|

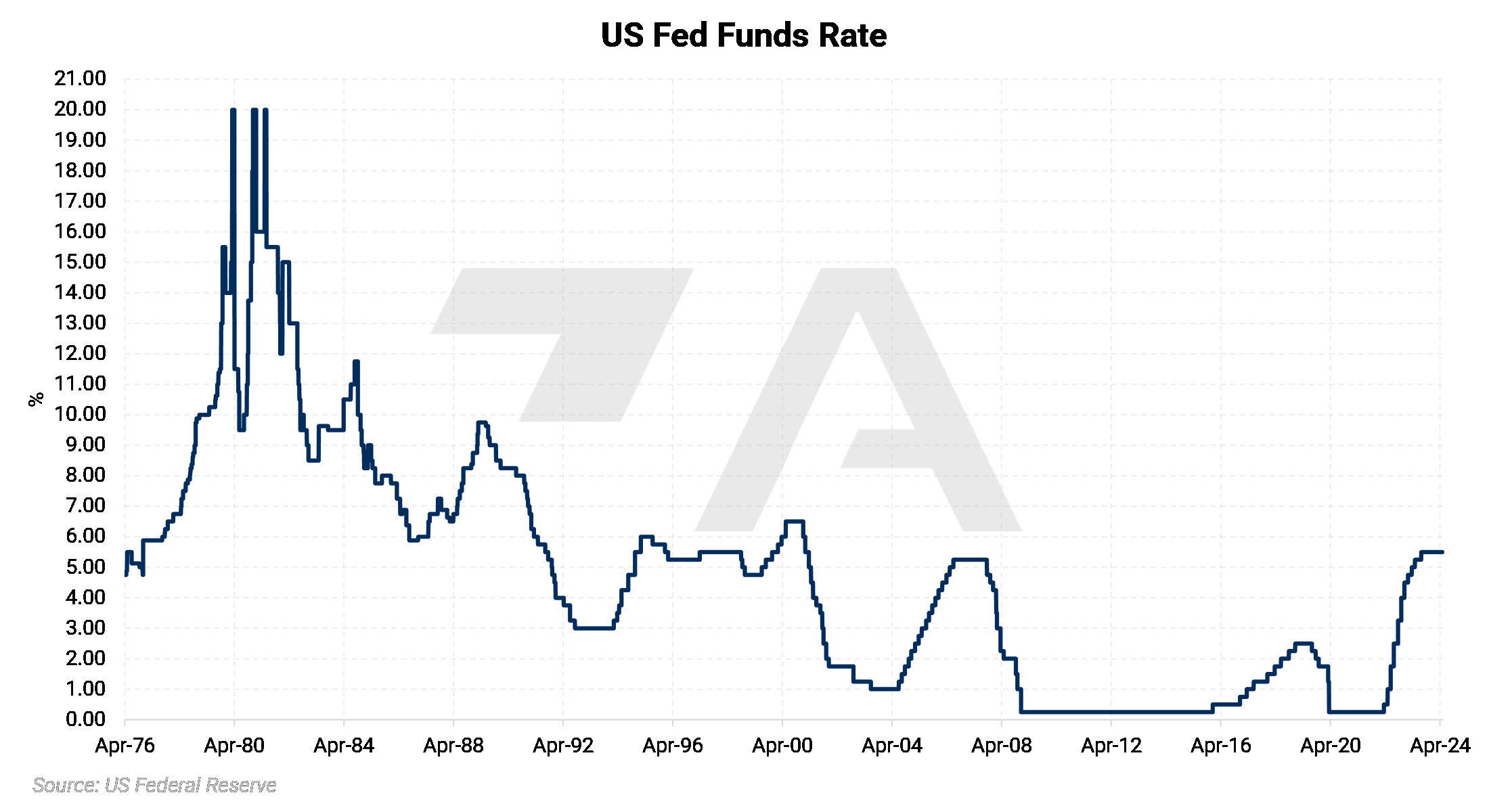

The US Federal Funds Rate, which is set by the US Federal Reserve on a monthly basis, is considered to be the most important interest rate benchmark in the world. After dropping rates to near zero spur demand after the pandemic, the US Federal Reserve has hiked interest rates to near 20-year highs. These recent rate hikes are meant to cool inflation but have also had other large ramifications. It currently sits at 5.5%. |

|

|

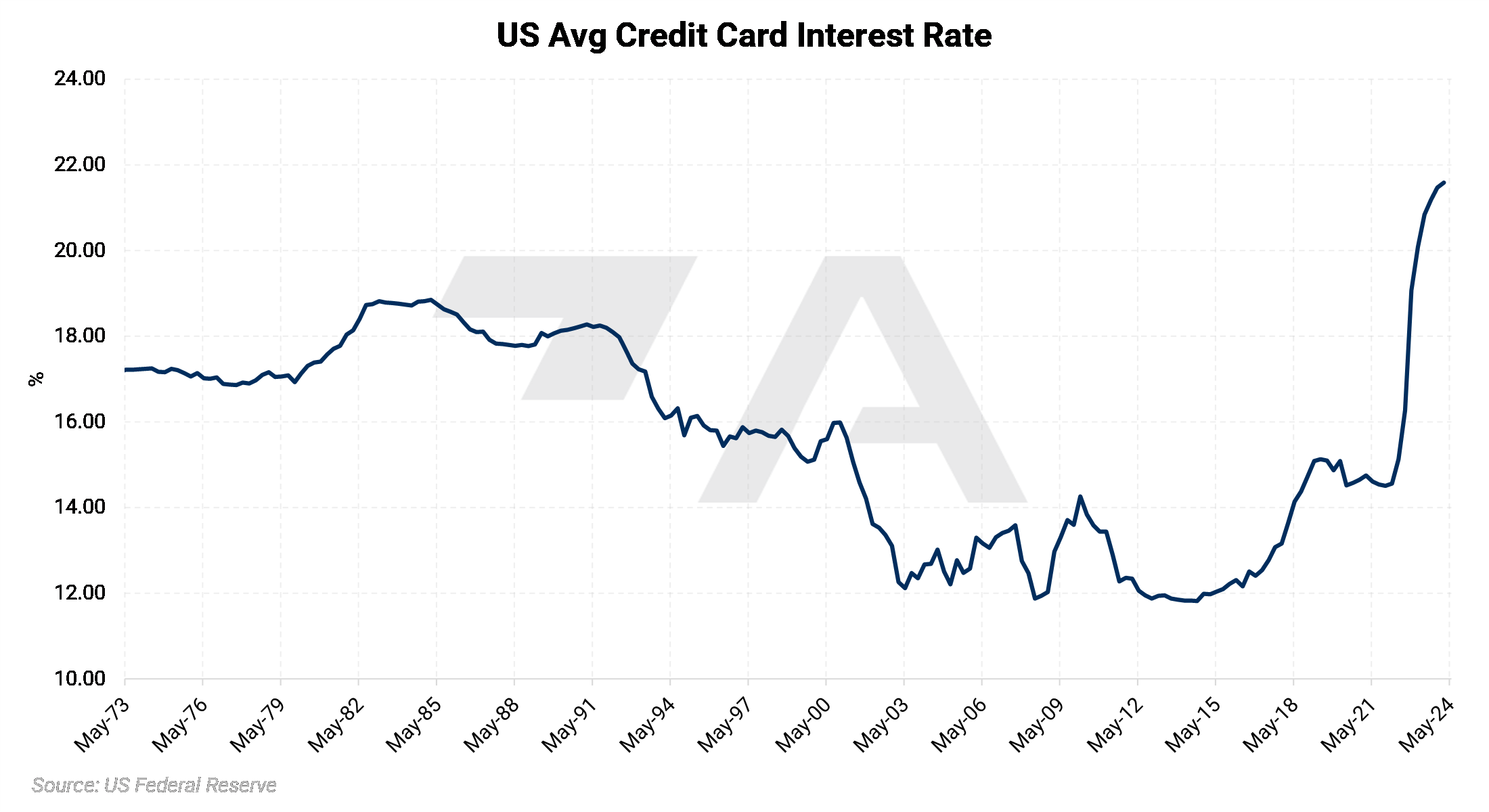

As the Federal Funds Rate has increased, credit card interest rates have also spiked. According to US Federal Reserve data dating back to 1972, the average US credit card interest rate is at an all-time high. As of November 2023 (the most recent data available), the average US credit card interest rate was 21.59%. |

|

|

The currently record-high credit card interest rate comes while credit card debt is also reaching record levels. At the end of 4Q2023, US consumers had about $1.13 trillion in credit card debt. This is up over $300 billion since 1Q2021. |

|

|

|

When the economy shut down in early 2020, consumer savings jumped to over $6 trillion. After the economy reopened, consumers opened their wallets, and savings hit a near 15-year low in mid-2022. The recent substantial drop in savings also coincides with spiking credit card interest rates and debt levels. |

|

|

|

One of the key reasons why the US Federal Reserve has rapidly raised interest rates is to combat stubbornly high inflation. These efforts have worked, as the US Consumer Price Index, which is a key gauge of inflation, has fallen dramatically since mid-2022. At 3.2%, it is, however, still at historically high levels and well above the Federal Reserve's target of 2%. The Federal Reserve recently proclaimed it might not be able to reach its 2% target until 2025. This could mean that interest rates might stay higher for longer. |

|

|

| A nation's Gross Domestic Product is a measure of economic growth. Two consecutive quarters of negative growth is considered to be a recession. The US economy did fall into a recession due to the pandemic but has since recovered. At 3.0%, the current GDP is right in line with historical norms. |

|

|

|

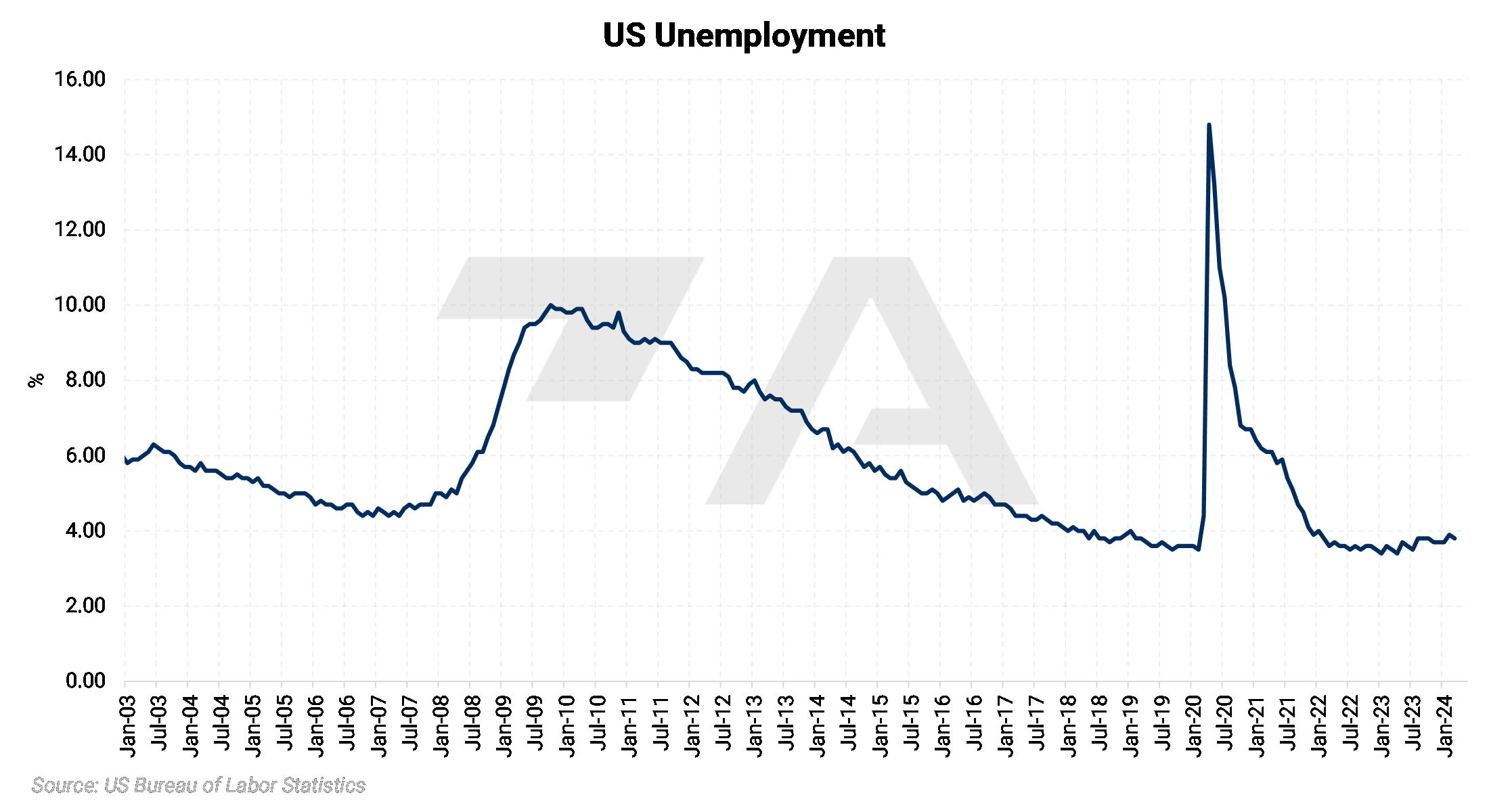

As the economy has recovered, so too has employment. Although there was a slight spike in unemployment in mid-2023, the unemployment rate is essentially at pre-pandemic levels. Any large rise in unemployment could suggest the economy is on shaky ground once again. |

|

|

The US economy is driven by consumers, therefore retail sales are a good indicator of the health of the US economy. Similar to the GDP, retail sales spiked dramatically once the economy reopened. Retail sales have cooled recently, and are now within historical norms. Like unemployment levels, a significant drop in retail sales could show the economy is on shaky ground. |

|

|

|

Finally, we will look at US manufacturing activity since it is a key part of metals demand. The Institute for Supply Management’s (ISM) manufacturing Purchasing Managers' Index is a key gauge of US manufacturing activity. A reading above 50 suggests the sector is growing, while a reading below 50 suggests contraction. As we can see, the sector contracted throughout 2023, but finally expanded in March 2024. This was the first expansion since September 2022. High interest rates, along with tepid consumer demand, have been headwinds for the manufacturing sector, the ISM recently stated. |

|

|

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.