Crude Oil Bottom Line — The pandemic still remains in focus as current, and new lockdowns persist. The March contract traded mostly sideways since breaking through $50/Bbl in early January, and AEGIS sees more risk weighted to the downside at least in the near term.

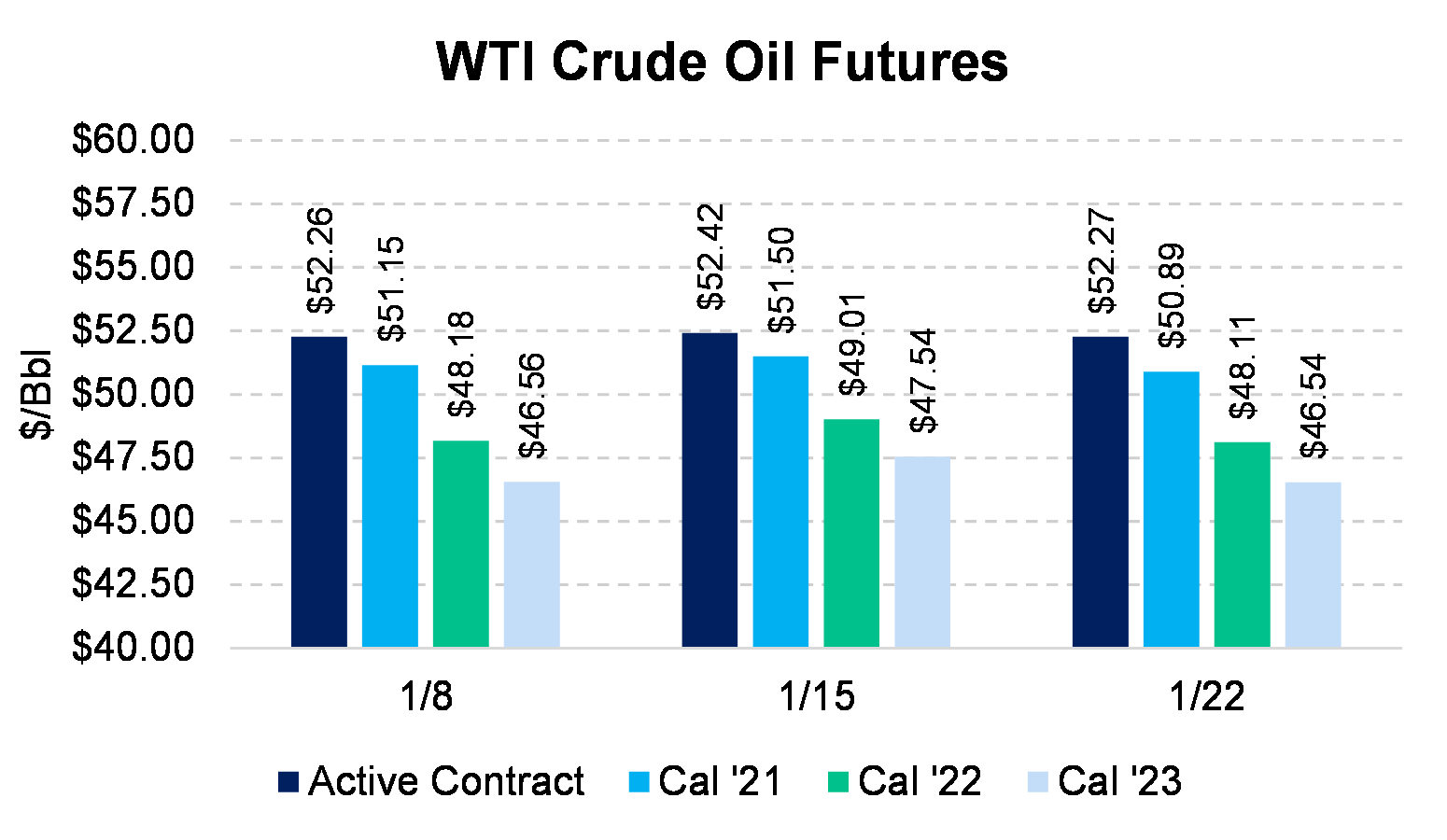

The February WTI contract rolled off the books this week, leaving us to focus on the March contract that ended the week at $52.27, mostly unchanged from Monday.

The WTI curve did get slightly more backwardated this week after longer-dated contracts lost more value than did the front of the curve.

AEGIS trading recommendations reflect a more conservative view for the remainder of the year as swaps are preferred over less attractive costless-collar structures. Beyond 2021 some clients should entertain a three-way collar. An attractive structure available as of Friday is $45 (Put) / $30 (Short Put) X $53.70 (Call). Three-ways are not for everybody, but this can be a solution to the costless collar pricing that would cause you to give up $6 to the downside while only gaining $4 to the upside in Cal 2022.