AEGIS Hedging - Metals First Look

|

| |

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here.

|

-

LME Aluminum 3M Select trades $-27.25 lower to $3132 at 8:29:45 AM

-

LME Copper 3M Select trades $-108.75 lower to $12860 at 8:29:45 AM

- (Bloomberg) -- Spot copper prices surged to trade at a huge premium over later-dated futures on the London Metal Exchange, with a closely watched one-day spread reaching levels not seen since an historic supply squeeze in 2021. The Tom/next spread was at a narrow discount on Monday, and the spike was among the largest ever seen in pricing records starting in 1998, creating a fresh bout of turmoil in the LME copper market. The surge in the Tom/next spread exposes holders of short positions to hefty losses if they look to roll them forward instead, and the move took the spread to the highest level since a major supply squeeze in 2021. Data from the LME showed that there were three separate entities with long positions equal to at least 30% cumulatively of the outstanding January contracts as of Friday, and if held to expiry the positions would entitle them to more than 130,000 tons of copper — more than the amount that’s readily available in the LME’s warehousing network. The spread later fell in the final minutes of trading, and closed at $20 a ton at 12:30 p.m. London time.

-

CME HRC Steel last traded at $938 and $-1 lower at 7:24:23 AM

|

|

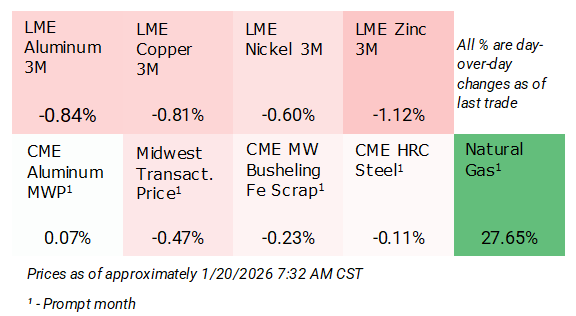

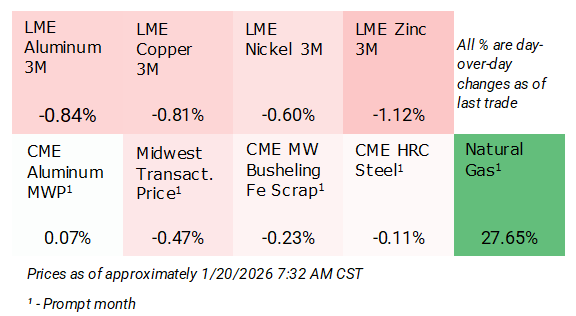

Price Indications

|

|

|

|

|

Today's Charts

|

|

|

|

|

Metals Factor Matrix

|

|

AEGIS Factor Matrices: Most important variables affecting metals prices

|

|

|

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|