How US Sanctions Could Impact Global Crude Supply

The US government’s sanctions on Iran and Venezuela could significantly pressure global oil markets. However, the impact of these sanctions differs substantially between the two nations. While the Trump administration’s maximum pressure campaign on Iran aims to squeeze the country’s vast oil exports, Venezuela’s situation is more sensitive due to its reliance on US Gulf Coast refineries and smaller production capacity. If the sanctions disrupt global crude flows, it could result in a tighter-than-expected oil market in 2025.

Iran: Resilient Exports Despite Sanctions Pressure

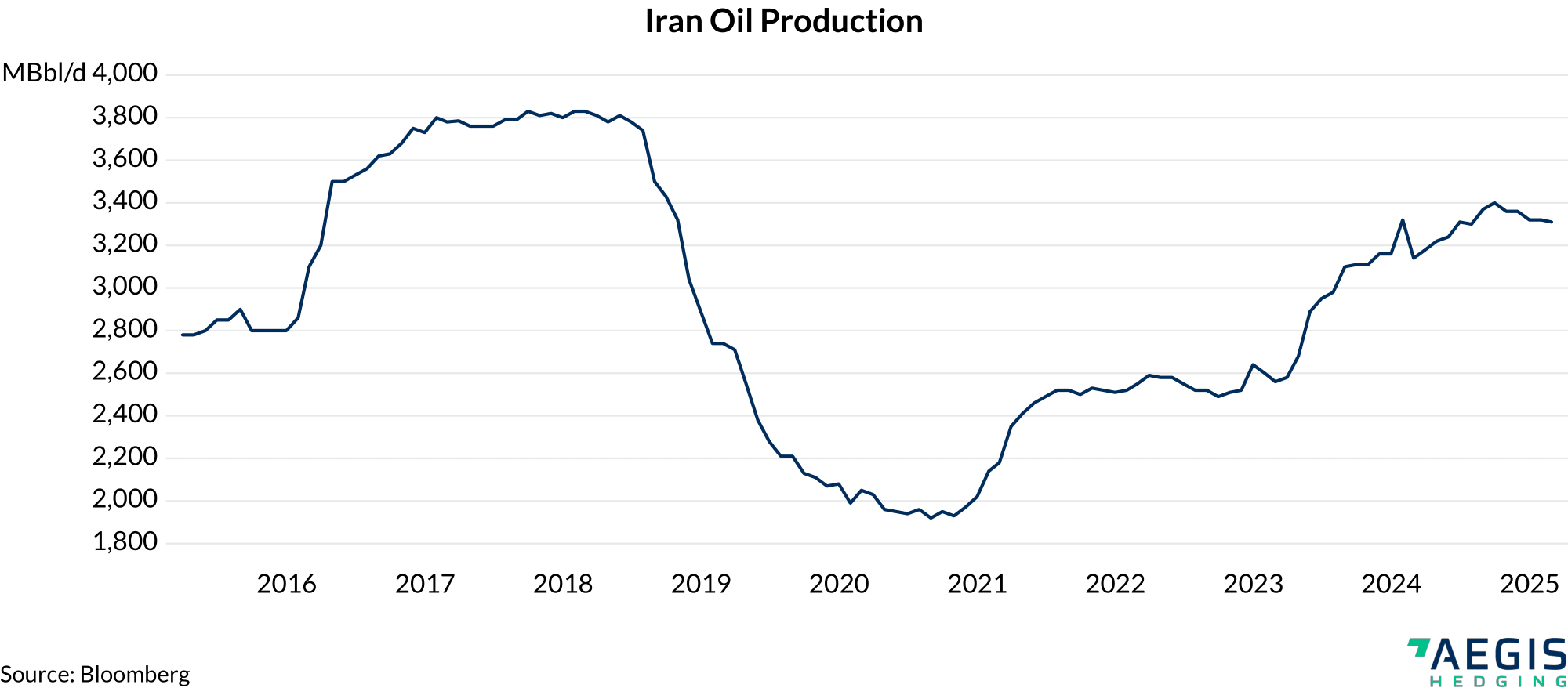

The US has long targeted Iran’s oil exports with sanctions, with the aim of reducing the country’s revenues. These sanctions have intensified recently, particularly under the Trump administration’s renewed “maximum pressure” campaign. While these sanctions are severe, Iran’s vast oil production capacity and extensive methods of circumventing the restrictions have allowed it to maintain significant exports, particularly to China, which has become Iran’s primary buyer.

Iran’s oil production in January 2025 was recorded at 3.31 MMBbl/d, or about 3% of global supply. The country has adapted to these sanctions by relying on its “shadow fleet”—a network of tankers that operate off the radar to transport oil. By using ship-to-ship transfers and obscuring the origin of the oil, Iran has been able to keep its exports flowing, particularly to China. Nonetheless, the escalation of sanctions could lead to disruptions in supply chains, particularly in Asia, where refiners will feel the effects of reduced Iranian oil availability. This could force Chinese buyers to seek cargoes from elsewhere.

The sanctions will only be effective if the US targets the small, independent Chinese refiners. These refiners, which operate with minimal exposure to US financial systems, are less susceptible to the threat of secondary sanctions. As a result, unless the US can exert pressure on these smaller refineries, the sanctions on Iran may not have the intended impact. China’s willingness to bypass US sanctions and its ability to use its own financial systems means that the US faces an uphill battle to curtail Iran’s oil exports fully.

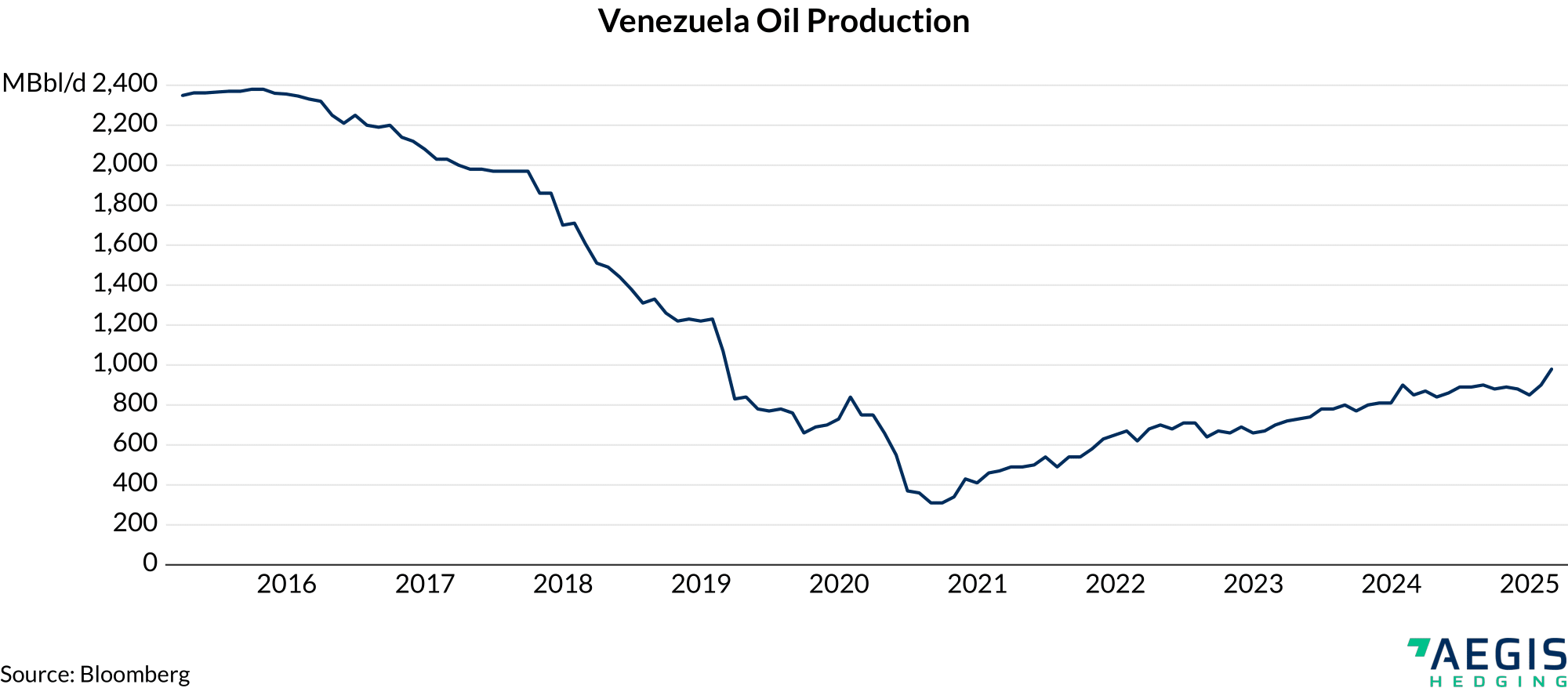

Venezuela Vulnerable to US Sanctions Despite Lower Production

In contrast, Venezuela’s oil market faces a more direct and immediate impact from US sanctions, primarily due to its reliance on exports to US Gulf Coast refineries. Venezuela’s crude oil production has steadily declined, with January 2025 production at just 860 MBbl/d. While this is far lower than Iran’s output, Venezuela’s proximity to the US market and its role as a key supplier of heavy crude to US refiners make it particularly vulnerable to US sanctions.

The recent US cancellation of Chevron’s license to operate in Venezuela has compounded the country’s difficulties. Chevron had been a significant player in Venezuela’s oil industry, exporting nearly 300 MBbl/d of Venezuelan crude to the US in January 2025. With the cancellation of its license, US Gulf Coast refineries that had relied on Venezuelan crude are now facing a supply gap. This shift in supply could push refiners to seek alternatives from other Latin American producers, such as Colombia or Guyana, or from further afield in the Middle East and West Africa.

The impact of these sanctions is felt more acutely because Venezuela’s oil sector lacks the same network of evasion tactics Iran developed. While Venezuela has historically relied on its proximity to the US and its existing relationships with American companies, its oil production is not only lower but also far less resilient to external pressures. With sanctions tightening, Venezuela will likely struggle to find new buyers for its oil at the same levels as before, particularly as the US government has warned of further actions to curtail the flow of oil revenues to the Maduro regime.

Impact on Global Oil Supply and Prices

The differing dynamics between Iran and Venezuela result in different market impacts, but both contribute to a tightening of global oil supply. For Iran, the ability to circumvent sanctions via its shadow fleet means that while sanctions are limiting its oil exports, they are not eliminating them. This gives Iran a level of resilience, allowing it to continue supplying oil to global markets, particularly in Asia. However, the long-term sustainability of this trade is uncertain, and further sanctions enforcement could lead to disruptions in supply to Chinese refiners, which could, in turn, affect global prices, particularly in the Asia-Pacific region.

For Venezuela, the effect is more immediate. The loss of US market access for Venezuelan crude is a significant blow to its oil sector. US refineries that had been importing Venezuelan crude will now need to find alternatives, creating tighter supply in the Gulf Coast region. This could lead to higher crude prices, particularly for the types of crude traditionally imported from Venezuela, such as heavier grades that are harder to replace.

The global oil market is also seeing the effects of these sanctions in other areas, such as the tanker freight market. After the imposition of new sanctions, tanker rates surged as demand increased for non-sanctioned vessels to transport alternative grades of crude from the Middle East and West Africa. As sanctions disrupt the flow of oil from Venezuela and Iran, refiners worldwide may face increased crude costs, which could lead to higher fuel prices globally. However, it is important to note that while these sanctions stand to reduce oil supply, this could make it easier for OPEC to increase output without substantially weakening oil prices.