President Trump’s “Liberation Day” came with a wave of new tariffs that will boost average levies to their highest level in more than a century.

The new average US tariff rate above 20% could lead to a global recession, according to economists.

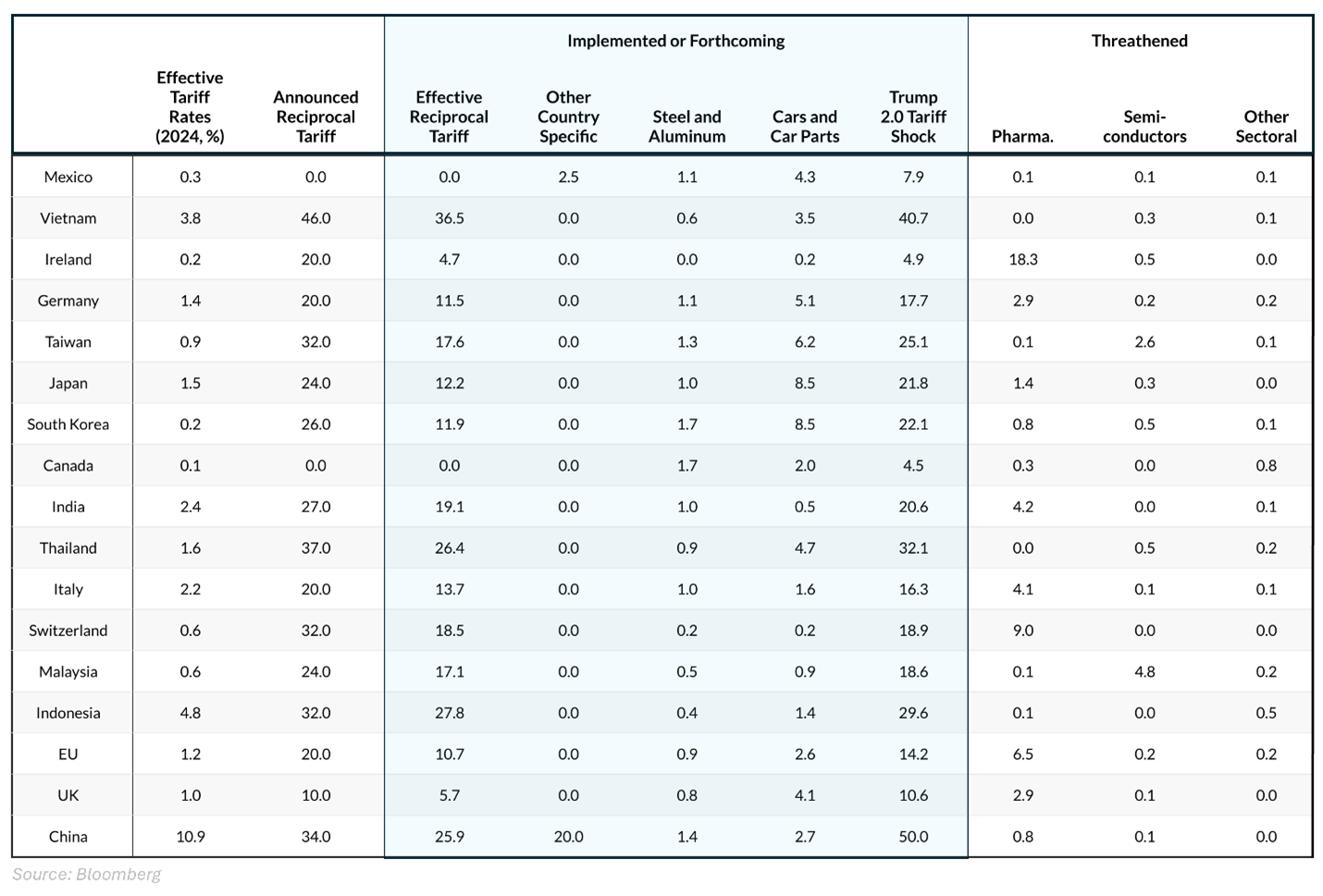

The 10% additional tariff on all imports is set to take effect on Saturday, with the specific “reciprocal” tariffs scheduled to take effect on April 9. Refer to the table below for a detailed breakdown.

Commodities came under pressure even though energy, aluminum, steel, gold, copper, lumber, and other metals were all, so far, exempt from the new tariffs. Canada and Mexico were also spared from the new round of tariffs.

Nearly all asset classes were down materially on Thursday.

|

|

|

|

Notes: Non-trading hours show as straight line. Timestamp for charts is 10:25 AM CT. |

West Texas Intermediate crude traded 7% lower or $5.12/Bbl to $66.62/Bbl as of 9:00 AM Central.

NYMEX Henry Hub was up 10c to $4.15/MMbtu.

The S&P 500 was down 3.6%. Nasdaq moved 4.01% lower.

US Diesel prices fell 6.2% to $2.17/gal.

Gasoline RBOB was down to $2.15/gal or 7.37%

The US 10-year Treasury fell 2.38% to 4.032%.

The dollar slumped by 2.7 points or 2.6% to 101.5 on the index.

Oil and gas, so far, are exempt from the latest round of tariffs. Secondary tariffs, previously announced for Venezuela, are likely to deter countries from purchasing Venezuelan crude, potentially redirecting the country’s heavy crude into global energy trade.

Even with energy imports exempt, a potential decrease in global energy consumption could indirectly affect trade flows. For example, if China’s economy slows due to the effect of tariffs, petchem demand for products like propane and ethane could wane, altering where products land and reducing price.

The tariffs could dampen global economic growth and lead to increased inflation. Consumers may face higher costs for a wide range of products. Financial markets have reacted negatively to the announcement, with major stock indices declining by over 3%.

The market impact is likely to get worse as retaliation is expected from trading partners. Treasury Secretary Scott Bessent urged other countries to avoid retaliatory tariffs when speaking with Bloomberg. “I wouldn’t try and retaliate,” he said. “As long as you don’t retaliate, this is the high end of the number.”

Despite Bessent’s warning, China vowed to respond in kind, and the EU is also readying plans to retaliate. Japan and Korea have previously said they would also respond to tariffs, in unison with a Chinese response.

Everything is set up for a potentially painful global trade war. The effect of China's tariffs would likely be a 2% hit to GDP and contraction in the country’s exports, according to Arthur Kroeber, a partner at Gavekal Dragonomics. (Bloomberg)

This is a fluid situation, and these terms are subject to change.