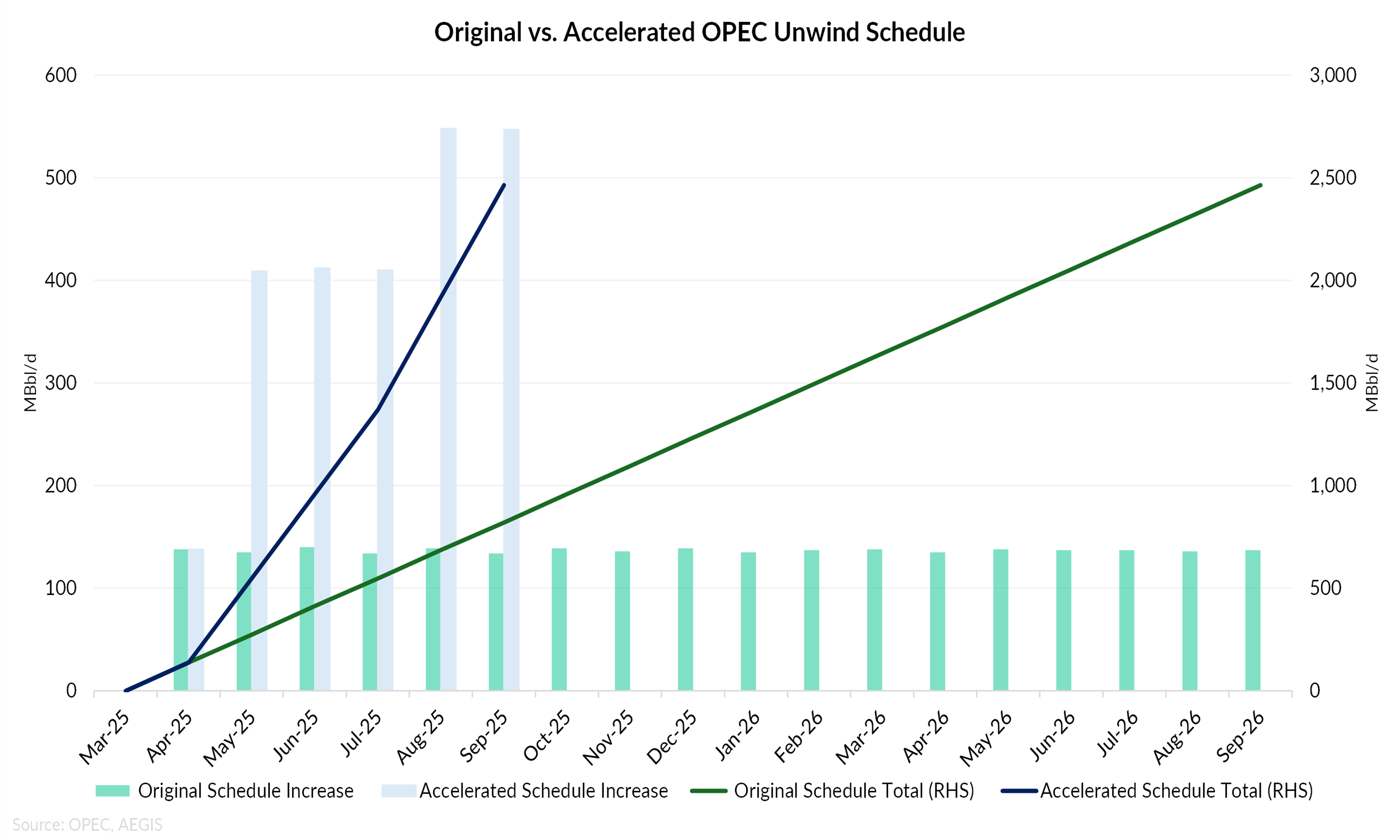

OPEC+ announced a 547 MBbl/d production quota increase for the month of September, completing the reversal of the group’s November 2023 supply cuts a full year ahead of schedule. The move brings the total unwind to approximately 2.5 MMBbl/d, including the 300 MBbl/d hike allocated to the UAE.

The announcement marks the end of a coordinated effort, launched in 2023, to support prices through voluntary production restraint. However, the group stopped short of committing to further increases, leaving ~1.6 MMBbl/d of voluntary cuts still offline and under review.

OPEC+ has scheduled a follow-up meeting for September 7 to reassess market conditions. According to RBC’s Helima Croft, the group’s messaging emphasized flexibility: “All options remain on the table, including bringing those barrels back, pausing increases for now, or even reversing the recent policy action.”

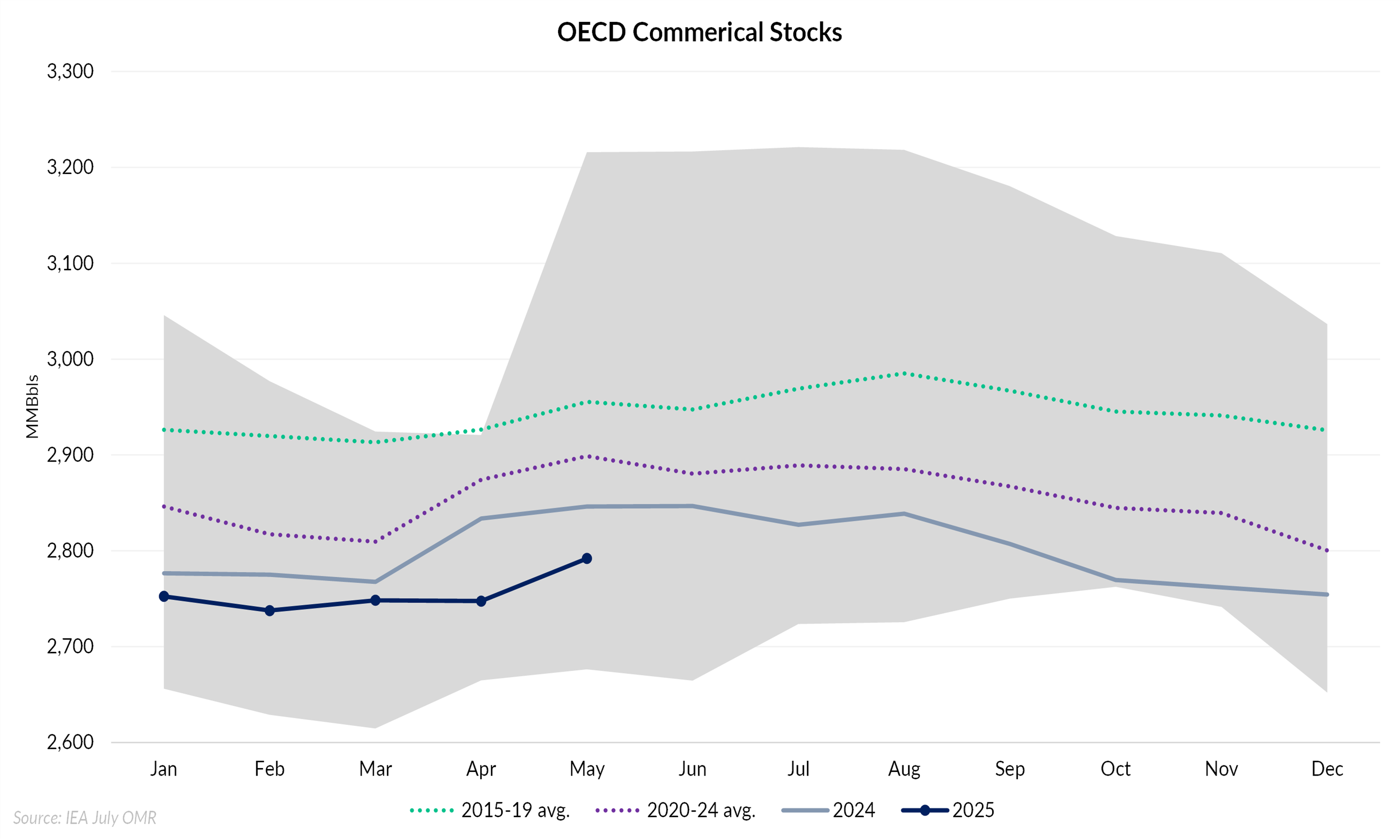

The coalition’s next steps will hinge on how the global balance shakes out in the second half of the year. With demand signals weakening and inventories starting to build, Goldman Sachs expect OPEC+ to pause and reassess before making any further moves.

As noted in the IEA’s latest Oil Market Report, global demand growth has slowed to its weakest pace since 2009, while supply is set to rise by more than 2 MMBbl/d in 2025. That backdrop points to a growing surplus and adds pressure on OPEC+ to proceed cautiously heading into 2026.