EIA Outlook Points to Persistent Oversupply, Soft Prices Ahead

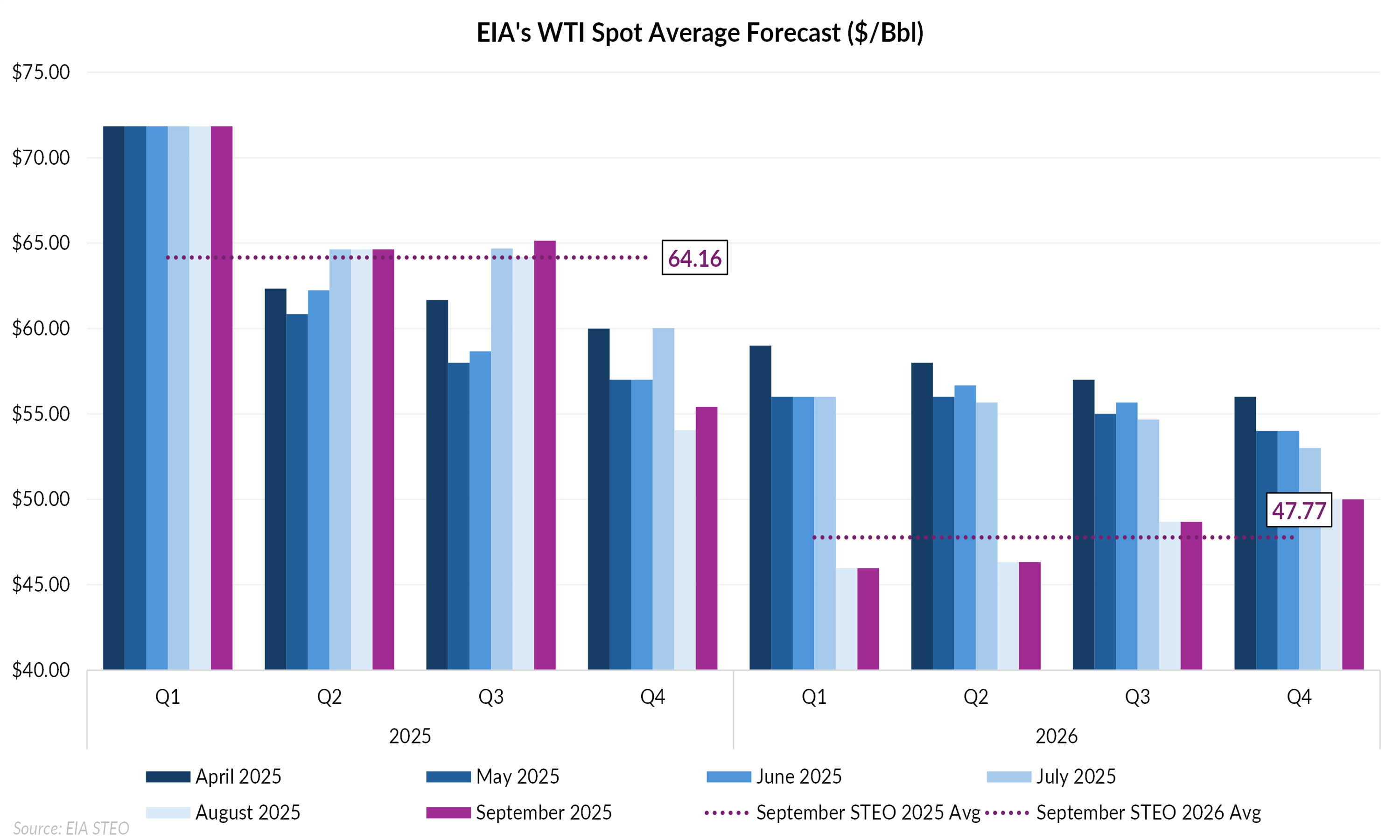

In its latest Short-Term Energy Outlook (STEO), the EIA projects that significant growth in global oil inventories will place sustained downward pressure on crude prices heading into 4Q 2025. This forecast reflects the seasonal slowdown in summer demand as well as a surge in global oil supply growth. Despite this broadly bearish outlook, the EIA raised its 2025 annual average WTI spot price projection by $0.58, from last month’s STEO, to $64.16/bbl. Even with this upward revision, the report maintains its longer-term view of a much lower annual average WTI price of $47.77

Production to Drive Inventories Higher

A major driver of the projected builds is the full unwinding of OPEC+’s 2.2 MMBbl/d production cuts, which were originally scheduled to remain in place until September 2026 but were phased out a full year early. The group’s restored production is expected to contribute materially to global inventory builds through 2026, adding significant downside risk for crude prices.

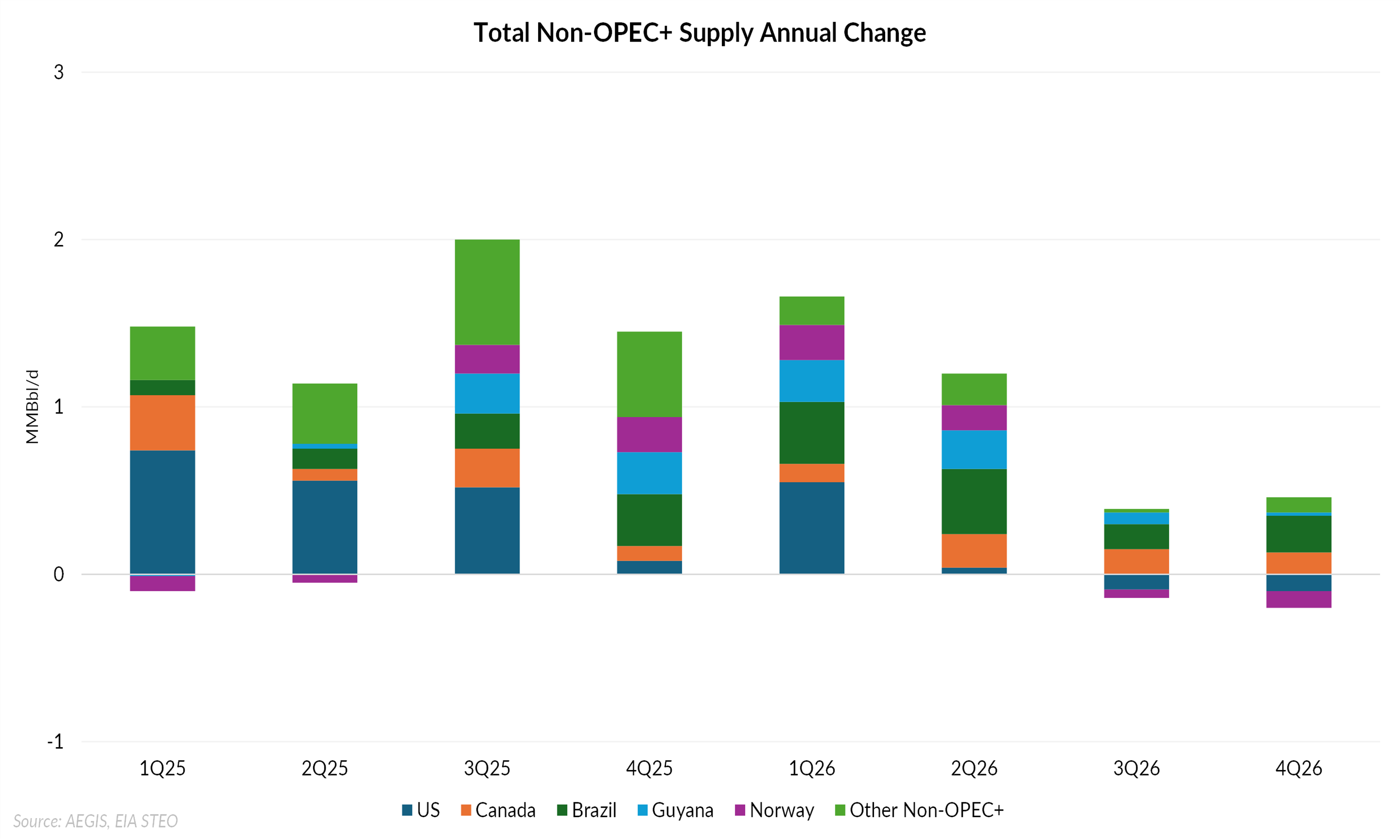

Importantly, these projections do not account for OPEC+’s latest announcement to revive the next 1.66 MMBbl/d tranche that had been paused since April 2023. The first step of that revival will begin with a production quota increase of 137 MBbl/d in October. This additional layer of supply, combined with rising output from non-OPEC producers, including the US, Brazil, Norway, Canada, and Guyana, could exacerbate the inventory surplus and further accelerate downward pressure on crude prices

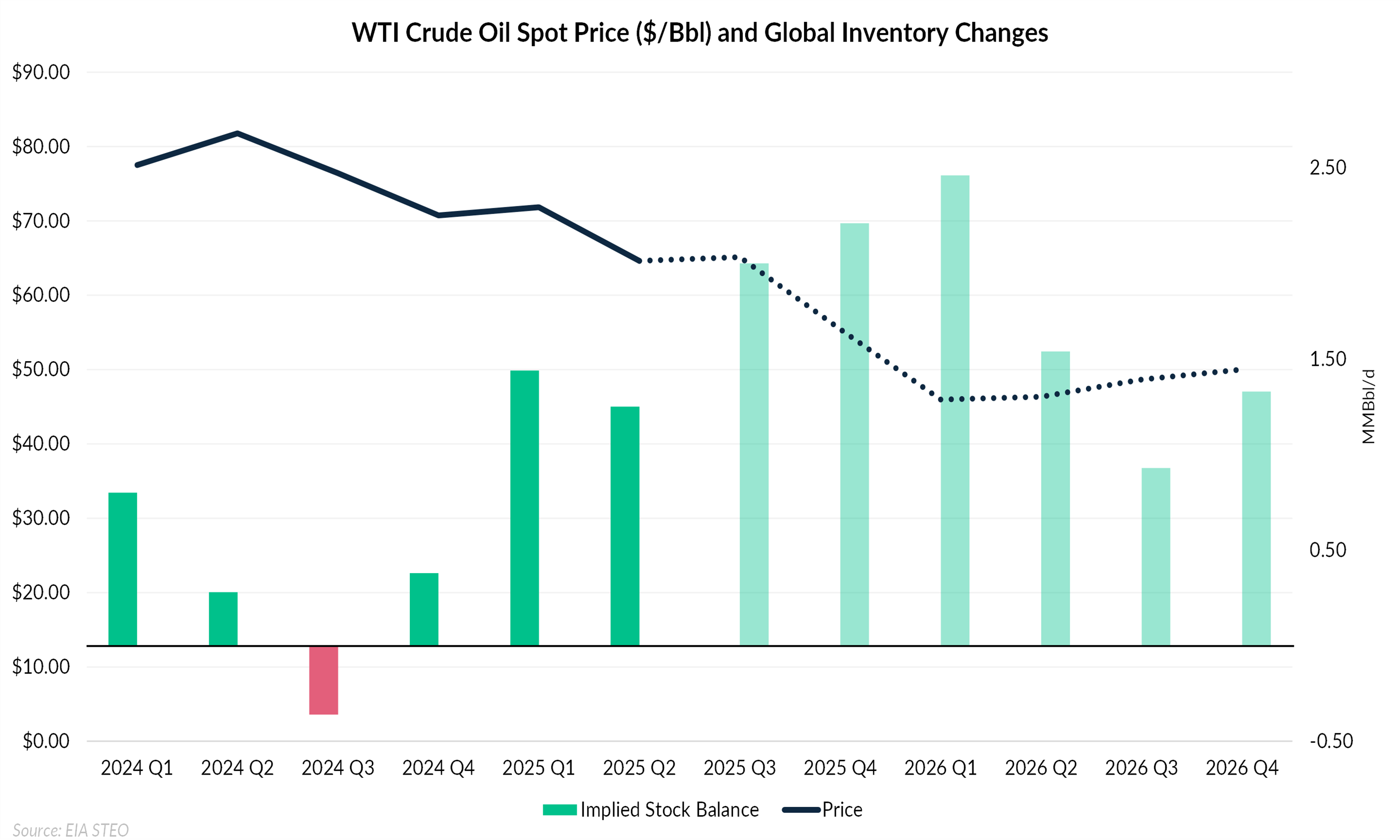

Inventory Growth to Pressure Prices

According to the EIA, global oil inventories are expected to rise by an average of 1.7 MMBbl/d in 2025, followed by a slightly slower but still significant 1.6 MMBbl/d increase in 2026. The most aggressive builds are forecast for 4Q 2025 and 1Q 2026, when inventories are projected to swell by 2.3 MMBbl/d on average.

Such rapid accumulation could begin to max out onshore commercial storage capacity, forcing market participants to turn to more expensive storage options such as floating storage. This would raise the marginal cost of storage and put additional pressure on crude prices as contango widens.

Inventories Remain Central to 2026 Market Outlook

Looking ahead, inventory builds are expected to moderate in 2026 as lower prices gradually encourage higher consumption and slow the pace of production growth. This adjustment is projected to narrow the supply-demand imbalance, leading to slower inventory accumulation compared with the sharp builds of late 2025 and early 2026. Even so, stock levels are expected to remain above pre-2025 norms for much of the year, indicating that the market will continue working through a substantial surplus. The EIA’s outlook suggests that a full return to balanced conditions may take time, with inventories likely to remain a prominent factor shaping market dynamics throughout 2026.