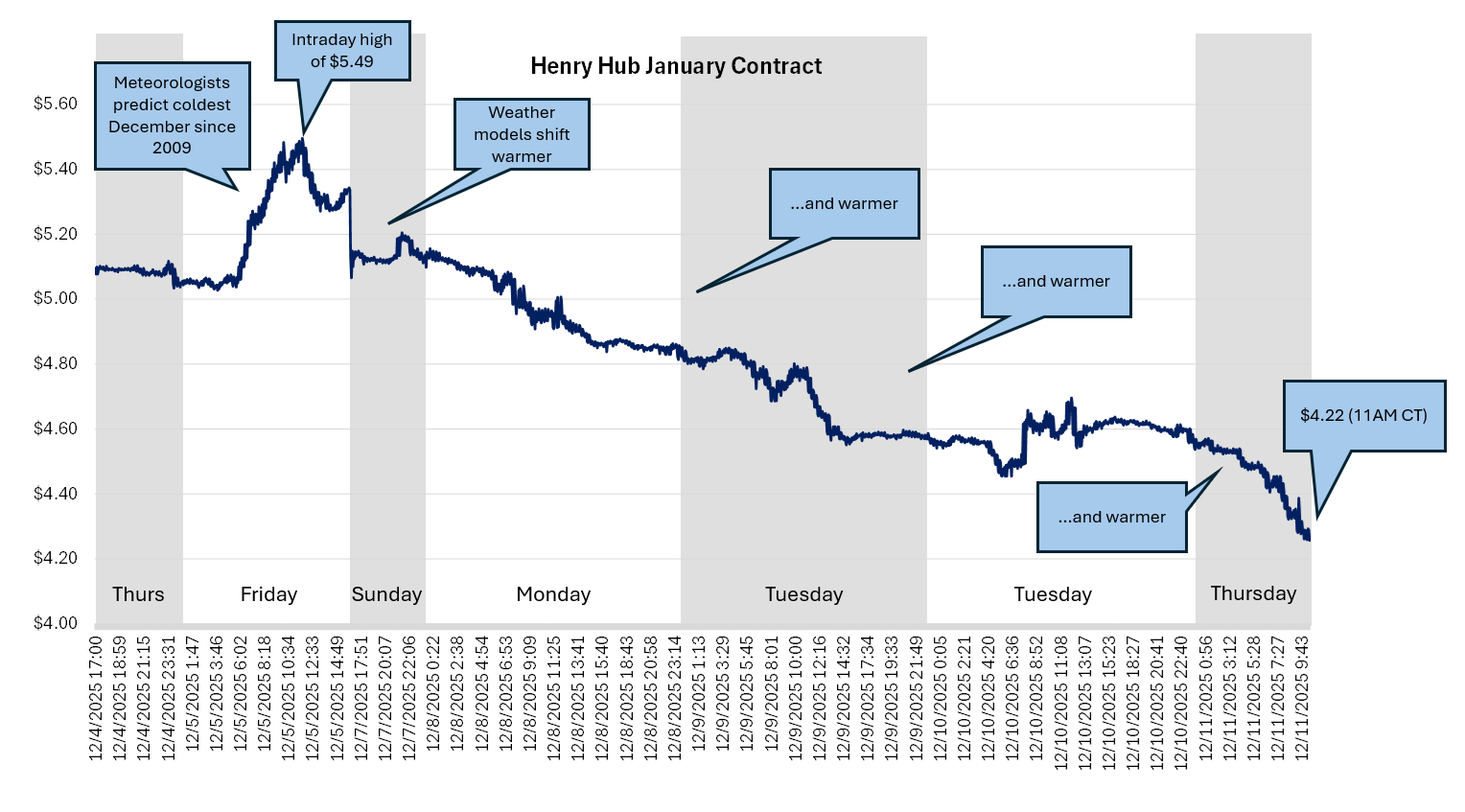

Natural gas prices experienced a sharp increase followed by a rapid decline within the initial eleven days of December.

Cold weather forecasts for December caused the January natural gas contract to surge to $5.49/MMBtu (intraday) on Friday, December 5. The following five days of weather models moderated the amount cold expected for this month and sent the natural gas price plunging to $4.22/MMBtu as of the 11th.

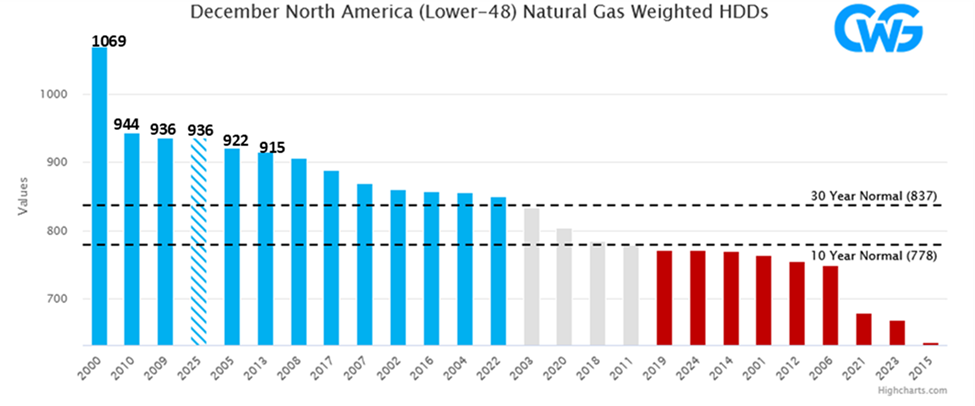

On December 5, meteorologists were estimating December to come in as the fifth coldest in the 2000’s in terms of heating degree days (HDDs). Natural gas prices reached their peak on this day. Calendar 2026 briefly traded at $4.54/MMbtu last Friday.

At AEGIS, we observed a large surge in hedging on December 5 – the largest single day hedge volume, and separately, number of clients hedging, on AEGIS Markets for natural gas in 2025.

Below was the pop-weighted HDD estimate for December as of the 5th, according to The Commodity Weather Group (CWG). The estimate was calling for 936 HDDs, way above the 10 and 30 year normal.

As of December 5

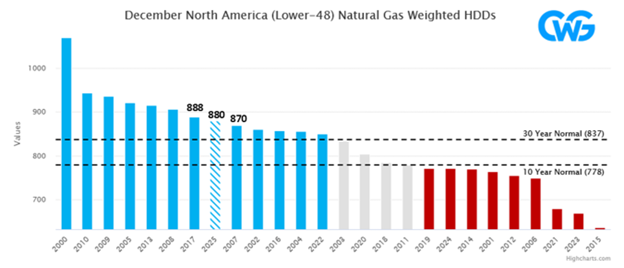

However, this started to slide to the right as more days went by and the weather models shifted warmer. The next graphic below shows that slippage by December 9.

As of December 9

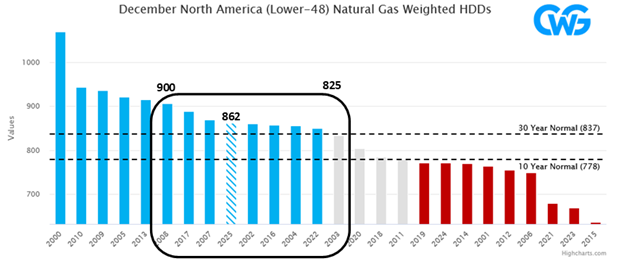

And as of December 11, the total number HDDs for December had slid to 862 shown in the last image. If this month performs at 862 HDDs, then December would rank 9th coldest in the 2000’s compared to tied for third as was estimated on the 5th.

As of December 11

The month of December now looks like a tale of two halves. The first half of December is estimated to be the third coldest in the 2000’s and the 8th coldest of all time for the same period. According to CWG, December 19 through December 25 is estimated to be the 3rd warmest in the 2000’s.

In summary, an anomalously cold start to December pushed natural gas prices much higher, and producers really took advantage of the rally. However, as weather models gave up some of the predicted cold, prices plummeted in less than a week’s time.