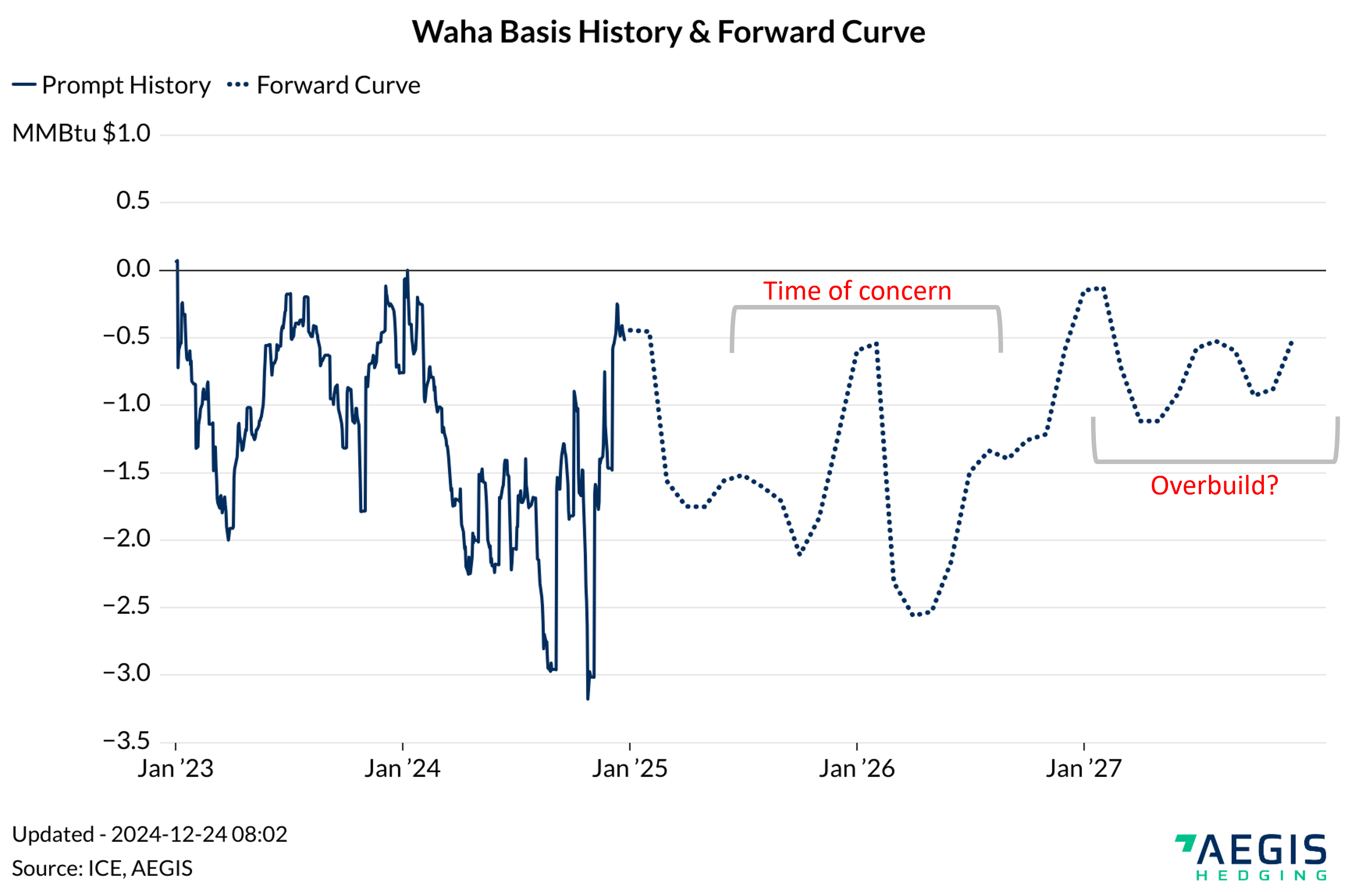

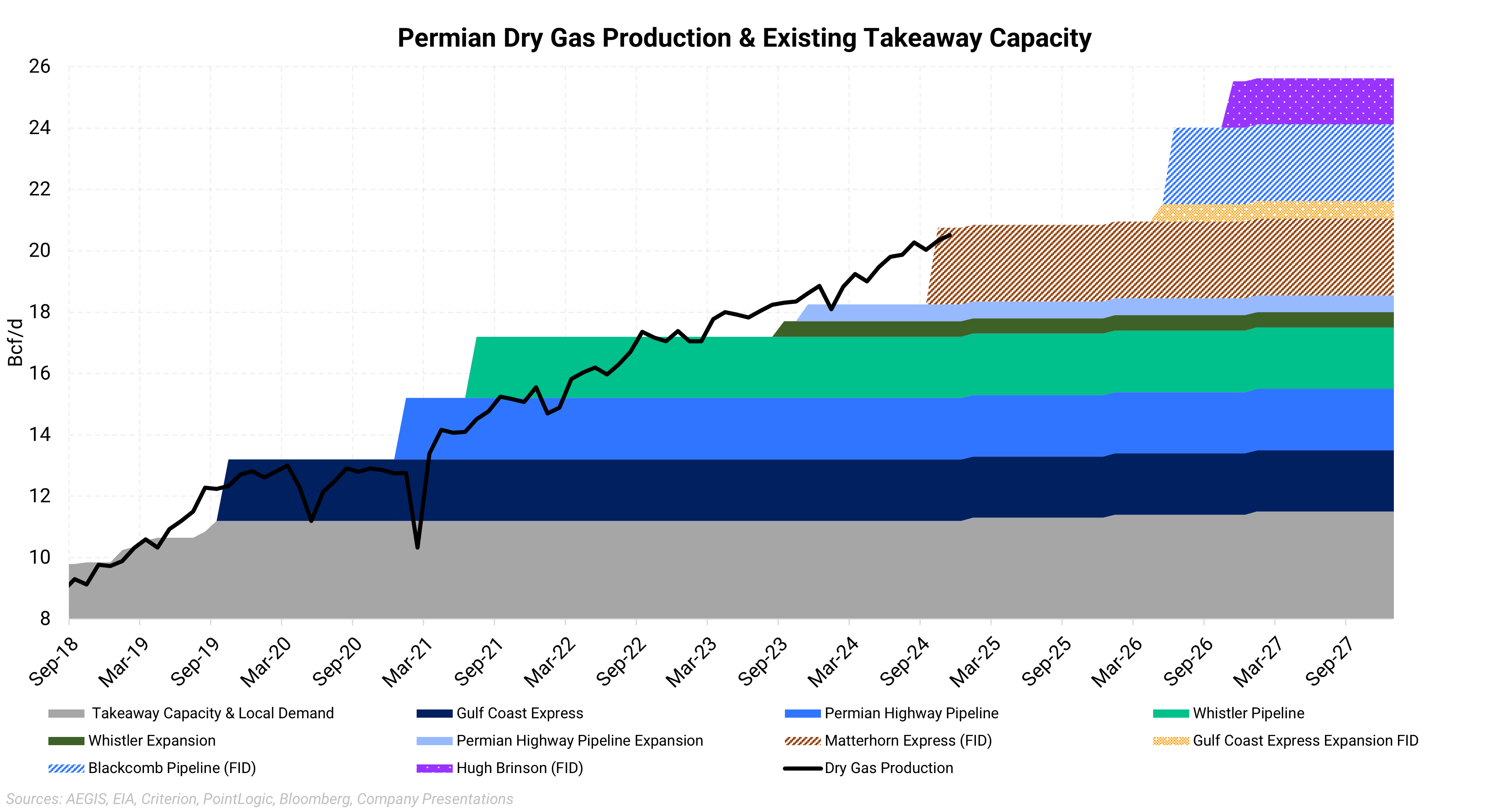

Permian gas prices face a turbulent road ahead, with stability likely only arriving once significant new pipeline capacity becomes operational in late 2026 and early 2027. But didn’t the region just gain a 2.5 Bcf/d takeaway pipeline with Matterhorn? Yes, but much of this relief is likely already priced into the forward curve. As the basin grows into this new capacity, Permian gas could face challenges until the anticipated late 2026 expansions.

The forward curve shown above illustrates how Waha is priced for future delivery. Between spring 2025 and late January 2026, there is a substantial $2 disparity between the high and low forward prices. Waha discounts to Henry Hub narrow after this period, coinciding with the expected addition of 4.5 Bcf/d of new pipeline capacity.

From a price risk perspective, mid-2025 through the fourth quarter of 2026 presents a period of concern for producers. If the basin’s supply grows sufficiently to fill the newly commissioned greenfield pipeline in 2025, Waha could find itself back in a precarious position. During periods of low demand or pipeline maintenance—as occurred in 2024—there would again be little margin for error.

As a wave of new long-haul egress projects comes online, the likelihood of heavily discounted prices in 2027 and beyond diminishes. This additional capacity should alleviate pressure on the marginal molecule, improving price stability.

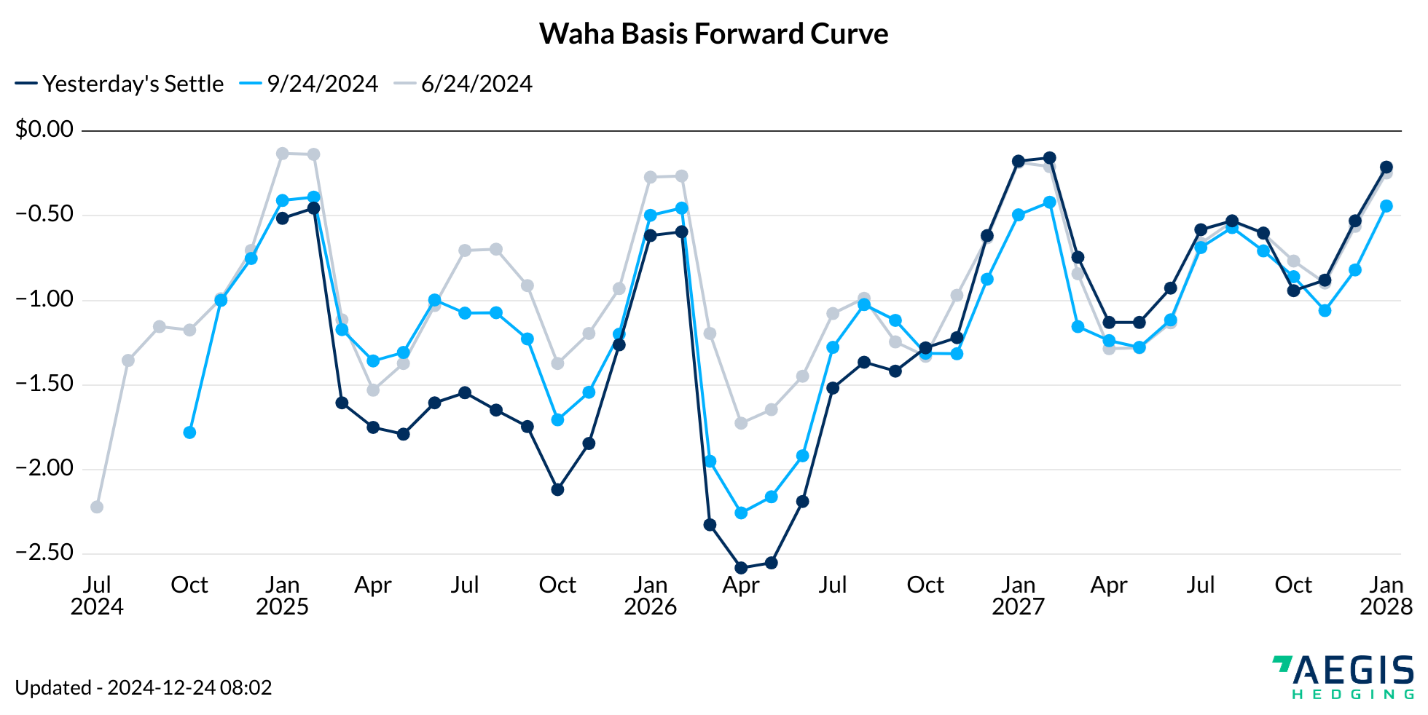

Notice how the Waha basis forward curve has evolved over the past six months in the chart above. The current curve (dark blue) has continued to decline, even after the commissioning of a new pipeline in October. For comparison, the light blue line reflects the forward curve three months ago, while the grey line represents six months ago.

The forward curve’s inability to accurately predict future pricing trends is notable. This could also hold true for parts of 2025 and 2026, depending on various factors.

The rapid pace of production growth—or the volume of gas awaiting takeaway capacity with Matterhorn—might explain the added concern for 2025 and 2026. Permian gas supply has been increasing faster than anticipated, as observed by analysts and noted by industry participants. Higher-than-expected production could lead to excess capacity filling more quickly. The stacked chart above shows the three projects, GCX Expansion, Blackcomb, and Hugh Brinson, that are FID'd and expected to bring an additonal 4.5 Bcf/d of takeaway capacity to West Texas.

Bottom Line: For Permian producers, relying on better Waha pricing is historically unwise. Time has shown that prices tend to trend lower rather than higher. However, there is good news: starting in 2027, the region may achieve an overbuilt state, with ample takeaway capacity thanks to at least 4.5 Bcf/d of new pipelines expected to come online around that time.