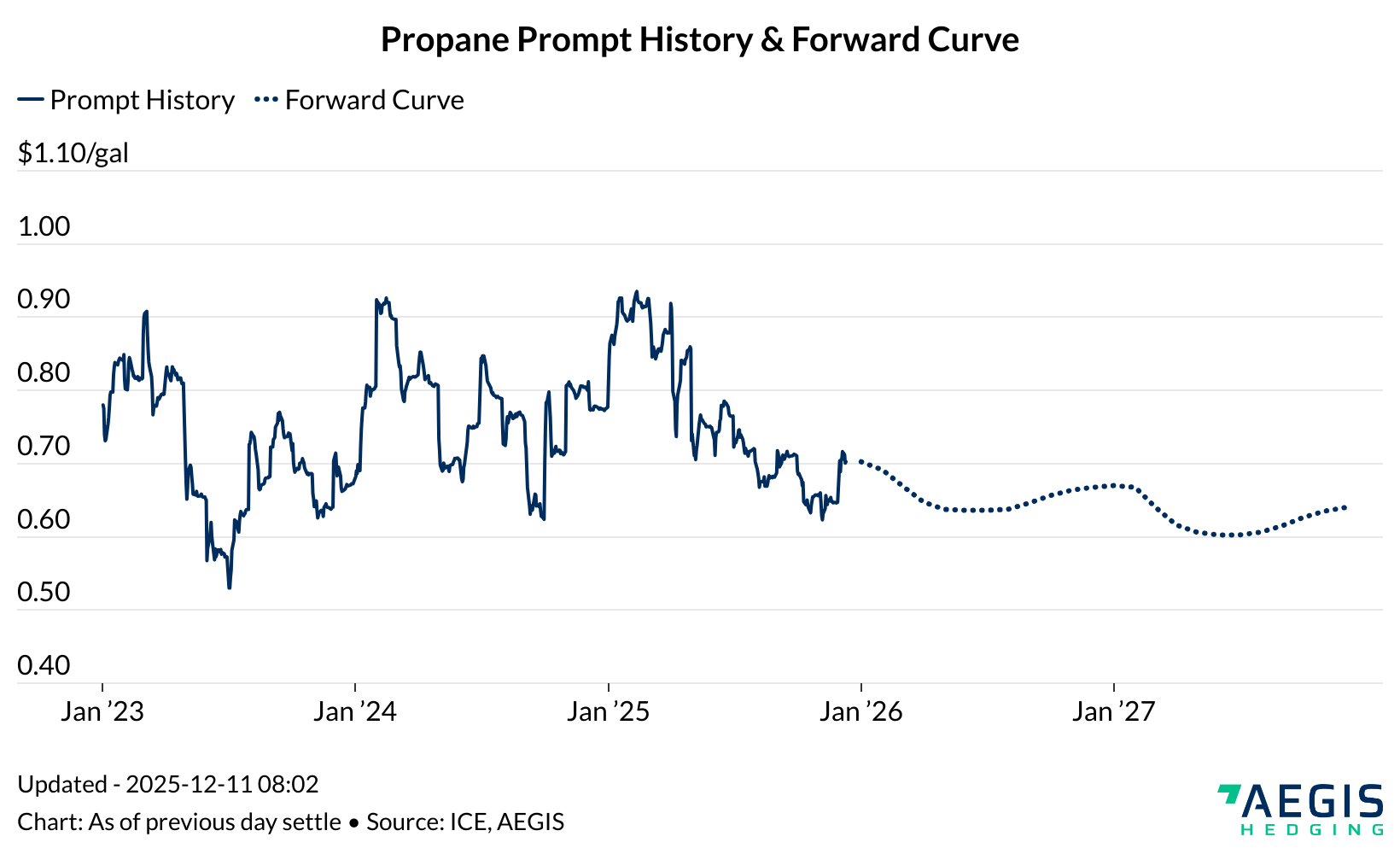

Propane prices strengthened in early December even though the underlying market remains well supplied. After trading in the lower $0.60/gal range through most of November, prompt Mont Belvieu propane rebounded above $0.70/gal, as shown in the chart below. The move was driven by colder early-December weather, which increased expected heating demand, rather than any change in propane’s supply-demand fundamentals or crude oil pricing.

US propane production continues to climb. The Propane Field Production chart below shows September output near 2.38 MMBbl/d, the highest monthly level on record. While the pace of growth has slowed compared to 2022–24, total volumes remain elevated, driven primarily by strong associated-gas output from the Permian Basin. Recent data shows no indication of tightening on the supply side, production is still rising, and there are no signs of meaningful slowdowns in upstream activity that would reduce NGL output.

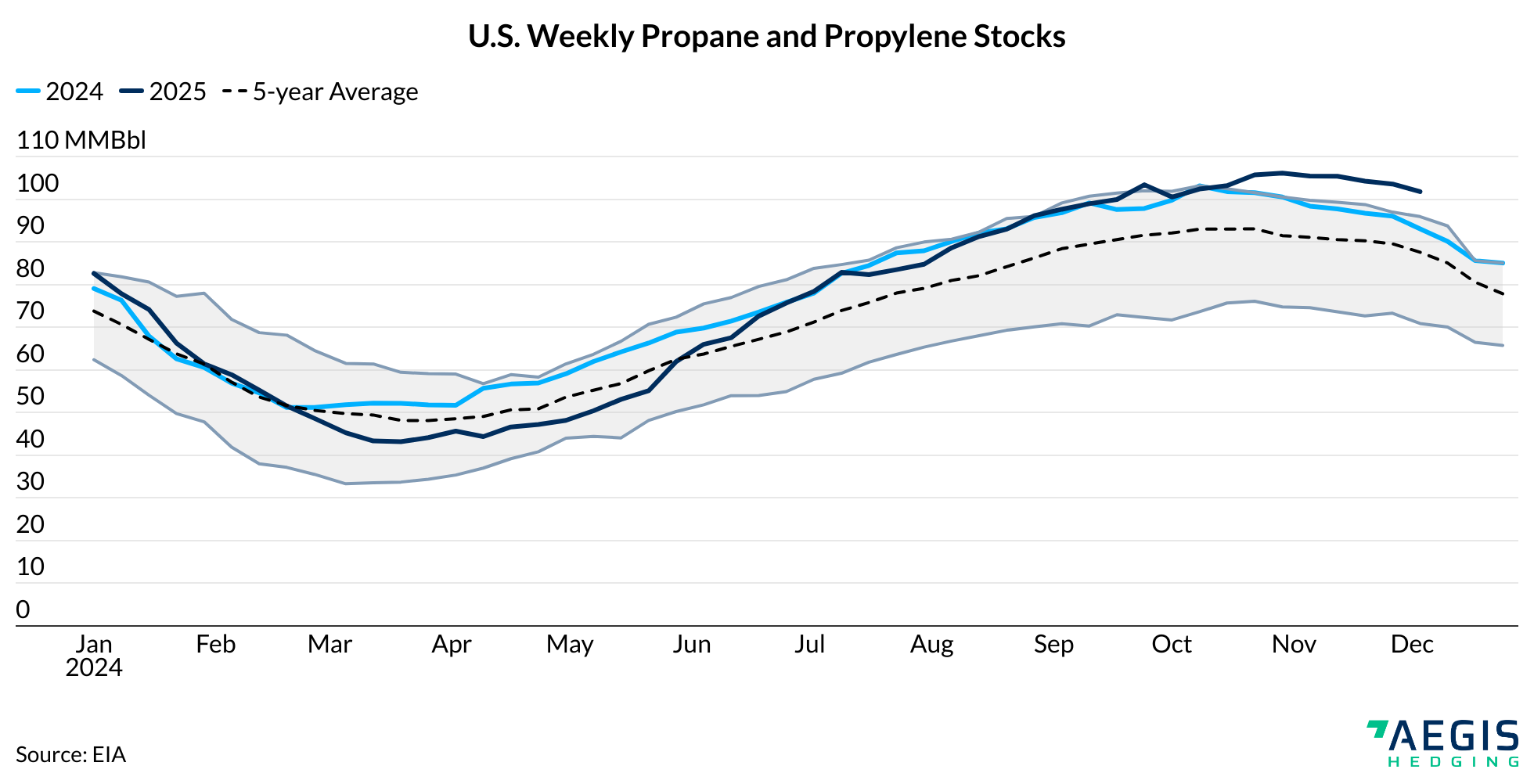

US propane inventories remain exceptionally high for this time of year. The Weekly Propane and Propylene Stocks shows 2025 levels sitting well above both last year and the five-year range, with stocks holding above 100MMBbls entering December. Elevated inventories reflect strong production throughout the year, while demand hasn’t kept pace. With stocks sitting atop the historical range, the storage picture continues to signal a loose, well-supplied market heading into peak heating season.

Crude oil has also offered little directional influence, trading in a narrow range near $60/Bbl. With propane fundamentals steady and crude flat, the December rally was driven primarily by weather. According to early-December forecasts from the Commodity Weather Group, December was tracking as the coldest since 2009 and nearly 18% colder than the 10-year normal, with 938 projected gas-weighted heating degree days, well above both the 10- and 30-year norms. In a market entering winter with high inventories but normal seasonal consumption, this colder pattern was enough to lift sentiment and firm prompt pricing.

Even with the recent rebound, the forward curve remains anchored around $0.60–$0.65/gal, reinforcing that the broader balance is still loose. Without a shift in crude, exports, or domestic fundamentals, the early-December price strength looks weather-driven rather than the start of a structural tightening.