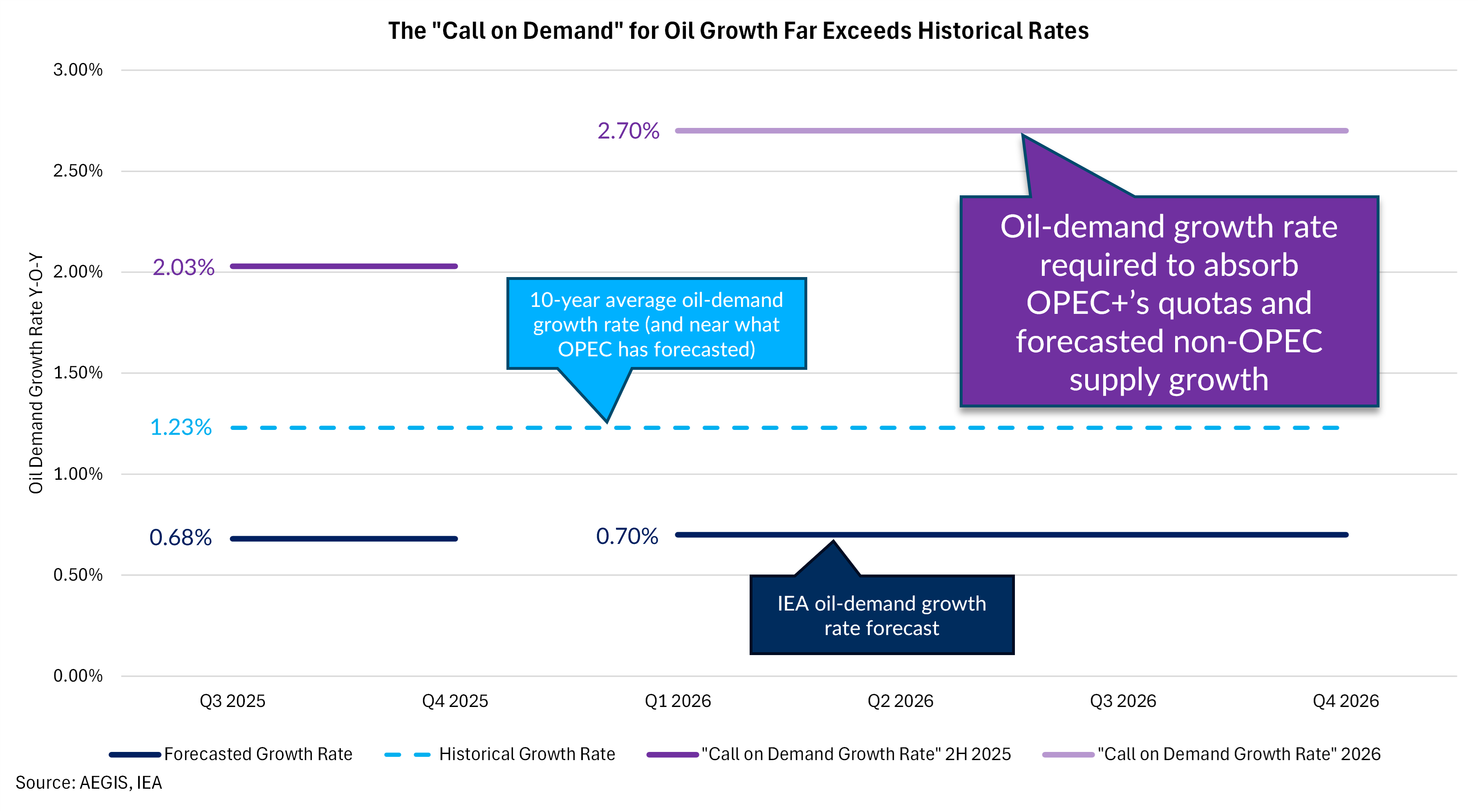

Global oil demand growth would need to vastly outperform historical trends over the next 18 months to absorb projected supply increases from OPEC+ and non-OPEC producers. According to the latest data from the IEA and OPEC, the market’s “call on demand” — the rate of demand growth needed to prevent oversupply — is well above both the 10-year average and current forecasts.

Over the past 30 years, global oil demand growth has averaged 1.23% year-over-year. This figure is a benchmark for how quickly the market has historically been able to expand consumption.. It also aligns closely with OPEC’s medium-term expectations for demand growth.

The IEA’s projections for the coming 18 months fall short of this historical mark. Forecasted growth rates hover near 0.68%–0.70% in late 2025 and early 2026, before edging only slightly higher. Such modest gains suggest that under normal economic conditions, demand expansion is unlikely to accelerate enough to offset supply.

In stark contrast, the market’s call-on-demand growth rate — the increase required to fully absorb OPEC+ output targets and expected non-OPEC supply growth — reaches 2.03% in late 2025 and climbs to 2.70% by mid-2026. These levels are more than double the IEA forecast and far above the historical average.

Bridging this gap would require extraordinary demand growth, far exceeding recent norms. Unless consumption accelerates sharply — driven by stronger-than-expected economic activity, transportation fuel use, or petrochemical demand — the global oil market risks entering a period of significant oversupply. Such an outcome could place sustained downward pressure on prices, especially if supply-side discipline falters.