Geopolitical risks and sanctions support crude prices despite bearish fundamentals

WTI crude prices floated near $60/Bbl after last week’s rally following the sanctions on Russian state-owned crude exporters Rosneft and Lukoil. Despite persistent concerns about oversupply, renewed geopolitical risks helped keep crude from sliding lower, with the prompt-month contract settling at $60.98 on Friday.

OPEC+ is set to meet over the weekend to discuss production output for the month of December. The group is widely expected to approve another production hike of roughly 137 MBbl/d, matching the previous two monthly increases and bringing total supply increases to nearly 2.9 MMBbl/d since April. Internal discussions remain focused on balancing quota hikes with the risk of further oversupply, especially as non-OPEC output continues to outpace demand growth.

On the domestic front, US crude production continued to edge higher, reaching a new peak above 13.6 MMBbl/d. This came despite the EIA reporting a 6.9 MMBbl draw, far exceeding market expectations. The decline was driven by a sharp drop in Gulf Coast inventories as regional imports hit a record low. Gasoline stocks also tumbled to their lowest since last November, reflecting reduced refinery runs and rising demand, with operational issues at BP’s Whiting plant contributing to a particularly steep draw in the Midwest.

Meanwhile, the impact of sanctions on Russian oil remains uncertain. India’s state-run refiners stated they are actively exploring ways to maintain purchases of discounted Russian crude by working with non-sanctioned suppliers, while also preparing for a scenario where Russian exports are significantly curtailed. Indian Oil Corporation is seeking up to 24 million barrels from the Americas to offset potential shortfalls. At the same time, volumes of Russian, Iranian, and Venezuelan oil at sea reached a record high according to Vortexa, possibly suggesting that the new sanctions are beginning to slow flows and create supply chain bottlenecks.

Geopolitical tensions intensified on Friday, as oil climbed following reports that the US may target Venezuelan military sites. However, prices quickly faded after President Trump pushed back on the report. The market’s reaction to these conflicting signals underscores heightened sensitivity to geopolitical headlines, as traders remain focused on any developments that could disrupt global supply flows.

While fundamentals point to persistent oversupply, geopolitical volatility and shifting trade flows remain key drivers of market sentiment. For producers and traders, the current environment offers opportunities to manage price exposure, but any sustained strength will depend on the material impact of sanctions and the ability of exporters to reroute displaced barrels. AEGIS maintains a bearish view.

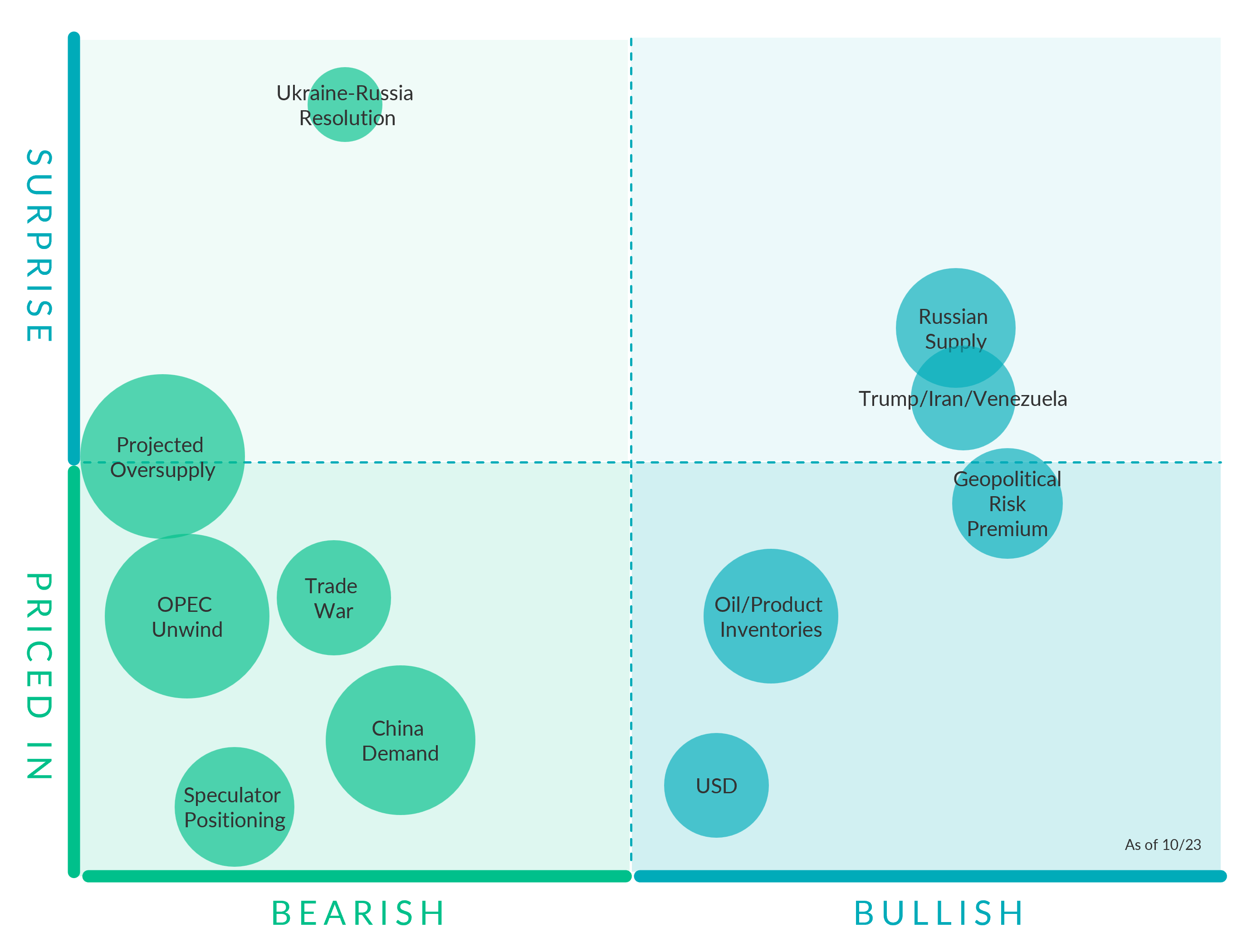

Crude Oil Factors

Geopolitical Risk Premium. (Bullish, Slightly Priced In) On Friday, crude hit an intraday high following reports the US may target Venezuelan military sites.

Speculator Positioning (Bearish, Priced In) The latest CFTC data show that as of August 12, money managers reduced their net long in CME’s flagship NYMEX WTI contract to just 48,865 contracts, the smallest bullish position since April 2009. Meanwhile, trades of WTI done on the ICE exchange show money managers holding a net short of about 53,000 contracts. When the two venues are combined, overall positioning in WTI has slipped into net short territory for the first time on record.

Oil/Product Inventories. (Bullish, Priced In) The EIA reported a 6.9 MMBbl draw. The decline was driven by the Gulf Coast where inventories fell by 10 MMBbls as imports into the region slid to the lowest on record. Fuel stocks also fell likely due to a decline in refinery runs accompanied by a rise in weekly demand. In the Midwest, operational issues at BP's Whiting plant caused fuel stocks to fall sharply.

3.53 MMBbl build in US commercial crude inventories last week. The build marks the third consecutive weekly build, the first such streak since April, bringing total nationwide inventories to about 423.8 MMBbls.

OPEC+ Quotas. (Bullish, Priced In) On June 2, OPEC+ announced its extension of 3.66 MMBbl/d cuts through December 2025. Additionally, the 2.2 MMBbl/d voluntary cuts from eight member countries will continue into Q3 2024 but will start to be reversed in October at a rate of 0.18 MMBbl/d per month. OPEC+ members agreed on September 5 to delay a planned gradual 2.2 MMBbl/d supply hike by two months, shifting the start to December. The group will add 0.19 MMBbl/d in December and 0.21 MMBbl/d from January onwards, with an option to adjust or pause these hikes depending on market conditions. The cartel also reaffirmed its compensation cuts of 0.2 MMBbl/d per month through November 2025, as members such as Iraq, Russia, and Kazakhstan have struggled to meet their original production quotas.

AEGIS notes that the global crude market would quickly build inventories without OPEC's support in reducing supply.

OPEC Unwind. (Bearish, Mostly Priced in) OPEC+ is expected to announce another modest output hike of ~137 MBbl/d for the month of December when the group meets this weekend, this would bring total production increase to nealry 2.9 MMBbl/d since the start of the unwind in April

China Demand. (Bearish, Priced In) China’s onshore crude inventories declined to 1.17 billion barrels this week, down from a record 1.20 billion barrels in mid-August, according to data from Kayrros. The draws came from commercial stockpiles, partially reversing the country’s earlier stockpiling surge, a key factor that has supported global oil prices even as the broader market faces record oversupply.

USD (Bullish, Priced In) The Federal Reserve cut its benchmark interest rate by 25 basis points, the first cut since December 2024, and signaled that another 50 basis point cut could be coming by then end of 2025. If markets expect rate cuts or looser monetary conditions, the dollar tends to weaken. Oil is priced in dollars, so a weaker dollar lowers the “real” cost of oil for buyers using other currencies. This often boosts demand at the margin and supports prices.

Ukraine-Russia Resolution. (Bearish, Surprise) During President Trump’s Thursday meeting with Chinese leader Xi Jinping, Trump noted, “We didn’t really discuss oil.” The absence of strong pressure on Beijing to curb Russian crude purchases remains a key revenue stream for Russia’s war effort.

Trade War. (Bearish, Mostly Priced In) There has been an increase in tit-for-tat trade tension between the US and China, with China sanctioning the US unit of Hanwha Ocean Co., a South Korean shipping major, and warned of additional retaliatory actions against the industry. However, President Trump said high tariffs on China were “not viable,” suggesting potential for de-escalation even as broader tensions remain elevated.

Projected Oversupply. (Bearish, Mostly Surprise) The IEA’s latest Oil Market Report projects global crude supply to outpace demand by nearly 4 MMBbl/d next year. The forecasted overhang is about 18% larger than last month’s estimate, reflecting OPEC+’s ongoing supply revival.

Trump/Iran/Venezuela. (Bullish, Slight Surprise) Tensions in South America are escalating as reports surfaced stating the US is looking to target Venezuelan military sites. According to OPEC secondary sources, Venezuela's crude production in September was 967 MBbl/d.

Russian Supply. (Bullish, Slight Surprise) Due to the latest sanction on Rosneft and Lukoil, analysts at Rystad Energy estimate 500–600 MBbl/d of Russian output could be curtailed, forcing Moscow to rely more heavily on shadow tanker fleets and Chinese buyers. However, the extent of any disruption remains uncertain, and it may take time to gauge how material the impact truly is.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as “edge,” “advantage,” ‘opportunity,” “believe,” or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.