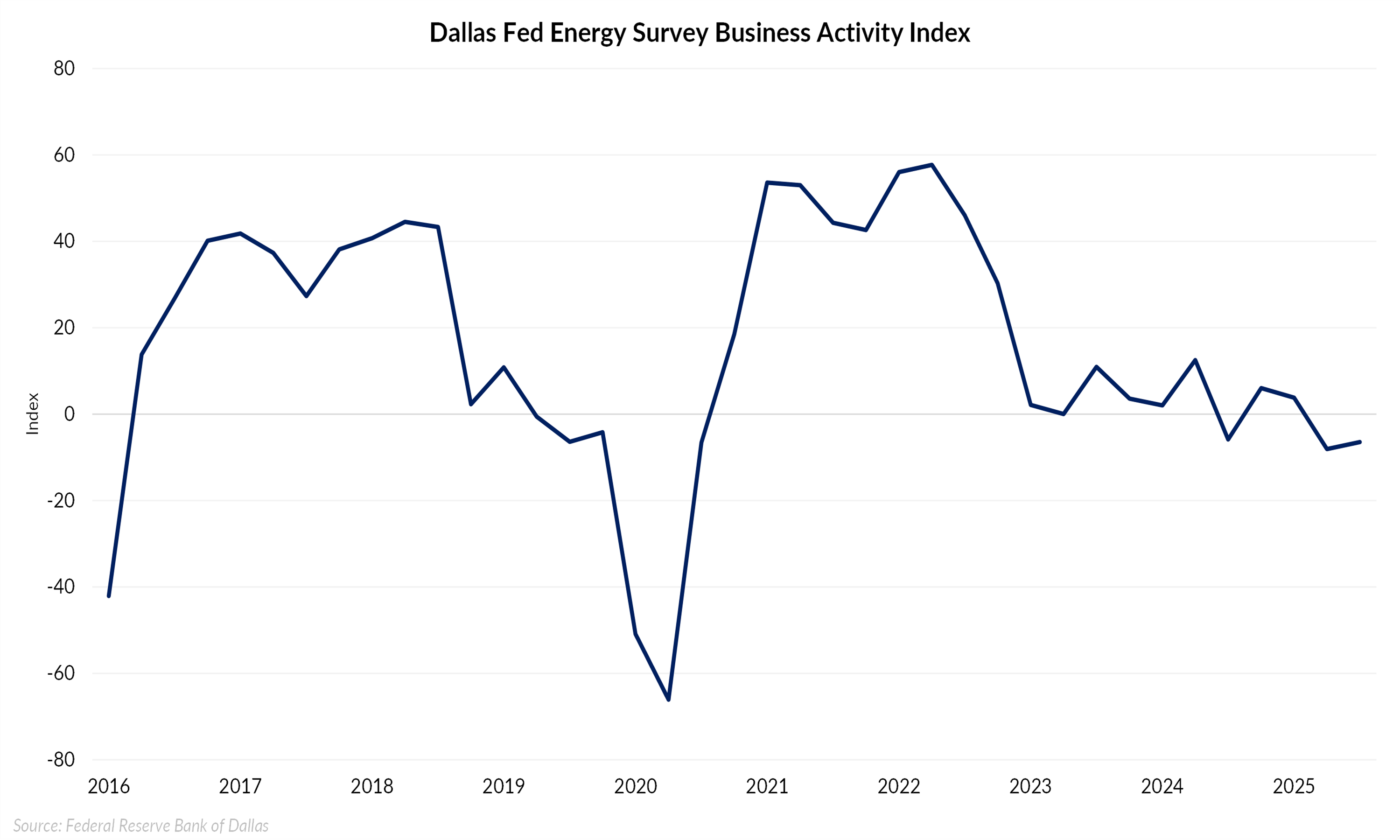

Oil and gas operators across Texas, northern Louisiana, and southern New Mexico endured another difficult quarter as activity slipped further under the weight of higher costs and persistent uncertainty. The Dallas Fed’s Energy Survey showed only a modest improvement in the Business Activity Index, which rose to -6.5 from -8.1 in the second quarter. The index measures the net share of firms reporting an increase in activity versus those reporting a decrease, so a positive reading signals expansion while a negative reading indicates contraction. With the index still in negative territory, the results show that more firms continue to report declines rather than growth.

In the second quarter, the index had swung into negative territory from modestly positive readings earlier in the year. The third quarter’s performance shows the downturn has not deepened significantly, but neither has there been a recovery. Firms appear to be adjusting to a slower pace of activity, maintaining output where possible while delaying more ambitious plans.

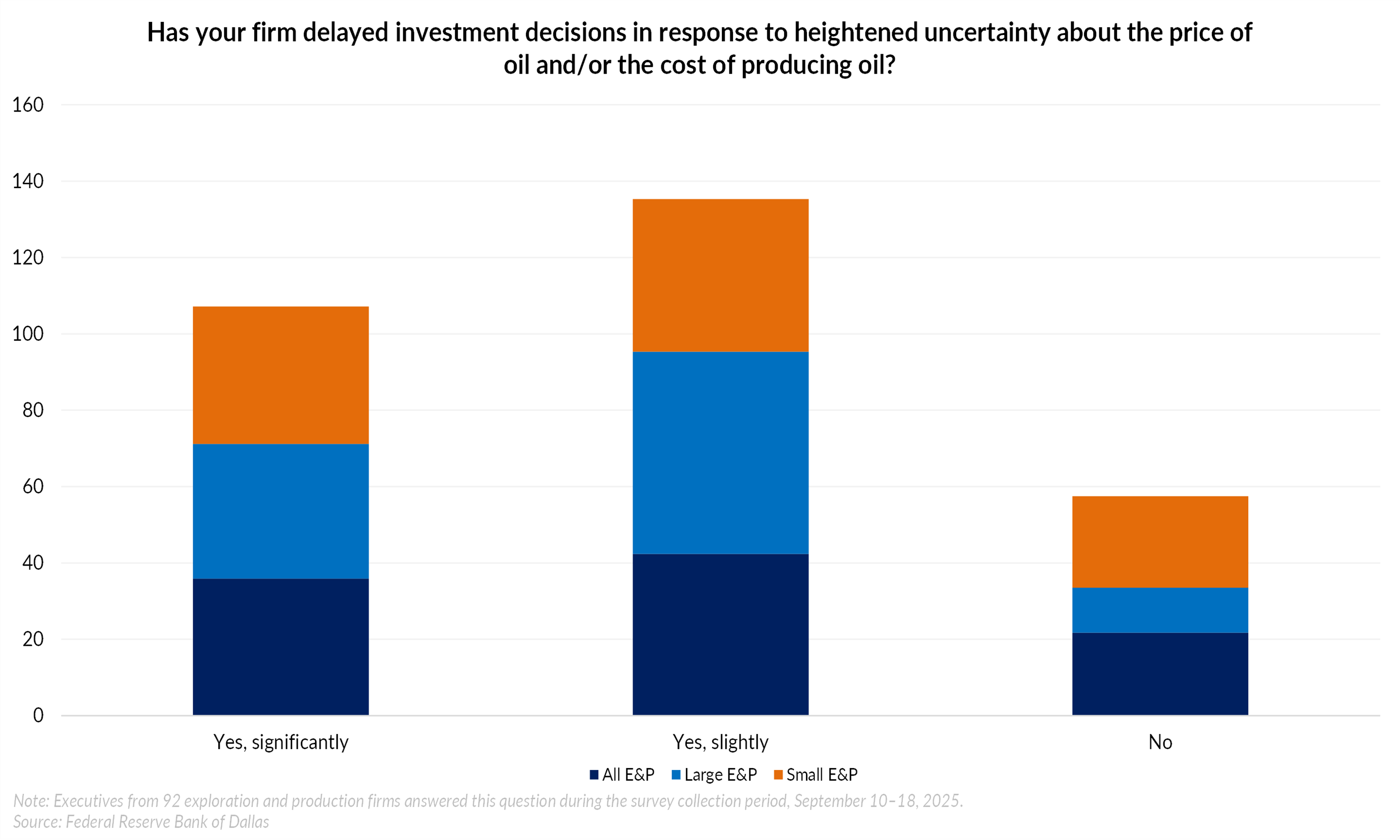

Investment decisions waiting for clarity

The survey also underscores the degree to which uncertainty is reshaping capital allocation. Nearly four out of five executives reported delaying investment decisions, with 36 percent saying they have significantly slowed projects and another 42 percent admitting to slight delays.

Compared with the second quarter, when the uncertainty index spiked to 47.1, the third quarter showed only a modest easing to 44.6. Yet the impact on investment remains profound. Rising lease operating expenses and finding and development costs have tipped the balance for many operators, making it harder to justify drilling new wells at current price levels. The result is a sector stuck in neutral and unwillingness to accelerate until costs cool or prices rise.

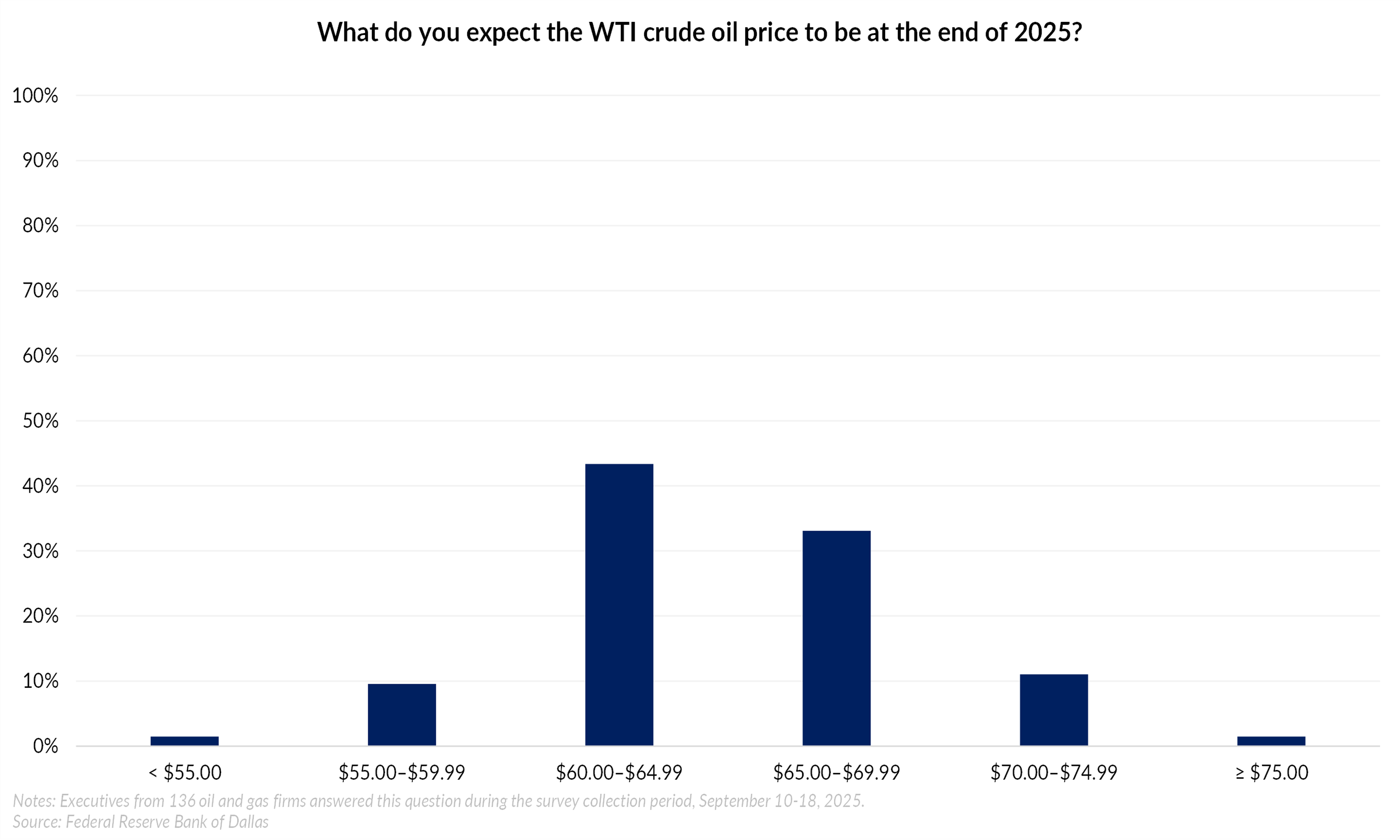

Price expectations anchored in the low 60s

Against this backdrop, producers continue to center their forecasts around $60.00-$65.00/Bbl The survey showed the most common expectation for year-end 2025 was between $60.00-$64.99/Bbl, followed closely by $65.00-$69.99.

In the previous survey, when WTI averaged nearly $70.00, most firms expected year-end prices in the $65.00-$75.00 range, with an average forecast of $68.00/Bbl. That expectation has now reset to $63.00.

Natural gas projections followed a similar path. In Q2, Henry Hub was expected to finish 2025 at $3.66/MMBtu. In Q3, that forecast slipped to $3.30.

Conclusion costs and caution dominate

The latest Dallas Fed Energy Survey paints a picture of a cautious industry. Activity is slipping, costs are rising, and uncertainty continues to delay investment decisions. While executives expect prices to hold steady, those levels are not enough to spark growth in drilling or services given today’s cost structures.

Compared with the second quarter, the story has not changed but it has hardened. The sector is caught in a holding pattern where capital discipline and patience define strategy. For producers, that means carefully waiting for clearer signals before committing new dollars to the ground.