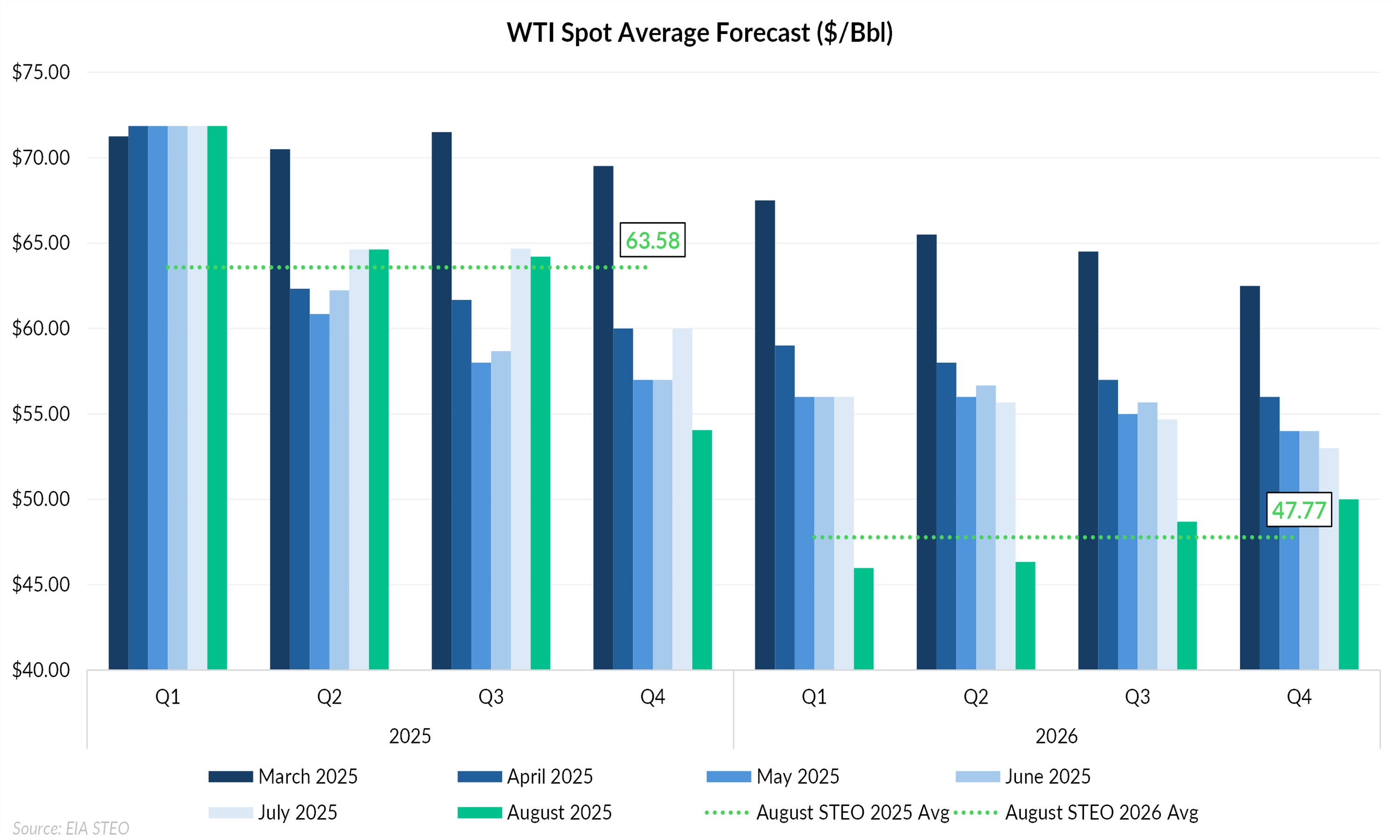

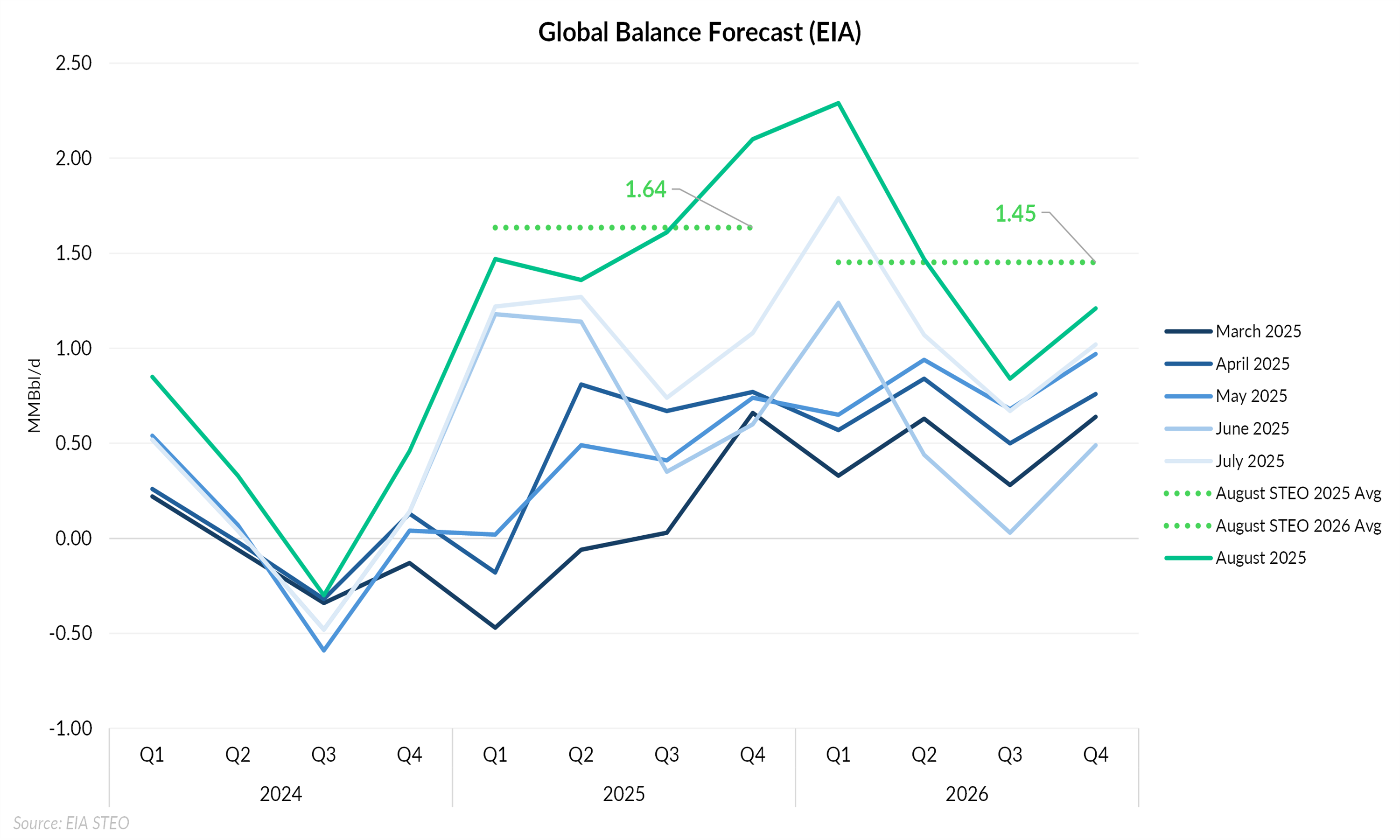

In its latest Short-Term Energy Outlook (STEO), the EIA lowered its near-term oil price forecasts. The chart below underscores the shift in sentiment, with the green bars showing the EIA’s current quarterly outlook (yearly averages marked by the dotted lines) and the adjacent blue bars representing projections from previous monthly STEO reports. West Texas Intermediate (WTI) is now expected to average $63.58/Bbl in 2025, down $1.64 from last month’s projection, and $47.77/Bbl in 2026, a steep $7.05 decrease from the prior forecast. The downward revisions reflect expectations for sizable inventory builds following OPEC+’s decision to accelerate the unwinding of its 2.2 MMBbl/d production cuts.

OECD Inventory Outlook

OECD commercial stocks are now projected to grow by more than 2 MMBbl/d in 4Q25 and 1Q26, about 0.8 MMBbl/d higher than last month’s STEO. The EIA anticipates that weaker prices in early 2026 will lead both OPEC+ and some non-OPEC producers to trim output, potentially slowing stock builds in the latter part of 2026.

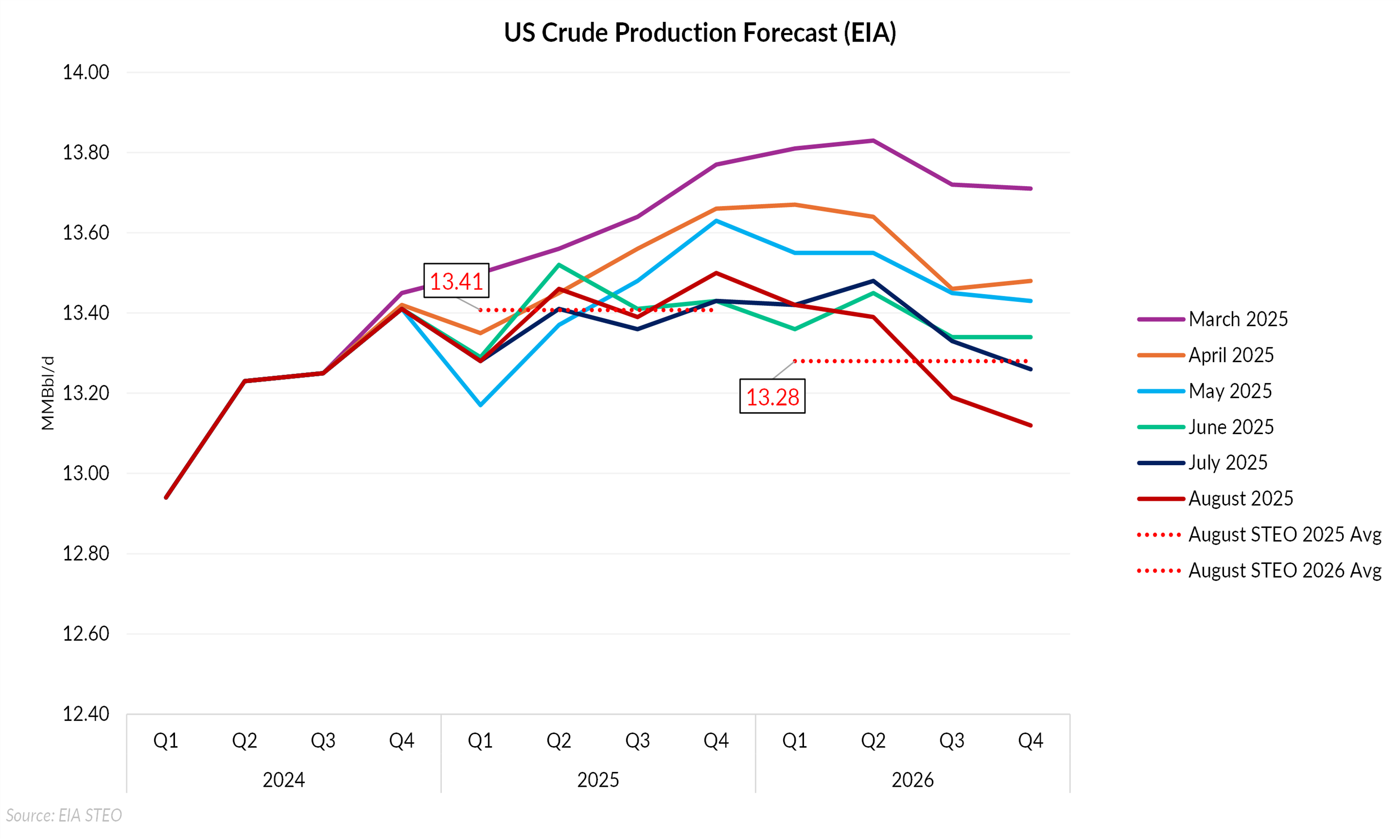

US Crude Production Trends

The agency expects improved well productivity to drive U.S. crude oil production to a record 13.6 MMBbl/d in December 2025. However, with falling prices, drilling and completion activity is forecast to decline more sharply, bringing production down to 13.1 MMBbl/d by 4Q26. On an annual basis, output is projected to average 13.4 MMBbl/d in 2025 and 13.3 MMBbl/d in 2026.

Conclusion

The EIA’s downward revisions point to a market entering a period of oversupply, with elevated inventories exerting pressure on prices through early 2026. While lower prices are expected to trigger production pullbacks in late 2026, the near-term outlook suggests a weaker price environment dominated by excess supply.