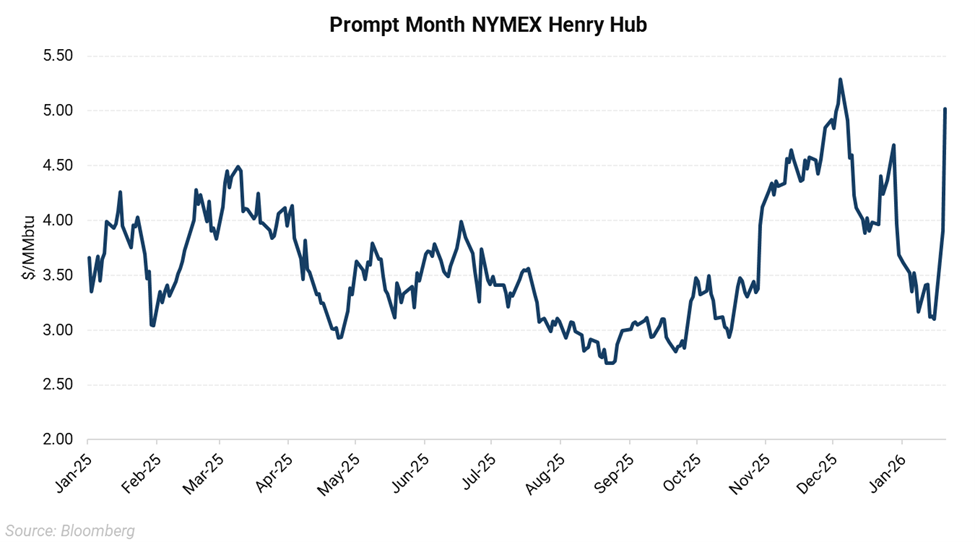

The February Henry Hub contract has risen $1.90 in the last three days, with the contract rising from $3.10/MMbtu on Friday to more than $5.00/MMbtu as of Wednesday afternoon. Wednesday’s gain amounted to more than $1, making it one of the largest daily price moves for the prompt natural gas contract in history. The rest of the forward curve has moved higher as well, but not to the same degree. The Summer 2026 seasonal strip has gained 56c and next winter is up 37c, over the same period. A significant shift in the near-term demand outlook has driven this, with a winter storm impacting much of the eastern and southern US this weekend. In addition to higher demand for space heating, temperatures in several major producing areas will be low enough to result in gas production freeze offs. Altogether, a sizeable withdrawal from storage will be reported after this week.

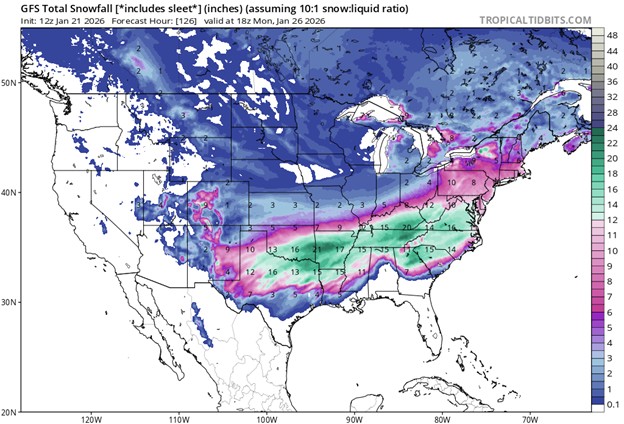

12z GFS Total Snowfall forecast through Monday, January 26

Since Friday, January 16, The European Ensemble weather model has gained 68.3 heating degree days. Lower-48 population-weighted average temperatures are forecast to be well-below the ten-year average for the entirety of the two-week forecast period, with this Saturday expected to be the coldest. According to data from Commodity Weather Group, temperatures in Chicago could fall to -13 ºF, a record low of 10 ºF is expected in Dallas, and snow and ice will cover much of the US. Residential/Commercial gas demand will rise to the highest level of this winter season so far, while power demand also jumps to a seasonal high. ERCOT is currently forecasting a load of nearly 70 GW, while PJM expects a new record of 145.7 GW. This level of gas demand alone would result in a large withdrawal from underground inventories, but there will also be significant production losses, exacerbating the call on storage.

The Permian Basin, Haynesville, Lower-MidCon, and Northeast may all see production freeze-offs, constraining supply and deliverability. The National Weather Service has a winter storm watch in place for the Midland/Odessa area, as temperatures are forecast to fall to 15 ºF with potentially up to three inches of snow fall. Historical precedents would imply a production loss of 2-3 Bcf/d in the Permian. Freezing temperatures in the Haynesville will also impact production, although not to the same extent as the Permian. While the Northeast is better prepared for winter conditions than the South, temperatures in the Appalachian basin are currently forecast to fall low enough to result in several Bcf/d of production losses. In total, Lower-48 dry gas output will likely suffer for at least two days this weekend, with underground storage filling the gap.

This rally in gas prices presents an opportunity for hedgers to secure additional volumes for this summer and next winter, especially given the increase in call-put skew, which can make costless collars more attractive.