The Golden Pass LNG export plant, developed by ExxonMobil and Qatar Energy, appears to be nearing completion and the startup of LNG production. While the facility has been delayed several times, project developers continue to guide towards a startup in the fourth quarter of this year, with commissioning possibly beginning as soon as October. However, there have been some constructive signs that the startup is imminent, such as a regulatory filing to re-export a cargo used to cool the facility, and small amounts of gas flowing into the terminal.

Often during the startup of an LNG export terminal, a cargo will be imported for the purpose of cooling down the liquefaction equipment. Golden Pass recently asked the Department of Energy for permission to re-export up to 50 Bcf of gas, requesting authorization to start by October 1, the first day Train 1 could be ready to start LNG production.

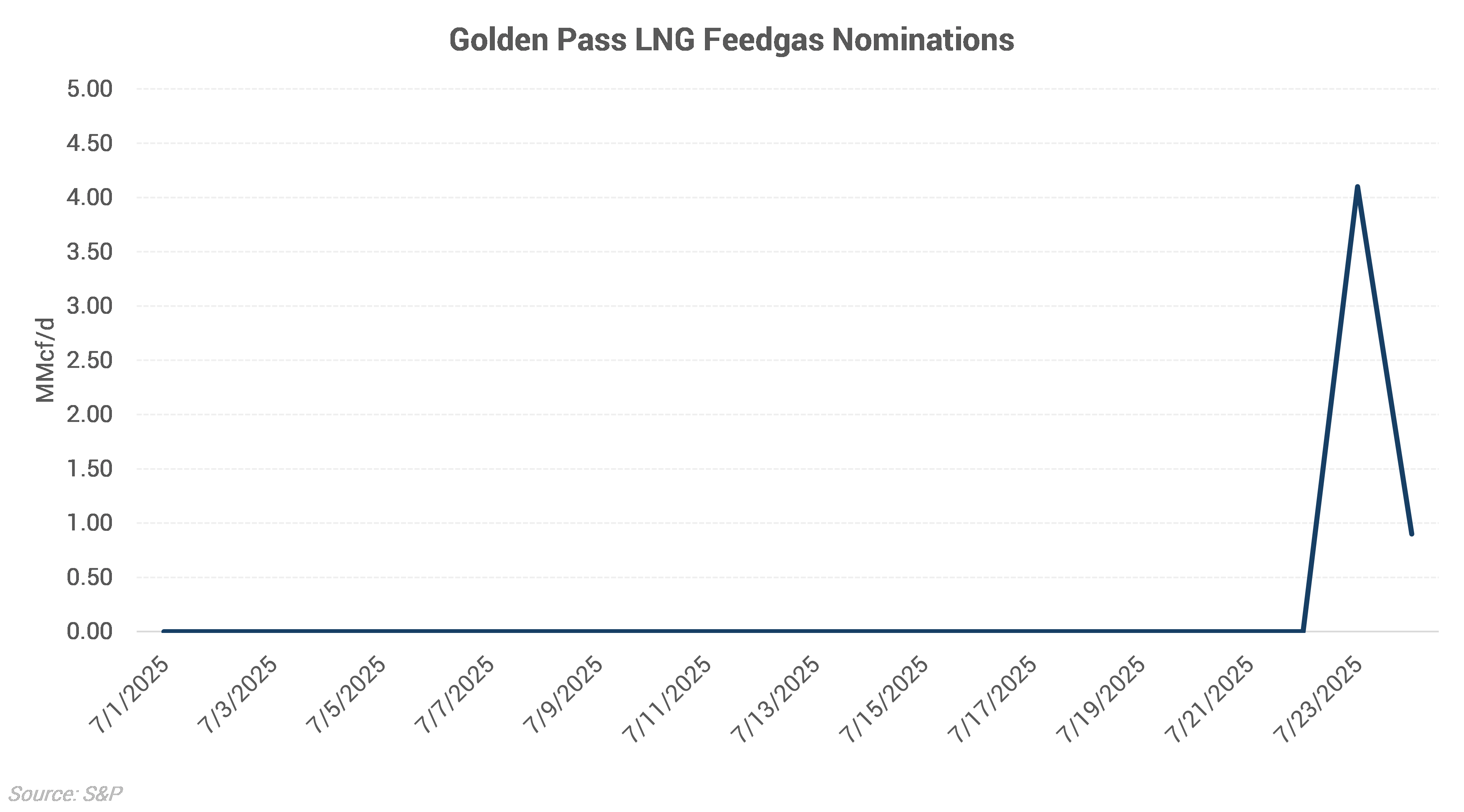

Gas has begun flowing into the plant from the Golden Pass pipeline, although the volumes are quite small. Several times in the past two weeks, pipeline nominations showed gas scheduled to flow into the plant, but these nominations were later revised down to zero. On July 23, 4 MMcf/d flowed into the facility, while volumes declined to 1 MMcf/d by the following day.

Flows should rise steadily over the next few months as Train 1 begins operation. Trains 2 and 3 are slated to enter service in 2026, bringing the total feedgas demand of the plant to about 2.4 Bcf/d.

These factors, importing cargos and introducing gas, shortly preceded the startup of other LNG facilities such as Plaquemines and LNG Canada. The timeline for Golden Pass will have wide-reaching implications for the natural gas supply-demand balance, with a more rapid startup, as seen with Plaquemines LNG, being a bullish factor for gas prices.