Dear Client,

If you missed the news on Friday, R^2 has been acquired by AEGIS Hedging Solutions. We are optimistic that the only changes you'll notice is an upgrade to and larger offering of services. All of R^2's employees, including me, will continue to serve you. Please call if you have any questions.

This is Christmas week. If you have hedges you'd like to place, we expect that today and tomorrow will offer you the best liquidity and ask that you avoid hedging on Thursday, if at all possible.Crude Oil is down almost $2 this morning, testing the Control Pivot. Natural Gas is down $0.02, trading just above the Control Pivot.

|  |

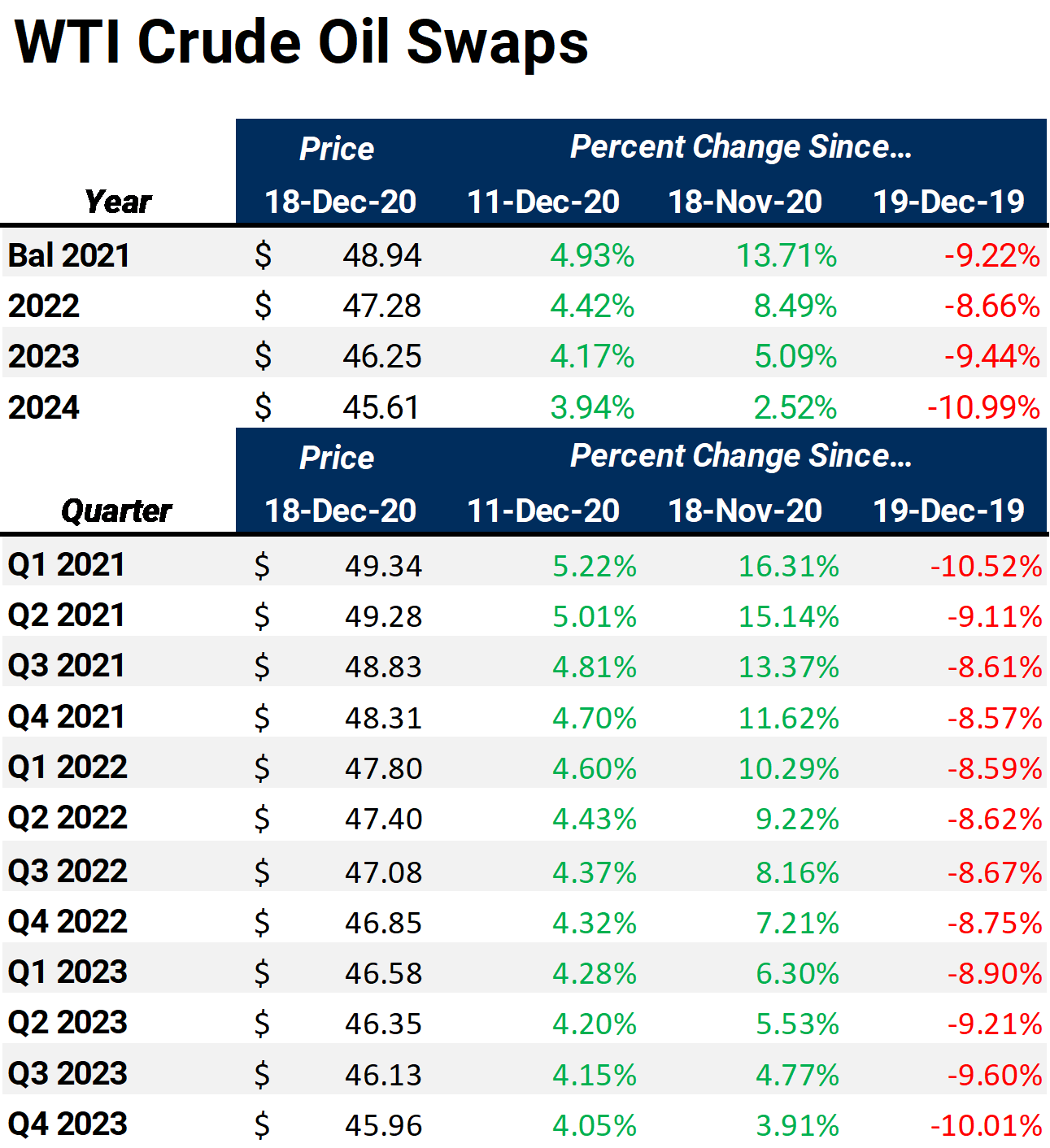

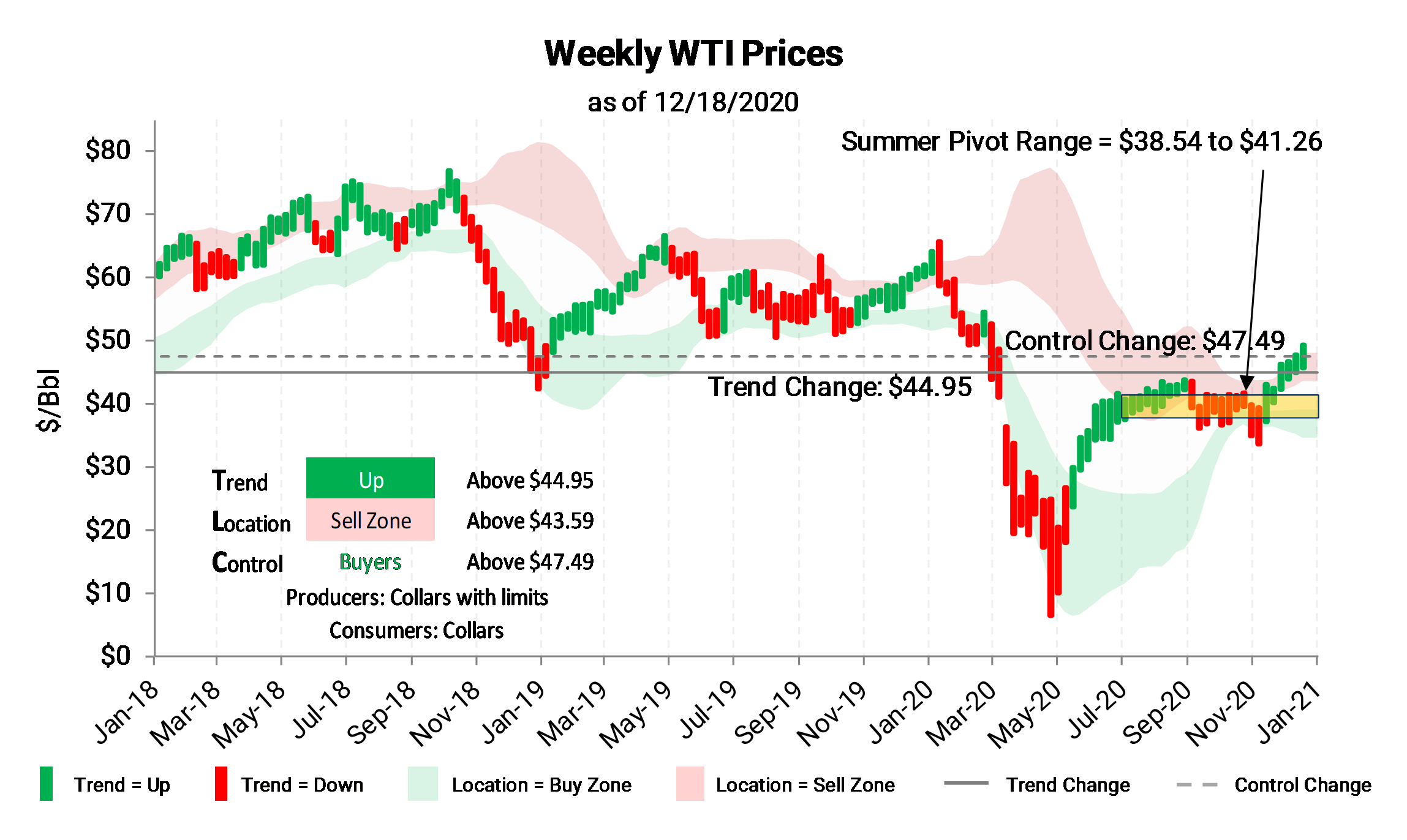

Crude Oil gained $2 last week. "Risk On" continues, with bullish sentiment increasing via record highs in the equity markets, optimism about vaccines, a new low in the dollar and less hawkishness from the Fed. Cal 2021 has entered the $47-$52 zone that has been highlighted this month for Producers to add Market Driven hedges.

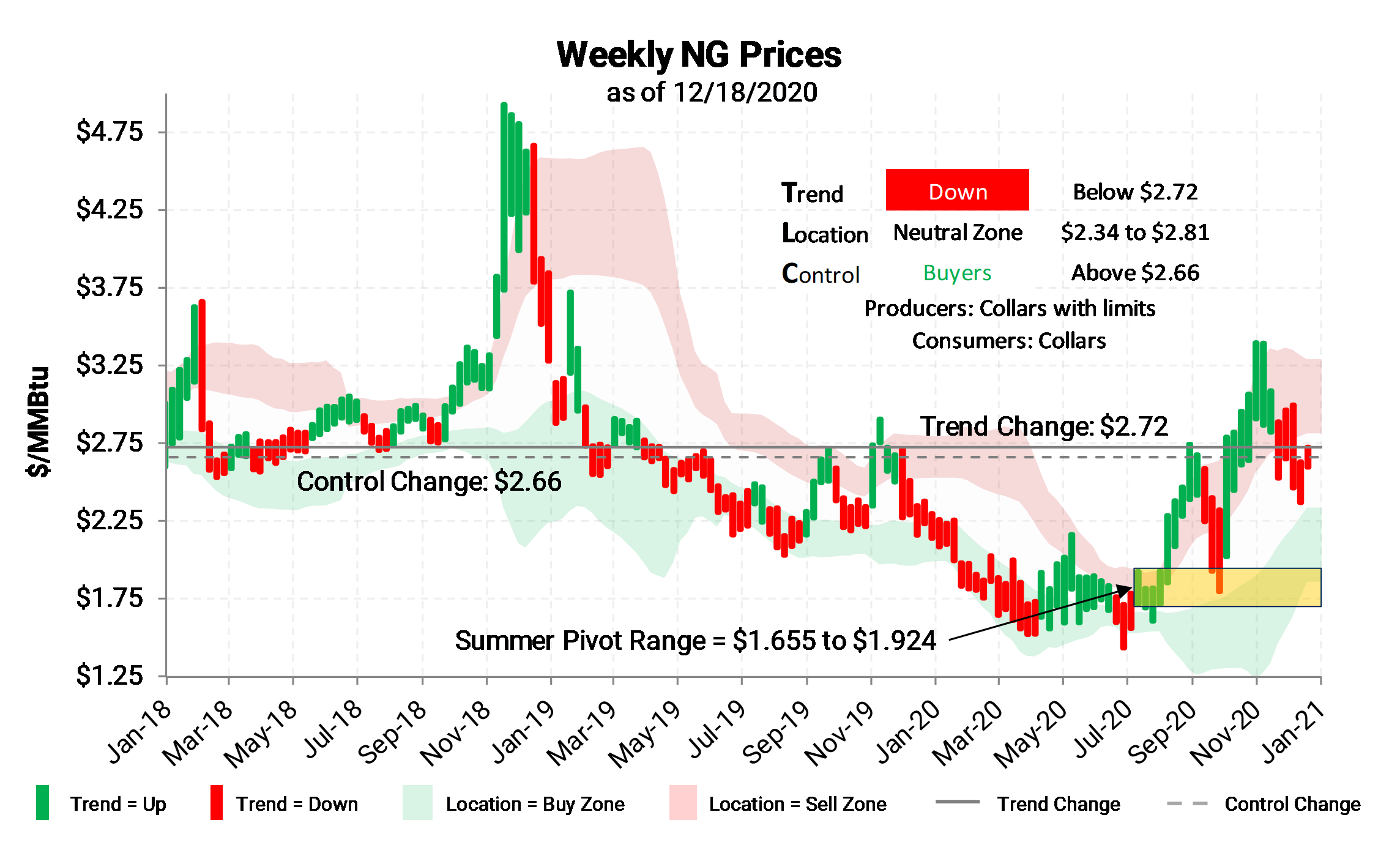

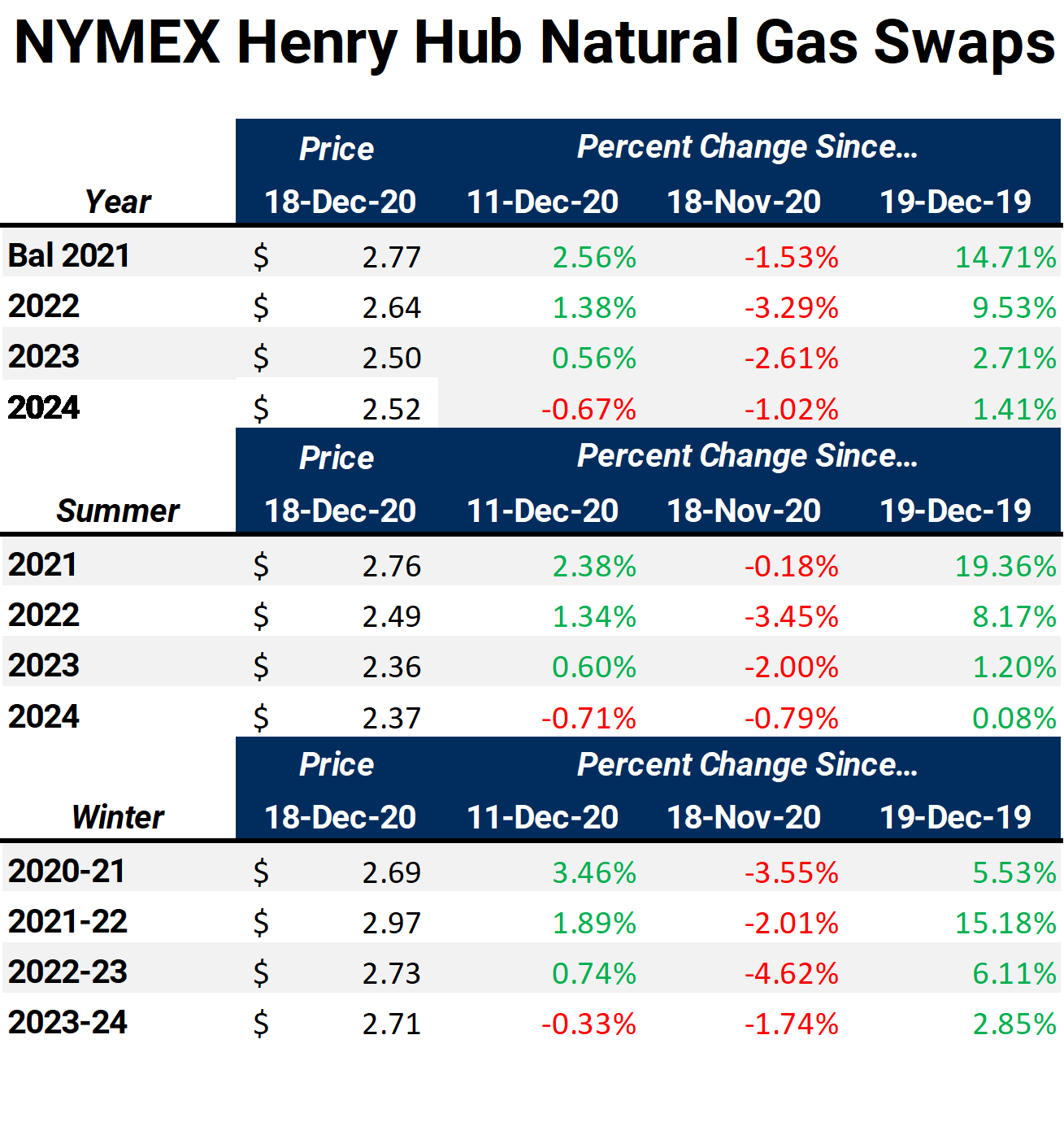

Natural Gas rose 11 cents in quieter rangebound trade. The majority of the week's gain came last Monday on a colder forecast, and the market consolidated those gains the next 4 sessions.