Natural gas reverses last week’s gains despite tighter supply

The November Henry Hub contract settled 22c lower at $3.11/MMbtu, the lowest level in several weeks. Winter ‘25/’26 also gave up gains, falling 23c this week to $3.70/MMbtu. Summer ’26 lost 11c to finish the week at $3.79/MMbtu. The weakness exhibited across the gas curve came despite a significant reduction in supply and a reduction in the storage surplus.

Lower-48 gas production has averaged about 107.5 Bcf/d over the past several weeks, but fell sharply this week by more than 2 Bcf/d, according to data from S&P. On Tuesday, output first dropped to 104.5 Bcf/d and remained low throughout the week, improving slightly on Friday to 105 Bcf/d. This is the lowest level that production has fallen to since May and should result in a smaller storage build in next week’s EIA report. The cause of this drop in supply is primarily driven by pipeline maintenance, with significant volumes offline in the Northeast and Permian.

Meanwhile, the surplus to the five-year average in gas storage shrank for a third week. The EIA reported an 80 Bcf injection for last week, placing inventories 157 Bcf above the five-year average. Three weeks ago, the storage surplus was +204 Bcf to the five-year average. There remains about one month until the start of the withdrawal season, with it currently looking like inventories will start winter near the top of the five-year range. Despite this, our modeling shows the supply-demand balance tightening this winter, resulting in a storage deficit by March.

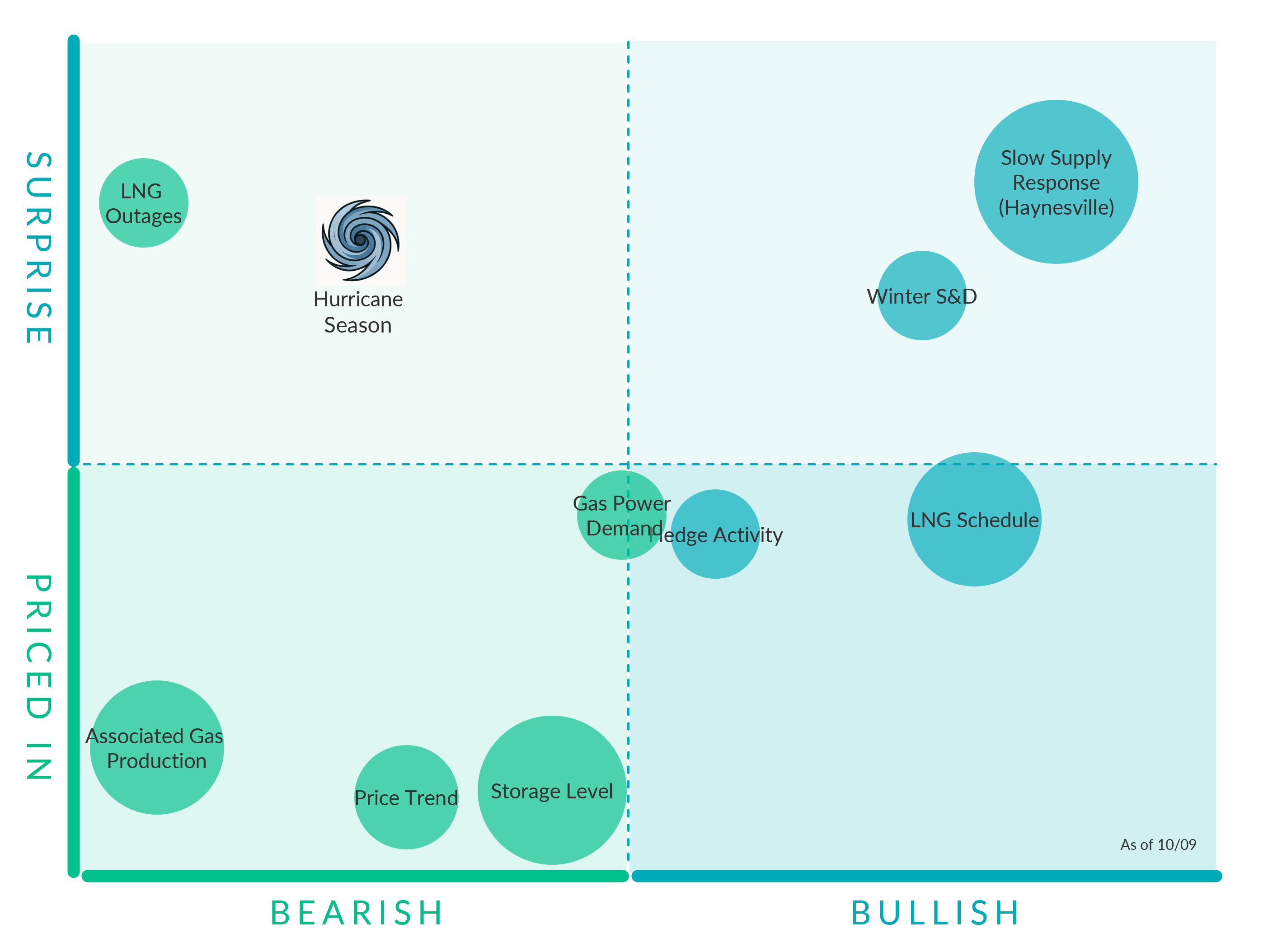

Natural Gas Factors

Price Trend. (Bearish, Priced In) Gas prices have moved lower this summer, but over the past several weeks the prompt Henry Hub contract has traded in a range around the $3.00/MMbtu level.

Winter S&D. (Bullish, Surprise)

Storage Level. (Bearish, Priced In) The storage level is a bearish priced-in factor due to the high levels of gas in inventories relative to the five-year average. According to the latest EIA weekly natural gas inventory report, the surplus to the five-year average stands at 204 Bcf above the five-year average but 4 Bcf below last year.

Associated Gas Production.(Bearish, Priced In) Growth in associated gas production will be much slower than has beeen seen over the past few years, at least until the second half of 2026. Pipeline capacity out of the Permian Basin will begin to grow again next year, likely filling relatively quickly. These new Permian pipes should enter servicce around the same time as projects which will reroute gas around Houston, towards the border of Louisiana.

LNG Outages. (Bearish, Surprise) Feed-gas levels are at their near max capacity, and if there's any unplanned maintenance event or an outage, it may act as a surprise bearish factor for natural gas prices.

Slow Supply Response (Haynesville). (Bullish, Surprise) If production remains near where it is currently and does not grow into winter, this would be a bullish factor for gas prices. As production growth in the Permian and Northeast should be relatively constrained by pipeline capacity until the second half of 2026, the Haynesville will likely be the primary engine of production growth in the near-term. After being flat through most of 2025, Haynesville production and drilling activity has begun to increase this summer. Production is now up about 1.5 Bcf/d from the start of the year, but remains down from levels seen two years ago.

Hurricane Season. (Bearish, Surprise) With the majority of US LNG feedgas demand located along the US Gulf Coast, and offshore gas production having declined relative to total US production in recent years, hurricanes are now a bearish factor for gas prices. In addition to potential impacts to export plants, hurricanes pose a risk to power demand in the US Southeast. North Atlantic hurricane seaosn typically peaks around mid-September.

LNG Schedule. (Bullish, Mostly Priced In) With a significant amount of new LNG feedgas demand coming this year and the next few years, if these facilities startup sooner than anticipated it should be a bullish factor for gas prices. One example of this occuring is the recent startup of Plaquemines LNG, which saw feedgas levels reach more than 1 Bcf/d much sooner than anticipated.

Hedge Activity. (Bearish, Priced in) With prices for next winter and beyond continuing to trend higher, producers have been hedging into the strength of forward prices.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as “edge,” “advantage,” ‘opportunity,” “believe,” or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.