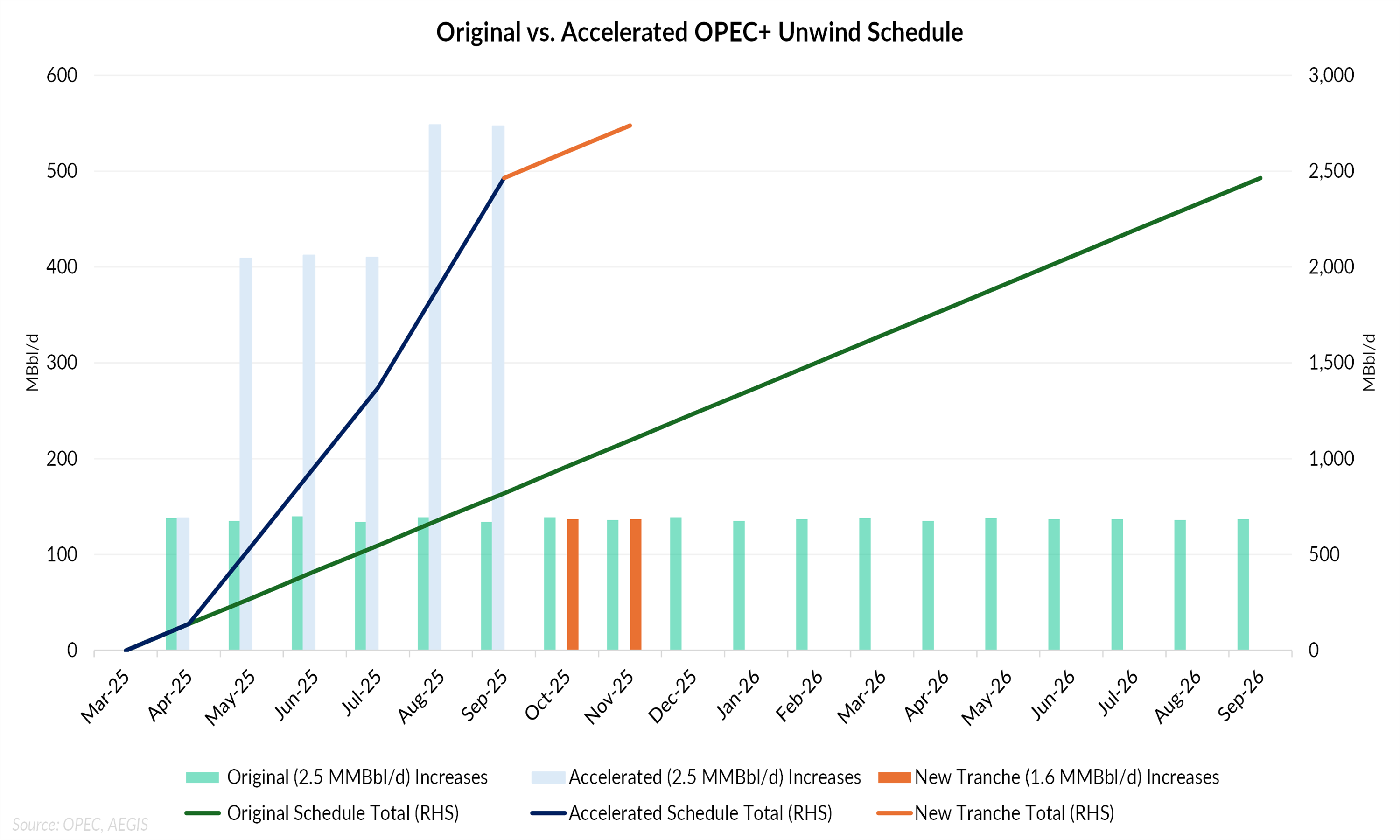

OPEC+ opted for a smaller-than-expected production increase over the weekend, easing concerns that the group might accelerate its supply recovery into an increasingly fragile market. The alliance agreed to raise its collective quota by 137 MBbl/d for the month of November, continuing the gradual unwind of its 1.66 MMBbl/d voluntary cuts through early 2026.

The decision reflects fundamental strategic differences between the coalition’s two largest producers, Saudi Arabia and Russia. Riyadh has sought to reclaim market share through more aggressive output gains, leveraging its ample spare capacity, while Moscow has favored a restrained approach to support prices as sanctions and Ukrainian strikes constrain its production.

That caution aligns with weakening market indicators. Global inventories remain tight onshore but are starting to build at sea, with unsold Middle Eastern cargoes signaling softer demand from refiners. Banks and key agencies alike expect stock levels to rise through 2026, potentially tipping the curve toward contango if the trend continues.

According to Bloomberg reporting, OPEC+ officials have been monitoring this shift closely, viewing the forward curve’s erosion as justification for holding back more aggressive output growth. The group appears intent on managing the pace of its return while maintaining flexibility should inventories expand more rapidly than expected.