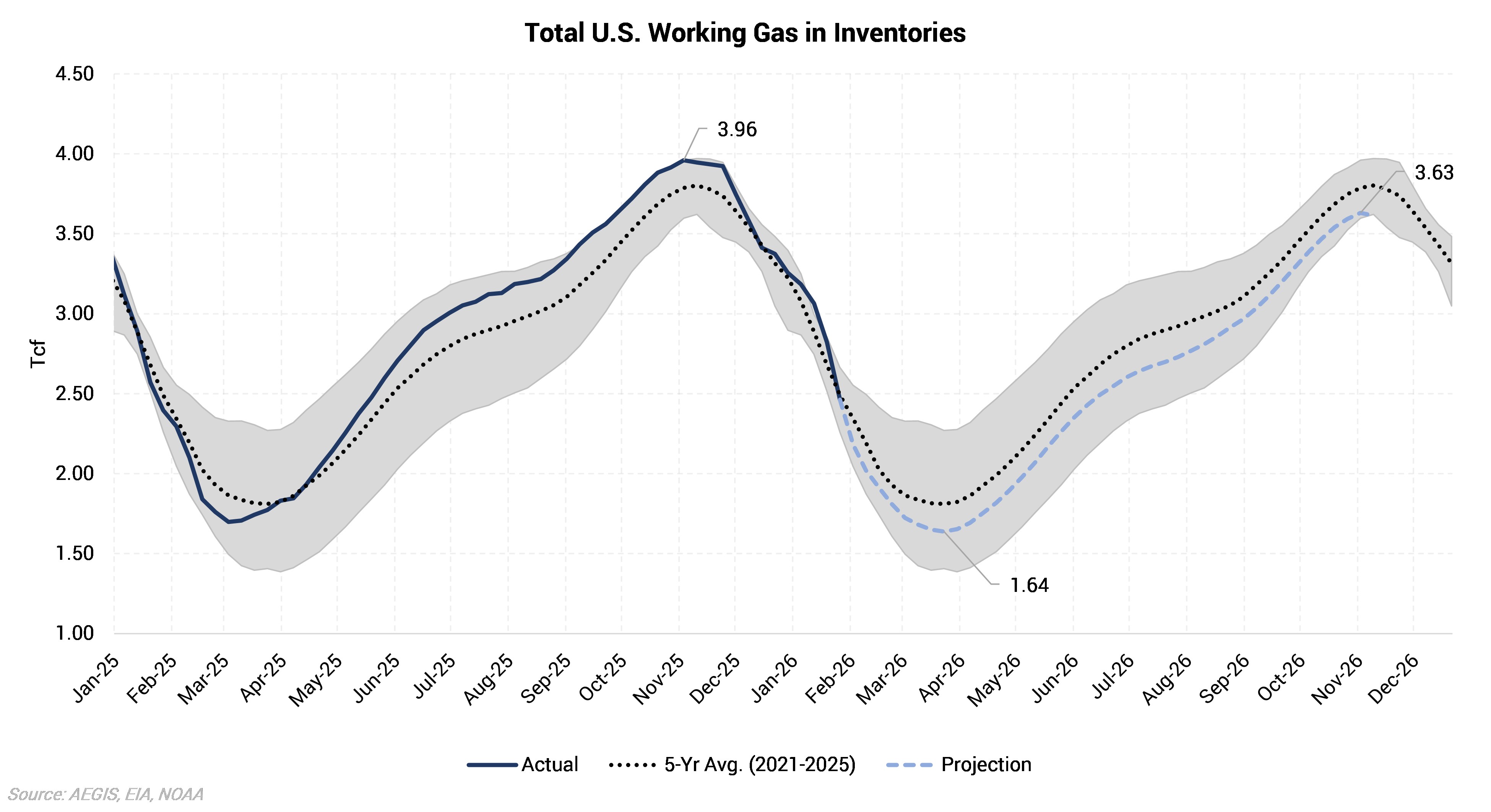

The EIA reported a storage withdrawal of -360 Bcf for the week of the storm, which surpassed the previous record weekly withdrawal of -359 Bcf, but was on the lower end of estimates. This sent inventories from a surplus of 143 Bcf to a deficit of -27 Bcf. This massive withdrawal has shifted the storage outlook going forward this year and significantly lowered our projection for how much gas will be available in inventories by the end of the current winter season.

As of January 15, about two weeks prior to winter storm Fern, inventories were firmly above the five-year average and it looked like storage would end winter around 1.8 Tcf, right on top of the five-year average. Now that a large amount of gas has been pulled from storage, our model shows inventories ending winter at 1.64 Tcf and remaining at a deficit to the five-year average through the following summer season and reaching only 3.63 Tcf by the start of next winter. A 3.63 Tcf November end-of-season number would have major implications for the market as this would be the lowest since 2021, and at the bottom of the five-year range. This would likely result in additional risk premium for the Winter ‘26/’27 strip. One key assumption in the model is that dry gas production rises to about 111 Bcf/d by the end of 2026, compared to roughly 108.5 Bcf/d seen so far this year. We have also adjusted summer power demand slightly lower given higher gas prices will encourage more coal generation relative to gas.

The main takeaway from this is that while the winter storm and demand surge primarily impacted near-term fundamentals and gas prices, it does make the setup for this summer and next winter appear more bullish.