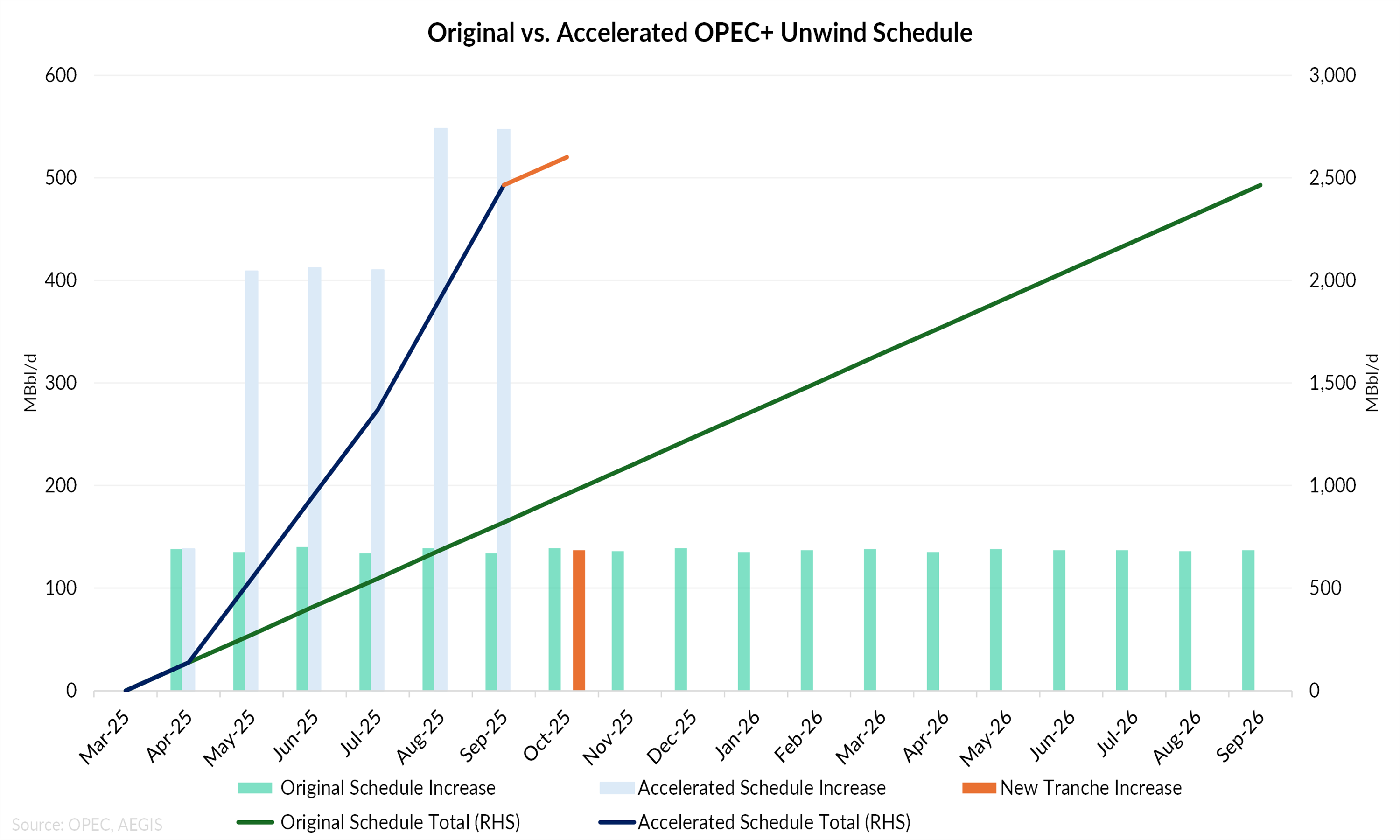

OPEC+ announced it will raise the group’s production quota by 137 MBbl/d for October, marking the start of unwinding 1.66 MMBbl/d of voluntary cuts that were originally planned to stay in place through the end of 2026.

This move follows last month’s 547 MBbl/d hike for September, which effectively completed the reversal of the cartel’s 2.5 MMBbl/d supply cut a full year ahead of schedule (including the additional 300 MBbl/d granted to the UAE. The chart below reflects the accelerated unwind through September with the orange representing the recently announced 1.66 MMBBl/d tranche.

OECD Inventories on Track to Swell

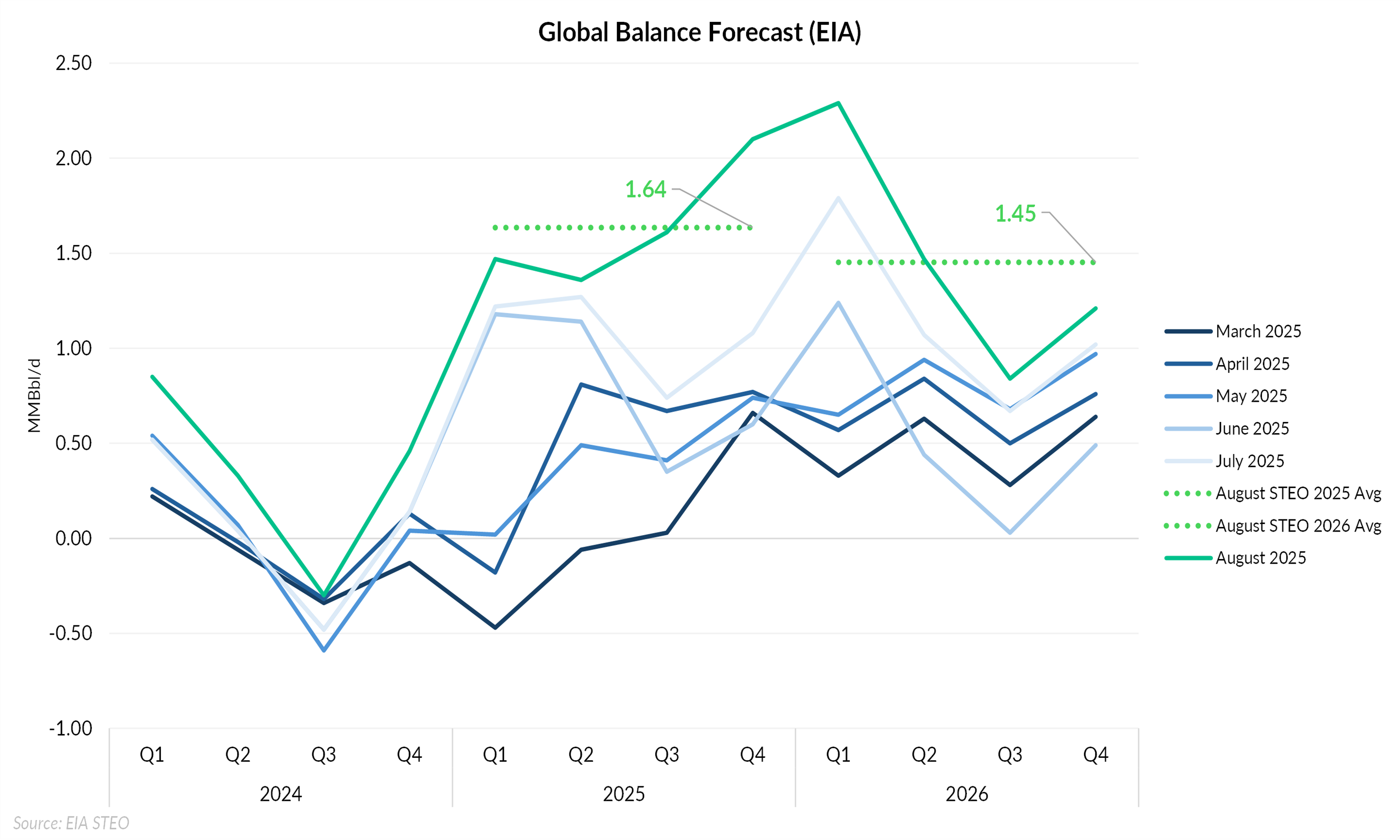

The speed of the unwind has surprised the market, prompting agencies and banks to lower near-term oil price forecasts. According to the latest EIA Short-Term Energy Outlook (STEO), OECD commercial stocks are projected to rise by more than 2 MMBbl/d in 4Q25 and 1Q26, and these figures do not yet incorporate October’s new production quota increase. The risk of higher inventory builds is growing.

Note: Each line shows the EIA STEO global balance forecast by vintage (March–August 2025) and the dotted green lines show the average annual surpluses for 2025 (1.64 MMBbl/d) and 2026 (1.45 MMBbl/d).

China as a Possible Bulwark

“The key question is where stock builds will turn up,” says Kim Fustier of HSBC Holdings. Traders are closely watching whether China will step in to absorb the extra barrels expected to hit the market. “If China continues to absorb excess oil volumes via its strategic reserves, as it did in the second quarter, stock builds in the OECD could be muted,” Fustier added.

IEA data show that global stockpiles rose by the most in 2Q since 3Q 2020, when COVID-19 collapsed global demand. OECD inventories increased by 60 MBbl/d, while non-OECD stocks climbed by over 1 MMBbl/d during the same period. However, analysts warn that prices may need to drop to incentivize China to continue filling its strategic reserves.

Market Still Waiting for Surplus to Show

Despite consensus expectations for a looming supply glut, market participants have yet to see evidence of it in real time. Price action will likely hinge on whether the expected builds actually materialize, and whether China’s buying appetite keeps them from showing up in OECD data.