AEGIS Hedging - Metals First Look

|

| |

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here.

|

-

LME Aluminum 3M Select trades $63.50 higher to $3120 at 8:16:51 AM

-

LME Copper 3M Select trades $605 higher to $13507 at 8:16:50 AM

-

(Bloomberg) – China’s state-backed metals industry group is calling for more copper in the country’s strategic stockpiles, a move that would add to upward pressure on prices and highlight a growing push by governments to bolster supply security. Industry experts suggest the country should expand strategic copper reserves, while working with major state-owned producers to boost commercial inventories, according to the China Nonferrous Metals Industry Association, which held an annual briefing to review trends in the sector on Tuesday. The comments come just days after copper prices spiked to a record high, and is the latest sign that copper is becoming even more of a strategic asset as major economies fret about supply-chain risks. The Trump administration unveiled a major commodity stockpiling program earlier this week. US President Donald Trump unveiled “Project Vault” on Monday — a planned $12 billion fund aimed at building strategic mineral reserves to insulate manufacturers and slash America’s reliance on Chinese supplies. Copper wasn’t explicitly mentioned, though the metal was classified as a critical mineral last year.

-

CME HRC Steel last traded at $972 and $0 lower at 8:27:41 AM

|

|

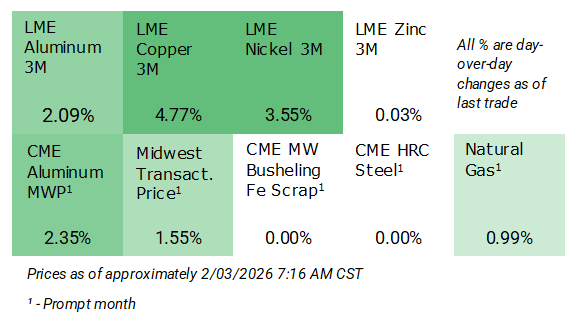

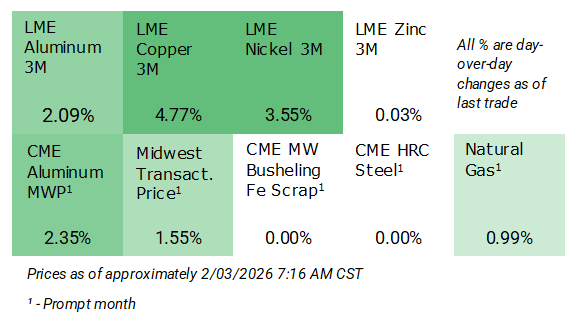

Price Indications

|

|

|

|

|

Today's Charts

|

|

|

|

|

Metals Factor Matrix

|

|

AEGIS Factor Matrices: Most important variables affecting metals prices

|

|

|

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|