You Can't Predict Policy. You Can Protect Price.California producers have always faced unique risks—some you can influence, and others you can’t. Our platform and team help you lock in oil prices (often based on Brent), navigate surprising local discounts, and take a proactive approach to price risk. Whether you’re dealing with market shocks or production strategy shifts, you shouldn’t have to tolerate price risk. |

|

| You Don't Have to Tolerate Oil Price Risk

|

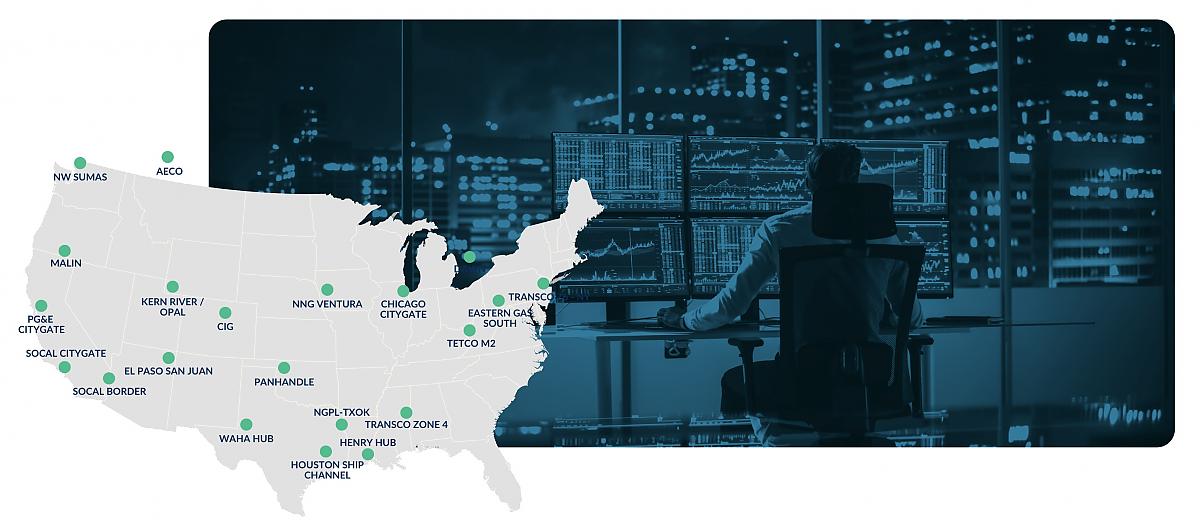

The Marketplace AdvantageAEGIS Markets connects you with a network of liquidity providers through a compliant, secure, and easy-to-use hedge execution platform. You can now hedge your commodity exposures on a digital marketplace providing transparent pricing, a clear audit trail, reporting accuracy, and robust analytics - trusted by banks and approved by regulators.See What All The Hype Is About

|

| Advisory + TechnologyBuilt for producers, backed by experts. |

Control What You CanWe're here to help you protect your balance sheet from price swings - without creating operational headaches. See how our marketplace and team can support your bottom line. |  |

Expertise When It MattersActionable insights and analysis in the oil and natural gas, metals, and fuels markets; delivered directly to your inbox for free. |

Energy Markets WebcastRegister to see our webcast for cutting-edge analysis, data-driven insights, and timely market updates on crude, natural gas, and key industry trends. Stay ahead with deep dives into the factors shaping the energy markets. |

|