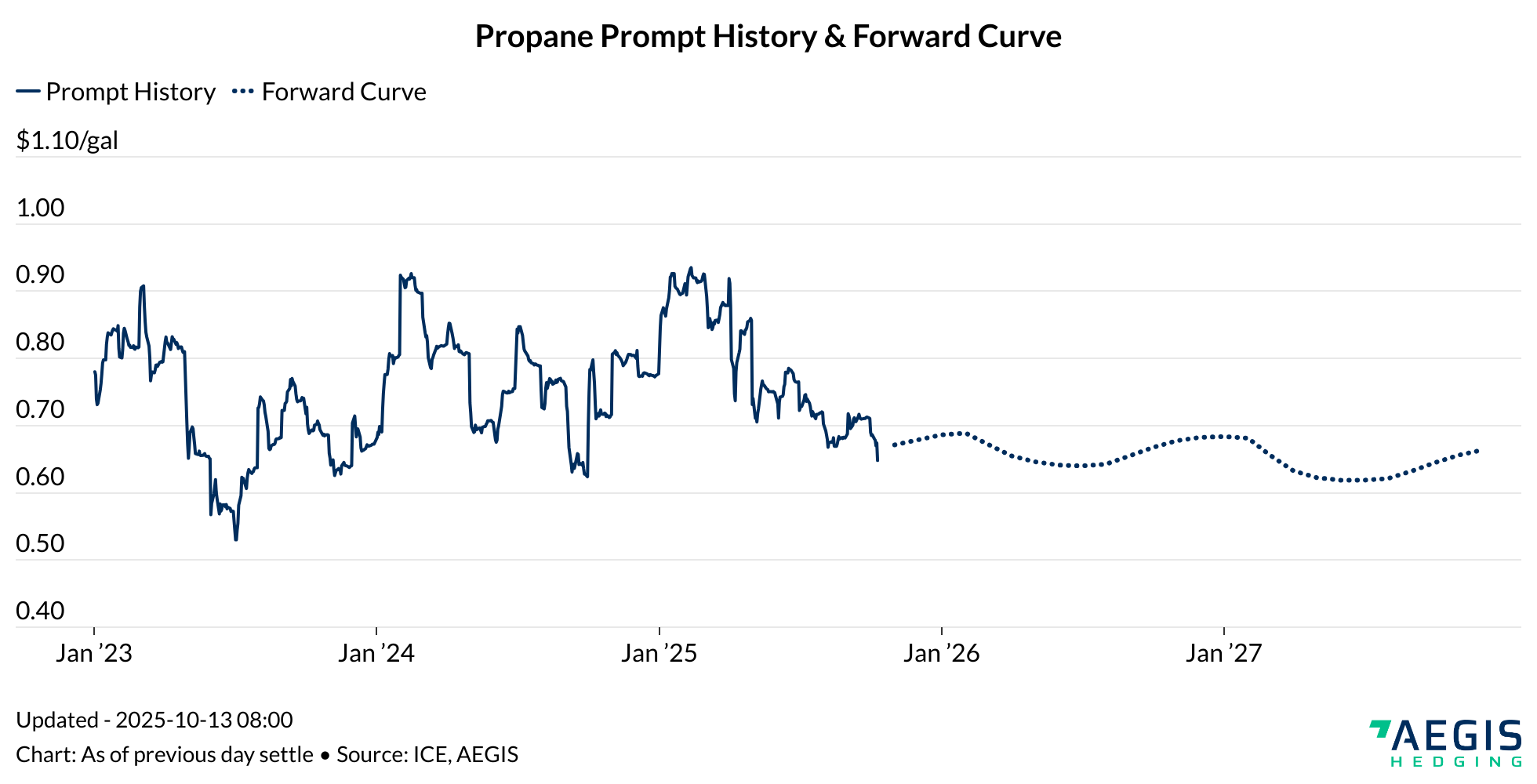

The combination of new LPG export capacity and slower supply growth could tighten propane fundamentals over the next two years. However, the outlook for oil prices over the next 18 months skews bearish, which could weigh on propane prices despite tighter market conditions. As of October 7, Mont Belvieu propane was priced at $0.68/gal, with the forward curve in backwardation for the next two years.

There are two main components that influence propane prices. First, propane has its own discrete supply and demand balance. Second, it maintains a relationship with crude oil because both are part of the same hydrocarbon value chain, linking propane’s pricing dynamics to crude oil–derived economics. With that in mind, it’s important to consider propane’s relative value to WTI.

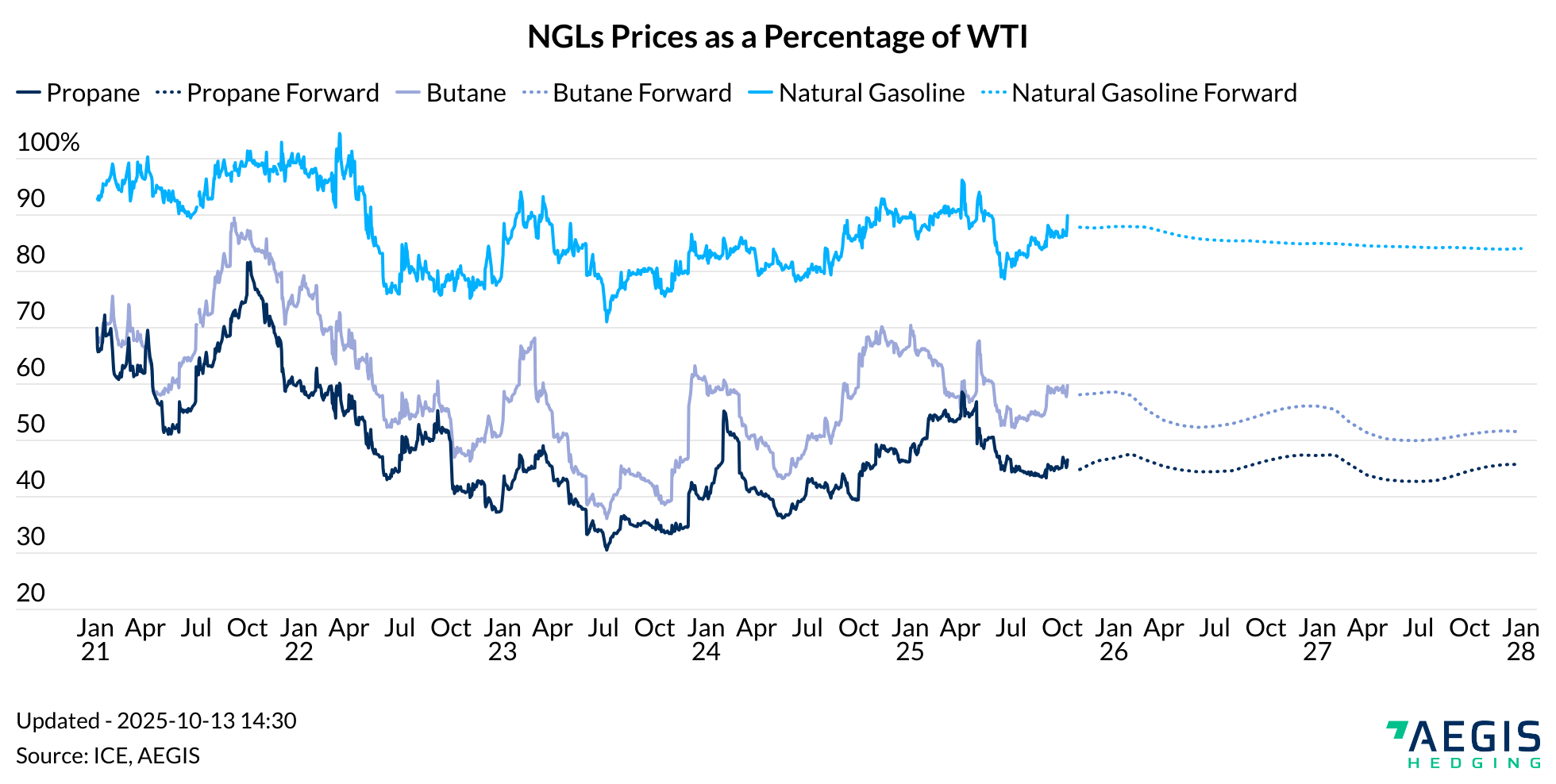

The chart below shows NGLs (excluding ethane) as a percentage of WTI. Mont Belvieu propane (navy blue line) is currently trading at 46% of WTI. Persistent oversupply in the U.S. has depressed propane’s relative value to WTI over the past two years, pushing the percentage well below historical norms. Over the past decade, when propane inventories are in surplus relative to the five-year average, the propane-to-WTI ratio has typically traded between 30% and 50%. Conversely, when inventories are below the five-year average, the ratio tends to range between 50% and 75%.

Looking ahead, slower propane supply growth combined with additional export capacity should reduce inventory surpluses over the next few years. This tightening should lift the propane-to-WTI ratio. If crude oil prices were to remain unchanged, propane prices would likely rise as a result. However, that is not the current expectation among us and many others in the market.

We expect the WTI forward curve to shift into contango, with front-month oil prices falling into the $50s over the next 18 months. If that materializes, propane prices are likely to decline even as the propane-to-WTI ratio improves modestly.

Empirically, when WTI was $64/Bbl and the propane-to-WTI ratio was 45%, propane prices averaged about $0.69/gal (close to current prices and ratio). If we assume the same ratio but a hypothetical WTI price of $50/Bbl, propane would price near $0.53/gal. Alternatively, if we take a moderately bullish view of propane’s U.S. supply-demand balance and assume the propane-to-WTI ratio increases to 50–55%, then WTI at $50/Bbl would imply a propane price between $0.59 and $0.65/gal. These scenarios illustrate how both crude prices and propane’s domestic fundamentals interact to determine the ultimate price outcome.