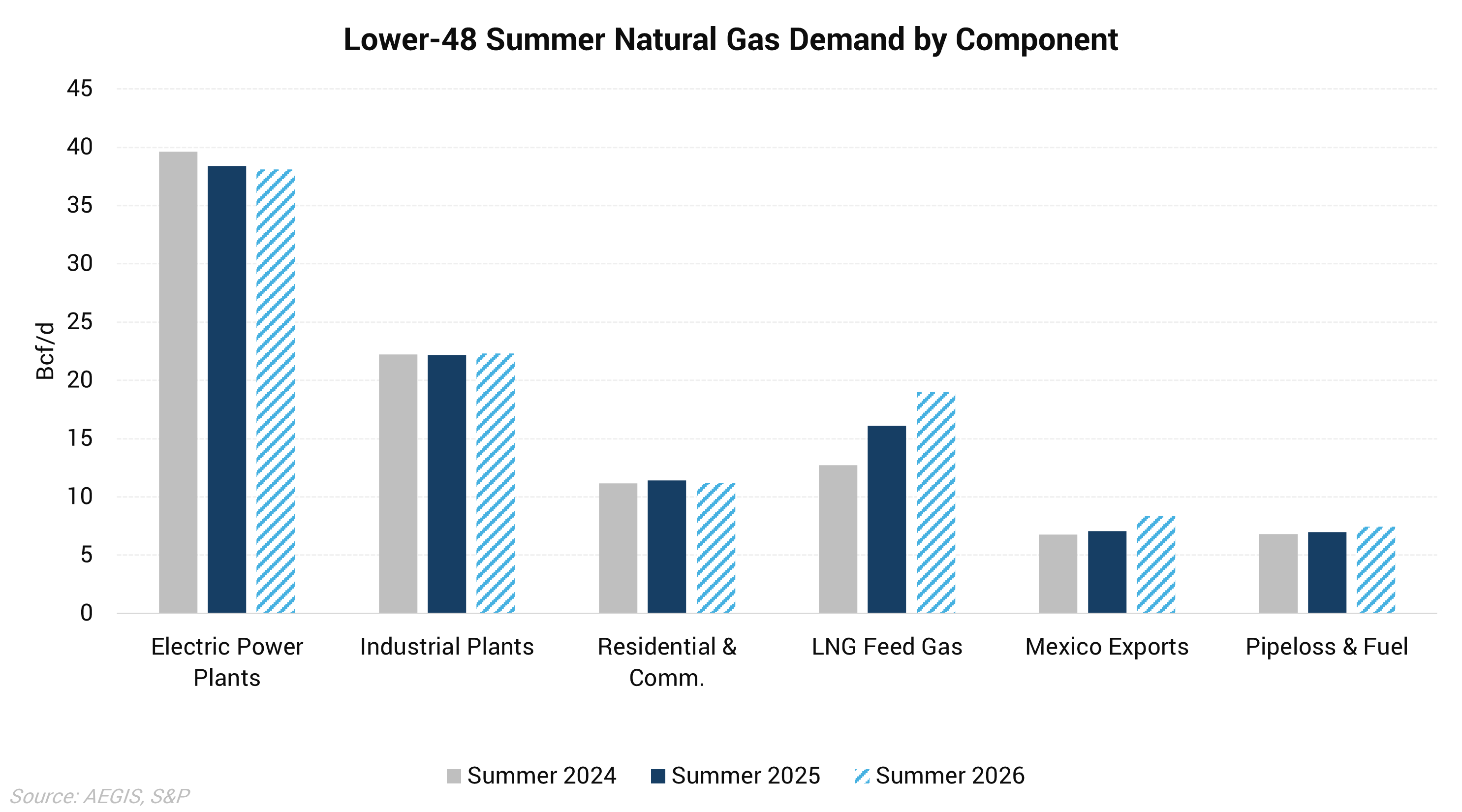

After what was a relatively bearish summer for natural gas in 2025, the supply-demand balance could tighten significantly in Summer 2026. Assuming ten-year average weather, we calculate that total Lower-48 gas demand could grow by 4.32 Bcf/d summer-over-summer, driven primarily by higher LNG feedgas demand. A tighter supply-demand balance should support Henry Hub prices, although weather could pose a risk to this view.

Total gas demand rose 2.79 Bcf/d in Summer ’25 from Summer ’24, and likely would have climbed more but cooler temperatures reduced power sector gas consumption. This offset some of the 3.38 Bcf/d summer-over-summer increase in LNG feedgas demand. Meanwhile, gas production jumped more than 5 Bcf/d from an average of 101.6 Bcf/d last summer to 106.8 Bcf/d in Summer ’25. The combination of these factors resulted in significantly higher inventory builds.

Assuming ten-year average weather, our modeling shows demand rising by 4.32 Bcf/d in Summer ’26, mainly due to higher LNG feedgas. Power demand could decline slightly as renewables continue to be added, but weather will be the primary driver of higher or lower power burn as seen this year, when cooler temperatures reduced demand relative to 2024.

To balance the market, production will need to rise to meet demand, which would equate to Lower-48 output levels of around 111 Bcf/d. This may be challenging as most new supply will need to come from the Haynesville, with Permian output mostly constrained through the second half of 2026. Based on this, our view is that prices may need to rise from current levels to encourage more production growth.