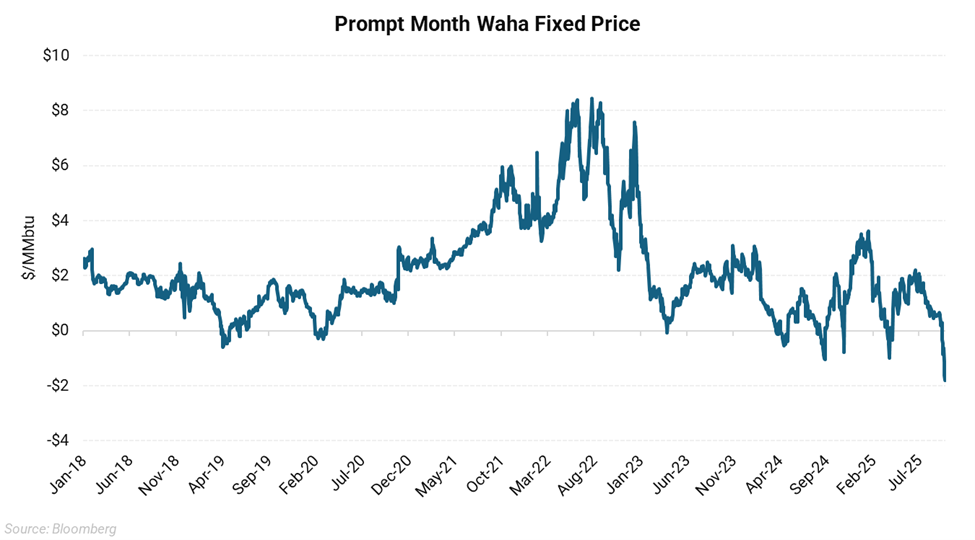

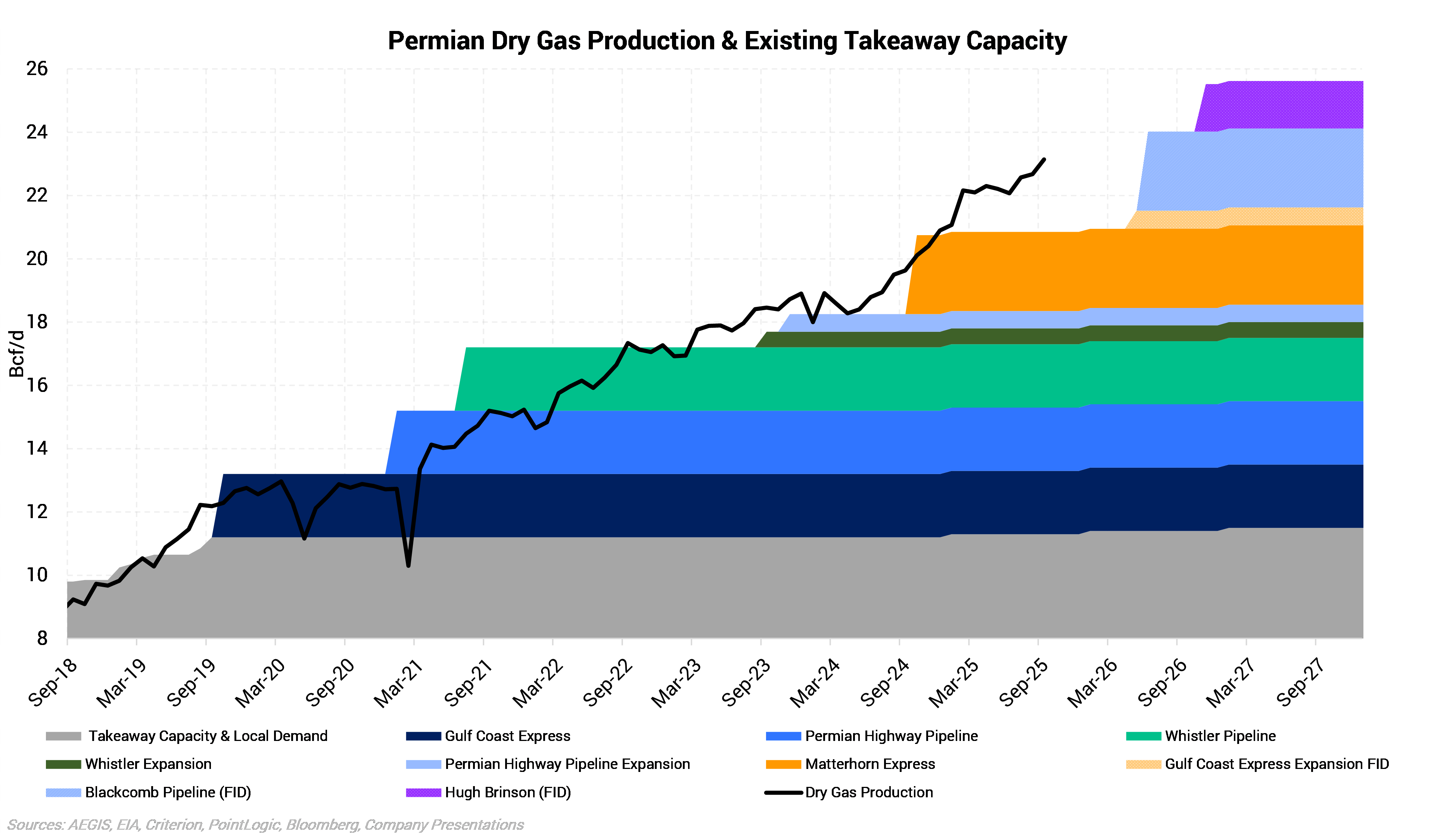

Spot and prompt month Waha basis prices sank into negative territory this month, with basis trading to -$4.50/MMbtu and fixed price falling to nearly -$2.00/MMbtu. This could foretell future weakness in spring and fall 2026 and possibly more periods of negative Waha prices. Pipelines in the Permian Basin often run at or near capacity, and new pipes fill up quickly. Without enough available space to ship gas out of the basin, prices can fall substantially. This is particularly true during the shoulder season months when gas demand is at its lowest. No new pipelines entering service until the second half of 2026 leaves Waha prices open to significant risk.

This particular price decline has been attributed to planned maintenance on Kinder Morgan’s Permian Highway Pipeline. Work will last for two weeks starting October 3, reducing capacity on the pipe by 1.2 Bcf/d. Periods of negative pricing have not been uncommon in recent years, with 2024 being particularly weak. The startup of the 2.5 Bcf/d Matterhorn pipeline late last year helped, but the pipe filled quickly. A 0.5 Bcf/d expansion is scheduled to start up later this year, but that is the only planned increase to Permian egress capacity until the following year.

These issues should mostly be alleviated after the second half of 2026, when new pipeline capacity starts up. The Blackcomb, Hugh Brinson, and Gulf Coast Express Expansion pipelines will allow for about 5 Bcf/d of new production. Beyond this, more capacity is planned to accommodate continued supply growth through 2030.

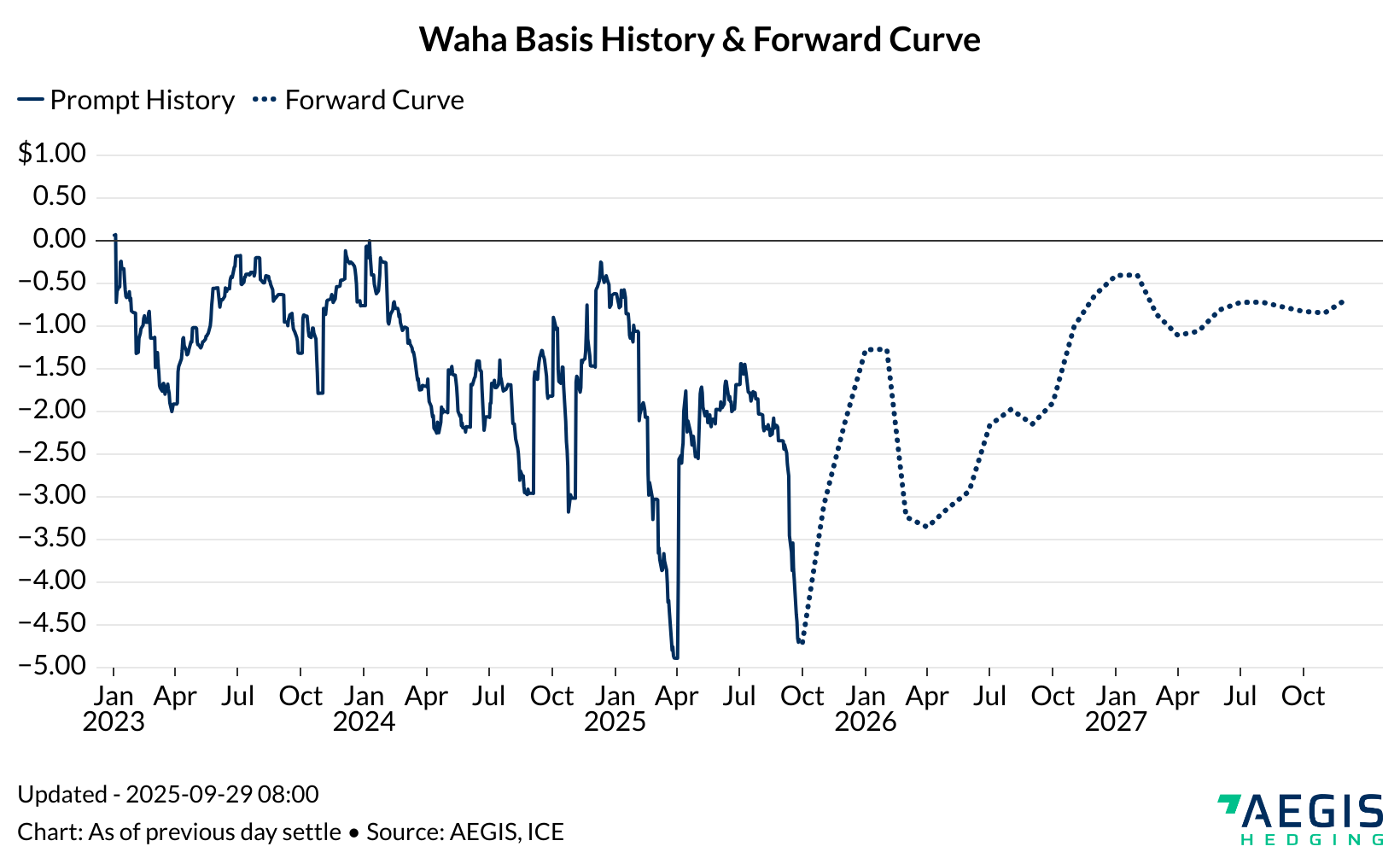

The impact of this infrastructure buildout can be seen in the forward curve for Waha basis. The 2027 calendar strip is trading much closer to Henry Hub than the 2026 strip, on expectations of much improved egress capacity. However, between now and the startup of these pipelines, Waha basis remains under considerable risk. This is primarily true for the shoulder season periods of spring and fall 2026. As demand in these months is limited, any maintenance can lead to sharp drops in basis pricing and potentially negative fixed prices.