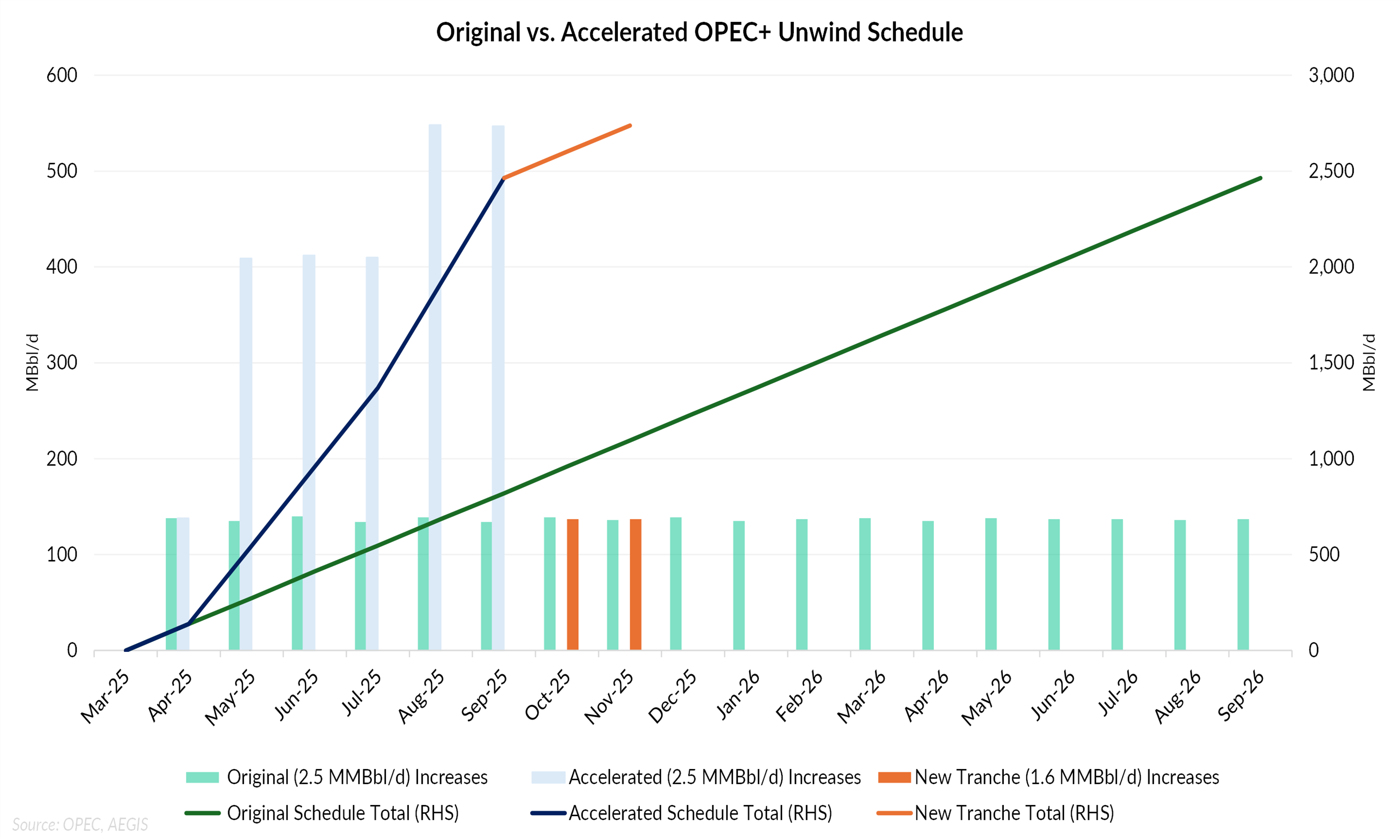

OPEC+ began unwinding its voluntary production cuts in April 2025, completing the first 2.46 MMBbl/d tranche of restored output by September, a full year ahead of schedule. The alliance also plans to return another 1.6 MMBbl/d by early 2026, as part of a broader effort to bring back supply after nearly two years of voluntary cuts.

Yet, the group’s actual production data reveal that fewer barrels are returning than official statements imply. Even so, key agencies like the EIA and IEA expect the market to be flushed with crude oil next year, suggesting that even partial follow-through from OPEC+ is enough to tilt balances toward surplus.

Headline vs. Reality

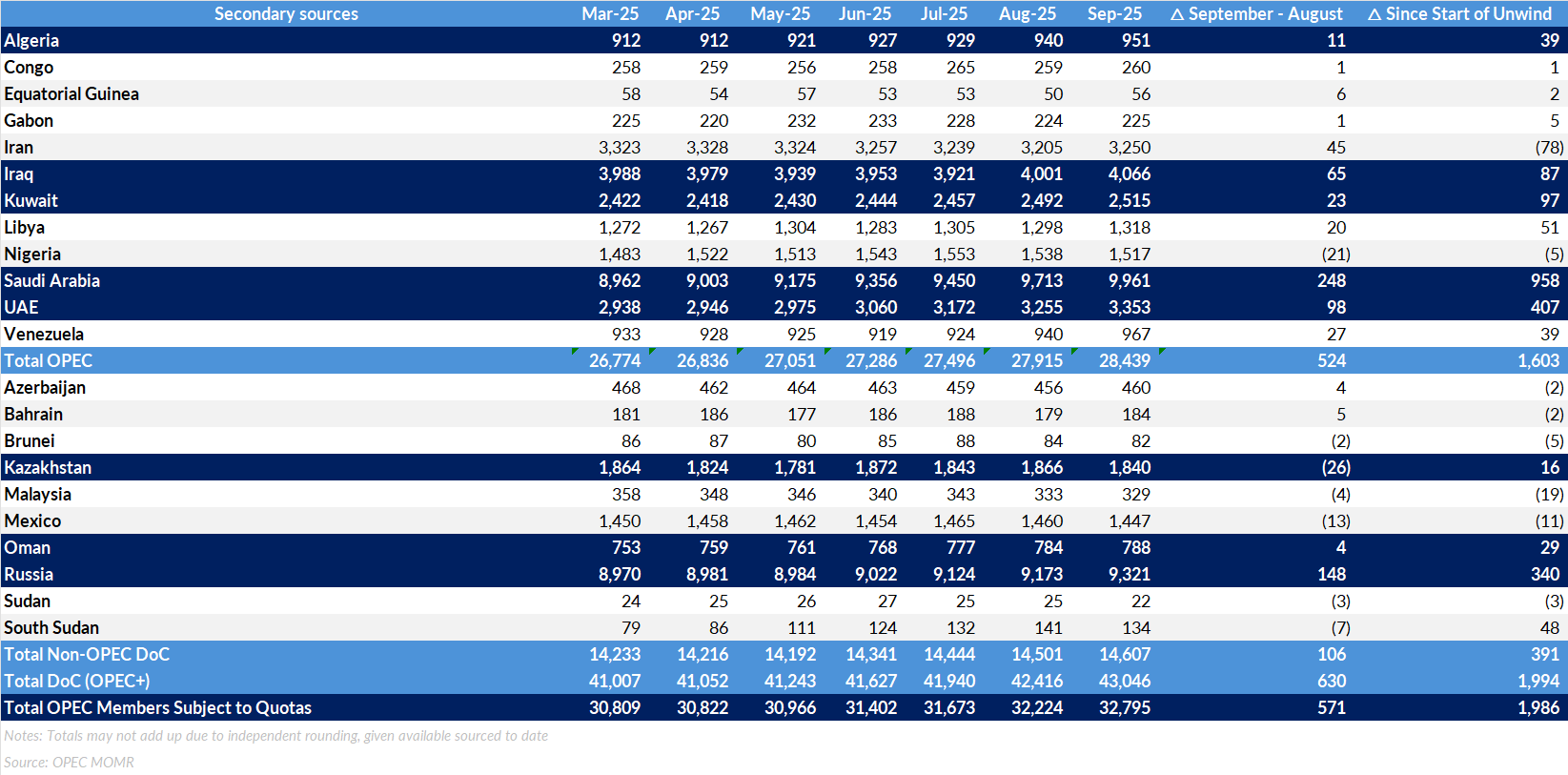

From April through September, OPEC+ announced a cumulative 2.46 MMBbl/d of production to be restored under its unwinding schedule. In practice, however, total OPEC+ crude output rose from 41.0 MMBbl/d in March, the last full month before the unwind, to 43.0 MMBbl/d in September, a gain of 1.99 MMBbl/d. That leaves about 470 MBbl/d of the pledged barrels still missing, meaning only roughly 80% of the announced volumes have materialized.

What the Data Show

OPEC’s own data show that the group is producing roughly what its models suggest the market currently needs. In its October report, OPEC estimated the “call on OPEC+ crude,” the amount of oil the world would need from the group to balance supply and demand, at 42.9 MMBbl/d for Q3 2025. Actual production in September averaged 43.05 MMBbl/d, essentially in line with that figure.

The organization projects that the call will rise to 44.2 MMBbl/d in Q4, reflecting its assumption that global demand will outpace non-OPEC supply later this year. In short, OPEC’s own balance suggests the market will need slightly more of its crude to stay balanced, but that view is built on OPEC’s relatively high demand forecasts compared with other agencies.

Most members are already near their sustainable limits, and the group cannot easily lift production by another 1–1.5 MMBbl/d without core producers drawing down spare capacity or smaller members overcoming technical hurdles. That’s why OPEC+ appears to be operating near its short-term practical ceiling, already producing about as much as it feasibly can under current conditions.

A Market Still Flooded

Even so, major forecasting agencies see little sign of tightness ahead. Projections for a record supply surplus in 2026 cite steady growth in US shale, Brazil, Canada, and Guyana alongside the OPEC+ unwind. The models already account for slower-than-promised OPEC+ production, yet the market still appears oversupplied by more than 1 MMBbl/d next year.

In short, even if OPEC+ falls short of its targets, it’s still adding more oil than the market needs. The issue isn’t whether every pledged barrel arrives, it’s that the ones already returning are enough to tip the balance toward surplus.