The latest Short-Term Energy Outlook (STEO) from the EIA presents a materially looser global oil landscape heading into 2026, driven by persistent non-OPEC supply strength and softer regional demand expectations. Despite elevated geopolitical risks, the agency expects WTI crude prices to drift lower next year as inventories build.

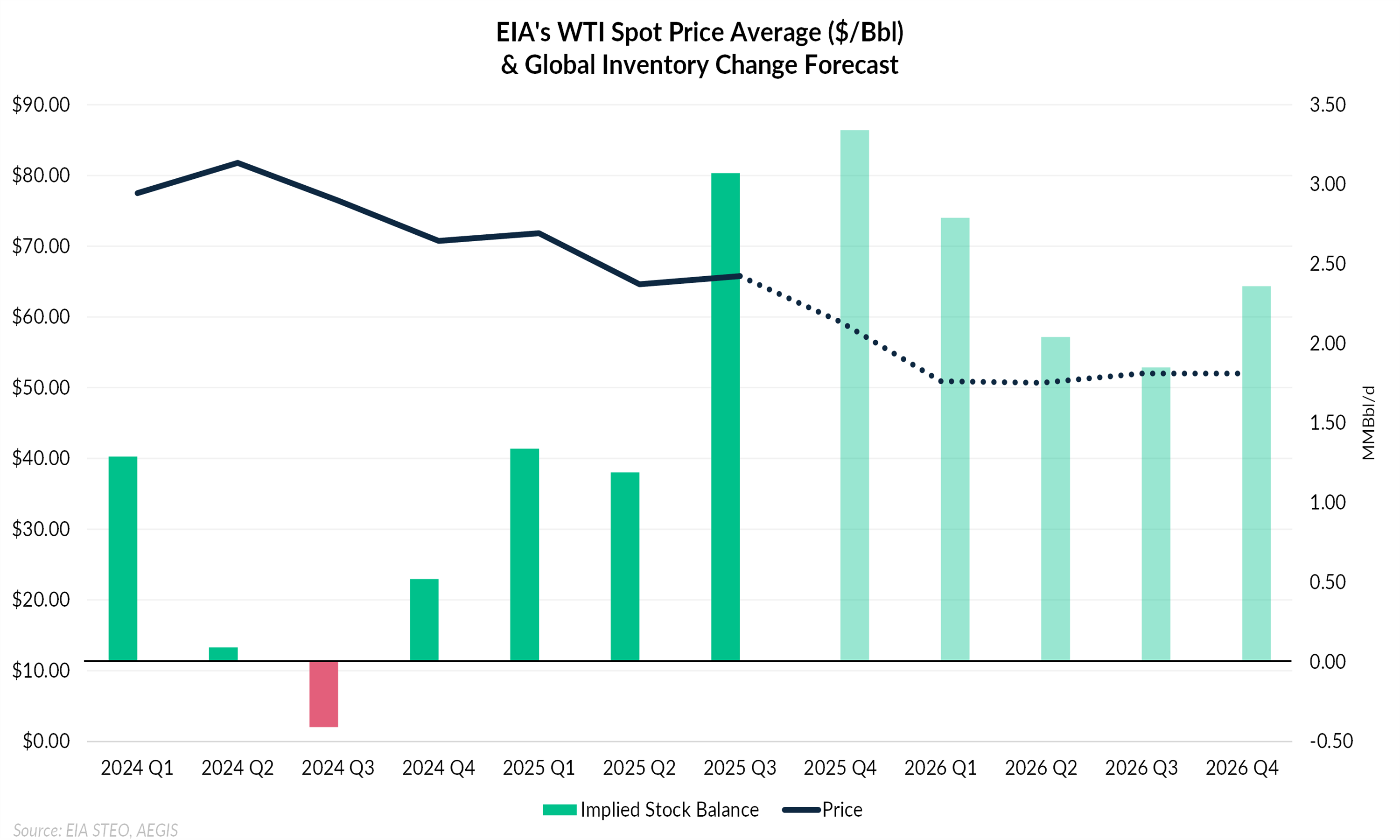

The EIA now forecasts WTI to average $50.93/Bbl in early 2026, down from price levels seen earlier this year as the global surplus widens. The market already showed signs of weakening in 4Q25, with rising commercial inventories pressuring prices. As shown in the chart, implied global stock builds accelerated sharply beginning in 2H 2025 and remain elevated through 2026, even as WTI prices trend lower, illustrating how persistent oversupply continues to weigh on the forward price outlook. With global liquids production continuing to exceed consumption, the EIA projects global stock builds of more than 2 MMBbl/d next year, leaving the crude market firmly oversupplied. As inventories continue to accumulate, storage economics may begin to play a larger role in pricing, especially if onshore storage starts to tighten.

On the demand side, the EIA maintains positive growth expectations but at a more modest pace than in prior outlooks. Global consumption is expected to rise by 1.1 MMBbl/d in 2025 and 1.2 MMBbl/d in 2026, driven almost entirely by non-OECD Asia. China and India remain the largest contributors to demand growth, supported by steady economic expansion and rising mobility. However, the agency made a significant adjustment to historical consumption trends in the Middle East, lowering the regional baseline. This revision softens the global demand trajectory and contributes to a looser balance.

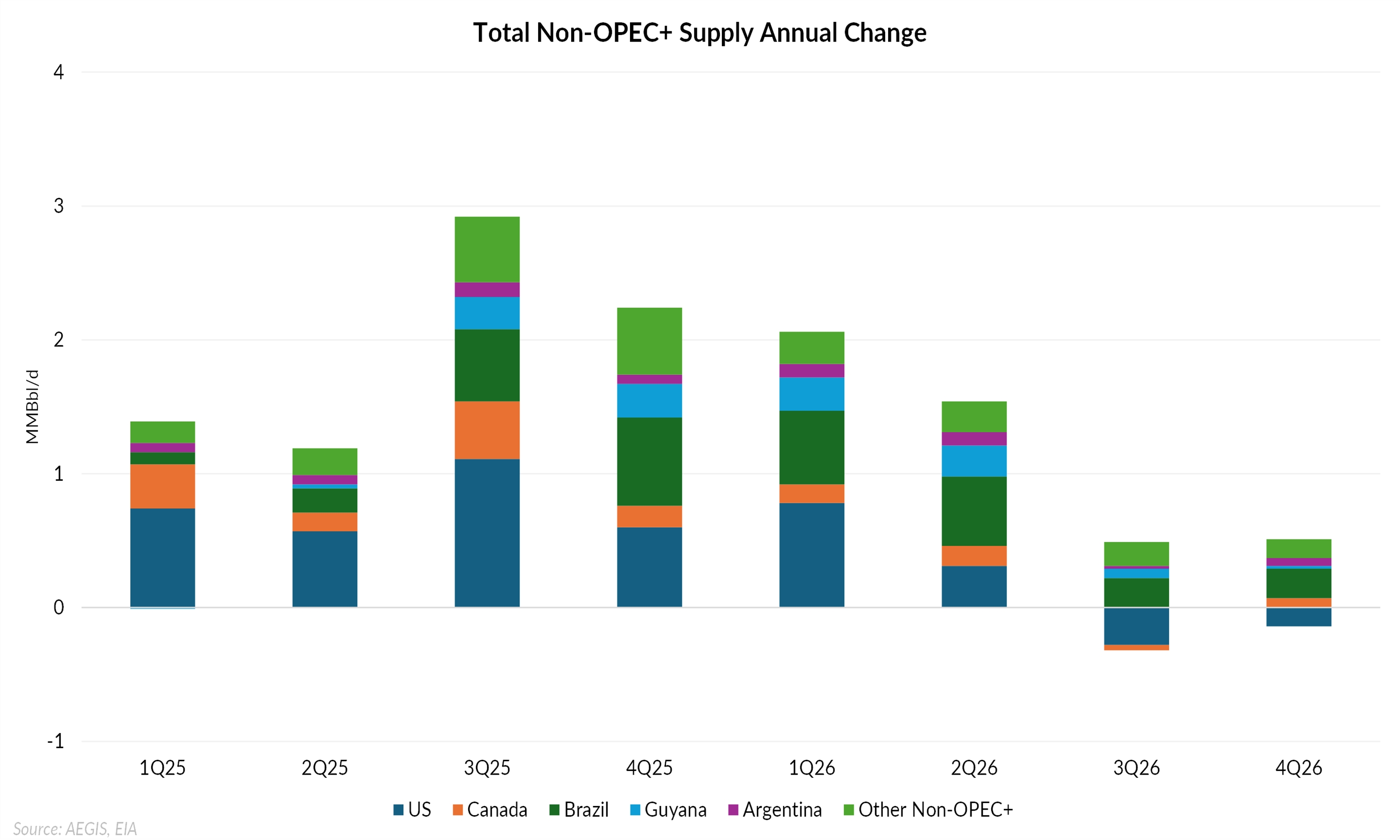

Supply continues to be the dominant factor shaping market weakness. The US, Brazil, Guyana, and Canada are collectively responsible for the majority of global supply growth in 2025 and remain major contributors into 2026. As the chart illustrates, US barrels make up the largest share of non-OPEC+ supply additions, but meaningful growth from Brazil, Guyana, and Canada creates a stacked wave of new supply that persists well into 2026. The EIA forecasts US crude oil production at 13.61 MMBbl/d in 2025 before easing slightly to 13.53 MMBbl/d in 2026. The small downward revision reflects updated assumptions around associated gas trends in the Permian Basin rather than any major change in drilling momentum. Meanwhile, OPEC+ producers are expected to continue supplying below their official targets, but even this level of restraint is not enough to counterbalance non-OPEC+ supply growth.

The December STEO outlines a crude market shaped by structural surplus rather than short-lived geopolitical risks. Without a meaningful shift in supply policy or an unexpected surge in global demand, the crude market appears firmly rooted in a lower-price environment heading into 2026.