A potential peace deal between Ukraine and Russia would arrive as the oil market moves into surplus. De-escalation could unwind remaining risk premiums at a time when the market is already structurally bearish.

A Surplus Market Sets the Backdrop

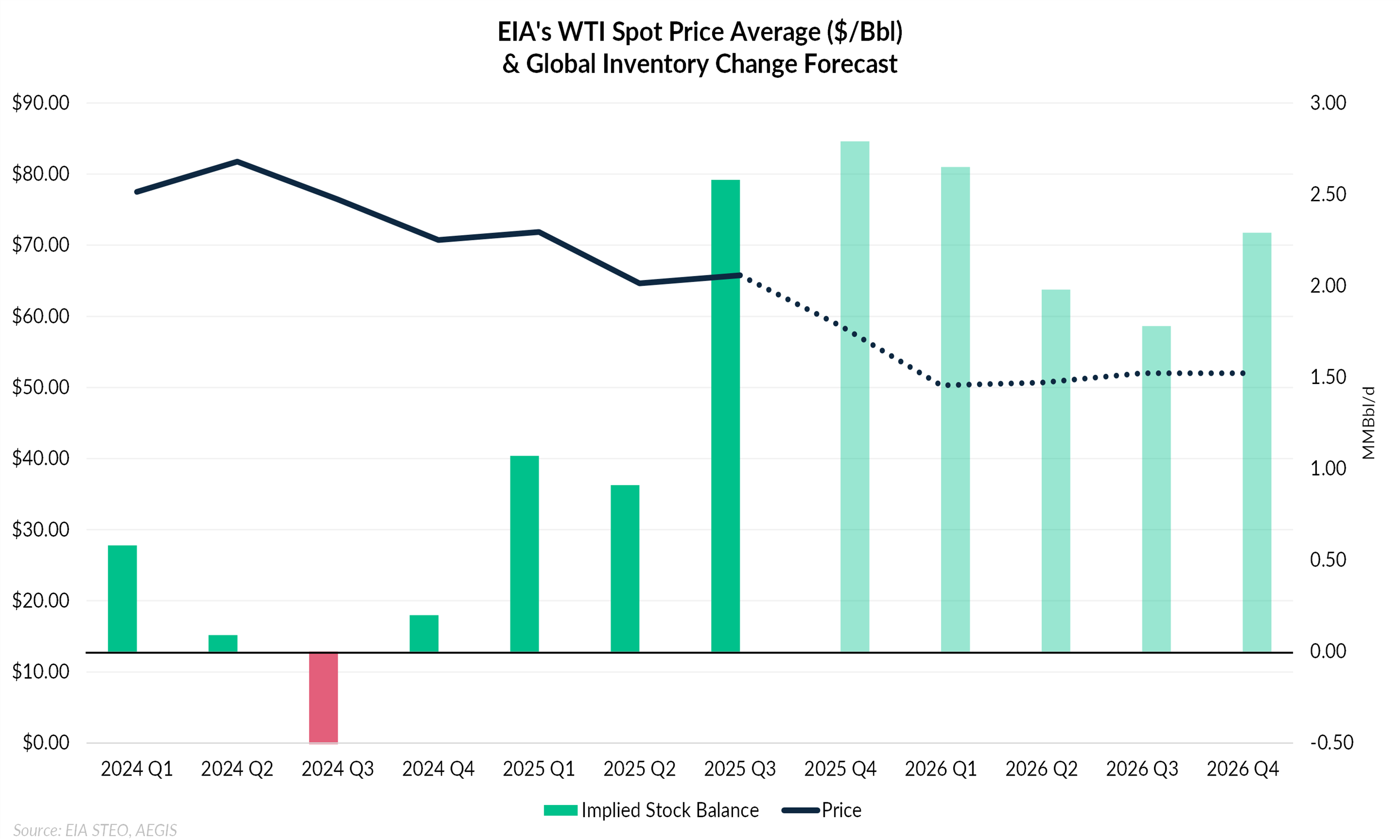

The EIA expects global oil supply to grow by 2.8 MMBbl/d in 2025 and another 1.4 MMBbl/d in 2026 as output rises across OPEC+ and non-OPEC producers. Inventories are also projected to build rapidly. The agency forecasts large stock increases in 4Q25 and 1Q26, with OECD commercial inventories climbing from 2.74 billion barrels at end-2024 to 3.18 billion barrels by end-2026. These builds reinforce a market that is already softening and preparing for a sustained oversupply period.

History shows that geopolitical shocks lose influence when balances are loose. Surplus periods consistently mute the price impact of disruptions, while deficit periods amplify them. With inventories rising and supply growth accelerating, today’s market mirrors earlier surplus cycles. A peace deal would therefore land in an environment tilted downward rather than one positioned for a strong rebound.

Peace Improves Flow Efficiency, Not Supply Volumes

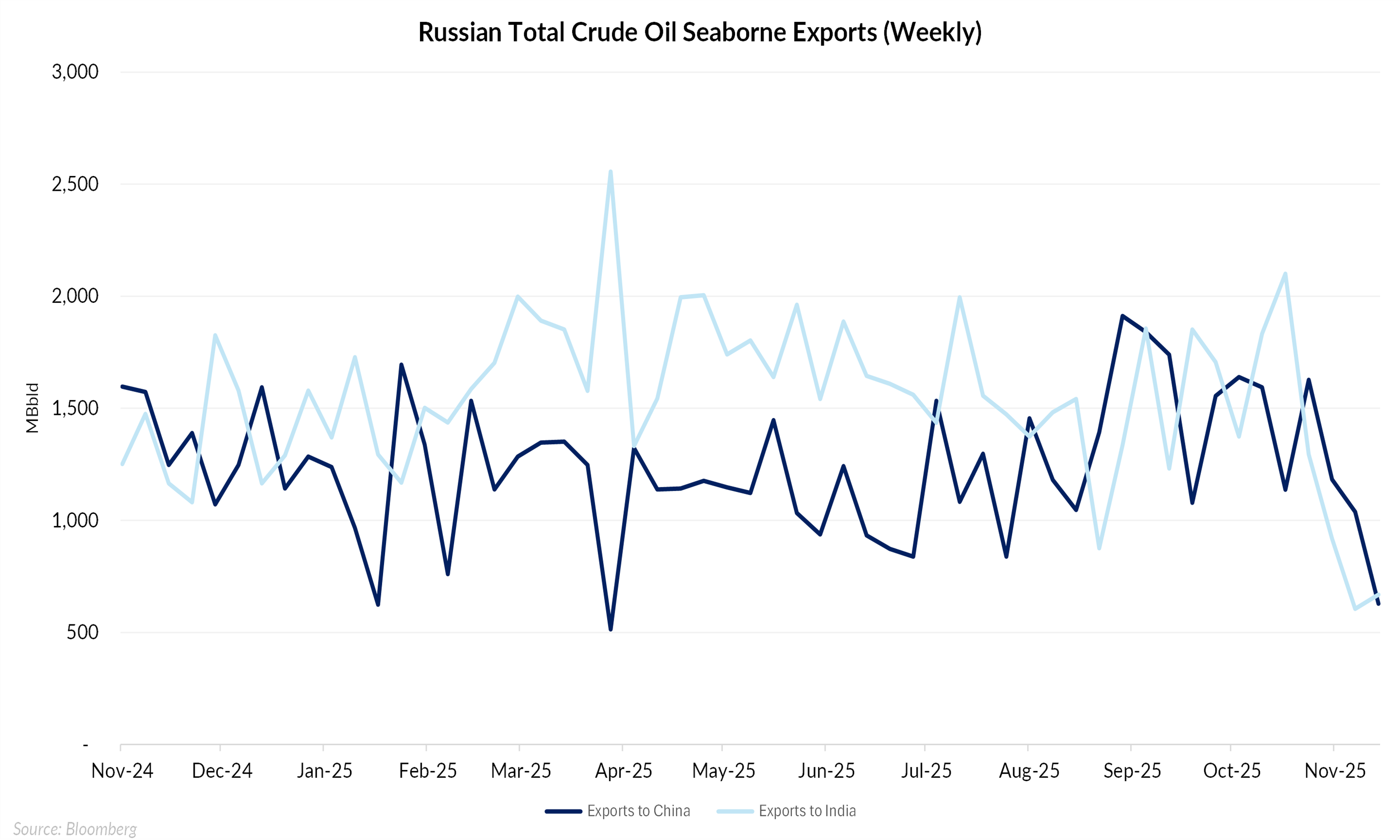

According to Bloomberg, US sanctions on Russia’s largest oil companies are already weighing on demand. Some Asian refiners have turned to alternative suppliers, leaving more Russian barrels idling at sea. Oil on the water has climbed 17% since August to roughly 171 million barrels, reflecting compliance-related pressure rather than logistical constraints.

A peace deal could reverse much of this behavior. Even with only partial sanctions relief, the perception of softer enforcement could quickly restore demand for Russian barrels. Reduced compliance risk and renewed access to traditional financing channels could ease routing constraints and lower shipping friction. This does not create new Russian supply. It returns discounted or stranded barrels into normal circulation, lifting effective supply in a market already bracing for heavy stock builds.

From Risk Premium to Structural Bearishness

Under a minimalist ceasefire, markets could unwind escalation-related risk premiums, leading to softer prices even if physical flows remain largely unchanged. A more consequential scenario would involve partial sanctions relief. In that case, Russia could re-enter markets currently backing it out. This could increase supply availability just as inventories rise, deepening contango and pushing prices below current forecasts as front-end risk premiums disappear.

A broader normalization would have the strongest long-term impact. Peace could allow Russia to restore upstream investment and regain access to capital and technology. This would improve production capability, expand competition across crude streams, and complicate future OPEC+ coordination.

Market pricing already reflects some of this de-escalation risk. A comparison of the WTI forward curve before and after the peace negotiations shows clear flattening. The curve was more backwardated before the announcement; post-announcement, the structure is flatter, indicating that traders have begun removing front-end geopolitical risk and are leaning toward a softer market profile. The shift suggests that part of the peace-related downside is already priced in, mainly through reduced backwardation rather than lower long-dated prices.

Peace Is Bearish Crude

A Ukraine–Russia peace deal could reduce geopolitical uncertainty while making physical supply more efficient in an already oversupplied market. The likely result is lower prices, flatter forward curves, and greater pressure on OPEC+ to stabilize the market.