Price Pressure for Oil Is Looking One Sided

AEGIS is officially shifting its crude oil view to bearish versus the forward curve. At this stage, we find it difficult to make a rational case for prices to materially move higher and see greater probabilities that spot WTI prices settle below the curve.

The shift in our view shouldn’t come as a surprise for those who have heard our rhetoric recently. In our recent webcast, we hammered on the growing forecasted supply glut expected in the global oil market. This commentary carried plenty of bearish undertones despite officially sticking with a neutral view on the curve. That has changed as a rapid rise in global oil inventories may be just around the corner.

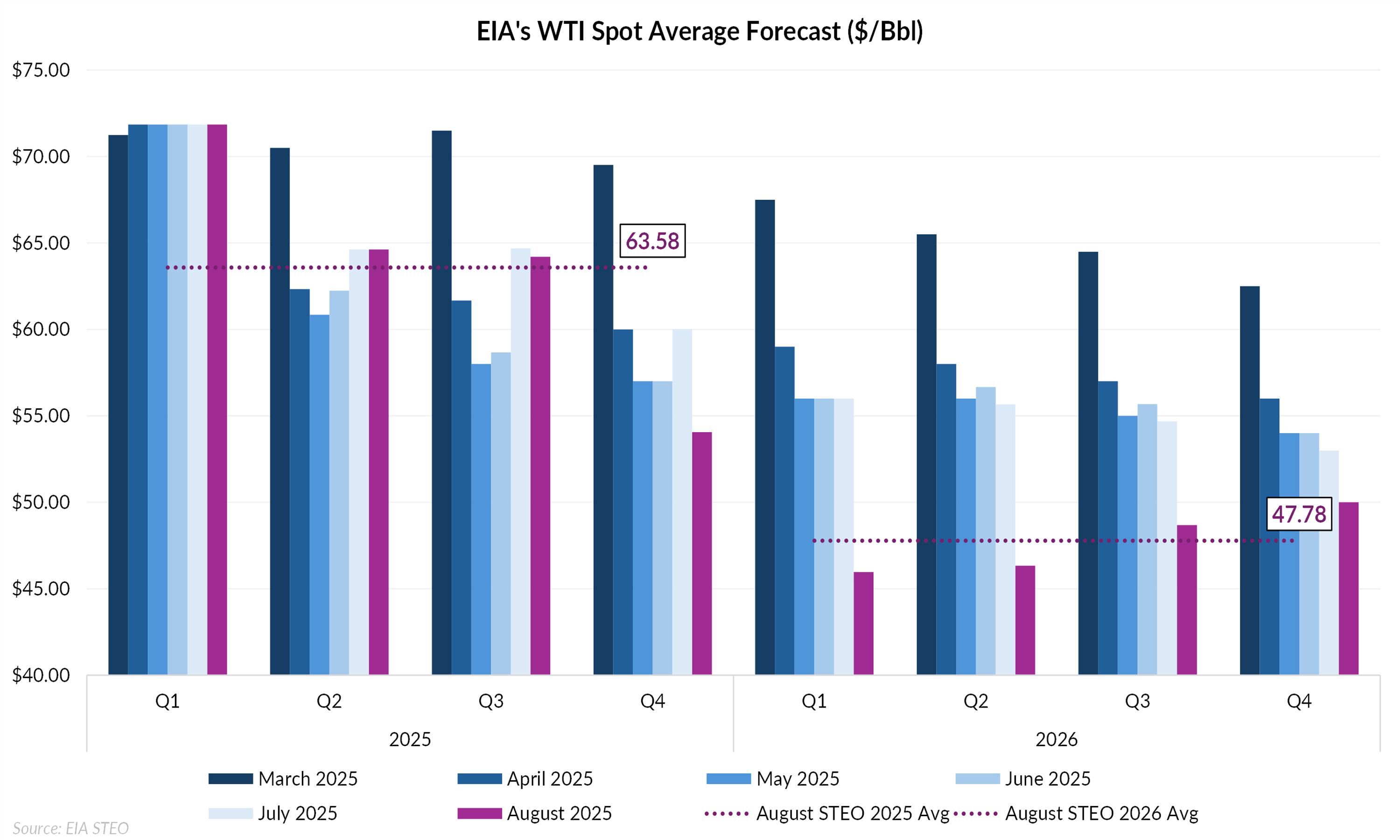

Unlike some other agencies and analysts, we are relatively late in formally adopting a bearish narrative. As of today, we join the broader consensus expecting weaker prices over the next 18 months. Read here for how not bullish speculators are on WTI crude. The most recent EIA price forecast, shown below, reinforces this view.

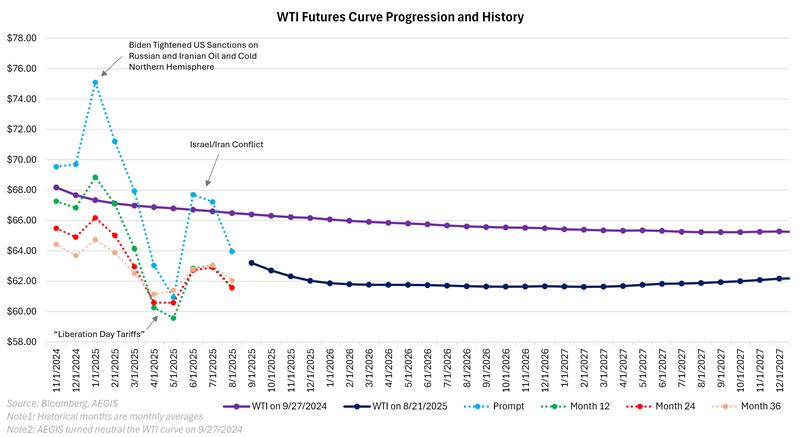

We shifted our view from bullish to neutral vs the curve on September 27, 2024, via our Market Summary that goes out to clients every Friday. Below is a graphic of the day we went neutral up until today August 21. Typically, looking back at how your price calls faired is quite humbling as many events happen outside what you are able to forecast, even if you have the perfect mousetrap. Yet, we didn’t fare too bad this time as WTI was mostly range bound over the past year while providing producers with some opportunities to catch price spikes.

The chart compares the WTI forward curve from our September 27, 2024 outlook (purple) with the curve as of August 21, 2025 (dark blue), the date we shifted to a bearish view. Between these two points, the chart also tracks how various maturities on the curve traded over time. For instance, the red line represents the monthly average price of the 24th month on the WTI curve. Highlighting multiple points along the curve provides a clearer picture of what producer hedgers monitor, rather than relying solely on the more volatile prompt-month contract.

In conclusion, we held on to neutrality for as long as possible—we dislike sitting in the middle, as it often feels like a copout. But with the projected degree of oversupply, we expect the WTI forward curve to give up its backwardation and transition into a modest contango if forecasts prove accurate.