EQT’s Q2 2025 earnings call showed a company focused less on production growth for its own sake and more on aligning gas volumes with firm, long-term demand.

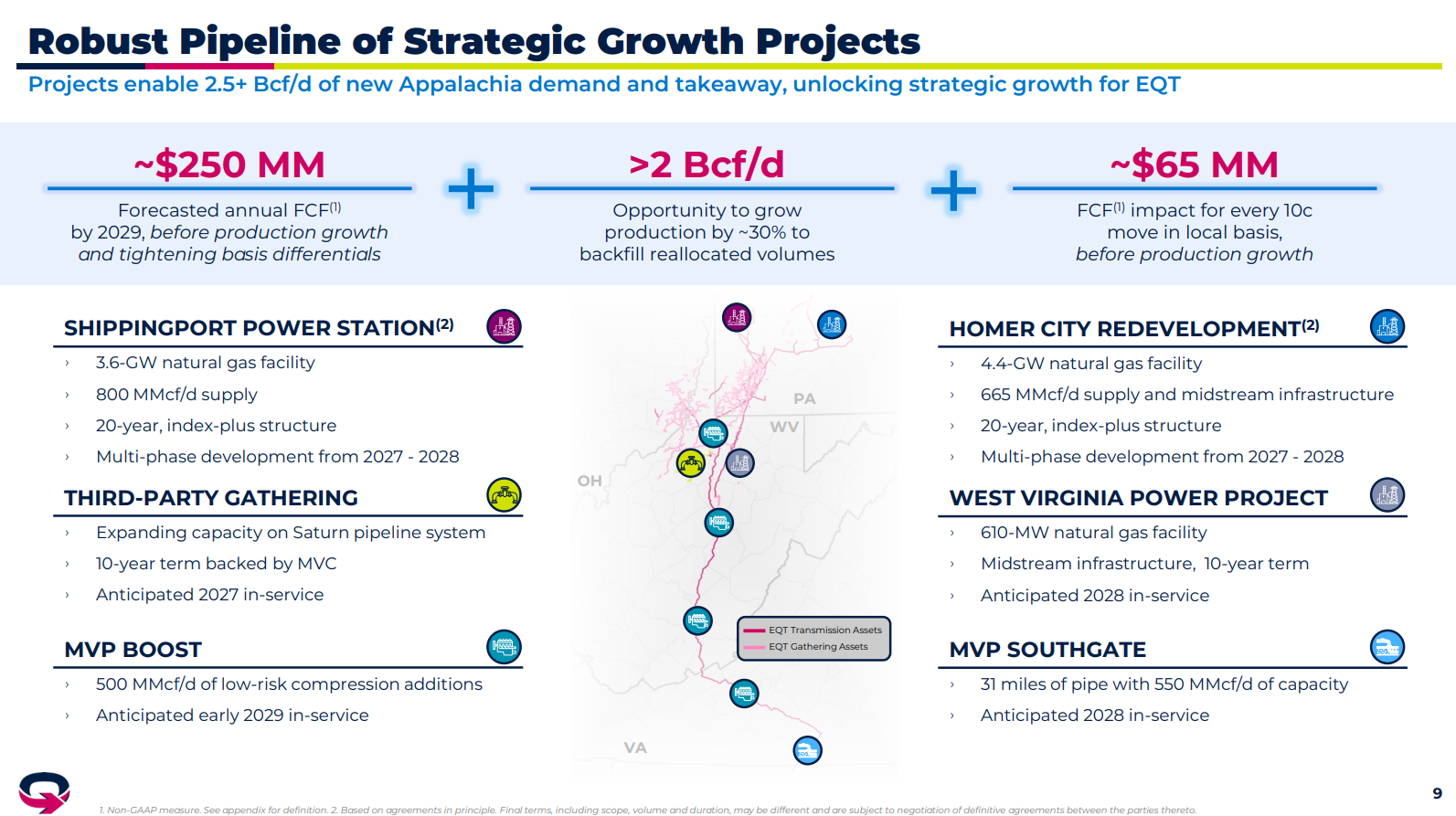

The company is moving ahead with two major expansions on the Mountain Valley Pipeline (MVP) system: MVP Boost, adding 500 MMcf/d of takeaway capacity by 2028, and MVP Southgate, adding 550 MMcf/d into the Carolinas by 2029. Both are backed by end-use customers like Duke Energy and Enbridge’s North Carolina utility, a departure from the supply-driven pipeline model.

At the same time, EQT has secured gas supply deals for two large-scale power and data center projects in Western Pennsylvania, Shippingport and Homer City, expected to consume a combined 1.5 Bcf/d by 2028. These contracts are priced on an “M-2 plus” basis, indexed to local Appalachian hubs with a premium for midstream delivery, and will be served through EQT’s own infrastructure.

“We see the opportunity to reallocate 2 Bcf/d of current production to meet this demand before growing,” CFO Jeremy Knop said on the call.

That reallocation could have significant implications for Appalachian basis. Today, the Appalachian basin is constrained by lack of pipeline egress, forcing supply to compete for limited takeaway capacity, often depressing local prices. But by redirecting existing volumes to new in-basin demand, EQT would free up pipeline egress, easing congestion. If those volumes are not immediately backfilled, local basis could strengthen as pressure on outbound transport eases.

EQT attributes today’s weak gas market to short-term oversupply, particularly from Haynesville producers. “You’ve got people still responding to price signals,” CFO Jeremy Knop said, noting that elevated activity has continued despite deteriorating well economics. Still, EQT expects balances to tighten into 2026, supported by what it sees as slowing associated gas growth, rising LNG feedgas demand, and weakening dry gas productivity. These trends underpin the company’s confidence in a tighter market ahead.

EQT’s strategy prioritizes infrastructure-led growth backed by firm demand rather than speculative drilling. If that demand continues to materialize, and EQT can control how its gas flows, the company sees a path to growth that doesn’t depend on market timing or pricing cycles.