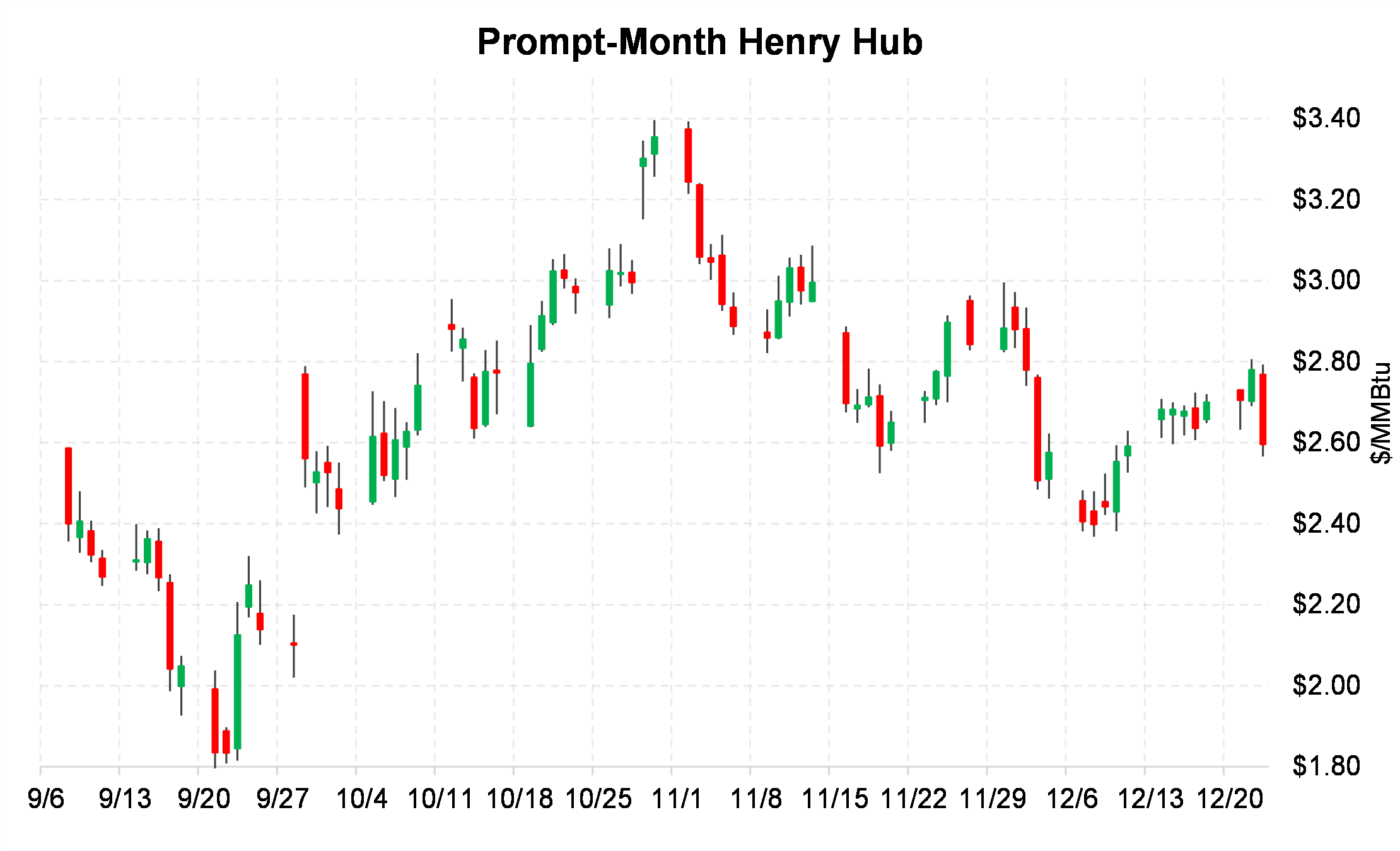

In the spirit of simple (ONE TREND LINE), this market is under pressure until we take out $2.69. Why? Why $2.69?

|

|

If the weather forecast changes and gets bullish, it will first test and likely fail at ~$2.69-$2.70. Until/unless we close above $2.69, this market is at risk for another down leg down (last leg was 63 cents from $3.00 to $2.37) from $2.80 to $2.17. That fills the gap on this daily continuation from the late September contract roll. There is some decent underpinnings of blocking (cold weather) which would be bullish but until we get other help, this is a challenge for this time of year. It is 11 cents. We will change the view in 11 cents, but there is the potential for another 40 cents downside if this plays out without bullish weather rescuing the market.

See also:

The most recent AEGIS webcast, where we describe how fundamentals are positive for 2021, despite recent price weakness.

Questions or comments, please contact us at research@aegis-hedging.com.