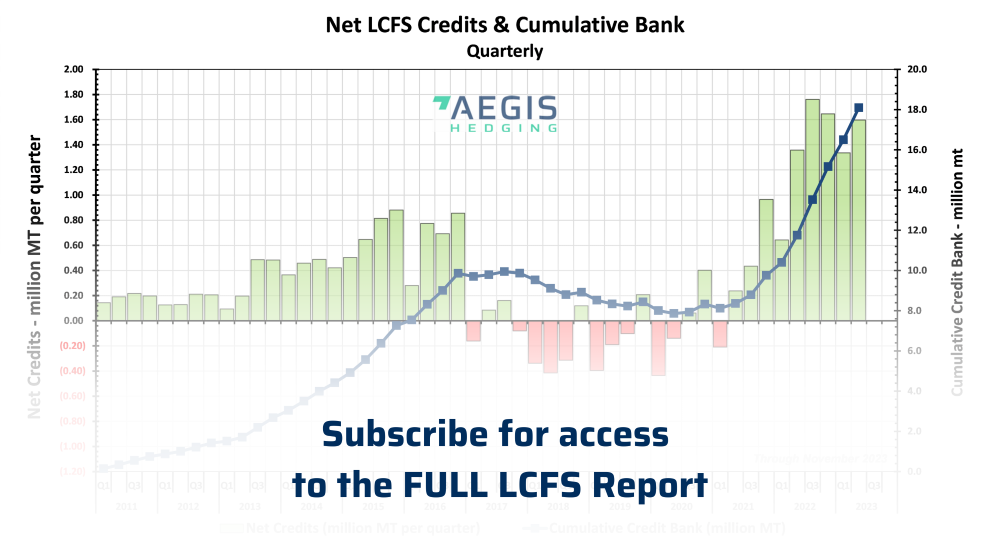

The California LCFS market recovered to $45.50/t after posting heavy losses during the first three weeks of May. Selling was spurred by a bearish Q4 2023 report showing a 23.6MM t surplus of unused credits. The cumulative credit bank has grown by 8.2MM t, or 53%, over the course of the last four quarters. The market’s growing disillusionment with the progress of CARB’s reform process has spurred heavy losses across the forward curve.

Oregon LCFS credit prices tumbled to $51.25/t from $70.75 over the course of May, shedding 28% of their value. The rout pressed into the first week and a half of June with credits reaching an all-time low of $34.00/t on June 11, 2024. The market has shed $55.50/t, or 61%, since the start of the year.

WCFS prices fell 17% to $36.75/t over the course of May, before tumbling to fresh all-time lows of $25.25/t during the first week and a half of June. Heavy renewable diesel and ethanol penetration coupled with a deferred 2023 obligation deadline of April 2025 have weighed heavily on the state’s credit market.

IN THIS REPORT AEGIS EXAMINES: