The latest EQT earnings call showed the company moving away from managing prices through paper positions and toward influencing them through physical control, pipeline reach, and international marketing.

Basis Hedging Replaced by Operational Control

CFO Jeremy Knop said EQT has significantly reduced its basis hedging exposure, calling it a fundamental change in how the company manages risk.

“We had usually hedged up to about 90% of our in-basin sales… We’re not doing that anymore. We can effectively hedge basis by just shutting gas in,” Knop said. “Instead, we’re turning it from a defensive strategy to more of an opportunistic, proactive strategy.”

Appalachian producers have long used basis hedges to protect cash flow, but widespread hedging created a short bias in forward markets, often pushing regional differentials below fundamental value. EQT is replacing those financial hedges with operational flexibility, curtailing when prices weaken and ramping up when demand returns.

Its scale, balance sheet strength, and midstream integration allow EQT to manage exposure in real time, a luxury smaller operators lack. With less forward hedging, synthetic selling pressure on basis eases, letting forward values better reflect physical balances. Curtailments during weak pricing also tighten near-term supply, further supporting local differentials and narrowing spreads between Henry Hub and Appalachian hubs.

Infrastructure-Led Growth and Demand Alignment

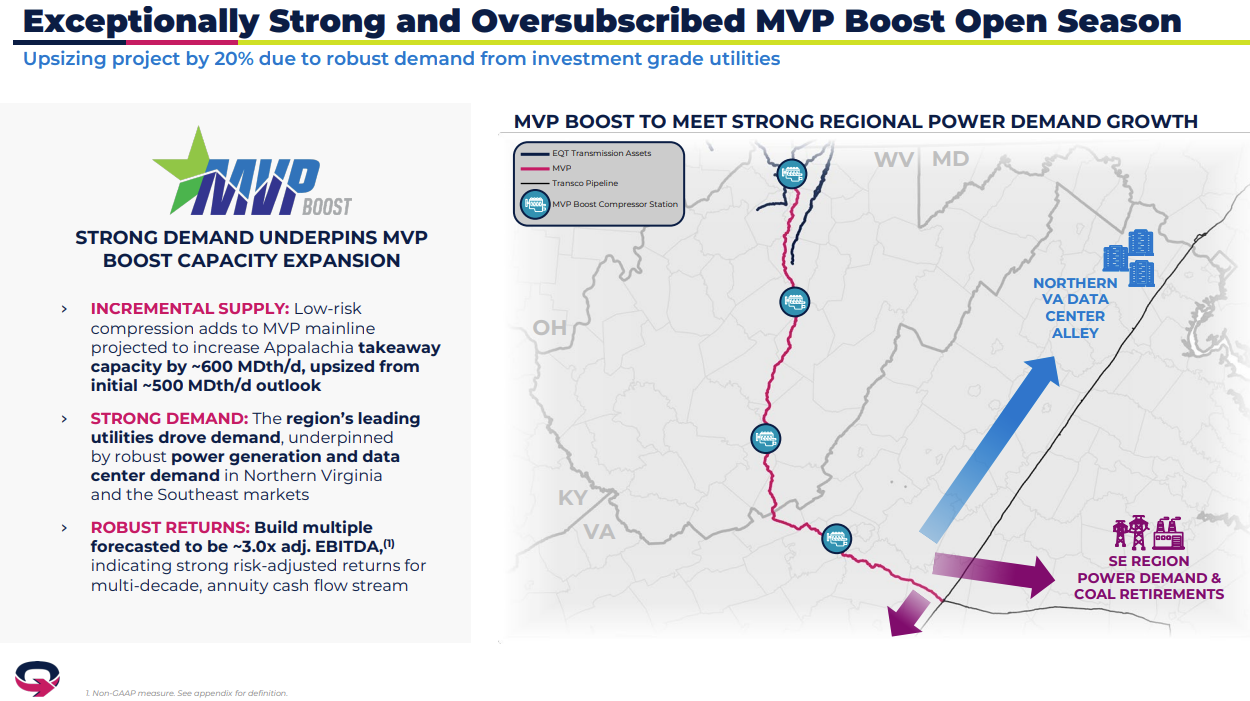

EQT’s growth strategy continues to revolve around matching supply with firm downstream demand. CEO Toby Rice said the Mountain Valley Pipeline Boost project was expanded from roughly 0.5 to 0.6 Bcf/d after utilities in the Southeast oversubscribed available capacity. The company is also advancing the Southgate extension into the Carolinas and progressing in-basin power projects such as Shippingport and Homer City, which together could add about 1.5 Bcf/d of new load by 2028.

These projects illustrate a deliberate shift in philosophy. Rather than drilling ahead of takeaway, EQT is securing customers and infrastructure first. Appalachia’s constraints typically come from egress capacity rather than resource potential. EQT’s approach begins to reverse that imbalance, turning the basin from a market that pushes gas outward to one where new demand pulls it through established corridors.

LNG Offtake and Global Integration

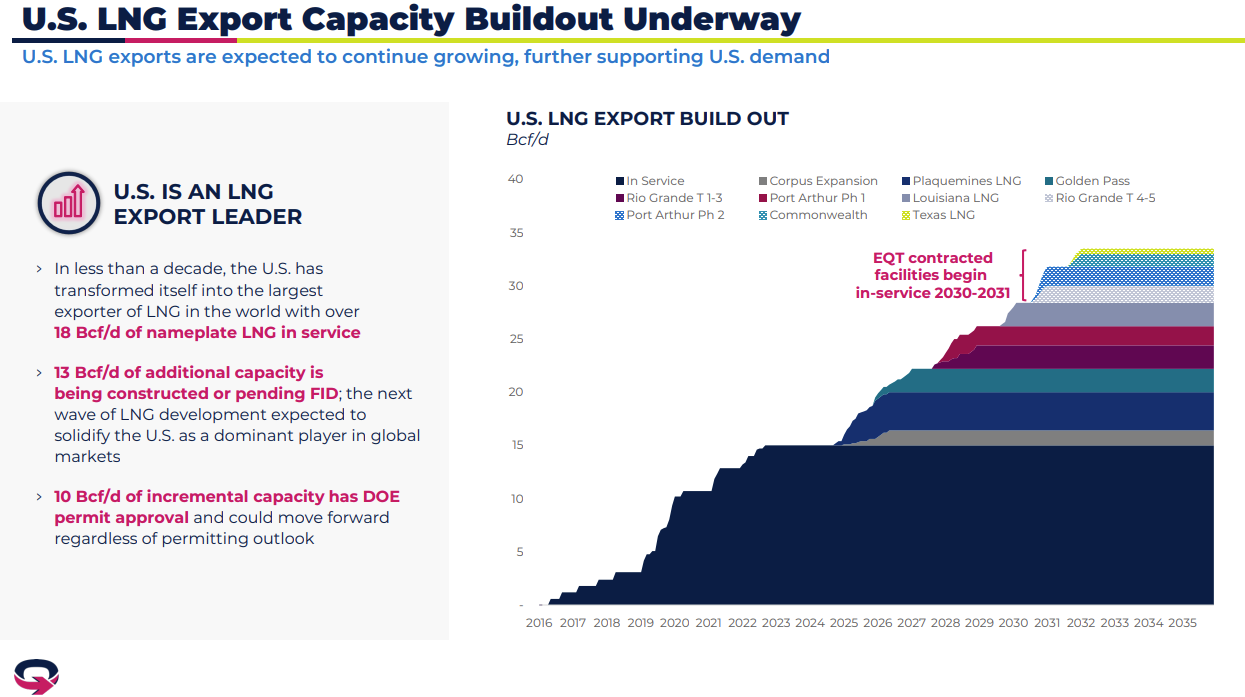

EQT has also completed a portfolio of 4.5 million tonnes per annum of LNG offtake across Port Arthur Phase 2, Rio Grande, and Commonwealth LNG, with deliveries beginning in 2030 and 2031. The Free-on-Board contracts give EQT title to the LNG once it leaves the terminal, allowing the company to market cargoes directly to international buyers. Knop said the company’s LNG “bucket is full” for now, with the next phase focused on developing marketing capabilities and securing regasification capacity overseas.

The structure effectively lets EQT capture value along the entire chain, from Appalachian feedgas to global sale. By entering the LNG market as an offtaker, EQT gains exposure to international prices and a natural hedge against domestic oversupply.

Market Implications

EQT’s message is clear. The next phase of natural gas will not reward the producer that drills the most, but the one that controls where its molecules flow and how they reach the market.