Oil rises on geopolitical tensions, but EIA projects bearish outlook through 2026

Crude oil prices finished higher on Friday, with the WTI prompt-month contract settling at $60.09/Bbl, up $1.40 on the day. This advance reflects a renewed risk premium in the market, as traders responded to escalating geopolitical tensions. Despite these gains, the broader market backdrop remains fundamentally bearish, as highlighted by the latest US EIA outlook projecting a widening global supply surplus and rising inventories through 2026.

The EIA’s November STEO underscores the increasingly bearish fundamentals for crude. The agency now expects global oil supplies to increase by 2.8 MMBbl/d in 2025 and by another 1.4 MMBbl/d in 2026, driven by robust growth from the US, Brazil, Guyana, and Canada, alongside the revival of OPEC+ production. As a result, the global supply surplus is projected to reach 2.17 MMBbl/d in 2026, up from last month’s estimate, and inventories are expected to build sharply, especially in OECD countries. Despite these bearish supply-demand dynamics, the EIA raised its crude price forecasts for 2026, citing ongoing strategic stockpiling by China and the impact of new sanctions on Russia’s oil sector as key factors supporting prices.

While fundamentals point to lower prices, Friday’s rally was driven by renewed geopolitical risks. In the Black Sea, a Ukrainian drone attack temporarily halted Russian exports from the key port of Novorossiysk, disrupting flows. Meanwhile, in the Gulf of Oman, Iranian forces seized a Marshall Islands-flagged tanker, further stoking concerns over the security of vital shipping lanes. These developments injected additional volatility and support into the market, highlighting the outsized influence of geopolitical events even as the underlying supply-demand balance remains loose.

In summary, while the EIA projects a growing supply surplus and accelerating inventory builds through 2026, recent geopolitical flare-ups have injected renewed volatility and support into the oil market. The combination of strategic stockpiling, sanctions-related risks, and sudden supply disruptions is keeping a floor under prices, even as fundamentals suggest a softer trajectory ahead. Despite this, AEGIS maintains a bearish position, reflecting our view that the underlying supply-demand imbalance will ultimately weigh on prices as geopolitical risks subside.

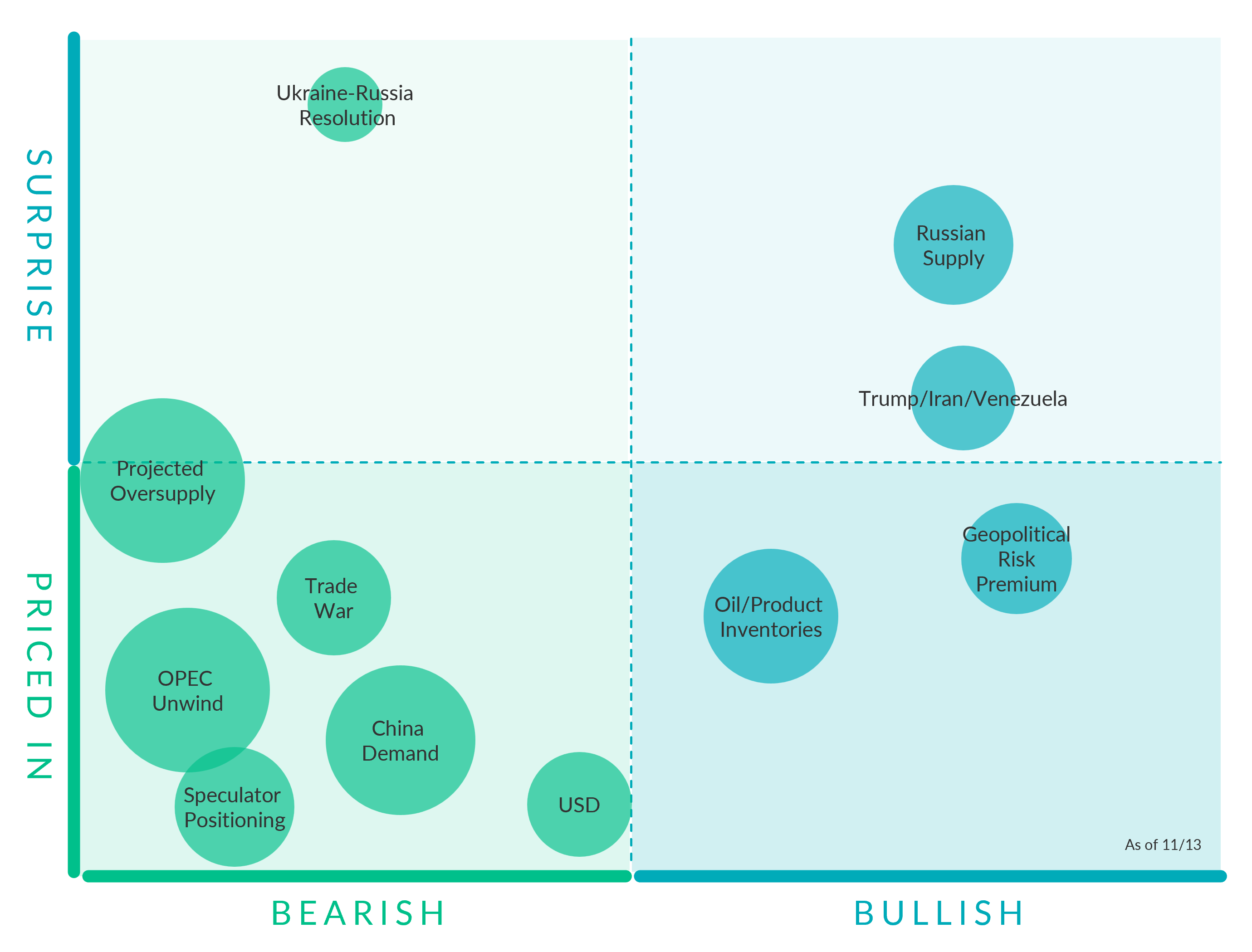

Crude Oil Factors

Geopolitical Risk Premium. (Bullish, Slightly Priced In) In the Black Sea, a Ukrainian drone attack temporarily halted Russian exports from the key port of Novorossiysk, disrupting flows. Meanwhile, in the Gulf of Oman, Iranian forces seized a Marshall Islands-flagged tanker, further stoking concerns over the security of vital shipping lanes. These developments injected additional volatility and support into the market.

Speculator Positioning (Bearish, Priced In) The latest CFTC data show that as of August 12, money managers reduced their net long in CME’s flagship NYMEX WTI contract to just 48,865 contracts, the smallest bullish position since April 2009. Meanwhile, trades of WTI done on the ICE exchange show money managers holding a net short of about 53,000 contracts. When the two venues are combined, overall positioning in WTI has slipped into net short territory for the first time on record.

Oil/Product Inventories. (Bullish, Priced In) The EIA reported a build of +5,202 MBbls in U.S. crude-oil inventories. In contrast, the market expected a draw of -247 MBbls as reported by Bloomberg. Inventories for the U.S. are now at a deficit of 5.90 MMBbls (-1.4%) to last year, and a deficit of 21.70 MMBbls (-4.9%) to the five-year average.

OPEC+ Quotas. (Bullish, Priced In) On June 2, OPEC+ announced its extension of 3.66 MMBbl/d cuts through December 2025. Additionally, the 2.2 MMBbl/d voluntary cuts from eight member countries will continue into Q3 2024 but will start to be reversed in October at a rate of 0.18 MMBbl/d per month. OPEC+ members agreed on September 5 to delay a planned gradual 2.2 MMBbl/d supply hike by two months, shifting the start to December. The group will add 0.19 MMBbl/d in December and 0.21 MMBbl/d from January onwards, with an option to adjust or pause these hikes depending on market conditions. The cartel also reaffirmed its compensation cuts of 0.2 MMBbl/d per month through November 2025, as members such as Iraq, Russia, and Kazakhstan have struggled to meet their original production quotas.

AEGIS notes that the global crude market would quickly build inventories without OPEC's support in reducing supply.

OPEC Unwind. (Bearish, Mostly Priced in) OPEC+ agreed to restore 137 MBbl/d for December, in line with the increases scheduled for October and November. Additionally, the group announced a pause in output hikes for Q1, citing typically weaker seasonal demand. Delegates noted the January pause reflects expectations of a seasonal slowdown.

China Demand. (Bearish, Priced In) China’s onshore crude inventories declined to 1.17 billion barrels this week, down from a record 1.20 billion barrels in mid-August, according to data from Kayrros. The draws came from commercial stockpiles, partially reversing the country’s earlier stockpiling surge, a key factor that has supported global oil prices even as the broader market faces record oversupply.

USD (Bearish, Priced In) The Federal Reserve cut its benchmark interest rate by 25 basis points, the first cut since December 2024, and signaled that another 50 basis point cut could be coming by then end of 2025. If markets expect rate cuts or looser monetary conditions, the dollar tends to weaken. Oil is priced in dollars, so a weaker dollar lowers the “real” cost of oil for buyers using other currencies.

Ukraine-Russia Resolution. (Bearish, Surprise) During President Trump’s Thursday meeting with Chinese leader Xi Jinping, Trump noted, “We didn’t really discuss oil.” The absence of strong pressure on Beijing to curb Russian crude purchases remains a key revenue stream for Russia’s war effort.

Trade War. (Bearish, Mostly Priced In) There has been an increase in tit-for-tat trade tension between the US and China, with China sanctioning the US unit of Hanwha Ocean Co., a South Korean shipping major, and warned of additional retaliatory actions against the industry. However, President Trump said high tariffs on China were “not viable,” suggesting potential for de-escalation even as broader tensions remain elevated.

Projected Oversupply. (Bearish, Mostly Surprise) The EIA’s November STEO underscores the increasingly bearish fundamentals for crude. The agency now expects global oil supplies to increase by 2.8 MMBbl/d in 2025 and by another 1.4 MMBbl/d in 2026, driven by robust growth from the US, Brazil, Guyana, and Canada, alongside the revival of OPEC+ production. As a result, the global supply surplus is projected to reach 2.17 MMBbl/d in 2026, up from last month’s estimate, and inventories are expected to build sharply, especially in OECD countries.

Trump/Iran/Venezuela. (Bullish, Slight Surprise) Tensions in South America are escalating as reports surfaced stating the US is looking to target Venezuelan military sites. According to OPEC secondary sources, Venezuela's crude production in September was 967 MBbl/d.

Russian Supply. (Bullish, Slight Surprise) Due to the latest sanction on Rosneft and Lukoil, analysts at Rystad Energy estimate 500–600 MBbl/d of Russian output could be curtailed, forcing Moscow to rely more heavily on shadow tanker fleets and Chinese buyers. However, the extent of any disruption remains uncertain, and it may take time to gauge how material the impact truly is.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as “edge,” “advantage,” ‘opportunity,” “believe,” or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.