The buildout of LNG export capacity in the US continues at a rapid pace, with capacity expanding significantly over the next five years. There is more than 10 Bcf/d of new export capacity either under construction or FID’d and slated to enter service by 2030. More than 8 Bcf/d of capacity is likely to FID just in the next few months, however these projects likely won’t enter service for some time.

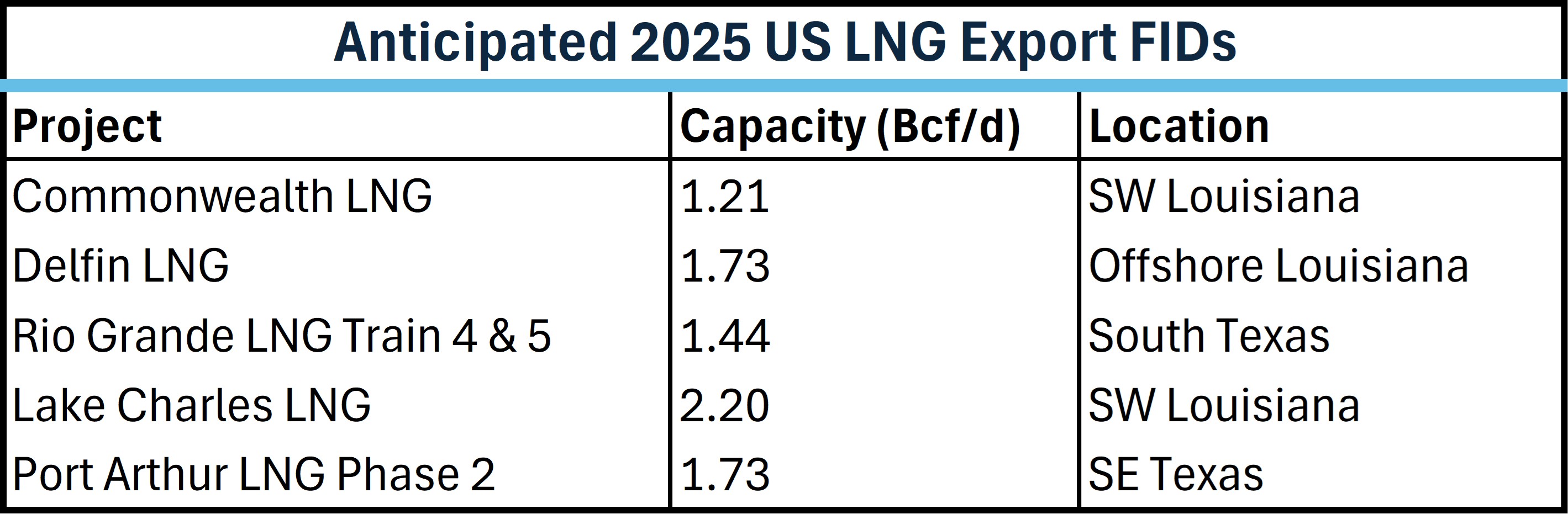

The table above shows the list of projects expected to secure a final investment decision by the end of 2025. These projects are currently in the process of securing permits from federal regulators and offtake agreements with buyers. Once enough agreements are signed, a final investment decision is made. These projects represent a total of 8.31 Bcf/d, and while many of these will not begin commercial service until the early 2030s, it does show that developers are continuing to be aggressive in bringing new capacity online.

Most of these projects, much like other LNG export plants, are located in the south Louisiana and southeast Texas region. Rio Grande LNG Train 4 and 5 is the exception, located in Brownsville, Texas.

While it is possible that not all of the projects reach FID by year-end, it does seem likely based on what the project developers have said and the pace of permitting and off-take agreements. Commonwealth LNG secured its final permit from the DOE this month, putting the project on track for an FID in Q3. Delfin received a deepwater port license, putting it on track for FID this fall. NextDecade recently signed agreements with TotalEnergies for Rio Grande Train 4 and said they are advancing towards a final investment decision. ConocoPhilips recently signed a 20-year offtake agreement with Sempra for the Port Arthur LNG plant, with developers targeting FID by year-end.

The buildout of export capacity will continue to drive incremental gas demand over the next several years.