Lower natural gas production could mean a tighter propane balance this winter. However, there are headwinds that could limit a higher price outlook past the next five months.

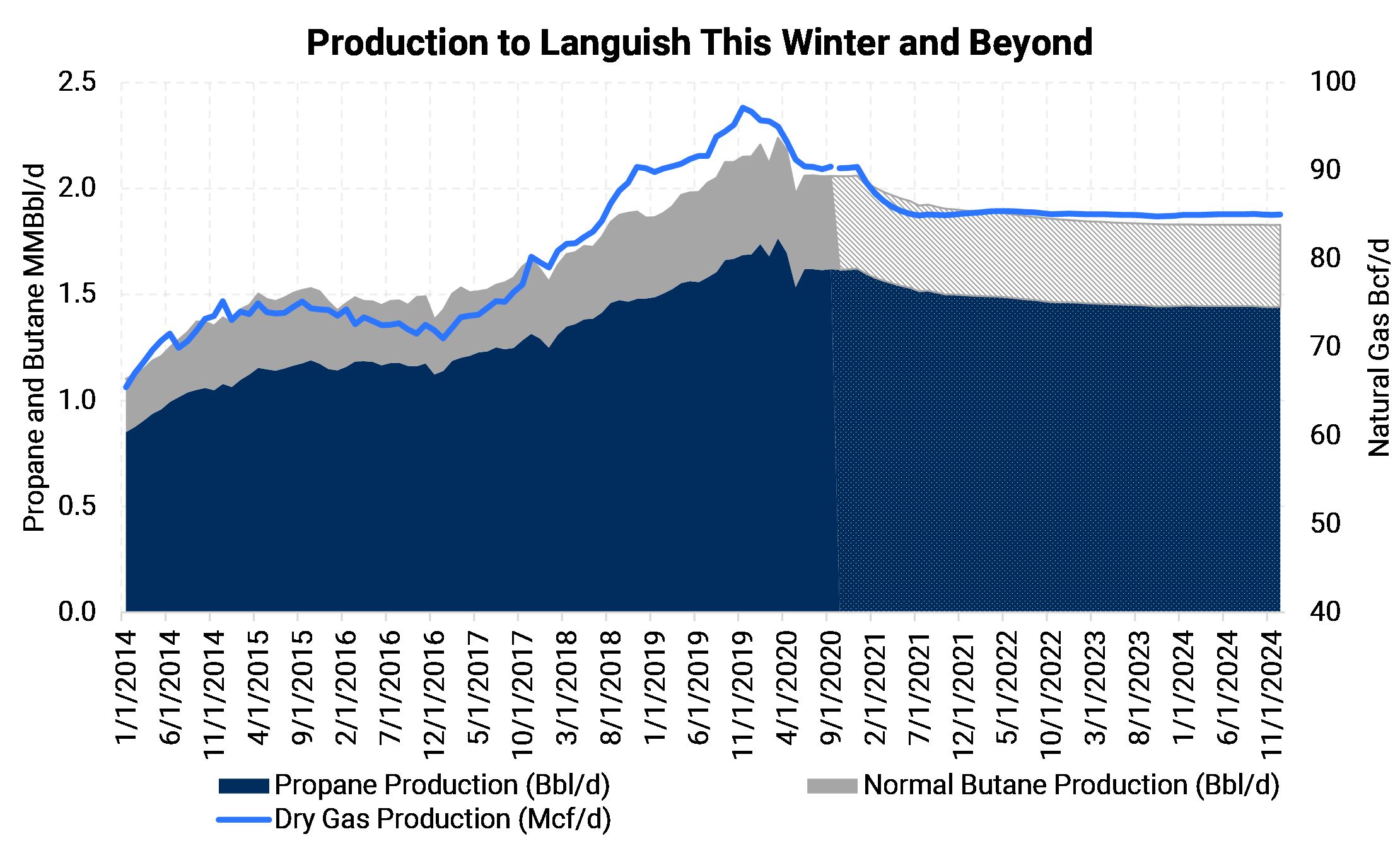

Pre-Covid, propane production was expected to grow beyond 2 MMBbl/d sometime in 2021 or early 2022. Our well economic forecast as of September 17 now reflects a declining trajectory for propane and butane production.

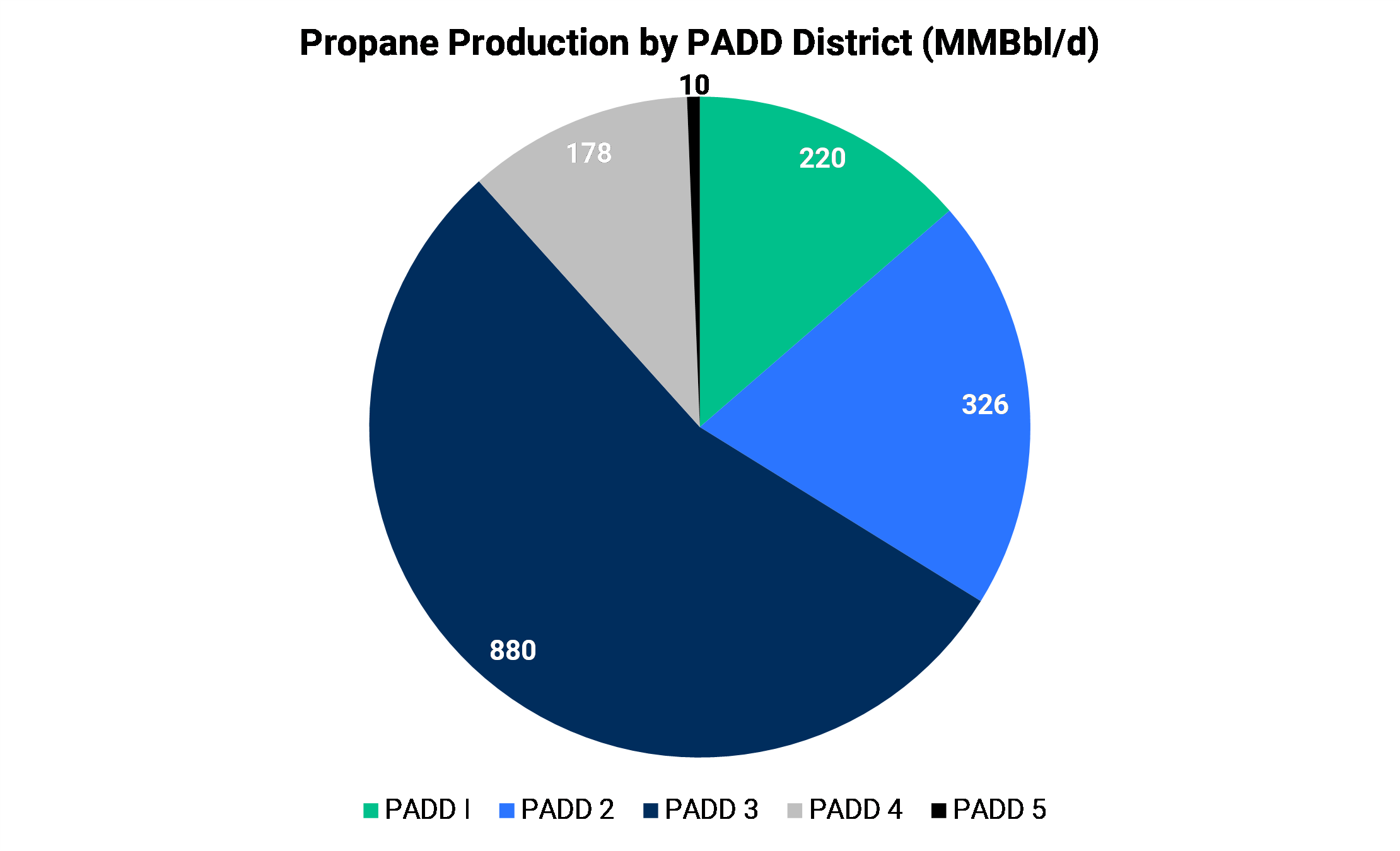

The decline in crude prices this year is to blame for the reversal in NGL production. Associated gas plays have recorded rapid declines in production for all three streams with lower crude activity resulting in lower gas and NGL output. PADD III (Gulf Coast), which includes the Permian Basin, accounts for about 55% or 880 MMBbl/d of U.S. propane production. As of August, propane production in PADD III was down 80 MBbl/d from right before crude prices started to fall in Q1 of this year.

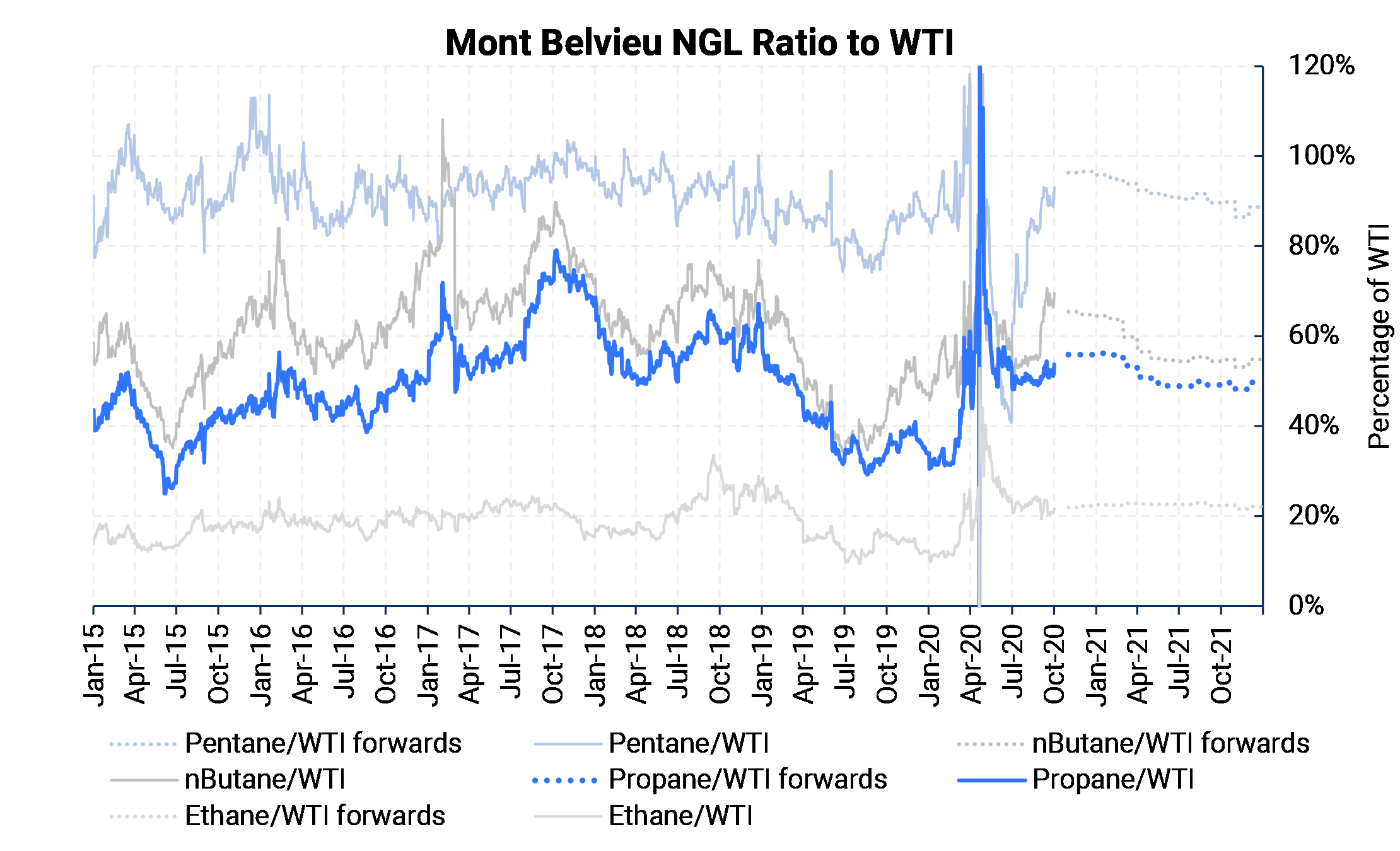

Mt. Belvieu's propane ratio to WTI has hovered around 52% lately, therefore, WTI's inability to move much beyond $40/Bbl could be a limiting factor for an upward movement in propane prices.

Source: Bloomberg, AEGIS Source: Bloomberg, AEGIS |

Source: Bloomberg, EIA, AEGIS Source: Bloomberg, EIA, AEGIS |

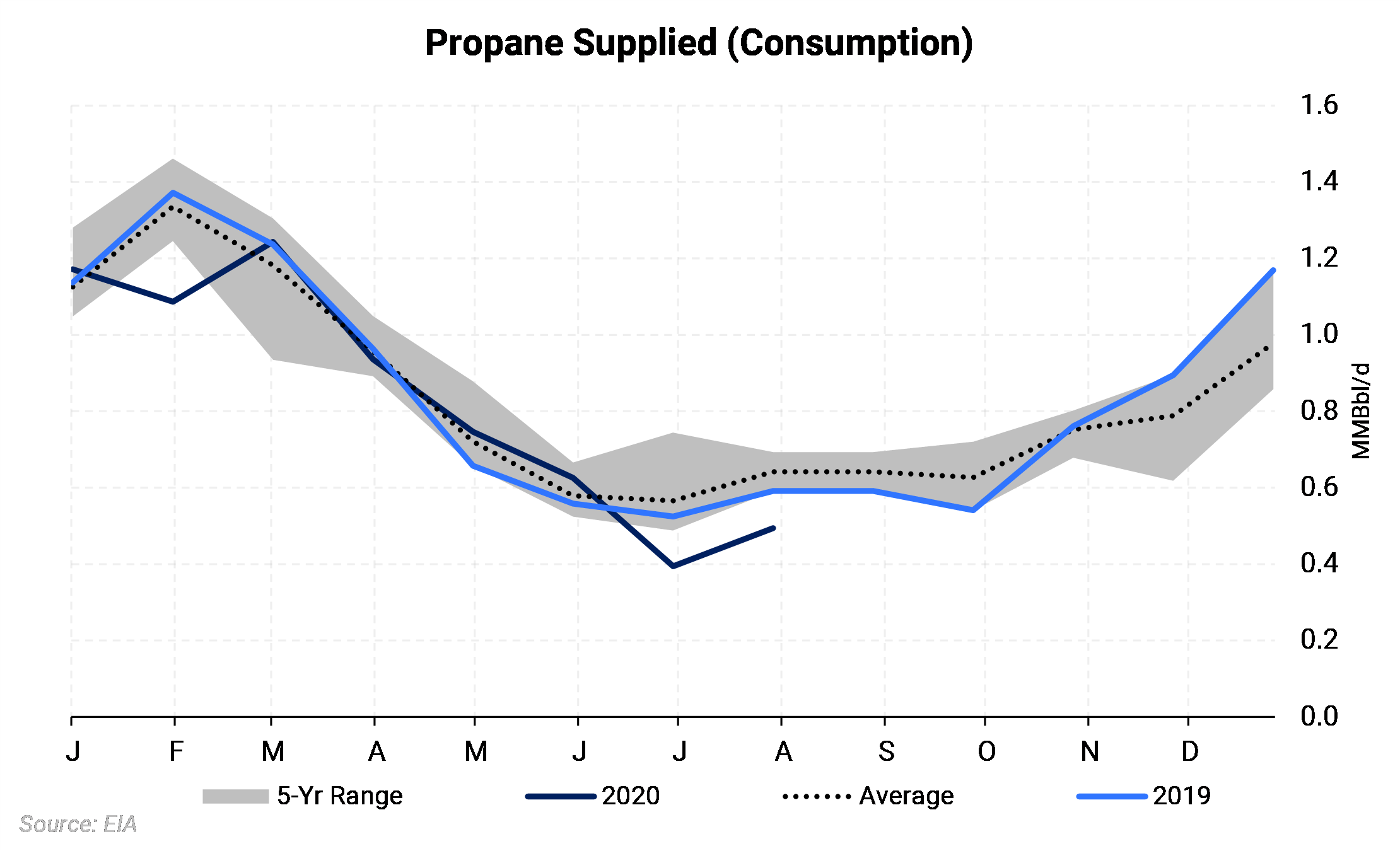

U.S. propane product supplied (a proxy for consumption) has been at the lowest level in at least the last 10 years. The chart below shows the previous five years, with COVID-19 induced lockdowns causing propane demand to drop below 500 MBbl/d this summer. Propane is very seasonal and this coming winter may be effected by COVID-19 related issues globally. Asian LPG demand is likely to fall well short of expectations, according to OPIS.

Propane prices will face an upward battle despite the change of course in supply. It's likely that propane prices would have come under heavier pressure had crude prices not plunged due to COVID-19 demand destruction. The propane outlook may not be bullish going forward but it's certainly less bearish with supply forecast to decline. To be bullish propane, one probably needs to be bullish crude oil prices.