AEGIS: The supply increase would be mistimed if global demand growth stalls. The timing of supply increases is not the factor to watch for 2022; focus on total demand growth instead.

The Wall Street Journal reports that Saudi Arabia is considering leading OPEC to no supply increases in early 2021. The article cites growing Libya oil production and uncertain global demand growth as causes. OPEC had plans to increase production by 2 MMBbl/d in January.

We have maintained wariness of OPEC's supply policies, noting that OPEC must time their supply increases with demand increases for their stated policy to work. If they mistime the supply increases, they would flood the spot market with more crude than can be absorbed.

This WSJ report does not change our conclusions. There may be less supply than expected in 1H2021, but that potential supply still exists and will eventually return. We remain cautious on near-term prices, and our standard trading recommendations reflect this belief (for trading recommendations, see the Research module inside the AEGIS platform).

The real story is not the timing of increases, but the total amount of spare capacity OPEC can deploy. That number has grown recently as Libya has taken steps to restore its production, perhaps up to an eventual 1 MMBbl/d increase.

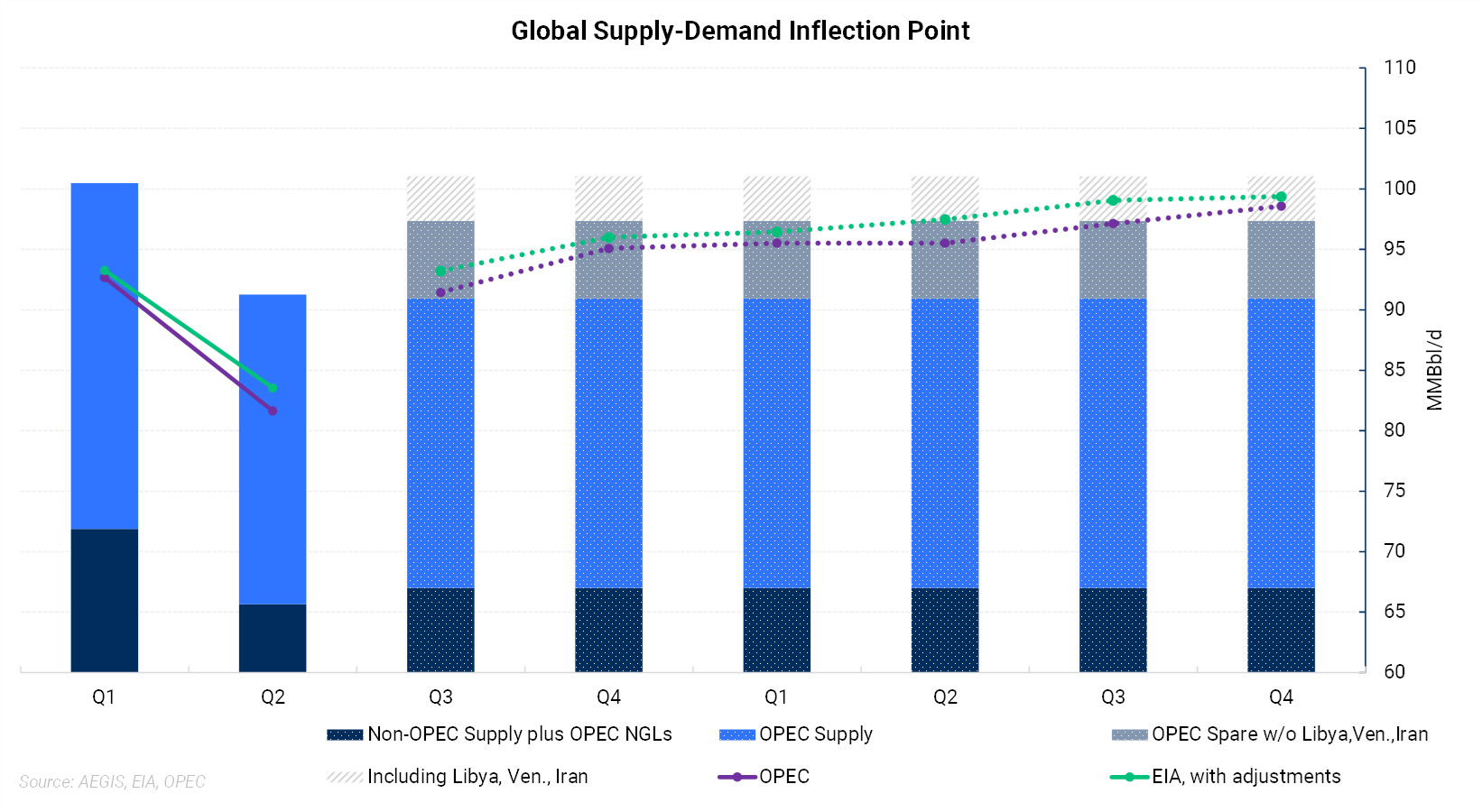

The chart below shows total non-OPEC production, and OPEC production plus its potential production (spare capacity), organized by "core" OPEC, then adding-in Libya, Venezuela, and Iran. Against these supply-side numbers are both EIA and OPEC demand forecasts as lines. When demand (the lines) rises above total supply including OPEC spare capacity (columns), then the global market would be undersupplied.

As global demand growth returns, the path of prices could be volatile, depending on OPEC's supply choices and the pace of demand.

However, once that "inflection point" occurs, where demand has become larger than supply, prices would need to rise to encourage more development in global oil. First on that list, in our view, is the U.S. tight-oil basins, namely the Permian basin.

Libya has been exempted by OPEC from supply-cut quotas. Therefore, increases in Libya may cause the rest of OPEC to adjust their own quotas.

Further, if Libya returns to full production, the "inflection point" in the global supply-demand balance may move to 2022, even if demand keeps its expected pace.

Next week, OPEC is likely to publish a revised demand outlook for 2021 in its monthly publication. We will update our outlook as well. Don't be surprised if their demand figures are changed to support an extension of supply-cut quotas.