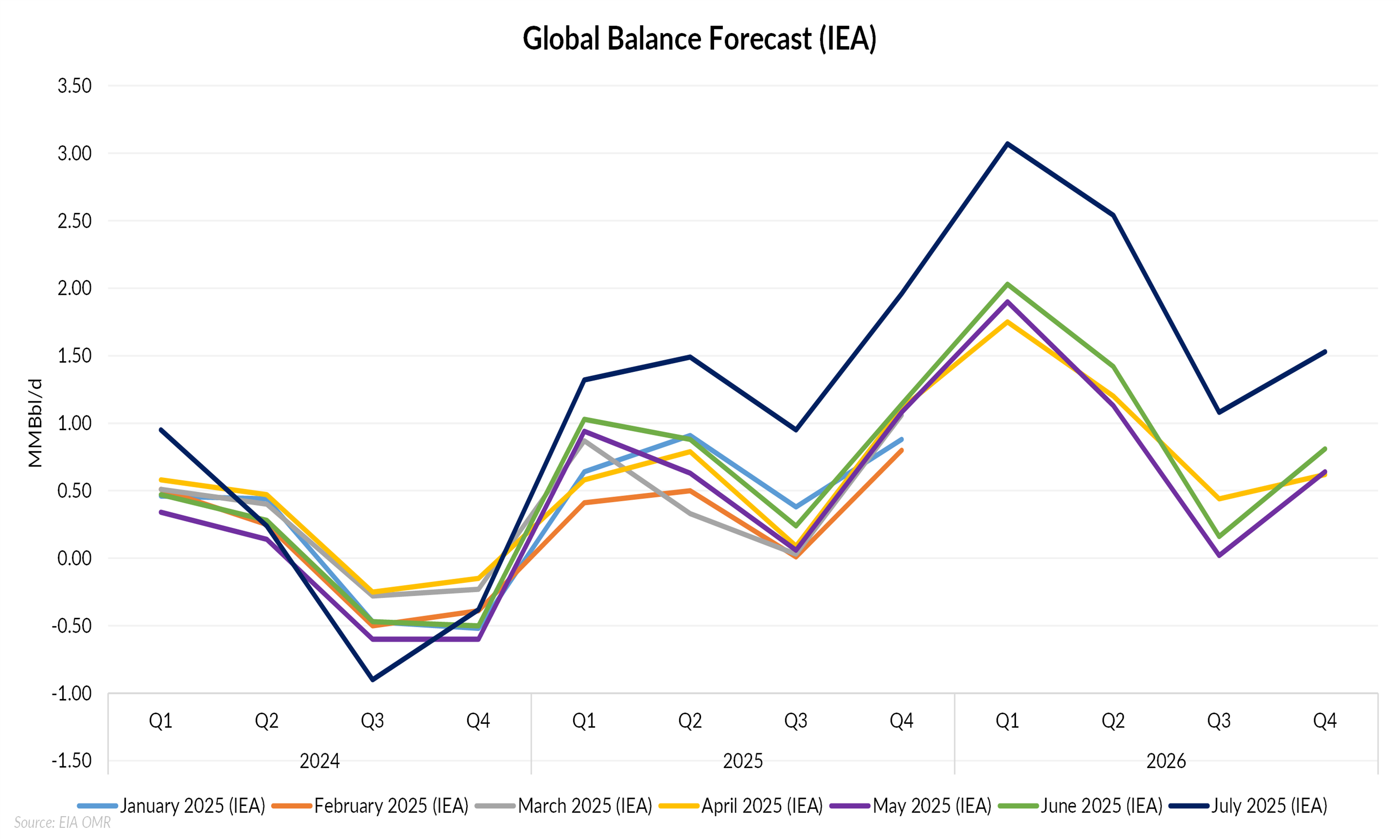

The International Energy Agency’s (IEA) July 2025 Oil Market Report (OMR) presents a deteriorating picture for the global oil balance. World oil demand growth has been revised downward, while supply projections have been adjusted upward following OPEC+’s decision to further unwind production cuts ahead of schedule.

World Oil Demand Growth Slows to a 16-Year Low

Global oil demand is now forecast to rise by only 700 MMBbl/d in 2025, its weakest annual growth rate since 2009, excluding the pandemic-impacted year of 2020.

Petrochemical feedstocks continue to drive much of the demand growth, largely offsetting weaknesses in gasoline and diesel consumption.

Supply Forecasts Revised Higher on OPEC+ Policy Shift

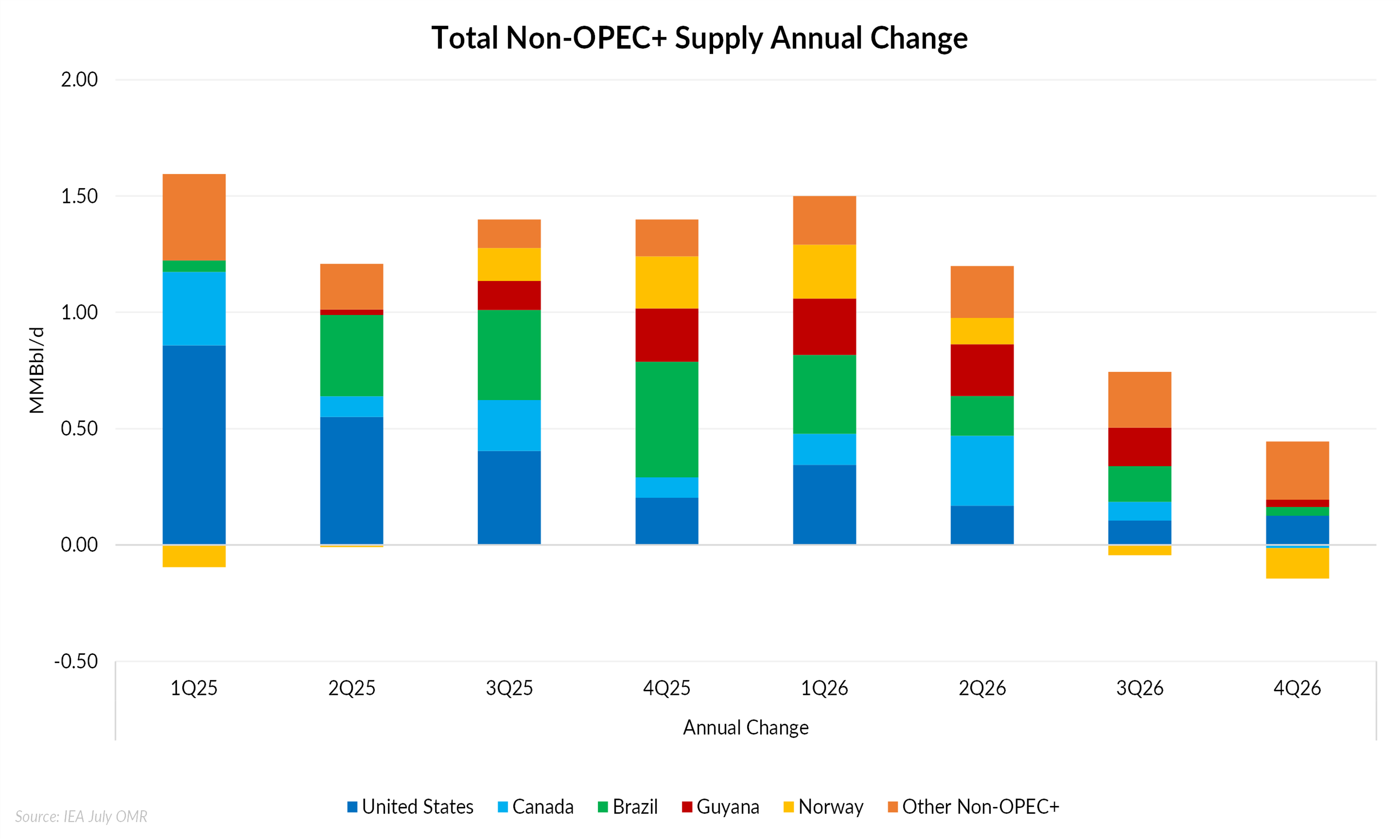

On the supply side, the IEA revised its 2025 forecast upward by 240 MBbl/d, reflecting both rising non-OPEC+ output and a faster-than-anticipated OPEC+ unwind. Total global supply is now expected to increase by 2.15 MMBbl/d in 2025 to reach 105.1 MMBbl/d, and by an additional 1.35 MMBbl/d in 2026.

Saudi Arabia was the primary driver of the June supply surge, increasing output by 700 MBbl/d month-on-month to 9.8 MBbl/d, while other Gulf producers also raised exports despite geopolitical tensions in the region.

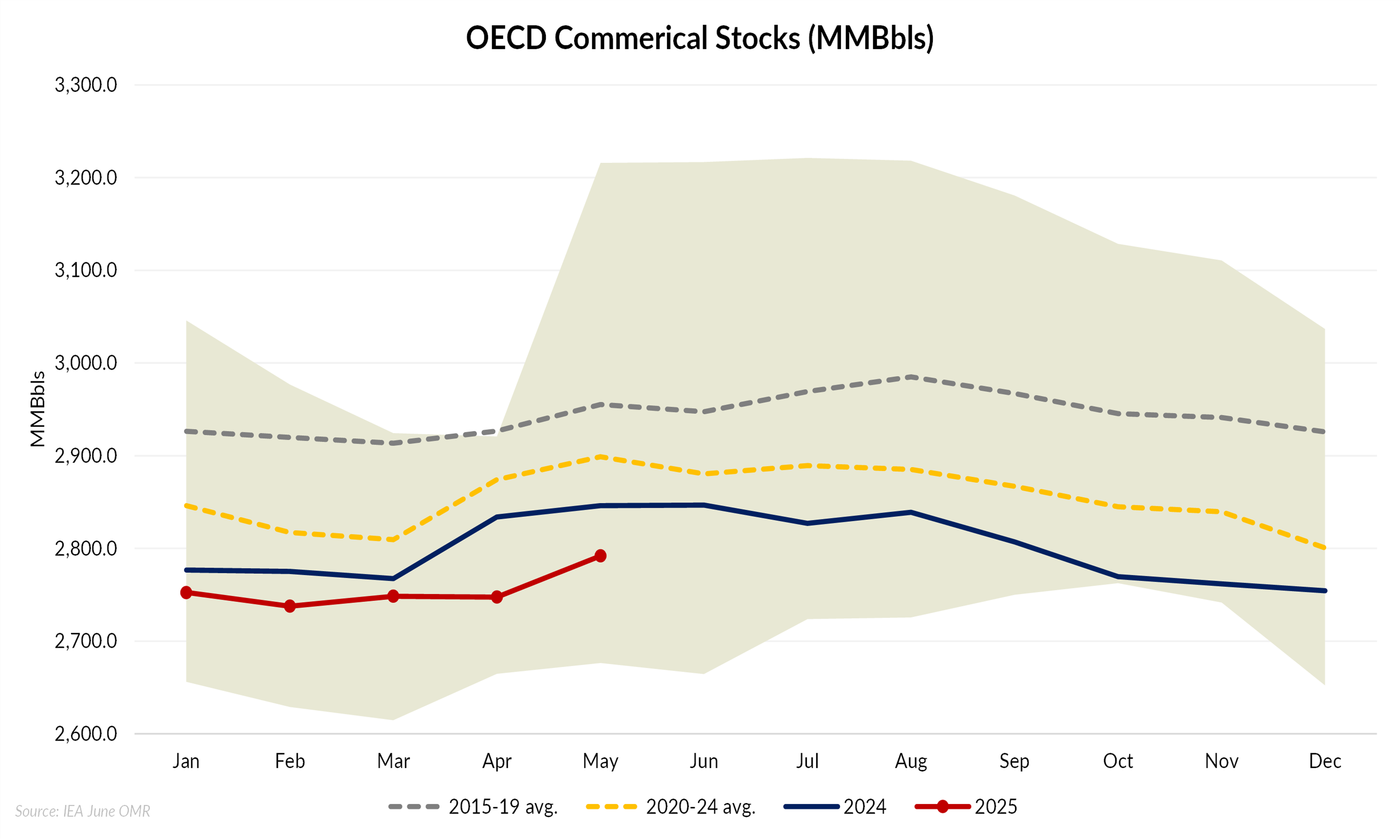

Inventories Build Sharply as Surplus Emerges

Commercial oil inventories in the OECD rose by 44.5 MMBbls in May to 2,792 MMBbls, driven largely by product builds in the US.

Observed stock builds suggest a physical market tipping toward surplus despite time spreads and refining margins indicating short-term tightness.

Conclusion

The combination of soft demand and accelerating supply sets the stage for persistent market oversupply through 2025 and into 2026, with further builds expected unless demand recovers or supply growth is curtailed.

The oil market faces a structural rebalancing challenge. Unless policy or macroeconomic conditions shift meaningfully in the coming quarters, the path of least resistance may be further stock accumulation and downward pressure on prices.